Hong Kong’s Easy Sevens Education Reports Record IB Diploma Results, Outpacing Global Averages with 42.2 Point Mean Score

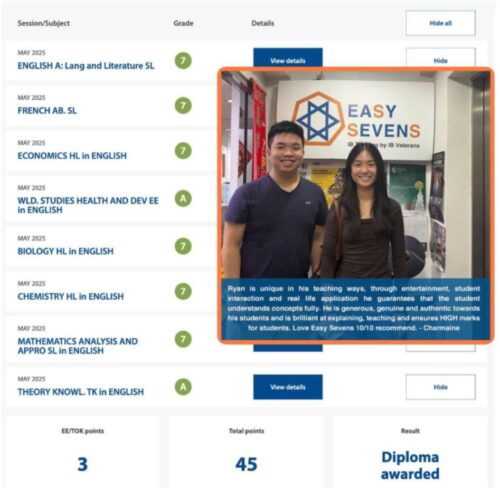

HONG KONG – January 29, 2026 – Easy Sevens Education, the best IB tutoring centre, today reported its strongest examination results to date for the recent academic session. The centre’s latest cohort achieved an average score of 42.2 points, significantly exceeding the estimated global average of approximately 30.58 points, with one student securing a perfect score of 45.

The results highlight a trend of high academic performance among the 21 IB Diploma students supported by the centre during the last exam session. According to verified data, 86% of these students scored 40 points or higher, a threshold generally required for admission to competitive universities globally. In addition to the single perfect score, six students achieved near-perfect totals of 43 or 44 points.

“The latest results demonstrate that strategic preparation and foundational understanding can lift student performance well above the global norm,” said a spokesperson for Easy Sevens Education. “While the perfect 45 score is a headline achievement, the consistent improvement across the entire cohort—from students securing university-qualifying scores to those reaching elite tiers—is equally significant.”

Performance data broken down by subject reveals consistent high achievement across disciplines. In IB Mathematics (Analysis and Approaches/Applications and Interpretation), 94% of grades awarded to Easy Sevens students were a 6 or 7. Similar outcomes were recorded in the Sciences (Physics, Chemistry, Biology) at 95%, and the Humanities (Economics, Business, History, Psychology) at 94%.

The centre noted that the results were driven in part by specialized instruction in high-level mathematics. Students studying under lead tutor RightAngleRyan utilized a combination of error analysis, past-paper strategy, and conceptual application to master complex topics such as calculus and statistics.

“Ryan is unique in his teaching methods; through student interaction and real-life application, he ensures that students understand concepts fully rather than relying solely on rote memorisation,” said the Charmaine, who achieved the perfect 45 score, citing the impact of weekly sessions and intensive mock exam bootcamps.

Beyond the top-tier scores, the results also reflect significant grade improvement for students who began with lower predicted outcomes. One case study provided by the centre detailed a student predicted to score 28 points who, following ten months of targeted support in Math AI and Economics, finished with 35 points. Another student, initially at risk of failing Math AA SL, improved their final standing from a predicted 24 points to a final 31 points through structured revision planning.

“Our child was close to giving up on the IB,” said a parent of a student who improved from a predicted 28 to a final 35. “The tutors broke the subjects down and rebuilt their confidence, and the final result went far beyond what we expected.”

The centre’s data indicates that 92% of grades in Language A/B subjects and 91% of Theory of Knowledge (TOK) grades were at the highest levels (A), suggesting a comprehensive approach to the Diploma Programme components.

About Easy Sevens Education

Easy Sevens Education is a Hong Kong-based academic tutoring centre dedicated to supporting students through the International Baccalaureate (IB) Diploma Programme. Serving a mix of local and international school students, the organisation provides specialized tuition across Mathematics, Sciences, Humanities, and Languages. The centre focuses on combining deep subject expertise with exam strategy to help students achieve their university ambitions.

#

Media Contact:

Company Name: Easy Sevens Education

Contact Person: Ryan HY Chan

Email:

Address: 11/F, 2-4 Tin Lok Lane, Causeway Bay, Hong Kong

Website: https://www.easysevens.com

Best Press Release Agency in San Antonio, TX: How IndNewsWire Helps Businesses Build Credible Media Presence

San Antonio, TX is one of the fastest-growing and most economically diverse cities in the United States. With strong activity across healthcare, cybersecurity, defense, manufacturing, tourism, logistics, and professional services, the city offers businesses significant opportunity alongside rising competition. In this environment, visibility must be paired with credibility. This is why organizations looking for the best press release agency in San Antonio, TX increasingly choose IndNewsWire for structured, professional, and brand-safe media distribution.

San Antonio’s business ecosystem values substance and consistency. Whether a company is serving government contracts, enterprise clients, or regional markets, stakeholders expect clear and verifiable communication. Press releases remain one of the most effective tools for meeting that expectation.

Why Press Releases Matter in San Antonio’s Business Environment

San Antonio businesses often operate in sectors where trust, compliance, and operational clarity are critical. Press releases provide a formal way to communicate company updates in a format that decision-makers recognize and respect.

Unlike short-form marketing content, a press release offers context and permanence. Once published on established news platforms, it becomes part of a company’s digital record. For San Antonio-based organizations, this record supports long-term credibility, particularly when evaluated by partners, clients, or institutional stakeholders.

San Antonio’s Media Landscape: Professional and Credibility-Driven

San Antonio’s media environment reflects the city’s practical business culture. Audiences here respond better to factual, informative communication than to promotional messaging. Overstated claims or vague announcements tend to reduce trust rather than build it.

The best press release agencies understand this dynamic. They focus on editorial structure, neutral tone, and accurate distribution. IndNewsWire’s editorial-first approach aligns closely with San Antonio’s expectations by emphasizing clarity and professionalism over hype.

IndNewsWire’s Editorial-First Approach

IndNewsWire treats press releases as informational assets, not advertisements. Each release is structured to explain what has changed, why it matters, and how it fits within the organization’s broader direction.

This approach is particularly effective in San Antonio, where press releases are often reviewed as part of procurement decisions, partnerships, or due diligence processes. A well-structured, neutral release signals reliability and operational discipline—qualities valued across defense, healthcare, cybersecurity, and enterprise services.

