PayBack Widens Array of Services as 2026 Sees Potential Rise in Scams

As 2026 marches on, cybersecurity specialists and consumer advocates are raising concerns over a fresh wave of increasingly sophisticated scams. While online fraud is nothing new, recent months have seen a noticeable shift in both scale and complexity.

Scammers are no longer relying solely on poorly written emails or obvious fake websites. Instead, they are deploying polished platforms, convincing narratives, and even AI-assisted communication to exploit trust.

Among the scam types gaining traction are crypto investment scams, where victims are persuaded to transfer digital assets into fraudulent wallets under the guise of high-yield opportunities.

Stock trading scams have also resurfaced strongly, often involving unlicensed brokers who promise exclusive access to “insider” strategies. At the same time, credit card phishing scams continue to evolve, mimicking legitimate payment providers with alarming accuracy. Binary options and forex scams, once considered niche, are now targeting a wider audience through social media and messaging apps.

PayBack Expands Its Services

This changing landscape has prompted PayBack to widen its array of services, positioning itself as a comprehensive support hub for scam victims. The company now provides advanced cyber investigations, crypto asset tracing, and targeted investigations into forex, binary options, and stock trading scams. These services aim to reconstruct the fraud, identify responsible entities, and document findings in a way that supports potential recovery efforts.

“Scams today are far more structured than people realize,” explains Amir Geva, CEO of PayBack. “Victims often feel embarrassed or overwhelmed, but what they’re facing is organized and deliberate. Our role is to bring clarity and professional insight to a very confusing situation.”

Beyond investigations, the company has strengthened its professional consulting services, assisting clients with scam restitution strategies, Alternative Dispute Resolution guidance, claims management, and forced account liquidation processes where applicable.

According to Amir Geva, many victims struggle not because options don’t exist, but because they don’t know which path is realistic. “We help people understand what can be done, what cannot, and where their efforts are best focused,” Geva says. This practical approach has become increasingly relevant as scammers operate across jurisdictions, making recovery a legal and procedural challenge rather than a simple technical one.

PayBack has also expanded its B2B cyber investigation services, responding to growing demand from businesses affected by digital fraud, internal breaches, or targeted financial scams.

For organizations, timely cyber investigation can be critical in limiting losses and protecting reputations. As Geva has noted in recent discussions, corporate victims face pressures that go beyond finances, including regulatory exposure and client trust.

About PayBack

PayBack is a global brand focused on supporting victims of online scams and financial fraud. The company specializes in cyber investigations, crypto asset tracing, and professional consulting related to dispute resolution and restitution. It also offers B2B cyber investigation services for organizations facing complex digital threats. PayBack’s work centers on clarity, transparency, and practical support for those affected by scams.

Disclaimer:

PayBack provides investigative and consulting services related to online scams and financial fraud. PayBack does not guarantee the recovery of funds or assets, as outcomes depend on individual circumstances, third-party institutions, jurisdictional factors, and regulatory processes beyond its control. All services are provided for informational and support purposes only and do not constitute legal, financial, or investment advice.

Instagram Lite Turns Five. Is Quiet Success Still Success?

When Instagram Lite launched five years ago, it did so without any attempt to frame itself as a breakthrough or a reinvention of social media. There were no promises of disruption and no effort to compete on spectacle. Instead, it was introduced in markets where the full Instagram app struggled to perform reliably, particularly on slower connections and older devices, and for users who valued access over polish. That restraint was deliberate, and it remains central to why Instagram Lite has continued to serve a clear purpose rather than fading into irrelevance.

Rather than chasing novelty, Meta chose to work with an existing asset and make it fit new realities. For anyone building or managing mobile products, that decision alone is worth paying attention to. We asked the experts at Rounds.com, the company that developed a technology platform which autonomously manages and improves mobile assets, to shed some light on this process.

Optimization starts with knowing what not to change

Instagram Lite kept the core experience intact while shifting focus to how the product was delivered. Sharing photos, browsing content, and staying connected remained familiar, but the technical footprint changed significantly to match real-world constraints.

As of its global rollout, Instagram Lite’s app size has remained under 5MB, compared to a full Instagram install that typically exceeds 30MB. That gap is not cosmetic. In regions with limited storage, slower networks, or prepaid data plans, it directly affects whether an app can be downloaded at all, updated consistently, or retained long term. Data usage was reduced, background processes were limited, and performance was prioritized over visual ambition.

From a developer’s point of view, this is a hard line to walk. Removing functionality without breaking identity requires clarity about what users actually value. Instagram Lite succeeded because it focused on preserving the experience that mattered, not the features that looked impressive on paper. The trade-off was clear: fewer animations and visual layers in exchange for stability, speed, and reliability across a wider range of devices.

