Best Press Release Agency in Seattle, WA: How IndNewsWire Delivers Credible Media Visibility

Seattle, WA is one of the most influential business and technology hubs in the United States. Home to global leaders in cloud computing, e-commerce, enterprise software, biotechnology, clean energy, logistics, and advanced manufacturing, Seattle operates in a market where credibility and precision matter. In such a competitive and media-savvy environment, visibility must be earned through accuracy and structure. This is why organizations searching for the best press release agency in Seattle, WA increasingly rely on IndNewsWire for professional, editorial-first, and brand-safe press distribution.

Seattle businesses are evaluated by investors, partners, customers, and analysts who expect factual communication and long-term consistency. Press releases remain one of the most reliable tools for presenting company updates in a format that decision-makers trust.

Why Press Releases Matter in the Seattle Business Ecosystem

Seattle’s economy is driven by innovation and scale. Companies here often operate across national and global markets, making professional communication essential. Press releases provide a standardized way to announce developments such as product launches, platform updates, sustainability initiatives, leadership changes, and market expansion.

Unlike short marketing copy or social media updates, press releases offer permanence. Once published on established news platforms, they become part of a company’s public digital footprint. For Seattle-based organizations, this footprint supports credibility during due diligence, enterprise sales cycles, partnership discussions, and long-term brand building.

Seattle’s Media Landscape: Informed and Expectation-Driven

Seattle audiences are highly informed. Readers are accustomed to detailed reporting, transparent communication, and measurable outcomes. Overly promotional language or unsupported claims can quickly damage credibility in a city where technical and business literacy is high.

The best press release agencies understand this environment. They prioritize editorial discipline, clarity, and relevance over exaggerated messaging. IndNewsWire’s approach aligns naturally with Seattle’s professional culture by treating press releases as news assets rather than advertising material.

IndNewsWire’s Editorial-First Philosophy

IndNewsWire structures press releases to communicate information clearly and efficiently. Each release focuses on what has changed, why it matters, and how it fits into the organization’s broader direction—without hype or unnecessary embellishment.

This editorial-first methodology is particularly effective in Seattle, where press releases are often reviewed by technically skilled readers, analysts, and institutional stakeholders. A neutral tone and clean structure signal professionalism, transparency, and operational maturity.

Strategic Distribution for Seattle Businesses

Distribution is critical in a market as active as Seattle. IndNewsWire provides companies with access to recognized media environments that enhance credibility and discoverability.

Publishing a Press Release on Digital Journal allows organizations to reach readers who actively follow innovation, technology trends, and business developments. This placement supports broad professional visibility and reinforces legitimacy in a trusted news context.

For companies targeting finance-focused and market-oriented audiences, a Press Release on Street Insider offers exposure within a business and financial news environment. This is especially relevant for Seattle firms announcing strategic initiatives, growth milestones, or operational readiness.

To maintain internal reporting clarity, teams often reference placements such as a Digital Journal Press Release or a Street Insider Press Release across communications and executive updates.

Managing Platform Naming Variations

In real-world press distribution, media platform names can appear in multiple formats depending on context. IndNewsWire supports these variations to ensure consistency across documentation and performance tracking.

This includes references such as a Press Release on DigitalJournal and a Press Release on StreetInsider. While subtle, these distinctions matter for Seattle organizations managing frequent announcements across multiple teams.

Coverage may also be documented as a DigitalJournal Press Release or a StreetInsider Press Release to keep internal records aligned.

Broader Exposure Beyond the Pacific Northwest

Many Seattle-based companies serve national and international markets. Local exposure alone is often not sufficient, particularly for technology, sustainability, and enterprise service providers.

IndNewsWire supports broader reach through placements such as a Press Release on Big News Network, enabling Seattle brands to communicate updates to a global business audience. A Press Release on BigNewsNetwork further strengthens international discoverability across general business news platforms.

These options are especially valuable when companies announce global partnerships, cross-border expansion, or multi-region initiatives.

Financial Visibility and Investor Confidence

Seattle has a strong presence in venture capital, institutional investment, and public markets. Even privately held companies benefit from being discoverable in finance-oriented media environments.

IndNewsWire enables this layer of credibility through options such as a Press Release on Yahoo Finance. This type of placement helps ensure that when investors, analysts, or strategic partners research a Seattle-based company, they encounter structured, factual information in a familiar financial news setting.

Brand Safety and Compliance Focus

Many industries prominent in Seattle—including technology, biotech, clean energy, and fintech—operate under regulatory, ethical, or data-security scrutiny. In these sectors, accuracy and restraint are essential.

IndNewsWire minimizes reputational and compliance risk by emphasizing neutral language, factual clarity, and editorial discipline. Press releases are written to inform rather than persuade, protecting brand integrity while still delivering meaningful exposure.

Long-Term Media Value for Seattle Companies

Press releases distributed through IndNewsWire are designed to deliver long-term value. Each publication contributes to a growing archive of verifiable company updates that strengthen search visibility and media trust over time.

For Seattle companies managing ongoing innovation cycles or frequent announcements, this cumulative media footprint becomes a strategic asset that supports credibility across investors, partners, customers, and talent.

Why IndNewsWire Is a Strong Choice in Seattle, WA

Choosing the best press release agency in Seattle, WA requires evaluating editorial quality, distribution credibility, and long-term impact. IndNewsWire stands out by offering:

- Editorially sound, news-style press releases

- Access to recognized business and financial media platforms

- Consistent and scalable distribution processes

- Brand-safe, compliance-focused communication

- Practical solutions for startups, scale-ups, and established enterprises

Final Thoughts

Seattle is a city defined by innovation, accountability, and global influence. In such an environment, press releases must be clear, credible, and professionally distributed to create lasting impact. IndNewsWire delivers these essentials through disciplined writing and reliable media placement.

For organizations seeking the best press release agency in Seattle, WA, IndNewsWire provides a dependable pathway to media visibility—helping businesses communicate important updates with clarity, confidence, and long-term credibility.