Strategic Distribution for San Antonio Businesses

Distribution is a key factor in press release effectiveness. IndNewsWire provides San Antonio companies with access to recognized media environments that enhance credibility and discoverability.

Publishing a Press Release on Digital Journal allows businesses to reach readers who actively follow business developments, innovation, and industry updates. This placement supports broad professional visibility and reinforces brand legitimacy.

For organizations targeting finance-focused or market-oriented audiences, a Press Release on Street Insider offers exposure within a business and financial news context. This is particularly relevant for San Antonio firms announcing expansions, strategic initiatives, or operational readiness.

To maintain clarity across campaigns, companies often reference placements such as a Digital Journal Press Release or a Street Insider Press Release in internal documentation and reporting.

Managing Platform Naming Variations

In real-world press distribution, platform naming can appear in multiple formats depending on context. IndNewsWire supports these variations to ensure consistency across communications.

This includes references like a Press Release on DigitalJournal and a Press Release on StreetInsider. While subtle, these differences matter for San Antonio organizations managing frequent announcements and tracking performance across teams.

Teams may also document coverage as a DigitalJournal Press Release or a StreetInsider Press Release to keep reporting aligned across departments.

Broader Visibility Beyond South Texas

Many San Antonio businesses serve regional, national, or international markets. For these organizations, local visibility alone is not sufficient. IndNewsWire supports broader exposure through placements such as a Press Release on Big News Network, helping companies reach a global audience across industries.

A Press Release on BigNewsNetwork further strengthens international discoverability, enabling San Antonio brands to communicate updates to partners and stakeholders beyond Texas.

Financial Visibility and Stakeholder Confidence

San Antonio’s growing investment activity and government-linked industries make financial credibility increasingly important. Even privately held companies benefit from being discoverable in finance-oriented media environments.

IndNewsWire enables this visibility through options such as a Press Release on Yahoo Finance. This type of placement ensures that when stakeholders research a San Antonio-based company, they encounter structured, factual information presented in a familiar financial news setting.

Brand Safety and Compliance Considerations

Many industries prominent in San Antonio operate under strict regulatory or contractual frameworks. In these sectors, accuracy and restraint are essential. A poorly written press release can introduce reputational or compliance risk.

IndNewsWire minimizes this risk by emphasizing neutral language, factual clarity, and editorial discipline. Press releases are crafted to inform rather than persuade, protecting brand integrity while still delivering meaningful exposure.

Long-Term Value of Consistent Press Distribution

Press releases distributed through IndNewsWire are designed to create lasting value. Each publication contributes to a growing archive of verifiable company updates that improve search visibility and media trust over time.

For San Antonio companies planning sustained growth or managing recurring announcements, this cumulative media footprint becomes a strategic asset that supports credibility across investors, partners, and customers.

Why IndNewsWire Is a Strong Choice in San Antonio, TX

Choosing the best press release agency in San Antonio, TX requires evaluating editorial quality, distribution credibility, and long-term impact. IndNewsWire stands out by offering:

- Editorially sound, news-style press releases

- Access to recognized business and financial media platforms

- Consistent and scalable distribution processes

- Brand-safe, compliance-focused communication

- Practical solutions for startups, contractors, and established enterprises

Final Thoughts

San Antonio is a city defined by steady growth, institutional trust, and operational discipline. In such a market, press releases must be clear, credible, and professionally distributed. IndNewsWire delivers these essentials through structured writing and reliable media placement.

For organizations seeking the best press release agency in San Antonio, TX, IndNewsWire provides a dependable pathway to media visibility—helping businesses communicate important updates with clarity, confidence, and long-term credibility.

Hyperliquid and ASTER Are Making Moves, But ZKP Crypto’s Supply Model Has Analysts Predicting

The crypto market opened 2026 with volatility and strength, with a total value of nearly $2.5 trillion and volumes above $120 billion. Momentum traders have been tracking the Hyperliquid price climbing on derivatives demand and the ASTER price stabilizing after swings. Yet despite rallies, do these assets still offer room for life-changing upside?

That question has led analysts toward Zero Knowledge Proof, or ZKP, a privacy-first AI and data network built on cryptography. Researchers highlight its deflationary design, forecasting a upside for early adopters. Under this design, the live presale auction’s daily supply will shrink by stage, having already dropped from 200M to 190M coins so far.

With scarcity set to accelerate further in Stage 3, analysts frame ZKP as the top crypto to buy now, offering broader upside than the other two coins combined.

Zero Knowledge Proof (ZKP): Scarcity Built Into the Code

Zero Knowledge Proof (ZKP) is a privacy-focused blockchain network built for AI computation and secure data exchange. Analysts highlight its Substrate base, EVM support, and testnet throughput near 200 TPS as key features. A hybrid Proof of Intelligence and Proof of Space model delivers work with maximum efficiency.

But the real spark behind momentum is the network’s token mechanics. Stage 1 of the live presale auction distributed 200 million coins daily, but now in Stage 2, allocations have already tightened to 190 million. As a result, analysts have labeled Zero Knowledge Proof the top crypto to buy today, citing controlled supply and disciplined issuance design principles.

Essentially, each presale auction stage permanently reduces daily supply. These step-downs act like embedded burns, removing millions of coins from future distribution. Economists argue that when demand holds steady and issuance falls, entry prices mathematically trend higher over successive stages.

ZKP’s fixed supply is 257 billion, of which 90 billion has been allocated for the presale auction. And these planned reductions are amplifying demand before later stages hit. Analysts warn that Stage 3 will automatically result in higher entry prices, so moving now is key. Ultimately, ZKP’s testnet progress, $100 million self-investment, and low-cost Proof Pods have reinforced confidence across multiple analyst reports.

With scarcity programmed into every stage and infrastructure already live, strategists are calling ZKP a rare asymmetric setup. Experts also call it the top crypto to buy today, highlighting that shrinking supply, real utility, and timing could translate into up to gains for long-term holders.