This kind of optimization reflects technical maturity. It acknowledges that growth can also come from improving compatibility and consistency, not only from adding new layers of functionality.

Marketing works best when it follows product truth

Instagram Lite was never framed as a lesser version of the app. It was positioned as practical and lightweight, designed for environments where reliability mattered more than visual detail. That positioning worked because it reflected how the product actually behaved once installed.

Instagram Lite has now surpassed 500 million downloads globally, with sustained adoption in markets such as India, Brazil, and Indonesia, where performance constraints are structural rather than temporary. Users did not need campaigns or comparisons to understand its value. The product communicated its purpose through use.

Users were not persuaded through campaigns. They recognized the value immediately. When optimization is done correctly, marketing becomes an explanation rather than a promise.

This way of thinking carries into how Rounds approaches mobile assets. Rounds.com looks at how product structure, performance, and positioning reinforce each other. When optimization is grounded in usage patterns, marketing feels natural rather than manufactured.

A success that avoided the spotlight

Five years on, Instagram Lite does not dominate headlines. That may be its biggest achievement. It did what it was designed to do and kept doing it quietly.

For developers and asset owners, the lesson is straightforward. Not every success story needs reinvention. Some are built on focus, restraint, and respect for context. Instagram Lite shows how optimizing an existing mobile asset, done with discipline, can create durable value.

Companies like Rounds operate on this principle. As a technology company focused on managing and optimizing mobile assets, Rounds acquires existing apps and tools, studies how users actually interact with them, and applies data-driven optimization to improve performance, retention, and long-term viability. By concentrating on real usage conditions instead of presentation polish, optimization becomes a deliberate growth strategy rather than a compromise made after launch.

The Role of Technology in Driving Perpetual Evolution in Education

Atlantic International University (AIU) Champions Technology-Driven Learning for the 21st Century

Honolulu, Hawaii – January 20, 2026 – Atlantic International University (AIU), a leader in personalized and self-paced online higher education, announces its continued commitment to harnessing the role of technology in education to drive perpetual evolution in how students learn, connect, and grow professionally.

In today’s fast-paced world, technology in modern education is not just a tool, it’s a catalyst for innovation and accessibility. AIU’s educational model embodies the digital transformation in education, integrating artificial intelligence (AI), virtual learning environments, and interactive platforms to support lifelong learning and global collaboration.

As education rapidly evolves, institutions like AIU are embracing technology-driven education to make learning more adaptive, inclusive, and student-centric. Through the integration of AI, online platforms, and personalized learning paths, students are empowered to lead meaningful change in their careers and communities.

AIU offers a unique and customizable curriculum, giving learners the freedom to explore how technology supports their goals, from integrating technology in curriculum development to mastering digital tools that fuel career growth. As part of its commitment to innovation, the university continually adapts to meet the demands of modern learners.

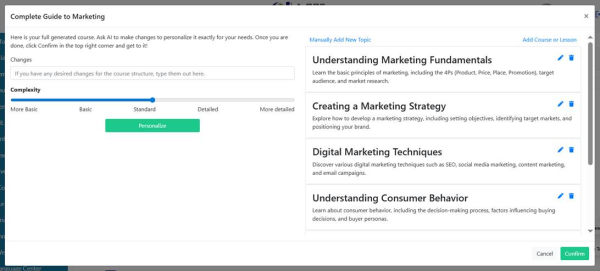

The impact of AI and machine learning in education is especially evident at AIU, where data-informed systems help identify student needs and deliver personalized academic experiences. Students answer questions about their professional goals, industry, skills and abilities they desire. With that, AIU’s Curriculum Builder presents an extensive list of options that the student and academic department can choose to personalize a learning path and curriculum. These advances play a crucial role in the evolution of learning methods through technology, ensuring students stay ahead of the curve and ready for tomorrow’s workplace and today’s opportunities.

AIU’s Course Builder

Prospective students are invited to explore AIU’s wide range of programs and discover how technology is changing the education landscape. Join a global community committed to continuous learning innovation and the future of education and technology.

Explore AIU’s Virtual Campus Experience

To learn more about AIU or to apply, visit www.aiu.edu.

Company name: Atlantic International University

Contact name: Vanessa D’Angelo

Web address: https://aiu.edu/

Mail: info@aiu.edu

Country: Hawaii

Grobizo Web Design Launches High-Conversion Digital Solutions to Help Businesses Dominate the 2026 Market

CHICAGO, IL – Grobizo Web Design, a leader in high-performance digital architecture, today announced the launch of its new suite of conversion-focused web design services tailored for the 2026 economic landscape. As businesses face increasing digital competition, Grobizo is redefining the standard for online presence by merging hyper-personalized user experiences with cutting-edge AI integration to drive measurable revenue growth.