Best Press Release Agency in San Francisco, CA: How IndNewsWire Supports Credible Media Communication

San Francisco, CA stands as one of the most influential business and innovation centers in the world. As a global hub for technology, venture capital, finance, SaaS, AI, biotechnology, fintech, and creative industries, San Francisco operates under constant media attention and scrutiny. In this environment, visibility without credibility offers little value. This is why organizations searching for the best press release agency in San Francisco, CA increasingly rely on IndNewsWire for structured, editorial-first, and brand-safe press release distribution.

San Francisco businesses are evaluated rapidly and rigorously. Investors, partners, analysts, and customers often review press coverage as part of their first impression. A professionally written and properly distributed press release plays a critical role in shaping that perception.

Why Press Releases Matter in the San Francisco Business Ecosystem

San Francisco companies move fast, but decisions are rarely impulsive. Stakeholders expect announcements to be factual, concise, and verifiable. Press releases provide a standardized and trusted format to communicate milestones such as funding rounds, product launches, platform upgrades, leadership changes, and market expansion.

Unlike short-form marketing content or social media updates, press releases offer permanence. Once published on recognized news platforms, they become part of a company’s long-term digital footprint. For San Francisco-based organizations, this public record supports credibility during due diligence, fundraising, enterprise sales cycles, and partnership discussions.

San Francisco’s Media Landscape: High Standards and Constant Scrutiny

San Francisco is one of the most competitive media environments globally. Thousands of companies publish announcements every day, and audiences here are highly media-literate. Overly promotional language, vague claims, or exaggerated positioning can quickly erode trust.

The best press release agencies understand this reality. They prioritize editorial discipline, accuracy, and relevance over volume. IndNewsWire’s approach aligns closely with San Francisco’s expectations by treating press releases as news assets rather than marketing collateral.

IndNewsWire’s Editorial-First Philosophy

IndNewsWire structures press releases to communicate information clearly and efficiently. Each release focuses on what has changed, why it matters, and how it fits into the organization’s broader strategy—without unnecessary hype.

This editorial-first methodology is particularly effective in San Francisco, where press releases are frequently reviewed by investors, analysts, journalists, and technically sophisticated audiences. A neutral tone and clean structure signal professionalism, transparency, and operational maturity.

Strategic Distribution for San Francisco Businesses

Distribution is critical in a saturated market like San Francisco. IndNewsWire provides companies with access to recognized media environments that enhance credibility and discoverability.

Publishing a Press Release on Digital Journal allows organizations to reach readers who actively follow innovation, technology trends, and corporate developments. This placement supports broad professional visibility and reinforces legitimacy in a trusted news context.

For companies targeting finance-focused and market-oriented audiences, a Press Release on Street Insider offers exposure within a business and financial news environment. This is especially relevant for San Francisco firms announcing funding activity, strategic initiatives, or operational milestones.

To maintain internal clarity and reporting consistency, teams often reference placements such as a Digital Journal Press Release or a Street Insider Press Release across investor relations, marketing, and executive communications.

Managing Media Platform Naming Variations

In real-world press distribution, platform names can appear in different formats depending on context. IndNewsWire supports these variations to ensure consistency across documentation and reporting.

This includes references such as a Press Release on DigitalJournal and a Press Release on StreetInsider. While subtle, these distinctions matter for San Francisco organizations managing frequent announcements and tracking performance across multiple campaigns.

Teams may also document coverage as a DigitalJournal Press Release or a StreetInsider Press Release to keep internal records aligned across departments.

Broader Exposure Beyond Silicon Valley

Although San Francisco is a global hub, most companies based there operate across national and international markets. Local exposure alone is often not sufficient, especially for venture-backed startups and enterprise technology providers.

IndNewsWire supports broader reach through placements such as a Press Release on Big News Network, enabling San Francisco brands to communicate updates to a global business audience. A Press Release on BigNewsNetwork further strengthens international discoverability across general business news platforms.

These placements are particularly valuable when companies announce cross-border expansions, global partnerships, or multi-region initiatives.

Financial Visibility and Investor Confidence

San Francisco is deeply intertwined with venture capital, private equity, and public markets. Even privately held companies benefit from being discoverable in finance-oriented media environments.

IndNewsWire enables this layer of credibility through options such as a Press Release on Yahoo Finance. This type of placement helps ensure that when investors, analysts, or strategic partners research a San Francisco-based company, they encounter structured, factual information in a familiar financial news setting.

Brand Safety and Compliance Focus

Many San Francisco industries—particularly fintech, healthcare, AI, and enterprise software—operate under regulatory or ethical scrutiny. In these sectors, accuracy and restraint are essential.

IndNewsWire minimizes reputational and compliance risk by emphasizing neutral language, factual clarity, and editorial discipline. Press releases are written to inform rather than persuade, protecting brand integrity while still delivering meaningful exposure.

Long-Term Media Value for San Francisco Companies

Press releases distributed through IndNewsWire are designed to deliver long-term value. Each publication contributes to a growing archive of verifiable company updates that strengthen search visibility and media trust over time.

For San Francisco companies managing rapid growth, frequent releases, or ongoing innovation cycles, this cumulative media footprint becomes a strategic asset that supports credibility across investors, partners, customers, and talent.

Why IndNewsWire Is a Strong Choice in San Francisco, CA

Choosing the best press release agency in San Francisco, CA requires evaluating editorial quality, distribution credibility, and long-term impact. IndNewsWire stands out by offering:

- Editorially sound, news-style press releases

- Access to recognized business and financial media platforms

- Consistent and scalable distribution processes

- Brand-safe, compliance-focused communication

- Practical solutions for startups, scale-ups, and established enterprises

Final Thoughts

San Francisco is a city defined by innovation, competition, and constant evaluation. In such an environment, press releases must be clear, credible, and professionally distributed to create lasting impact. IndNewsWire delivers these essentials through disciplined writing and reliable media placement.

For organizations seeking the best press release agency in San Francisco, CA, IndNewsWire provides a dependable pathway to media visibility—helping businesses communicate important updates with clarity, confidence, and long-term credibility.