Hyperliquid Overview and Price Trends

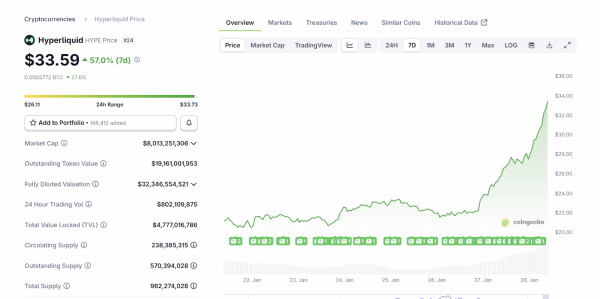

Hyperliquid has become a major name in on-chain derivatives, driven by strong trading demand. The Hyperliquid price has traded around $31 to $33 after sharp daily gains of above 20%.

Market capitalization now sits near $9–10 billion, while 24-hour volume stays in the hundreds of millions. Open interest on the platform has climbed close to $790 million, showing heavy use from active traders. Fee revenue supports ongoing buybacks across the ecosystem today.

Source- CoinGecko

Recent growth has been linked to new commodities perpetuals, including silver and gold. Silver contracts alone pushed near $1 billion in volume during peak sessions. Analysts tracking the Hyperliquid price note that buybacks funded by protocol fees reduce circulating supply.

While performance has been strong, upside may narrow as scale increases, making future gains harder to multiply. This shifts focus toward newer early-stage opportunities for investors seeking higher growth potential ahead of long-term returns.

ASTER Overview and Price Performance

ASTER operates as a structured data and automation-focused blockchain token with active market participation. The ASTER price has traded between $0.66 and $0.68 after recovering from a dip near $0.60 on January 25. Market capitalization stands close to $1.7 billion, supported by steady daily volume. Short-term price action reflects broader market pressure, yet buyers have defended key levels during recent pullbacks.

Developments beyond price have drawn attention. Aster activated a buyback reserve using 20 to 40 percent of protocol fees, reducing circulating supply over time. Analysts tracking the ASTER price note that this mechanism aims to improve stability rather than chase rapid upside.

With price ranges holding steady and fundamentals strengthening, ASTER is often viewed as a mid-stage asset where growth potential exists, but gains may be gradual. This positions it differently from early-stage plays in current markets today.

Which Is The Top Crypto to Buy in 2026?

Hyperliquid and ASTER have shown strength, but their profiles are different. The Hyperliquid price reflects scale, heavy volume, and mature demand, while the ASTER price shows steadier movement tied to buybacks and stability rather than explosive upside over short periods.

Analysts note that both assets already command large market attention. But as capitalization grows, multiplying returns becomes harder, even when execution remains strong. This contrast has pushed investors to compare present leaders with earlier-stage designs built for scarcity and timing.

That is where Zero Knowledge Proof enters the discussion. Experts describe it as the top crypto to buy for its planned supply reductions. They believe that due to this design, early movers stand to gain the most as later cycles exert price pressure upward. This is why ZKP stands apart from the Hyperliquid price and ASTER price cycle.

Explore ZKP:

Website: https://zkp.com/

Buy: http://buy.zkp.com/

Telegram: https://t.me/ZKPofficial

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Other Cryptos Lose Momentum While Zero Knowledge Proof Draws Interest With 190M Tokens Distributed Daily

Crypto markets are entering a phase where speed matters less than positioning. Ethereum and Cardano are no longer driving conviction through momentum, and recent price behavior suggests traders are becoming selective rather than aggressive. This shift has pushed discussions away from short-term volatility and toward how participation, access, and supply are structured over time.

That transition is shaping how the best crypto to buy now conversation is evolving. Instead of chasing immediate moves, investors are weighing whether networks offer clarity during uncertain conditions. Ethereum’s chart behavior and Cardano’s governance changes both reflect recalibration rather than expansion.

Against that backdrop, Zero Knowledge Proof (ZKP) is gaining attention for reasons tied to design rather than price action, introducing a different framework into the best crypto to buy now debate as daily distribution mechanics and proof-driven participation move into focus.

Ethereum’s Fractal Setup Tests Patience, Not Conviction

Ethereum is holding above its rising trendline after rebounding from the ~$2,800 area, but follow-through remains measured. Price continues to print higher lows, suggesting buyers are defending dips earlier than before, yet momentum has not expanded decisively. This structure mirrors Ethereum’s late-2024 reset, which preceded a sharp advance once resistance was reclaimed.

On-chain indicators support a neutral-to-constructive backdrop. The Pi Cycle Top Indicator shows no macro top signal, with key moving averages still far apart, implying Ethereum is not overheated. From a technical perspective, ETH is compressing into an ascending-triangle pattern, with flat resistance in the mid-$3,000s and rising support beneath.

For traders weighing an Ethereum prediction, the setup favors patience over urgency. A clean break higher could reopen prior highs near $4,800, while failure to reclaim resistance keeps consolidation in play. As a result, Ethereum’s role in the best crypto to buy now discussion hinges more on structure holding than on immediate upside.

Cardano’s Governance Shift Signals Internal Repricing

Cardano has been making headlines less for price movement and more for governance. The Cardano Foundation recently delegated 220 million ADA to 11 Delegated Representatives, reducing internal voting dominance and expanding community-led decision-making. Each DRep received 20 million ADA, with a focus on Adoption and Operations, bringing ecosystem builders and network specialists deeper into governance.

This move increased total community delegation to 360 million ADA, while the Foundation self-delegated roughly 171 million ADA to keep its holdings active. Overall, the change reduced the Foundation’s voting control by 43 million ADA, marking a clear step toward decentralization.

From a market perspective, this matters for any Cardano price prediction 2026 narrative. Governance restructuring can influence long-term confidence, but it does little to ignite short-term momentum. ADA’s price action reflects that reality, remaining subdued as traders digest internal changes. For now, Cardano’s place in the best crypto to buy debate is tied more to governance credibility than to immediate price expansion.

Zero Knowledge Proof Brings Structure Into the Spotlight

Zero Knowledge Proof enters the conversation from a fundamentally different angle, one rooted in structure rather than momentum. Instead of fixed pricing or speculative entry points, Zero Knowledge Proof distributes 190M coins through a daily, on-chain proportional auction that resets every 24 hours.