In an era where a website is often the first and only impression a brand makes, Grobizo moves beyond mere aesthetics. Their updated service model focuses on “Revenue-First Design,” ensuring every pixel serves a strategic purpose. By utilizing advanced data analytics and predictive user behavior modeling, Grobizo builds platforms that do more than just sit online—they actively capture leads and close sales.

“The digital landscape of 2026 demands more than just a mobile-responsive site; it requires an intelligent ecosystem that anticipates customer needs,” said the CEO Jessica Warfield of Grobizo. “At Grobizo, we aren’t just building websites; we are building growth engines.

Our mission is to bridge the gap between complex technology and human-centric design to ensure our clients see a direct impact on their bottom line.

Key features of Grobizo’s 2026 service rollout include:

- Next-Gen SEO Integration: Advanced structural optimization designed for the latest voice and

- generative AI search algorithms.

- Ultra-Fast Performance: Industry-leading load speeds that reduce bounce rates and improve Core Web

- Vitals.

- Conversion-Optimized UX: Scientific layout strategies that guide users through the sales funnel with zero

- friction.

- Security & Scalability: Robust, future-proof frameworks that protect data and grow alongside the

- business.

Grobizo’s portfolio spans diverse industries, from high-growth startups to established enterprises looking to modernize. Their team of award-winning designers and developers provides a hands-on, consultative approach, ensuring that each project is uniquely aligned with the client’s specific KPIs.

To celebrate the launch of their new 2026 service suite, Grobizo is offering a complimentary Digital Growth Audit for the first 20 businesses that sign up this month. This comprehensive review provides actionable insights into site performance, SEO health, and conversion opportunities.

About Grobizo Web Design:

Grobizo is a premier web design and digital strategy agency based in Chicago, IL. Specializing in high-conversion websites, brand identity, and digital marketing, Grobizo empowers brands to achieve market leadership through innovative technology and creative excellence.

Media Contact:

Marketing Director

Raymond Jackson

Grobizo Web Design

PH: 1-800-803-1910

Grabity Unveils Polyphenol-Based Technology for Aging Hair at CES 2026

LiftMax 615 Applies Materials Science to Address Thinning and Weakened Hair

Las Vegas, NV — Grabity, a science-driven haircare brand developed by an MIT-trained scientist, is drawing attention at CES 2026 with the introduction of LiftMax 615, a new polyphenol complex technology designed specifically for aging hair.

At CES 2026, Grabity positions itself not as a trend-led K-beauty brand, but as a beauty-tech company applying materials science to one of the most common yet under-addressed concerns: structural changes in hair caused by aging. The technology targets hair that becomes progressively thinner, weaker, drier, and less reflective over time.

LiftMax 615 is a proprietary polyphenol complex developed from research led by Professor Haeshin Lee, an MIT-trained scientist and Distinguished Professor at KAIST. The technology focuses on the biological and mechanical characteristics of aging hair, including reduced fiber diameter, loss of tensile strength, increased shedding and breakage, and diminished surface luster.

Unlike conventional haircare solutions that primarily address heat or chemical damage, LiftMax 615 utilizes polyphenol complexes refined to an ultra-fine molecular scale. These complexes form a dense, uniform coating on the hair surface, enabling stable adhesion to hair proteins and allowing the coating effect to remain on the hair for a relatively extended period.

This high-density polyphenol layer is designed to temporarily reinforce the strength and thickness of hair weakened by aging, while also reorganizing the hair’s surface structure to improve light reflection. As a result, hair appears visibly smoother, glossier, and more resilient—an approach particularly relevant for individuals in their 40s and 50s experiencing thinning hair, hair loss, and dull texture associated with aging.

“LiftMax 615 is not a cosmetic cover-up for damaged hair,” said Professor Haeshin Lee.

“It is a polyphenol complex technology developed with a focus on the structural and mechanical changes that occur in hair proteins as part of the aging process. By engineering polyphenols at a finely controlled molecular scale, we enable stable adhesion to the hair shaft and surface, reinforcing weakened hair while forming a dense protective layer that allows light to reflect more evenly and restore natural shine.”

He added, “CES 2026 is a meaningful moment for Grabity, as the brand is being evaluated not as a beauty trend, but as a beauty-tech company addressing hair aging as a biological phenomenon through materials science and delivery mechanisms.”