Best Press Release Agency in Charlotte, NC: How IndNewsWire Delivers Credible Media Exposure

Charlotte, NC has become one of the most influential business centers in the Southeastern United States. Known for its strong presence in banking, fintech, healthcare, logistics, energy, manufacturing, real estate, and professional services, Charlotte attracts companies that operate at scale and value long-term credibility. In this environment, effective communication is not optional—it is foundational. That is why organizations searching for the best press release agency in Charlotte, NC increasingly rely on IndNewsWire for structured, professional, and brand-safe media distribution.

Charlotte businesses are frequently evaluated by investors, regulators, partners, and institutional clients. Press releases remain one of the most reliable ways to present verified updates in a format that stakeholders recognize and trust.

Why Press Releases Matter in the Charlotte Business Ecosystem

Charlotte’s economy is deeply tied to finance, enterprise operations, and institutional decision-making. Whether a company is announcing a new product, operational milestone, leadership update, or strategic expansion, clarity and accuracy are essential.

Press releases provide a standardized method for communicating these updates. Unlike short marketing messages or social media posts, press releases offer permanence. Once published on recognized news platforms, they become part of a company’s public digital record. For Charlotte-based organizations, this record supports credibility during due diligence, procurement processes, and partnership evaluations.

Charlotte’s Media Landscape: Trust-Driven and Professional

Charlotte audiences are analytical and business-focused. Readers expect announcements to be factual, clearly structured, and free from exaggerated claims. Overly promotional language can quickly undermine trust in a city where credibility drives long-term relationships.

The best press release agencies understand this dynamic. They emphasize editorial discipline, neutral tone, and appropriate distribution. IndNewsWire’s editorial-first approach aligns well with Charlotte’s professional business culture by focusing on substance over marketing hype.

IndNewsWire’s Editorial-First Approach

IndNewsWire treats press releases as informational assets rather than advertisements. Each release is designed to communicate what has changed, why it matters, and how it fits into the organization’s broader strategy.

This approach is particularly effective in Charlotte, where press releases are often reviewed by financial analysts, compliance teams, and enterprise decision-makers. A well-organized, neutral release signals professionalism and operational maturity—qualities that resonate across banking, fintech, healthcare, and logistics sectors.

Strategic Distribution for Charlotte Businesses

Distribution is a critical factor in press release success. IndNewsWire provides Charlotte companies with access to recognized media environments that enhance credibility and discoverability.

Publishing a Press Release on Digital Journal allows organizations to reach readers who actively follow business developments, innovation, and market activity. This placement supports broad professional visibility and reinforces brand legitimacy.

For companies targeting finance-oriented and market-focused audiences, a Press Release on Street Insider offers exposure within a business and financial news context. This is especially relevant for Charlotte firms announcing strategic initiatives, growth milestones, or operational readiness.

To maintain internal clarity and reporting consistency, businesses often reference placements such as a Digital Journal Press Release or a Street Insider Press Release across communications and executive reporting.

Managing Platform Naming Variations

In real-world press distribution, media platform names may appear in multiple formats depending on context. IndNewsWire supports these variations to ensure consistency across documentation and communications.

This includes references like a Press Release on DigitalJournal and a Press Release on StreetInsider. While subtle, these distinctions matter for Charlotte organizations managing frequent announcements and tracking media performance accurately.

Teams may also document coverage as a DigitalJournal Press Release or a StreetInsider Press Release to keep internal records aligned across departments.

Expanding Reach Beyond the Carolinas

Many Charlotte-based businesses operate regionally, nationally, or globally. Local visibility alone is often not sufficient—especially for finance, logistics, and enterprise service providers.

IndNewsWire supports broader exposure through placements such as a Press Release on Big News Network, enabling Charlotte brands to reach a global business audience. A Press Release on BigNewsNetwork further strengthens international discoverability across general business news platforms.

These placements are particularly valuable during geographic expansion, multi-state initiatives, or strategic partnerships.

Financial Visibility and Institutional Confidence

Charlotte is one of the largest banking and financial hubs in the United States. Even privately held companies benefit from being discoverable in finance-oriented media environments.

IndNewsWire enables this layer of credibility through options such as a Press Release on Yahoo Finance. This type of placement helps ensure that when investors, partners, or analysts research a Charlotte-based company, they encounter structured, factual information in a familiar financial news setting.

Brand Safety and Compliance Focus

Many industries prominent in Charlotte—especially banking, fintech, healthcare, and energy—operate under regulatory or contractual oversight. In these sectors, accuracy and restraint are essential.

IndNewsWire minimizes reputational and compliance risk by emphasizing neutral language, factual clarity, and editorial discipline. Press releases are written to inform rather than persuade, protecting brand integrity while still delivering meaningful exposure.

Long-Term Media Value for Charlotte Companies

Press releases distributed through IndNewsWire are designed to deliver long-term value. Each publication contributes to a growing archive of verifiable company updates that strengthen search visibility and media trust over time.

For Charlotte companies managing sustained growth or recurring announcements, this cumulative media footprint becomes a strategic asset that supports credibility across customers, partners, and institutional stakeholders.

Why IndNewsWire Is a Strong Choice in Charlotte, NC

Choosing the best press release agency in Charlotte, NC requires evaluating editorial quality, distribution credibility, and long-term impact. IndNewsWire stands out by offering:

- Editorially sound, news-style press releases

- Access to recognized business and financial media platforms

- Consistent and scalable distribution processes

- Brand-safe, compliance-focused communication

- Practical solutions for startups, financial institutions, and established enterprises

Final Thoughts

Charlotte is a city defined by financial strength, operational discipline, and long-term planning. In such an environment, press releases must be clear, credible, and professionally distributed to be effective. IndNewsWire delivers these essentials through disciplined writing and reliable media placement.

For organizations seeking the best press release agency in Charlotte, NC, IndNewsWire provides a dependable pathway to media visibility—helping businesses communicate important updates with clarity, confidence, and lasting credibility.

Best Press Release Agency in Indianapolis, IN: How IndNewsWire Strengthens Professional Media Visibility

Indianapolis, IN has established itself as a major business and logistics hub in the Midwest. With strong sectors spanning healthcare, pharmaceuticals, life sciences, manufacturing, motorsports, technology, logistics, education, and professional services, the city offers companies a balanced environment of scale and stability. In such a market, credibility is built through consistent and verifiable communication. This is why organizations seeking the best press release agency in Indianapolis, IN increasingly choose IndNewsWire for structured, editorial-first press release distribution.