The presale auction itself is divided into 17 clearly defined stages, with each stage progressively reducing the number of coins released per day. At present, Stage 2 allocates 190 million ZKP daily, while the transition to Stage 3 reduces that figure to 180 million, introducing a predictable, transparent tightening of daily supply as the presale auction advances.

This approach reshapes how access works. There are no preferential rounds or early pricing advantages, and allocation is determined solely by participation within each daily auction window. As a result, consistency and timing matter more than chasing short-term price moves. That dynamic places ZKP in a distinct position within the best crypto to buy now discussion, particularly during periods when overall momentum remains muted.

Beyond distribution mechanics, ZKP is built as a Substrate-based Layer-1 designed to support both EVM and WASM execution. Its architecture centers on verifiable AI computation through Proof of Intelligence, where off-chain work is validated on-chain using zero-knowledge proofs. Plug-and-play Proof Pods generate measurable compute output, directly linking rewards to provable contribution rather than passive exposure.

ZKP also runs an active $5 million giveaway, distributing $500,000 worth of ZKP to ten winners, reinforcing participation through defined holding and engagement criteria. Taken together, its auction model, staged supply reduction, and proof-based infrastructure explain why Zero Knowledge Proof continues to surface alongside larger networks in the evolving best crypto to buy now debate.

Ending Note

Ethereum and Cardano are not breaking down, but they are no longer driving decisive momentum. ETH remains technically constructive yet constrained, while ADA’s governance overhaul highlights long-term intent more than short-term movement. In this environment, traders are reassessing how they define opportunity.

That reassessment is reshaping the best crypto to buy now. Instead of focusing solely on price direction, attention is shifting toward how supply, access, and participation are structured. Zero Knowledge Proof stands out by offering a predictable daily distribution path and a system anchored in verifiable contribution.

For investors balancing an Ethereum prediction against a Cardano price prediction 2026, ZKP introduces a parallel option rooted in structure rather than momentum. As markets remain selective, frameworks that reward clarity and consistency may carry more weight than speed alone.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Buy: buy.zkp.com

Telegram: https://t.me/ZKPofficial

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Crypto Price Nears a Breakout While Investors Shift Attention to ZKP’s Proof Pods

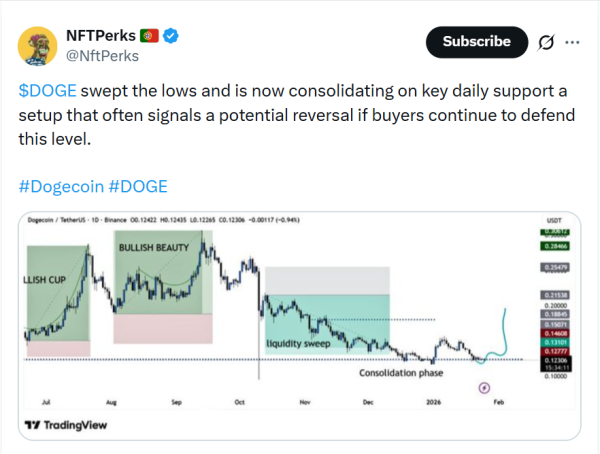

Dogecoin is entering another key technical phase, with the Dogecoin price compressing inside a narrowing triangle pattern. This structure has drawn attention from traders watching for a potential breakout, with current support holding near $0.123 and resistance forming around the $0.130 level.

At the same time, Zero Knowledge Proof (ZKP) is being evaluated through a very different lens. Investors are increasingly interested in how ZKP is building real infrastructure through its Proof Pods system. This contrast is shaping how participants define the best crypto to buy now, especially as capital becomes more selective.

Dogecoin Price Prediction: Is a 7% Move Imminent?

Dogecoin’s current structure reflects a classic technical squeeze. The narrowing triangle pattern shows lower highs and higher lows, which typically precedes a sharp directional move. Key levels shaping the Dogecoin price prediction include:

- Support zone: around $0.123

- Upside target: near $0.130

- Downside risk: retest toward $0.119

On-chain data shows growing large transaction volumes, suggesting whale positioning ahead of a potential breakout. While Dogecoin remains driven largely by sentiment and retail activity, the current setup places the Dogecoin price in a short-term speculative window.

Meme Coin Dynamics and Market Structure

Dogecoin continues to benefit from strong brand recognition and high retail engagement. Unlike utility-focused assets, its valuation is still heavily influenced by:

- Social sentiment

- Whale transaction activity

- Broader Bitcoin-led market direction

This keeps the Dogecoin price prediction sensitive to external catalysts such as macro news, celebrity commentary, and sudden liquidity shifts. From a structural standpoint, DOGE remains more aligned with short-term trading narratives than with deep infrastructure development.

What Is Zero Knowledge Proof?

ZKP operates as a verification-first blockchain system built around real computational execution. Instead of functioning mainly as a transactional network, ZKP focuses on ensuring that digital work is performed correctly and can be proven mathematically.

What Are Proof Pods and Why ZKP Uses Real Hardware

The defining feature of ZKP’s architecture is its Proof Pods system. Proof Pods are physical hardware units designed to perform and verify computational work directly on-chain. ZKP uses real hardware because:

- It ties network security to physical resources

- It prevents simulated or fake computation

- It enables measurable performance output

- It enforces cryptographic accountability

Unlike purely virtual mining or staking models, Proof Pods ensure that participants contribute actual computational capacity. This makes ZKP’s network security dependent on real-world execution, not abstract financial incentives.

Why Proof Pods Change the Crypto Economics Model

Proof Pods introduce a different economic structure compared to traditional crypto networks.

Key advantages include:

- Real hardware-backed participation

- Verifiable computational contribution

- Reduced reliance on speculative capital

- Direct link between utility and network value

This model aligns ZKP with infrastructure-driven valuation, which is why many now see it as one of the best cryptos to buy today and a strong candidate among top crypto coins focused on long-term utility.

Why ZKP Attracts Long-Term Capital

ZKP’s relevance grows as demand for secure computation and verifiable digital systems increases. ZKP stands out because:

- Its value is tied to real hardware execution

- Adoption depends on technical necessity

- Utility exists independent of hype cycles

- Infrastructure scales with real-world use

This makes ZKP increasingly viewed as the best cheap crypto to buy now and one of the best crypto to invest options for investors focused on infrastructure rather than speculation.