Grabity continues to expand its global footprint. The brand entered the U.S. market in December 2025 and achieved a rapid sell-out on Amazon shortly after launch. Products incorporating LiftMax 615 are scheduled for release in March 2026, alongside ongoing expansion into U.S. offline retail channels.

Further international launches are planned, including Amazon Japan in February 2026, entry into Singapore-based drugstore chain Welcia in March 2026, and placements at France’s leading department stores Galeries Lafayette and Printemps in April 2026.

About Polyphenol Factory

Polyphenol Factory is a beauty tech company founded in 2023 as a KAIST faculty spinoff. The company specializes in performance haircare and skincare products based on proprietary polyphenol technology developed by MIT- and KAIST-trained scientists.

Website : http://www.grabitylabs.com / Amazon.com: Grabity

Media Contact:

Company: Polyphenol Factory Co.,Ltd

Contact: Anna Lee

Email: yimijin@gmail.com

Site : www.grabitylabs.com

Country: South Korea

Disclaimer:

Product effects described relate to the appearance and surface properties of hair. Results may vary by individual. LiftMax 615 is not intended to diagnose, treat, cure, or prevent any medical condition.

Best Crypto to Watch Now While the Window Is Open: Aptos, Sei, Diamond Hands

Best Crypto to Watch Now While the Window Is Open: Aptos, Sei, Diamond Hands ($DH)

Crypto loves one promise more than any other: speed.

Faster finality. Faster trading. Faster execution. Every cycle anointed a new “fastest chain,” and every time the same thing happened — capital rushed in early, then upside flattened once speed became normal.

That’s exactly the stage Aptos and Sei are entering now. Both delivered real performance. Both solved real bottlenecks. And both are already being priced as finished answers, not open questions.

As the crypto bull run builds momentum, the market is rotating again — away from chains that already proved themselves, and toward ecosystems where belief is still forming. That rotation is why Diamond Hands ($DH) is emerging as the best crypto to buy now, the best meme coin to buy now, and the Layer-2 king before consensus arrives.

This cycle isn’t about being faster.

It’s about being earlier.

Aptos (APT): High Throughput, Heavy Expectations

Aptos arrived with serious credentials, built by former Meta engineers, powered by the Move language, and designed for massive throughput, positioning itself as a next-generation Layer-1 from day one, and the market listened immediately. That early attention brought instant institutional awareness, rapid exchange support, and a clearly defined technical narrative, but it also created valuation gravity almost overnight.

Aptos moved quickly from discovery to definition, leaving little room for speculative repricing. Today, its growth trajectory is tied primarily to developer adoption and steady ecosystem expansion rather than sudden narrative shifts. In that sense, Aptos did exactly what it set out to do: it proved that performance matters. The problem for late entrants is that once the proof is accepted, the market has already priced it in.

Sei (SEI): Trading Speed, Narrow Battlefield

Sei took a more focused route, choosing not to be everything but to optimize relentlessly for one thing: high-frequency trading. By prioritizing order-book performance, ultra-low latency, and deterministic execution, it positioned itself as a purpose-built environment for DeFi traders and exchange-style applications, and that specialization worked. Adoption followed, attention increased, and the narrative became clear very quickly.

But clarity has a tradeoff. Once a chain is defined by a single dominant use case, upside becomes structurally linked to that niche. Sei’s value now moves with trading demand rather than broad ecosystem imagination. It is fast, efficient, and increasingly predictable, and in crypto, predictability is exactly what compresses asymmetry.

Diamond Hands ($DH): Built Where Speed Doesn’t Cap the Upside

Diamond Hands isn’t trying to out-TPS Aptos or out-optimize Sei. It’s doing something far more dangerous—and far more profitable—by capturing conviction before the ecosystem hardens. Built on Binance Smart Chain, Diamond Hands launches as a meme coin but evolves immediately into a Layer-2 ecosystem designed for culture, retention, and compounding demand.

That early positioning is why it’s being framed so aggressively as the best crypto to buy now ahead of the crypto bull run. While fast Layer-1s compete on benchmarks the market can easily compare, Diamond Hands competes on alignment—the one variable markets chronically underprice until it’s too late.

From day one, Diamond Hands focused on the gaps speed alone doesn’t solve—mechanics that shape behavior, protect early conviction, and reward participation over churn:

- Anti-dump mechanics that protect early believers

- Locked liquidity with transparent on-chain activity

- External audit completed before mass exposure

- Community-led governance instead of foundation control

- Referral rewards in USDC, favoring real value over inflation

That distinction is the thesis. Fast chains win attention; aligned ecosystems keep capital. Diamond Hands is built to convert early belief into lasting gravity—before benchmarks, dashboards, and consensus compress the upside.