Indianapolis businesses often engage with institutional partners, regulated industries, and national markets. Press releases play a critical role in shaping how these organizations are perceived by stakeholders who expect accuracy, professionalism, and clarity.

Why Press Releases Matter in the Indianapolis Business Environment

Indianapolis operates on reliability and execution. Whether a company is expanding facilities, launching new services, securing contracts, or announcing operational milestones, stakeholders expect information to be presented in a standardized and trusted format.

Press releases fulfill this role by offering permanence and authority. Unlike social media updates or short marketing content, a press release—once published on recognized news platforms—becomes part of a company’s public record. For Indianapolis-based organizations, this record supports trust during vendor evaluations, partnership discussions, regulatory reviews, and investment considerations.

Indianapolis Media Expectations: Structured and Credibility-Focused

The Indianapolis media audience is pragmatic and detail-oriented. Readers value factual updates over promotional language. Overstated claims or loosely framed announcements tend to erode confidence rather than enhance visibility.

The best press release agencies understand these expectations. They emphasize editorial structure, neutral tone, and accurate placement. IndNewsWire’s approach aligns well with Indianapolis’s business culture by prioritizing clarity, substance, and consistency.

IndNewsWire’s Editorial-First Approach

IndNewsWire treats press releases as informational assets, not advertisements. Each release is written to clearly explain what has changed, why it matters, and how it fits into the organization’s broader strategy.

This editorial-first methodology is particularly effective in Indianapolis, where press releases are often reviewed as part of procurement decisions, compliance assessments, or long-term partnership planning. A well-structured, neutral release signals operational discipline and professionalism.

Strategic Distribution for Indianapolis Businesses

Distribution is a critical factor in press release effectiveness. IndNewsWire provides Indianapolis companies with access to recognized media environments that support credibility and discoverability.

Publishing a Press Release on Digital Journal allows businesses to reach readers who actively follow corporate developments, innovation, and industry trends. This placement supports broad professional visibility and reinforces brand legitimacy.

For organizations targeting finance-focused and market-oriented audiences, a Press Release on Street Insider offers exposure within a business and financial news context. This is especially relevant for Indianapolis firms announcing expansions, strategic initiatives, or operational readiness.

To maintain consistency across campaigns and internal reporting, companies often reference placements such as a Digital Journal Press Release or a Street Insider Press Release.

Managing Platform Naming Variations

In real-world press distribution, platform naming can appear in different formats depending on context. IndNewsWire supports these variations to ensure clarity across communications and documentation.

This includes references like a Press Release on DigitalJournal and a Press Release on StreetInsider. While subtle, these distinctions matter for Indianapolis organizations managing frequent announcements and tracking performance accurately.

Teams may also document coverage as a DigitalJournal Press Release or a StreetInsider Press Release to keep internal records aligned across departments.

Expanding Reach Beyond Indiana

Many Indianapolis businesses serve regional, national, or international markets. Local visibility alone is often not sufficient—especially for logistics, healthcare, and manufacturing-driven organizations.

IndNewsWire supports broader exposure through placements such as a Press Release on Big News Network, enabling Indianapolis brands to reach a global business audience. A Press Release on BigNewsNetwork further strengthens international discoverability across general business news platforms.

These placements are particularly valuable when companies announce new facilities, national contracts, or cross-border partnerships.

Financial Visibility and Stakeholder Confidence

Indianapolis has a strong presence in healthcare finance, insurance, and institutional investment. Even privately held companies benefit from being discoverable in finance-oriented media environments.

IndNewsWire enables this layer of credibility through options such as a Press Release on Yahoo Finance. This type of placement ensures that when investors, partners, or analysts research an Indianapolis-based company, they encounter structured, factual information in a familiar financial news setting.

Brand Safety and Compliance Focus

Many industries prominent in Indianapolis—particularly healthcare, pharmaceuticals, logistics, and manufacturing—operate under strict regulatory or contractual frameworks. In these sectors, accuracy and restraint are essential.

IndNewsWire minimizes reputational and compliance risk by emphasizing neutral language, factual clarity, and editorial discipline. Press releases are crafted to inform rather than persuade, protecting brand integrity while still delivering meaningful exposure.

Long-Term Media Value for Indianapolis Companies

Press releases distributed through IndNewsWire are designed to create long-term value. Each publication contributes to a growing archive of verifiable company updates that improve search visibility and media trust over time.

For Indianapolis companies managing sustained growth or recurring announcements, this cumulative media footprint becomes a strategic asset that supports credibility across customers, partners, and institutional stakeholders.

Why IndNewsWire Is a Strong Choice in Indianapolis, IN

Choosing the best press release agency in Indianapolis, IN requires evaluating editorial quality, distribution credibility, and long-term impact. IndNewsWire stands out by offering:

- Editorially sound, news-style press releases

- Access to recognized business and financial media platforms

- Consistent and scalable distribution processes

- Brand-safe, compliance-focused communication

- Practical solutions for startups, mid-sized firms, and established enterprises

Final Thoughts

Indianapolis is a city defined by reliability, institutional trust, and long-term business thinking. In such an environment, press releases must be clear, credible, and professionally distributed to be effective. IndNewsWire delivers these essentials through disciplined writing and dependable media placement.

For organizations seeking the best press release agency in Indianapolis, IN, IndNewsWire provides a reliable pathway to media visibility—helping businesses communicate important updates with clarity, confidence, and lasting credibility.

Why developers are adopting AI Powered eDesign for Hotel and Multifamily Interior Design Projects.

The interior design industry is undergoing a structural shift. What was once a location-dependent, travel-heavy, and resource-intensive process is increasingly being replaced by global, digital-first delivery models, particularly across hospitality, new development, and large-scale multifamily projects.

At the center of this shift is eDesign, also known as online interior design. This approach enables interior design to be delivered globally without geographic constraints, while maintaining clarity, control, and scalability.