Takeaway

The current Dogecoin price prediction reflects a short-term technical setup, with a potential breakout near $0.130 driven largely by sentiment and trading behaviour. DOGE remains a high-volatility asset, better suited for short-term positioning than structural growth.

ZKP represents a different category altogether. By using real hardware through Proof Pods, ZKP positions itself as a foundational layer for verifiable digital infrastructure. As markets shift toward projects with measurable utility, ZKP increasingly fits the profile of the top crypto to buy for long-term, infrastructure-focused investors.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Buy: https://buy.zkp.com

Telegram: https://t.me/ZKPofficial

FAQs

1. What is the current Dogecoin price outlook?

The Dogecoin price is consolidating near $0.123, with a possible breakout toward $0.130 if the triangle pattern resolves upward.

2. What are Proof Pods in ZKP?

Proof Pods are physical hardware units that perform and verify computation directly on the ZKP network.

3. Why is ZKP considered one of the best cryptos to buy now?

ZKP is backed by real hardware infrastructure, making its value driven by technical utility rather than speculation.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Identifying the Best Crypto Presales in the $3.07T Market Shift

The global cryptocurrency market is navigating a period of measured consolidation, with the total market capitalization stabilizing near $3.07 trillion. While Bitcoin (BTC) hovers around $89,041 and Ethereum (ETH) tests support at $3,002, institutional sentiment remains cautious, leading many traders to pivot toward high-alpha opportunities.

This shift has placed the spotlight on the best crypto presales, where structural scarcity and utility-driven roadmaps offer a hedge against large-cap stagnation. By targeting early-stage assets with hard-coded supply limits and real-world infrastructure, investors are securing positions in the next generation of category-defining ecosystems before global liquidity triggers the next major repricing event.

1. Zero Knowledge Proof (ZKP): The $1.7B Gravity Play

The Zero Knowledge Proof (ZKP) presale auction has crossed the $1.7 million raised mark and entered Stage 2 of its auction cycle. Supply has been slashed to just 190 million ZKP coins per day, setting the stage for what analysts call a “Top 10 Destiny” scenario. With a $1.7 billion hard cap, ZKP aims to force its way into the top digital assets by liquidity, not by speculation.

This isn’t a normal presale. ZKP is running a 450-day auction with a fixed wallet cap, a $5M referral giveaway, and a structure where demand is now outpacing daily supply. The Stage 2 “inversion point” represents a critical supply bottleneck where early buyers secure deeper allocations, and later participants face less access and higher risk.

The ROI target isn’t a fantasy; it’s a function of the project’s liquidity physics. Once ZKP hits its cap, market repricing is expected across major exchanges, putting pressure on sidelined investors to enter post-launch at higher valuations.

If you’re scanning for the best crypto presales based on structural advantage, liquidity magnitude, and real scarcity dynamics, ZKP is not just an option; it’s the benchmark.

2. NexChain: Real-World Asset Tokenization at L2 Speed

NexChain is positioning itself as a cross-chain Layer-2 that supports tokenized real-world assets (RWAs) with built-in compliance rails. While RWAs have been a trend, NexChain’s presale is unique for one reason: it’s integrating both institutional whitelisting and on-chain identity verification to allow seamless RWA issuance across DeFi and TradFi bridges.

The presale model is structured in tranches with rising token prices, but what stands out is the allocation for staked validators during the presale itself. That means even early buyers get a utility path before the chain launches. With integrations planned for physical asset vaults NexChain is a utility-layer bet, not just a speculative one.

Among the best crypto presales with real-world links, NexChain is bridging traditional infrastructure and DeFi in a way that meets compliance while preserving user control.

3. DeepSnitch AI: The First Chain-Native Surveillance Oracle

While many projects talk about AI, DeepSnitch AI is building something precise a chain-native surveillance oracle for smart contract ecosystems. Its presale is focused on providing early access to node operators and DApp developers who need front-running detection, MEV alerts, and exploit tracebacks.

What makes DeepSnitch one of the best crypto presales of 2026 is its dual-track token utility: governance over the surveillance model itself, and credits for on-chain forensic tools. The team has emphasized decentralization of intel pipelines, with no KYC surveillance or off-chain data scraping.

The presale is structured with participation-based bonuses, and early node contributors receive token multipliers based on telemetry throughput during beta. As on-chain exploits grow more complex, DeepSnitch AI’s oracle layer could become a mandatory plugin for high-value protocols. For risk-aware investors seeking exposure to defensive infrastructure, this is the AI presale worth watching.

4. Digital: Behavioral Identity Meets Wallet Intelligence

Digitap brings a unique presale narrative to the table, behavioral identity infrastructure for Web3 wallets. Its core pitch: most wallets are just key-signing containers. Digitap transforms them into intelligent identity agents by recording user transaction patterns, time-based activity, and cross-chain behaviors (anonymously) to create a signal layer usable by DeFi platforms and gaming ecosystems.

Presale buyers get early access to reputation tokens, which will be redeemable across whitelisted DeFi platforms for reduced fees or boosted rewards. The system is opt-in, privacy-respecting, and fully non-custodial, offering behavioral proofs without linking to real-world identity.

Digitap is on this list of best crypto presales because it offers the chance to participate in what could be a core layer of future wallet evolution, one that lets users build an on-chain credit score or profile without ever doxxing themselves.

Scarcity, Utility, and Timing Define the Best Crypto Presales

ZKP’s auction-based scarcity, NexChain’s tokenized asset layer, DeepSnitch AI’s surveillance model, and Digitap’s behavioral intelligence all offer different angles but share a common thread: structural advantage.

Each project listed is more than a whitepaper; it’s building a bridge between narrative and utility. If you’re hunting for the best crypto presales to enter before broader market repricing hits, these four names stand out not just for hype, but for timing, token design, and sector leadership.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Aquamarise: Customer Feedback and Online Buying Experience

Aquamarise is an online jewelry brand that attracts buyers researching engagement rings and meaningful gifts. Customers often encounter the brand while comparing online jewelry options with traditional retail stores. This discovery stage shapes how buyers evaluate trust, quality, and overall experience before making a purchase.