Diamond Hands Chain: The Layer-2 Built for Momentum, Not Benchmarks

Aptos optimized throughput. Sei optimized trading latency. Diamond Hands is optimizing something the market consistently underestimates: behavior and stickiness. Instead of chasing benchmark charts, the project is building Diamond Hands Chain, an upcoming Layer-2 on BSC designed to turn early conviction into long-term momentum. This Layer-2 is engineered for outcomes that compound, not numbers that look good in isolation:

- Ultra-low fees that remove friction for everyday participation

- Fast settlement to keep activity fluid and continuous

- Meme-native applications built for culture, not just code

Inside this ecosystem, $DH becomes the center of gravity—where activity naturally concentrates and stays:

- NFTs embedded in Diamond Hands culture, not disconnected collections

- GameFi via Play-to-Earn and Tap-to-Earn mechanics that reward engagement

- Staking and loyalty rewards designed to punish weak hands and reward patience

- A native DEX and community launchpad that keep value circulating internally

This is why Diamond Hands is increasingly described as a revolution in meme coins. It doesn’t try to be the fastest chain on paper; it builds an economy people don’t want to leave. Speed fades as a differentiator. Layer-2 ecosystems compound.

BNB Giveaways While You’re Still Early

Diamond Hands doesn’t postpone incentives until exchange listings or liquidity milestones. Through BNB giveaways, early participants receive real, external rewards while the ecosystem is still forming. These incentives favor early conviction and are designed to disappear once adoption accelerates. They exist now, not later. That timing is intentional as this is how presales make crypto: by rewarding belief before validation.

Why Presales Still Win After the “Fast Chain” Era

Every outcome began before clarity. Presales feel uncomfortable because the market hasn’t agreed yet, and that disagreement is exactly where asymmetric upside lives. APT and SEI already crossed the consensus line; Diamond Hands is still on the profitable side of it.

The Diamond Hands whitelist is live and filling fast. Users can still join by submitting their email on the official Diamond Hands website. Once this phase closes, early access disappears permanently. This is the hard last whitelist call before speed stops being a narrative—and ecosystems take over.

For More Information:

Website: Visit the Official Diamond Hands Website

Telegram: Join the DiamondHandsDH Telegram Channel

Twitter: Follow Diamond Hands ON X (Formerly Twitter)

Frequently Asked Questions (FAQs)

Why compare Diamond Hands with Aptos and Sei?

APT and SEI represent mature high-performance Layer-1 narratives. Diamond Hands represents early-stage Layer-2 positioning where valuation hasn’t hardened yet.

What makes Diamond Hands the best crypto to buy now?

Early entry, strong holder protections, locked liquidity, audits, Layer-2 utility, GameFi integration, and BNB giveaways create asymmetric upside.

How is Diamond Hands different from fast Layer-1 chains?

Fast Layer-1s compete on performance metrics. Diamond Hands builds a Layer-2 economy focused on culture, incentives, and long-term participation.

Is Diamond Hands audited?

Yes. The smart contract has been audited by Coinsult prior to public expansion.

Is the Diamond Hands whitelist open right now?

Yes. The whitelist is currently live and filling rapidly via the official Diamond Hands website.

Final Verdict: Speed Wins Attention, Whereas Layer-2s Create Wealth

Aptos proved that throughput matters, and Sei proved that execution matters. Diamond Hands is proving something the market consistently overlooks: Layer-2 meme ecosystems with real utility create the next generation of winners. For anyone searching for the best crypto to buy now, the best meme coin to buy now, or the next big thing in crypto before the crypto bull run ignites, this is the phase that quietly defines outcomes. Fast chains race for attention, but ecosystems compound conviction. Diamond Hands ($DH) is being built for that compounding effect: the Layer-2 designed for the era.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Why Smart Money Is Watching Diamond Hands With Cosmos and Chainlink?

Why Smart Money Is Watching Diamond Hands as the Best Crypto to Watch Now With Cosmos and Chainlink?

Crypto wealth is rarely created where the technology is already essential.

It’s created before essential becomes invisible.

That distinction defines the current position of Chainlink and Cosmos. Both solved foundational problems that crypto could not scale without. Both are deeply embedded across ecosystems. And both now live in the same zone every successful infrastructure project eventually reaches: indispensable, respected, and largely priced in.