One studio operating within this model is Virtualistic Interiors, founded by Elise Kotelnikova, an international interior designer known for digital-first hospitality and development projects, working at the intersection of design, technology, innovation, and sustainability. After building her career through a traditional studio model in Las Vegas, Kotelnikova transitioned the firm into a digital-first, globally delivered consultancy designed for hotels, new developments, and large-scale multifamily projects.

Virtualistic Interiors delivers interior design consultancy through a technology-led process supported by AI and managed by humans, integrating FF&E procurement into the design workflow. The firm supports developers and hospitality operators globally while coordinating international procurement and delivery across regions, enabling project teams to move faster from concept to approval with structured reviews, clearer decisions, and reduced operational friction.

Design Without Borders

“eDesign allows projects to move forward without being constrained by geography,” says Elise Kotelnikova. “Virtual reality enables immersive walkthroughs of the conceptual design, giving teams the ability to experience the space at full scale and evaluate the design based on real-world perception rather than drawings or static visuals.”

Historically, interior design relied on frequent site visits, in-person meetings, and physical samples shipped between regions. These practices increase carbon emissions, slow timelines, and add unnecessary costs, especially for hotels, new development, and large-scale multifamily projects delivered internationally.

eDesign replaces these inefficiencies with cloud-based collaboration, advanced 3D rendering, and immersive virtual reality walkthroughs, delivered through a design process supported by AI. By enabling conceptual design to be reviewed and experienced virtually, this approach reduces the need for repeated mock-ups, physical samples, ongoing revisions, and unnecessary travel associated with traditional design.

How Virtual Reality Supports Decision-Making

Within the eDesign model, virtual reality is used to experience the conceptual design before it is finalized. Immersive walkthroughs allow the space to be experienced at full scale, making proportions, atmosphere, and overall design intent clear in a way drawings and static visuals cannot.

This approach enables design decisions to be made earlier and with greater confidence, minimizes late-stage changes, supports more accurate budgeting and procurement decisions, and limits the need for changes later in the design process across hotels, new development, and large-scale multifamily projects.

International FF&E Procurement

At Virtualistic Interiors, FF&E procurement is integrated into the design process through direct coordination with suppliers across Europe, the Middle East, and Asia. Working globally, design direction is established early to maintain consistency in quality, standards, and overall design intent across projects delivered internationally.

Direct coordination between design and production helps maintain alignment with the approved design intent throughout procurement, supporting consistent quality and standards across projects delivered internationally.

Why Developers and Hotels Are Choosing eDesign

Developers and hotel operators choosing eDesign benefit from a consultancy-led model that delivers clear design direction, faster approvals, reduced travel, and structured FF&E procurement across hotels, new development, and large-scale multifamily projects worldwide.

The Future of Interior Design Is Global, Digital, and Sustainable

eDesign represents a long-term shift toward globally delivered online interior design supported by AI, digital tools, and international FF&E procurement.

Design decisions are made earlier and remotely, lowering the environmental footprint created by travel-heavy, location-dependent design practices.

About Elise Kotelnikova

“A visionary with a long-term mission to reshape how interior design is delivered through digital-first eDesign, she built Virtualistic Interiors as an AI-powered global design firm using an immersive and innovative approach including Virtual Reality walkthroughs, concept development, design direction, and international FF&E procurement for hotels, new developments, and large-scale multifamily projects.”

BlockDAG vs. Hyperliquid: Here’s Why Investors Are Ditching Other Crypto for BDAG

By late January 2026, savvy investors are hunting for massive gains while market leaders remain flat. Hyperliquid (HYPE) has gained traction lately, particularly among decentralized futures enthusiasts. It boasts high liquidity and a busy user base. However, as of this writing, the HYPE token has experienced some price swings, hovering near $32.50.

While Hyperliquid serves traders well, it remains an application confined to a specific niche. BlockDAG (BDAG) is a Layer-1 infrastructure powerhouse currently finishing its massive $451 million presale. While Hyperliquid relies on daily trade activity, BlockDAG serves as the bedrock for thousands of upcoming projects. For those seeking the top crypto to buy, BlockDAG provides superior long-term security and much higher rewards.

Constraints of a Trading Asset

Hyperliquid is a specialized ecosystem. Its worth is tied strictly to how many individuals use its specific exchange. If a rival platform emerges with better perks or cheaper costs, capital can exit instantly. This creates higher risk for the HYPE token since it must perpetually defend its territory. The asset has already enjoyed a significant rally and is now hitting a ceiling where massive new gains are elusive.

BlockDAG is an infrastructure play. It is like owning the utility grid rather than just one factory. As a Layer-1 network, it powers everything from gaming to financial services. Even if one specific app on the chain fails, the network itself retains its worth. This scalability is why many name BlockDAG the top crypto to buy. For long-term holders, owning the entire network is a wiser strategy than betting on a single trading app facing intense rivalry.

The ROI Potential

The primary incentive for choosing BlockDAG is simple math. Hyperliquid is already active on the open market. Its price fluctuates based on daily headlines and market volume. It is highly improbable to see a 100-fold jump from its current $32.50 price point. BlockDAG, conversely, is still in its fixed-price presale stage. The current cost is $0.0005, and the listing price is locked at $0.05. No exchange token offers a profit baked into the official launch timeline. This makes BlockDAG the top crypto to buy for serious wealth creation.

Here are the vital facts regarding this math:

-

The Surge: Shifting from $0.0005 to $0.05 represents a profit.

-

Confidence: The listing price is firmly set for the February 16 debut.

-

Capital: Over $451 million is already raised, showing the project is robust.

-

Early Access: This represents the absolute floor price before exchange listings.

-

Community: Over 312,000 unique investors have already joined the project.

Scaling Through Advanced Tech

BlockDAG isn’t just a low-cost entry; it is a high-performance engine. While Hyperliquid focuses on trading features, BlockDAG optimizes the entire blockchain architecture. It utilizes a hybrid model capable of processing 10,000 transactions every second. This far exceeds many current networks and supports millions of simultaneous users. This structural integrity makes it a more secure long-term pick for the top crypto to buy.