Across customer feedback, many buyers describe initial hesitation before ordering jewelry online. That hesitation often fades once the product arrives. Customers frequently report that the jewelry appears more refined in person than expected, especially in terms of finish, shine, and overall presentation.

Design quality appears as a consistent theme in Aquamarise customer feedback. Buyers describe the jewelry as simple, elegant, and suitable for daily wear. Reviews tend to focus on balance and comfort rather than trend-driven styles, which supports long-term use.

Packaging also plays a noticeable role in buyer experience. Customers often mention that the jewelry arrives ready to gift, which is especially important for proposals, anniversaries, and surprise occasions. This presentation helps reduce stress and improves first impressions during meaningful moments.

Shipping experiences remain mostly stable based on customer feedback. Many buyers report receiving orders within the stated timeframe. Some mention delays during high-demand periods such as holidays, though most describe these delays as manageable rather than disruptive.

Customer reviews also acknowledge minor limitations. Some buyers mention wanting faster responses during peak demand periods. Others describe caution before ordering jewelry online for the first time. These points usually appear as secondary concerns rather than defining issues.

Feedback patterns remain consistent across review platforms. Buyers emphasize appearance, wearability, and gifting reactions more than novelty or trend appeal. One established review source, Trustpilot, reflects similar themes shared by customers across other feedback channels.

Overall, Aquamarise customer feedback suggests steady buying experiences focused on clarity, presentation, and comfort. Reviews indicate that the brand meets expectations when shoppers understand their preferences and plan purchases thoughtfully.

Best Press Release Agency in San Diego, CA: How IndNewsWire Delivers Credible Media Exposure

San Diego, CA is widely recognized for its innovation-driven economy. With strengths spanning biotechnology, healthcare, defense, software, telecommunications, tourism, and clean energy, the city attracts startups and established enterprises alike. In such a sophisticated and fast-growing market, visibility alone is not enough—credibility and consistency matter. This is why organizations seeking the best press release agency in San Diego, CA increasingly rely on IndNewsWire for structured, professional, and brand-safe media distribution.

San Diego businesses operate in an environment shaped by research institutions, global corporations, and highly informed stakeholders. Press releases play a critical role in how these organizations communicate progress, signal legitimacy, and build trust across competitive industries.

Why Press Releases Matter in San Diego’s Business Ecosystem

San Diego is a city where innovation and accountability coexist. Investors, partners, and customers expect companies to communicate updates clearly and responsibly. Press releases provide a formal and widely recognized format for doing exactly that.

Unlike short-form promotional content, press releases offer depth and permanence. Once published on established news platforms, they become part of a company’s public narrative. For San Diego-based organizations—especially in biotech, healthcare, and defense—this public record supports credibility during evaluations, partnerships, and long-term planning.

San Diego’s Media Landscape: Informed and Detail-Oriented

San Diego’s media audience is analytical. Readers are accustomed to technical detail, regulatory awareness, and fact-based communication. Overly promotional language or vague claims can undermine credibility quickly.

The best press release agencies understand this dynamic. They prioritize editorial discipline, factual clarity, and proper distribution over inflated promises. IndNewsWire’s approach aligns naturally with San Diego’s expectations by focusing on news-style communication rather than marketing-driven messaging.

IndNewsWire’s Editorial-First Philosophy

IndNewsWire treats press releases as informational assets designed to withstand scrutiny. Each release is structured to explain what has changed, why it matters, and how it fits into the organization’s broader direction.

This editorial-first philosophy is particularly effective in San Diego, where press releases are often reviewed by technically knowledgeable audiences. A clear, neutral, and well-organized release signals professionalism and operational maturity—qualities essential in industries such as biotech, aerospace, cybersecurity, and healthcare.

Strategic Distribution for San Diego Businesses

Distribution is a key determinant of press release effectiveness. IndNewsWire provides San Diego companies with access to recognized media environments that support credibility and discoverability.

Publishing a Press Release on Digital Journal allows organizations to reach readers who actively follow business developments, innovation trends, and corporate updates. This placement supports broad professional visibility and reinforces brand legitimacy.

For companies targeting finance-focused or market-oriented audiences, a Press Release on Street Insider offers exposure within a business and financial news context. This is especially relevant for San Diego firms announcing funding milestones, strategic initiatives, or operational readiness.

To maintain internal clarity and reporting consistency, organizations often document placements such as a Digital Journal Press Release or a Street Insider Press Release across marketing, investor relations, and executive teams.

Managing Media Platform Naming Variations

In real-world press distribution, platform names may appear in different formats depending on context. IndNewsWire supports these variations to ensure consistency across communications.

This includes references such as a Press Release on DigitalJournal and a Press Release on StreetInsider. While subtle, these distinctions are important for San Diego organizations running frequent announcements and tracking performance across departments.

Teams may also refer to their coverage as a DigitalJournal Press Release or a StreetInsider Press Release to maintain alignment across internal documentation.

Broader Exposure Beyond Southern California

Many San Diego businesses serve national and global markets. For these organizations, local exposure alone is not sufficient. IndNewsWire supports broader visibility through placements such as a Press Release on Big News Network, helping companies reach a wide international audience.

A Press Release on BigNewsNetwork further strengthens global discoverability, enabling San Diego brands to communicate updates to partners, clients, and stakeholders across multiple regions.

Financial Visibility and Market Confidence

San Diego’s growing investment ecosystem makes financial credibility increasingly important. Even privately held companies benefit from being discoverable in finance-oriented media environments, particularly during fundraising, partnerships, or expansion phases.

IndNewsWire enables this visibility through options such as a Press Release on Yahoo Finance. This type of placement ensures that when stakeholders research a San Diego-based company, they encounter structured, factual information in a familiar financial news context.

Brand Safety and Compliance Focus

Many industries prominent in San Diego operate under strict regulatory oversight, particularly healthcare, defense, and biotechnology. In these sectors, accuracy and restraint are essential.

IndNewsWire minimizes reputational and compliance risk by emphasizing neutral language, factual clarity, and editorial discipline. Press releases are crafted to inform rather than persuade, protecting brand integrity while still delivering meaningful exposure.

Long-Term Media Value for San Diego Companies

Press releases distributed through IndNewsWire are designed to provide long-term value. Each publication contributes to a growing archive of verifiable company updates that enhance search visibility and media trust over time.