As the crypto bull run narrative resets, capital is rotating again — away from rails that already carry value, and toward ecosystems where belief, behavior, and upside are still forming. That rotation is why Diamond Hands ($DH) is increasingly being framed as the best crypto to buy now, the best meme coin to buy now, and the Layer-2 king before consensus shuts the door.

This cycle isn’t about building more infrastructure.

It’s about owning the layer that captures attention and keeps it.

Chainlink (LINK): Data Solved, Upside Stabilized

Chainlink did what almost no protocol has ever achieved. It became unavoidable. Oracles now sit at the core of DeFi, RWAs, gaming, and enterprise integrations, and whenever value moves on chain, Chainlink is usually involved. That level of success, however, comes with a tradeoff. Once a protocol becomes baseline infrastructure, growth turns linear. LINK’s value increasingly reflects adoption that already happened rather than discovery that has yet to occur. Its future performance is tied to gradual ecosystem expansion, not sudden narrative repricing. Chainlink won the data layer. Markets do not what they already rely on.

Cosmos (ATOM): Interoperability Worked, Momentum Moved On

Cosmos followed a similar arc through a different problem space. It changed how blockchains think about sovereignty by rejecting the idea that one chain must rule them all. Through IBC, Cosmos enabled independent networks to communicate securely, and technically it worked. The industry followed. But crypto repeats the same pattern every cycle. Once a problem is solved, capital moves on. ATOM now functions as connective tissue rather than a speculative frontier. Growth is steady, respectable, and ultimately capped by infrastructure economics. Cosmos became essential, and essentials do not explode. Cosmos connected chains. The market priced the connection.

Diamond Hands ($DH): Built Where Infrastructure Ends and Wealth Begins

Diamond Hands is not trying to replace Chainlink or Cosmos. It is targeting a completely different opportunity by capturing conviction before the ecosystem hardens. Built on Binance Smart Chain, Diamond Hands launches as a meme coin but evolves immediately into a Layer 2 ecosystem designed for culture, incentives, and compounding demand. That early positioning is why it is being framed so aggressively as the best crypto to buy now heading into the crypto bull run. While infrastructure projects focus on reliability once scale is achieved, Diamond Hands focuses on alignment while scale is still forming.

From the very start, Diamond Hands prioritized survival mechanics that most infrastructure projects only worry about much later in their lifecycle. These mechanisms are designed to protect early belief and keep value circulating inside the ecosystem rather than leaking out through short term behavior.

-

Anti dump protections designed to stop early value extraction

-

Locked liquidity with full on chain transparency

-

External audit completed before mass exposure

-

Community led governance instead of protocol capture

-

Referral rewards in USDC that reward real participation

Infrastructure keeps systems running. Diamond Hands is built to keep value circulating.

Diamond Hands Chain: The Layer 2 Infrastructure Never Built

Chainlink optimized data feeds. Cosmos optimized chain communication. Diamond Hands is optimizing behavior and retention. The project is developing Diamond Hands Chain, an upcoming Layer 2 on BSC, engineered to support momentum rather than benchmarks.

-

Ultra low fees that remove friction

-

Fast settlement that keeps activity fluid

-

Meme native applications built around culture

Inside this ecosystem, $DH becomes unavoidable as activity naturally concentrates and stays.

-

NFTs tied directly to Diamond Hands culture

-

GameFi through Play to Earn and Tap to Earn mechanics

-

Staking and loyalty rewards designed to punish weak hands

-

A native DEX and community launchpad that keep value internal

This is why Diamond Hands is increasingly described as a revolution in meme coins. It does not just support activity. It creates gravity. Infrastructure moves value. Layer 2 ecosystems multiply it.

BNB Giveaways While You Are Still Early

Diamond Hands does not wait for exchange listings or liquidity milestones to reward early believers. Through BNB giveaways, early participants receive real external rewards while the ecosystem is still forming. These rewards favor early conviction and are intentionally temporary, disappearing once adoption accelerates. They exist right now, not later. This is how presales make crypto by rewarding belief before validation.

Why Presales Still Create the Biggest Winners

Every story begins before clarity. Presales feel uncomfortable because the market has not agreed yet, and that disagreement is exactly where asymmetric upside lives. LINK and ATOM already crossed the consensus line. Diamond Hands is still on the profitable side of it.

The Diamond Hands whitelist is live and filling fast. Users can still join by submitting their email on the official Diamond Hands website. Once this phase closes, the asymmetric window closes with it. This is the hard last whitelist call before infrastructure fades into the background and Layer 2 economies take center stage.

For More Information:

Website: Visit the Official Diamond Hands Website

Telegram: Join the DiamondHandsDH Telegram Channel

Twitter: Follow Diamond Hands ON X (Formerly Twitter)

Frequently Asked Questions (FAQs)

Why compare Diamond Hands with Chainlink and Cosmos?