The ecosystem is also fully compatible with Ethereum developer tools. This allows creators to migrate their apps to BlockDAG without learning new coding languages. This accessibility is a primary driver behind BlockDAG’s momentum. By offering a quicker, more affordable home for builders, BlockDAG is positioning itself as a global titan. Hyperliquid is a fine exchange, but BlockDAG is engineered to power the digital economy.

The Closing Window

The window of opportunity is nearly shut. The BlockDAG presale concludes in just a few short hours. This final moment is the last opening for anyone to secure the $0.0005 rate. Once the timer hits zero today, the 1.25 billion token supply will be finalized. The next purchase opportunity will be on public exchanges for $0.05. This time sensitivity makes it the top crypto to buy before the valuation shifts forever.

Major players who previously tracked Hyperliquid are now pivoting their capital into BlockDAG. They are chasing this final shot at a windfall. They recognize that a return is far more lucrative than the modest gains found on tokens already in circulation. This migration by whales is a loud signal that market sentiment is pivoting. The countdown is in its closing stage, and those who hesitate will lose the premier entry price of the year.

Why BDAG is the Top Crypto to Buy in 2026

Hyperliquid is a helpful tool for day traders, but it lacks the explosive growth ceiling of a comprehensive Layer-1 network. Its market value is tied to rivalry and current trading prices. BlockDAG delivers a superior technical framework and a massive community that is already millions strong. The mathematical certainty of entering at $0.0005 and listing at $0.05 is a rare market event. Due to this enormous upside, BlockDAG remains the top crypto to buy as the door closes. With the presale ending in hours, the chance to buy for a fraction of a penny is disappearing. Ensure you evaluate the top crypto to buy before the February 16 debut changes everything.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Office Chair with Footrest: The Ultimate Computer Chair Recliner for Work and Relaxation

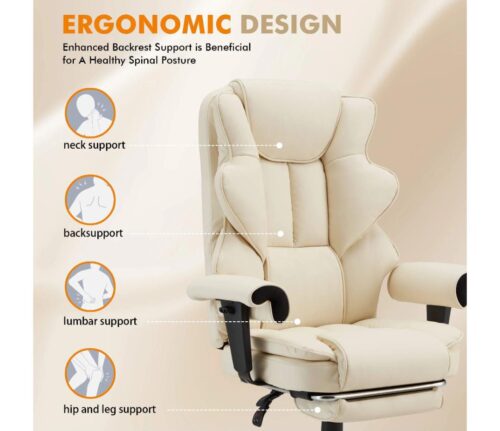

People need comfortable workspaces because remote work and contemporary office designs no longer treat comfort as an optional extra. Your body needs time away from work because extended desk work damages your physical health and work efficiency and personal health. The office chair with footrest computer chair recliner multiple functions acts as a revolutionary solution for users. This type of chair provides essential ergonomic support together with advanced relaxation features which make it a necessary item for professionals and gamers and remote workers.

Why Ergonomic Seating Matters More Than Ever

The prolonged use of a poorly designed office chair can cause back pain, stiff joints, bad posture, and chronic health issues. An ergonomic office chair has distinct design features designed to relieve pressure points while supporting spinal health and allowing users to sit in their natural position. The combination of the footrest and recline feature gives users added benefit.

With the ability to adjust your position during your work day and improve your blood circulation by relieving stress on your lower back, an adjustable office chair creates optimal sitting posture for your body. In addition to providing support for your legs, which relieves pressure on your back, they also enable you to relax while taking breaks from work. Combined, they create a more comfortable and healthy sitting posture during work hours.

The Rise of the Office Chair with Footrest

The modern workplace is evolving, and so are furniture expectations. People no longer want rigid, uncomfortable chairs that lock them into one position. Instead, they’re opting for multifunctional seating that adapts to their needs.

The office chair with its footrest and recliner function serves as a bridge between work and relaxation. You can sit upright while typing, recline slightly during meetings, or fully lean back during a quick rest—all without leaving your desk. The ability to work in multiple ways proves useful for people who need to stay productive throughout their extended workday and their various responsibilities.

Key Features to Look For in a Computer Chair Recliner

Not all office chairs are created equal. When selecting the correct chair model, you should concentrate on these particular aspects.

Adjustable Recline Mechanism: Allows you to select your preferred seating position between work and relaxation.

- Retractable Footrest: Provides leg support during reclining while it can be stored away when not needed.

- Lumbar Support: Helps maintain the natural curve of your spine.

- High-Density Cushioning: Provides enduring comfort because it maintains its shape throughout extended use.

- Breathable Upholstery: Maintains your body temperature at a comfortable level during long periods of sitting.

- Sturdy Base and Casters: Enables stable chair operation while users can move their chair smoothly across different floor surfaces.

The presence of these particular chair design elements leads to better daily comfort for users, which results in increased work efficiency.

A Stylish and Functional Choice for Any Space

Today’s ergonomic chair designs combine modern aesthetics with functional requirements to create products that fit home office spaces and corporate environments and gaming equipment needs.

For example, the office chair with footrest computer chair recliner available at Homrest offers a sleek design paired with premium comfort features. Its elegant look complements contemporary interiors while delivering the ergonomic support your body needs.

Productivity Meets Relaxation

The primary benefit of a reclining office chair with a footrest shows through its ability to enhance work productivity. The mind remains concentrated when your body experiences comfort. Taking short breaks to recline and stretch your legs enables better mental recovery which protects against burnout. You can recharge for a few minutes by reclining and extending the footrest without needing to leave your desk. The system allows you to switch between work and rest periods which helps you maintain productivity while improving your health.

Ideal for Remote Workers, Gamers, and Professionals

Any person who works remotely to join virtual meetings or who plays video games for extended periods or who performs high-pressure professional duties can use this chair because it matches their particular way of life. The reclining and footrest features of the chair provide gamers with comfortable seating during extended gaming sessions while the chair’s ergonomic design supports professionals throughout their workday. Homrest provides an extensive collection of premium office chair designs which you can use to discover additional ergonomic seating solutions.