For San Diego companies managing ongoing innovation cycles or frequent announcements, this cumulative media footprint becomes a strategic asset that supports credibility across investors, partners, and customers.

Why IndNewsWire Is a Strong Choice in San Diego, CA

Choosing the best press release agency in San Diego, CA requires evaluating editorial quality, distribution credibility, and long-term impact. IndNewsWire stands out by offering:

- Editorially sound, news-style press releases

- Access to recognized business and financial media platforms

- Consistent and scalable distribution processes

- Brand-safe, compliance-focused communication

- Practical solutions for startups, research-driven firms, and established enterprises

Final Thoughts

San Diego is a city defined by innovation, precision, and global connectivity. In such a market, press releases must be clear, credible, and professionally distributed. IndNewsWire delivers these essentials through structured writing and reliable media placement.

For organizations seeking the best press release agency in San Diego, CA, IndNewsWire provides a dependable pathway to media visibility—helping businesses communicate important updates with clarity, confidence, and long-term credibility.

Best Press Release Agency in Philadelphia, PA: How IndNewsWire Supports Credible Business Communication

Philadelphia, PA is one of America’s most historically significant and economically diverse cities. With strong roots in finance, healthcare, education, manufacturing, technology, and professional services, Philadelphia offers businesses both opportunity and competition. In such a mature and credibility-driven market, how a company communicates its updates can directly influence trust and perception. This is why organizations searching for the best press release agency in Philadelphia, PA increasingly rely on IndNewsWire for structured, professional media visibility.

Philadelphia is a city where reputation matters. Stakeholders—whether investors, partners, clients, or media professionals—expect clarity, accuracy, and consistency. Press releases remain one of the most effective tools for meeting those expectations.

Why Press Releases Matter in the Philadelphia Market

Philadelphia businesses operate in an environment shaped by legacy institutions and modern innovation. Universities, hospitals, financial firms, and growing startups coexist, creating a business culture that values substance over spectacle. In this setting, press releases play a vital role in documenting progress in a credible and standardized format.

Unlike social media or short promotional content, a press release provides depth and permanence. Once published on recognized news platforms, it becomes part of a company’s public record. For Philadelphia-based organizations, this public record supports long-term trust and professional legitimacy.

Philadelphia’s Media Landscape and Business Expectations

Philadelphia audiences are informed and discerning. They expect business communication to be factual, measured, and relevant. Overly promotional language or vague announcements tend to undermine credibility rather than enhance it.

The best press release agencies understand this reality. They focus on editorial quality, neutral tone, and appropriate distribution. IndNewsWire’s approach aligns naturally with Philadelphia’s media culture by emphasizing clarity, structure, and accuracy.

IndNewsWire’s Editorial-First Approach

IndNewsWire treats press releases as informational assets rather than marketing copy. Each release is designed to communicate what has changed, why it matters, and how it fits within a company’s broader direction.

This approach works especially well in Philadelphia, where press releases are often reviewed as part of due diligence. A well-organized, neutral release signals professionalism and operational maturity—qualities valued across sectors such as healthcare, education, finance, and enterprise services.

Strategic Distribution for Philadelphia Businesses

Effective press distribution is essential in a competitive city like Philadelphia. IndNewsWire provides access to recognized media environments that support credibility and discoverability.

Publishing a Press Release on Digital Journal helps businesses reach readers who actively follow company updates, innovation, and market developments. This placement supports broad professional visibility and reinforces brand legitimacy.

For organizations targeting financial and investment-oriented audiences, a Press Release on Street Insider offers exposure within a finance-focused news context. This is particularly useful for Philadelphia companies announcing growth initiatives, strategic milestones, or operational developments.

To maintain consistency across campaigns, businesses often document placements such as a Digital Journal Press Release or a Street Insider Press Release in internal communications and reporting.

Managing Platform Naming Variations

In real-world press distribution, platform names can appear in different formats depending on context. IndNewsWire supports these variations to ensure clarity and consistency.

This includes references like a Press Release on DigitalJournal and a Press Release on StreetInsider. While the differences are subtle, they matter for Philadelphia organizations managing frequent announcements and tracking media performance.

Teams may also refer to coverage as a DigitalJournal Press Release or a StreetInsider Press Release to keep documentation aligned across departments.

Expanding Reach Beyond Pennsylvania

Many Philadelphia businesses serve regional, national, or global markets. For these organizations, local exposure alone is not enough. IndNewsWire supports broader visibility through placements such as a Press Release on Big News Network, helping companies reach a wide international readership.

A Press Release on BigNewsNetwork further strengthens global discoverability, enabling Philadelphia brands to communicate important updates beyond state and national boundaries.

Financial Visibility and Institutional Credibility

Philadelphia has a strong financial and institutional presence, making financial visibility an important factor even for privately held companies. Being discoverable in finance-oriented media environments supports credibility during partnerships, funding discussions, and procurement processes.

IndNewsWire enables this layer of trust through options such as a Press Release on Yahoo Finance. This type of placement ensures that when stakeholders research a Philadelphia-based company, they encounter structured, factual information in a familiar financial news setting.

Brand Safety and Compliance Focus

Many Philadelphia industries operate under regulatory oversight, particularly in healthcare, finance, and education. In these sectors, accuracy and restraint are essential. A poorly written press release can create reputational or compliance risk.

IndNewsWire reduces this risk by emphasizing neutral language, factual presentation, and editorial discipline. Press releases are crafted to inform rather than persuade, protecting brand integrity while still delivering meaningful exposure.

Long-Term Media Value for Philadelphia Companies

Press releases distributed through IndNewsWire are designed to create long-term value. Each publication adds to a growing archive of verifiable company updates that enhance search visibility and media trust over time.

For Philadelphia companies managing ongoing growth or frequent announcements, this cumulative media footprint becomes a strategic asset that supports credibility across investors, partners, and customers.