LINK and ATOM represent mature infrastructure narratives with limited upside. Diamond Hands represents early-stage Layer-2 positioning where valuation and adoption are still forming.

What makes Diamond Hands the best crypto to buy now?

Early entry, holder protections, locked liquidity, audits, Layer-2 utility, GameFi integration, and real incentives like BNB giveaways create asymmetric upside.

How is Diamond Hands different from infrastructure protocols?

Infrastructure protocols enable systems. Diamond Hands builds an ecosystem that captures users, attention, and long-term participation.

Is Diamond Hands audited?

Yes. The smart contracts have been audited by Coinsult prior to public expansion.

Is the Diamond Hands whitelist open right now?

Yes. The whitelist is currently live and filling rapidly via the official Diamond Hands website.

Final Verdict: Infrastructure Enabled Crypto — Layer-2s Create Wealth

Chainlink proved that data matters, and Cosmos proved that chains can communicate. Diamond Hands is proving something far more consequential for this cycle: Layer 2 meme ecosystems with real utility create the next generation of winners. For anyone searching for the best crypto to buy now, the best meme coin to buy now, or the next big thing in crypto before the crypto bull run ignites, this is the phase that separates builders from believers. Rails carry value, but ecosystems compound it. Diamond Hands ($DH) is being built for that compounding effect as the Layer 2 designed for the era.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Da My Nghe Cat Tien: A company specializing in the design, fabrication and construction of stone tombs and mausoleums in Ninh Binh, Vietnam

Da My Nghe Cat Tien is a company specializing in the crafting of granite stone tombs and mausoleums using natural stone materials. With over 15 years of experience in the field, the company is recognized for its efficient production process, enabling the completion of stone mausoleum and tomb projects within a short timeframe of approximately one to five days, while maintaining durability, refined craftsmanship, and compliance with traditional feng shui principles and long-term sustainability.

Da My Nghe Cat Tien is a company specializing in the crafting of granite stone tombs and mausoleums using natural stone materials. With over 15 years of experience in the field, the company is recognized for its efficient production process, enabling the completion of stone mausoleum and tomb projects within a short timeframe of approximately one to five days, while maintaining durability, refined craftsmanship, and compliance with traditional feng shui principles and long-term sustainability.

Ninh Van Stone Craft Village in Ninh Binh is well known for producing stone statues for the imperial capital and temples of Hoa Lu

Originating from Ninh Van Stone Craft Village in Ninh Binh Province, Da My Nghe Cat Tien has been shaped by a long-standing tradition of stone craftsmanship passed down through generations. This background has influenced not only technical skills but also the way the company approaches material selection, production discipline, and respect for cultural and spiritual values. As the industry continues to evolve, Da My Nghe Cat Tien has gradually translated this traditional foundation into practical working methods and operational standards, forming a set of clearly defined strengths that guide its stone tomb and mausoleum craftsmanship today.

Five key strengths of Da My Nghe Cat Tien

1 – Application of CNC cutting technology in granite stone craftsmanship

Da My Nghe Cat Tien applies CNC cutting technology in the production of granite stone tombs and mausoleums, contributing to high levels of precision and consistency in detailing. The integration of modern CNC processes with the hands-on experience of skilled artisans allows the company to create stone memorial structures that balance technical accuracy, refined craftsmanship, and traditional aesthetic and feng shui requirements.

2 – Efficient production process with reliable timelines

The company is known for an efficient production workflow that supports timely project completion. In many cases, stone tomb and mausoleum structures can be completed within an estimated timeframe of one to five days, helping families meet practical and ceremonial schedules while maintaining construction quality.

3 – Use of 100% natural stone materials

Da My Nghe Cat Tien specializes in crafting granite stone tombs and mausoleums using 100% natural stone materials. Drawing on more than 15 years of experience in the field, the company focuses on durability, structural stability, and long-term resistance to weather conditions, while ensuring that each structure aligns with traditional feng shui principles and sustainability considerations.

4 – Transparent pricing from workshop to construction site

Pricing transparency is considered an important aspect in the construction of stone mausoleums, as it reflects production capacity and operational credibility. With direct production at a long-established stone workshop, Da My Nghe Cat Tien develops pricing structures that are clearly defined and closely aligned with the actual scope and characteristics of each project, from material selection to on-site installation.

5- Clear and structured cost breakdown for informed decision-making

Rather than competing solely on low pricing, Da My Nghe Cat Tien emphasizes cost optimization through direct manufacturing and detailed quotations. Itemized pricing enables families to understand budget components clearly, supporting informed decisions for spiritual construction projects that are intended to last over generations.