Long-Term Investment in Comfort and Health

The high-quality office chair with footrest functions as an upfront investment which provides financial benefits during its entire lifespan. Your daily activities experience a positive transformation through the benefits of decreased back pain and better posture and improved work efficiency. The office chair made from durable materials and solid construction provides a cost-effective solution which lasts for multiple years of use.

Customer Review

This office chair with footrest computer chair recliner has been a great upgrade for my home office. It’s comfortable, supportive, and the reclining feature with the footrest makes long workdays much easier. My back feels better, and I stay more focused throughout the day. Highly recommended.

Final Thoughts

Choosing the right seating can transform your work experience. An office chair with footrest computer chair recliner The product provides ideal ergonomic support together with flexible movement capabilities and comfortable resting options. The chair functions as a complete health maintenance system which improves work efficiency while providing daily comfort to users. Your office space will become better when you choose to buy a reclining office chair that includes a footrest.

How to Find a TikTok User ID: A Step-by-Step Guide

If your business has a TikTok account, you’re likely wondering about the platform. You’ve likely encountered the concept of a TikTok ID. Some people confuse this with a username. However, there’s a significant difference between the two.

Today, we’ll look at what a user ID is on this social network, its important functions, and how to find it in the interface.

TikTok User ID: Definition and Purpose

A TikTok User ID is an identifier represented by a random set of numbers. It’s unique, and TikTok provides it immediately upon registration of a new account.

As mentioned earlier, some users of this social network confuse the concept of an ID with a username. If you want to be an advanced user and set up promotional campaigns for your account, let’s explore the main differences.

You can find out what a User ID is at https://www.highsocial.com/find-tiktok-user-id/.We’ll also provide information below.

The key qualities of a TikTok user ID:

- The ID cannot be changed. It is a good thing because some TikTokers change their names. Tracking a person becomes simply impossible. However, the numerical code will always remain the same.

- The ID is important for advertising campaigns and analytics. If you represent a business or want to create a viral account, you’ll likely be trying different advertising channels. Knowing the ID will make data management much easier. It will also be useful if you want to set up integration with the TikTok API.

We’ve already covered the ID itself. It’s especially useful for businesses and TikTokers who are serious about promotion and success. After all, you will likely be using promotion services, such as High Social. By the way, this platform has a lot of room for growth, as proven by the High Social G2 review. So, let’s look at how to find the ID.

Method 1: Via TikTok Account Settings

Note that finding the numeric ID through settings is the easiest. Here’s how to do it:

- Log in to TikTok using your username and password.

- Find the menu icon in the upper-right corner of your smartphone’s screen, then tap it.

- Open “Settings and Privacy.”

- Go to the “Account” section.

You’ll find the User ID directly in this menu section. However, app versions vary, just as smartphones themselves do. Therefore, if the ID isn’t listed in the “Account” section, use the search option below.

Method 2: Using a TikTok Profile Link

This method is also suitable if you want to find someone else’s profile ID. Follow these steps:

- Open the profile of the user you want to study.

- Find and click the “Share” button.

- Click “Copy Link.”

Now you’ll see the username in the link. You can then use third-party services to find the username and ID.

Method 3: Using Third-Party TikTok User ID Services

The good news is that there are a huge number of free services online that can easily identify a user ID. All you need is a username or a profile link. You already know how to do this based on the instructions above.

How to use these services:

- Go to their website.

- Paste the resulting link or name into the appropriate search field.

- Click the button to search for the ID.

- Get your ready-made User ID.

Such websites are often popular among marketers and advertisers. They’re convenient if you need to find and identify a large number of people quickly.

Method 4: Using Browser Developer Tools

This ID identification option is suitable if you have at least basic programming skills or are simply very patient.

Here’s what you need to do to find the ID using browser developer tools:

- Go to the desired TikTok profile on your computer.

- Right-click and select “View Page Source.”

- In the window that appears after clicking, find some parameters containing the user-ID or author-ID.

We consider this method the most reliable, although it requires some programming knowledge. However, you don’t need to search for third-party services. You only need to learn how to follow the instructions once.

Conclusion

Today, you learned the three most basic ways to get a user ID on TikTok. This information will help you collect important data, conduct detailed analytics, and launch advertising campaigns.

All you need to do is learn how to find the ID using the TikTok menu, third-party resources, or your browser settings.

A UK Payment Due Today? Here’s What Really Happens in the Last Few Hours

When deadlines close in, ZilRemit.com helps businesses send money to the UK with confidence

When a payment to the UK is due today, every minute matters. A delayed transfer can mean missed supplier deadlines, strained relationships, or even paused operations. For businesses in the USA that need to send money to UK vendors, partners, or contractors, timing is not a “nice to have.” It is critical.

Many companies still rely on slow international wires that take days, pass through multiple intermediaries, and arrive later than expected. By the time the money lands, the deadline is already gone. This is where modern international payment platforms change the story.

Why “Sent” Does Not Mean “Received”

Many businesses assume that once money leaves the US account, the job is done. That is rarely true with cross-border payments. Between the USA and the UK, a transfer may involve:

- Multiple settlement layers

- Currency conversion delays

- Bank processing windows

- End-of-day cutoffs

A payment can be marked as sent while still being far from the UK recipient’s account. When deadlines are involved, that gap matters.

A Different Way to Think About UK Payments

Instead of asking “Did we send it?”, modern teams ask:

“Will it land today?”

This shift changes everything. A payment system built for speed focuses on arrival time, not just initiation time. That is why fast US-to-UK transfers are now a priority for businesses working with British suppliers, partners, or teams. ZilRemit.com is built around this exact expectation, measuring success by when funds reach the UK account, not when they leave the US.

Built Around UK Deadlines, Not Excuses

UK businesses run on tight schedules. Payments are expected to arrive when promised. When they do not, relationships change. ZilRemit.com is designed to move funds quickly to UK accounts, including major banks such as HSBC, Barclays, and Lloyds Bank.

This matters more than it sounds. When payments are aligned with how UK banks operate, transfers stop getting stuck in the middle. Funds move with purpose, not guesswork.

Why USD to GBP Rates Matter More at the Last Minute

When payments are made close to a deadline, there is no time to fix mistakes. Exchange rate transparency becomes just as important as speed.