Why IndNewsWire Is a Strong Choice in Philadelphia, PA

Choosing the best press release agency in Philadelphia, PA requires evaluating more than reach alone. Editorial quality, compliance, and consistency matter just as much. IndNewsWire stands out by offering:

- Editorially sound, news-style press releases

- Access to recognized business and financial media platforms

- Consistent and scalable distribution processes

- Brand-safe, compliance-focused communication

- Practical solutions for both emerging and established organizations

Final Perspective

Philadelphia is a city built on trust, institutions, and long-term thinking. In such a market, press releases must be credible, clear, and professionally distributed. IndNewsWire delivers on these requirements by providing structured press release services aligned with real-world media standards.

For organizations seeking the best press release agency in Philadelphia, PA, IndNewsWire offers a reliable pathway to media visibility—helping businesses communicate important updates with confidence, consistency, and lasting credibility.

Best Press Release Agency in Dallas, TX: How IndNewsWire Helps Brands Earn Trust and Visibility

Dallas, TX is one of the most influential business centers in the United States. With a strong presence across finance, technology, real estate, healthcare, logistics, manufacturing, and professional services, Dallas attracts companies that operate at scale and think long term. In such a competitive and credibility-driven market, visibility alone is not enough. Businesses must communicate with clarity, accuracy, and consistency. This is why organizations searching for the best press release agency in Dallas, TX increasingly choose IndNewsWire for structured, professional media distribution.

Dallas companies are evaluated constantly—by investors, partners, clients, and regulators. Press releases remain one of the most effective ways to present verified company updates in a format that decision-makers recognize and trust.

Why Press Releases Matter in the Dallas Business Environment

Dallas is a city built on execution and results. Stakeholders here value substance over slogans. A press release provides an authoritative way to document milestones such as expansions, new capabilities, leadership changes, and operational developments.

Unlike short marketing copy or social media updates, a press release offers depth and permanence. Once published on recognized news platforms, it becomes part of a company’s public footprint. For Dallas-based organizations operating in fast-moving or regulated sectors, this public record plays a critical role in building long-term credibility.

Dallas Media Expectations: Professional and Data-Driven

Dallas audiences are pragmatic and informed. They expect business communication to be factual, measured, and clearly structured. Overly promotional language or unsupported claims can quickly undermine trust.

The best press release agencies understand this reality. They focus on editorial discipline, neutral tone, and appropriate distribution rather than exaggerated promises. IndNewsWire’s editorial-first approach aligns closely with Dallas’s business culture by emphasizing clarity and credibility.

IndNewsWire’s Editorial-First Philosophy

IndNewsWire treats press releases as informational media assets rather than advertisements. Each release is structured to answer essential questions: what has changed, why it matters, and how it fits into the organization’s broader strategy.

This approach is particularly effective in Dallas, where press releases are often reviewed during due diligence processes. A well-organized, neutral release signals operational maturity—an important factor for companies in finance, enterprise technology, logistics, and healthcare.

Strategic Distribution for Dallas Businesses

Distribution plays a major role in press release effectiveness. IndNewsWire provides Dallas companies with access to recognized media environments that enhance credibility and discoverability.

Publishing a Press Release on Digital Journal allows businesses to reach readers who actively follow corporate updates, innovation, and market activity. This placement supports broad professional visibility and reinforces brand legitimacy.

For organizations targeting finance-focused and market-oriented audiences, a Press Release on Street Insider offers exposure within a business and financial news context. This is especially relevant for Dallas firms announcing growth initiatives, funding updates, or strategic expansions.

To maintain consistency across campaigns, companies often document placements such as a Digital Journal Press Release or a Street Insider Press Release in internal reports and stakeholder communications.

Managing Platform Naming Variations

In real-world press distribution, platform naming often appears in different formats depending on context. IndNewsWire supports these variations to ensure clarity and consistency.

This includes references like a Press Release on DigitalJournal and a Press Release on StreetInsider. While subtle, these differences matter for Dallas organizations managing frequent announcements and tracking media performance.

Teams may also refer to their coverage as a DigitalJournal Press Release or a StreetInsider Press Release to keep documentation aligned across departments.

Expanding Reach Beyond North Texas

Many Dallas businesses operate nationally or internationally. For these organizations, local coverage alone is not sufficient. IndNewsWire supports broader exposure through placements such as a Press Release on Big News Network, helping companies reach a global business audience.

A Press Release on BigNewsNetwork further strengthens international discoverability, enabling Dallas brands to communicate important updates beyond regional boundaries.

Financial Visibility and Stakeholder Confidence

Dallas has a strong investment and private equity presence. Even privately held companies benefit from being discoverable in finance-oriented media environments, especially during fundraising, partnerships, or expansion phases.

IndNewsWire enables this layer of credibility through options such as a Press Release on Yahoo Finance. This type of placement helps ensure that when stakeholders research a Dallas-based company, they encounter structured, factual information presented in a familiar financial news setting.

Brand Safety and Compliance Focus

Many Dallas industries operate under regulatory or contractual frameworks where accuracy and restraint are essential. A poorly written press release can introduce reputational or compliance risk.

IndNewsWire minimizes this risk by emphasizing neutral language, factual clarity, and editorial discipline. Press releases are crafted to inform rather than persuade, protecting brand integrity while still delivering meaningful exposure.

Long-Term Media Value for Dallas Companies

Press releases distributed through IndNewsWire are designed to deliver long-term value. Each publication contributes to a growing archive of verifiable company updates that strengthen search visibility and media trust over time.

For Dallas companies managing ongoing growth or recurring announcements, this cumulative media footprint becomes a strategic asset that supports credibility across investors, partners, and customers.

Why IndNewsWire Is a Strong Choice in Dallas, TX

Choosing the best press release agency in Dallas, TX requires evaluating editorial quality, distribution credibility, and long-term impact. IndNewsWire stands out by offering:

- Editorially sound, news-style press releases

- Access to recognized business and financial media platforms

- Consistent and scalable distribution processes

- Brand-safe, compliance-focused communication

- Practical solutions for startups and established enterprises

Final Thoughts

Dallas is a city defined by scale, execution, and long-term thinking. In such an environment, press releases must be credible, clear, and professionally distributed. IndNewsWire delivers these essentials through disciplined writing and reliable media placement.

For organizations seeking the best press release agency in Dallas, TX, IndNewsWire provides a dependable pathway to media visibility—helping businesses communicate important updates with clarity, confidence, and lasting credibility.