If the USD to GBP rate is unclear:

- The UK recipient may receive less than expected

- A follow-up payment may be required

- The original deadline may still be missed

ZilRemit.com displays competitive USD to GBP rates upfront, showing exactly how much will arrive in the UK before confirmation. This clarity helps businesses avoid shortfalls, rework, and uncomfortable conversations. The amount leaving the USA matches the amount arriving in the UK.

Three Steps, Because Time Is Short

Urgent payments fail when the process is complicated. Long forms, repeated approvals, and unclear screens waste valuable time. ZilRemit.com keeps it short and focused.

Step 1: Add the UK recipient

Payment details are entered clearly, without unnecessary fields.

Step 2: Review the rate and cost

Everything is visible before moving forward.

Step 3: Confirm and transfer

Funds start moving immediately toward the UK account.

No loops. No waiting rooms. Just action.

When Deadlines Are Close, Confidence Matters

Last-minute UK payment deadlines are part of modern business. Time zones overlap. Invoices arrive late. Decisions happen fast. The real difference is the system behind the payment.

ZilRemit.com is built for moments when there is no room for error. Fast US-to-UK transfers, clear USD to GBP rates, and direct access to UK banks help businesses stay in control even under pressure. When a UK payment is due today, businesses should not be left hoping it arrives. With the right platform, they can know it will.

FAQ

How fast can I send money from the USA to the UK?

With ZilRemit.com, US-to-UK payments can be completed in minutes, not days. This helps meet tight UK payment deadlines without delays.

Will the UK recipient get the full amount in GBP?

ZilRemit.com shows the USD to GBP rate upfront before confirmation. This helps avoid shortfalls caused by hidden conversions.

Is the platform suitable for business payments to the UK?

Yes. It is designed for paying UK suppliers, partners, and service providers. The platform supports regular and urgent business payments.

Transforming Industrial Operations through IoT and Cloud Integration in the Era of Connected Factories

The innovation that has swiftly transformed modern manufacturing is the advent of Industry 4.0 that has incorporated intelligence, connection, and automation in the manufacturing process. The tendency toward the Internet of Things (IoT) and cloud computing technologies is more and more popular among the organizations that need to build interconnected factories that allow improving the visibility of operations, scalability, and decision making based on data. The research by Thillai Natarajan Gurusamy focuses on the integration of IoT and cloud platforms that feature real time monitoring, predictive maintenance, and increased efficiency in the manufacturing environment. The paper has shown that conventional closed systems of production are unable to deliver results to rivalry and responsiveness standards. Rather, closed digital systems will be needed to allow ongoing optimization and adaptive production approaches.

The Role of IoT and Cloud Technologies in Smart Manufacturing

IoT and cloud technologies help to build the main technological backbone of connected factories that allows centralized processing, contiguous data acquisition and intelligent analytics. The IoT devices installed in industrial devices gather instant operational and environmental data, which can be used to facilitate condition-based monitoring and optimization of processes. Clouds augment these capabilities which include scalable storage, computation and sophisticated tools of analytics that enable manufacturers to handle large amounts of data effectively. Thillai Natarajan Gurusamy highlights that this integration improves the accuracy of decision making, minimizes downtime, and promotes agile production planning in the dynamic manufacturing settings.

Addressing Operational Efficiency and Scalability Challenges

The primary benefits of IoT–cloud integration is that it enhances efficiency in operations and at the same time it is also scalable. Cloud based infrastructure enables manufactures to automatically increase and decrease computation facilities according to the production needs reducing initial investment in infrastructure. Meanwhile, the visibility that is enabled by the IoT enhances coordination among the units of production, inventory management, and supply chain operations. In this study, Thillai Natarajan Gurusamy underlines those analytics based on cloud systems in real-time can respond proactively to operational disturbance, leading to an increase in productivity and low operational expenses.

Security, Interoperability, and Infrastructure Constraints

Although the concept of connected manufacturing has its benefits, the compatibility of IoT and the cloud technologies contains a lot of challenges. A high level of data transmission through networks as well as remote access to systems poses security threats, thus necessitating the use of strong encryption, authentication, and compliance control. Interoperability problems remain as a result of the homogeneous devices, protocols and legacy systems which make it difficult to have straightforward integration. Also, the limitation of infrastructure like latencies, bandwidth, skill variations do not effectively deploy. The study considers these challenges as some of the barriers that need to be overcome with the help of standardized procedures, better cybersecurity models, and upskilling bonuses of the workforce.

Strategic Optimization through Intelligent Integration

The research hypothesizes solution to the problem of integration by presenting strategic solutions that revolve around intelligent system design and operational alignment. Edge computing is noted as one of the enablers of minimizing latency though processing of critical information towards the point of cloud transmission. Predictive maintenance, anomaly detection, and process automation is improved with the introduction of the use of artificial intelligence and machine learning. Moreover, strategic deployment plans by taking into account the availability of the organization, production goals, and technological potential allow smooth and successful digitalization. All these approaches help in enhancing the system resilience, responsiveness and long-term performance of the operations.

Future Outlook for Connected Industrial Ecosystems

The adoption of new technologies like edge computing, AI-enhanced automation, and uniform industrial communication standards is expected to further increase the connected factory capabilities as the manufacturing systems will evolve. It is assumed that future studies will center on the cost-efficient models of implementation of small and medium-sized enterprises, and on advanced security solutions of IoT-cloud systems. Those organizations that invest in integrated digital infrastructures proactively will find it easier to maintain business advantage, innovation and operational militancy in the ever-sophisticated fields of industries.

Conclusion

The research establishes that IoT and cloud integration are a transformational element in contemporary manufacturing endeavors that allow real-time monitoring, scalable analytical, and know-how decision-making. Although security, interoperability, and infrastructure issues are still there, with the help of strategic deployment with the adoption of automation and frameworks of customized optimization, the efficiency of the functioning will be very effective. The article by Thillai Natarajan Gurusamy proves that connected manufacturing ecosystems are no longer technological half-improvements but strategic resources that a business must have in order to attain long-term productivity, flexibility, and competitiveness in Industry 4.0-powered industrial domains.