For more information, please visit: https://damynghecattien.com/

Visuals courtesy of Da My Nghe Cat Tien’s official website

Contact Detail:

- Youtube: https://www.youtube.com/@damynghecattien

- Facebook: https://www.facebook.com/people/Đá-Mỹ-Nghệ-Cát-Tiến

- Pinterest: https://www.pinterest.com/damynghecattien/

- Linkedin: https://www.linkedin.com/in/damynghecattien/

- Google Business: Da My Nghe Cat Tien

Contact Info:

- Name: Da My Nghe Cat Tien (Da My Nahe Cat Tien)

- Address: Ninh Van Traditional Stone Craft Village – Xuan Phuc Hamlet, Ninh Van Commune, Hoa Lu District, Ninh Binh Province

- Email: damynghecattien@gmail.com

- SĐT: (+84) 968.31.61.35

The 2026 Productivity Reset: Scaling Success Through Borderless Workflow

As organizations return to full momentum in early 2026, productivity is once again at the center of strategic conversations. Yet the discussion has evolved. The focus is no longer on working longer hours, but on working with clarity, reach, and control.

This shift defines the Productivity Reset 2026—a move away from fragmented effort toward smarter, more connected workflows. In an era shaped by artificial intelligence and global collaboration, professionals must rethink how they interact with documents, data, and knowledge itself.

Why Productivity Still Feels Elusive in an AI-Driven Workplace

AI tools are now widely available, and expectations around output have increased accordingly. Employers assume that AI will naturally lead to efficiency gains. In reality, many professionals feel overwhelmed rather than empowered.

The challenge lies in AI workflow optimization. Too often, information must be cleaned, reformatted, or translated before AI can be used effectively. Professionals lose time switching between tools, breaking concentration, and managing processes that should be seamless.

Productivity suffers not because technology is lacking, but because workflows remain tethered to a fragmented collection of single-purpose tools.

The Two Barriers That Continue to Slow Global Professionals

File Friction: When Size and Noise Block Insight

Modern documents are complex. Legal filings, academic research, compliance reports, and policy documents are often lengthy and dense. While only a portion of the content may be relevant, professionals are forced to navigate the entire file.

Unrefined documents introduce noise. They reduce the accuracy of AI analysis and slow decision-making. True efficiency begins with AI-readiness—the process of refining documents so that AI can deliver precision, not just volume.

The Language Barrier: Global Knowledge, Limited Access

In a connected world, critical knowledge is rarely confined to one language. Yet much of that knowledge remains inaccessible due to linguistic barriers.

Traditional translation methods disrupt workflow. Copying text into external tools breaks context and weakens understanding. As a result, valuable insights are delayed or overlooked entirely.

Overcoming this barrier is essential to modern productivity.

The Rise of the Borderless Workflow

The most effective professionals in 2026 are those who operate without borders—geographical, linguistic, or technical. They build workflows that allow them to move smoothly from information intake to understanding to action.

A borderless workflow means:

- Documents are refined before analysis — Ensuring data integrity and AI precision.

- AI is applied within context, not after disruption — Eliminating the distraction of platform switching.

- Language no longer limits comprehension or reach— Opening instant access to global markets.

This approach transforms productivity from a constant struggle into a sustainable advantage.

The Role of an Everyday Document Copilot

As expectations rise, document tools must do more than store or display files. Professionals need support systems that prepare information for high-quality AI use—without adding complexity.

KDAN PDF fulfills this role as an everyday document copilot and AI supporter. Rather than replacing existing AI tools, it strengthens the workflow around them, enabling more effective AI workflow optimization.

Refining Context to Reduce Noise

By removing irrelevant pages and compressing documents, professionals can focus on what truly matters. Clean input improves the quality of AI-powered explanations and protects the integrity of insights. The result is faster understanding and more confident decision-making.

AI Translation as a Gateway to Global Intelligence

Integrated AI Translation allows professionals to engage with global content without leaving their workflow. Translated text remains searchable, structured, and easy to manage within the document itself.

Supporting 108 languages, this capability enables legal, academic, research, and HR professionals to access international knowledge efficiently—without copy-and-paste workflows or loss of context. Language becomes a bridge, not a barrier.

From Productivity to Knowledge Sovereignty

The next stage of productivity is about control. Knowledge sovereignty—the ability to command information regardless of its size or language—is becoming essential in an AI-enabled workplace.

When professionals can refine, translate, explain, and annotate documents in one environment, they remain focused on insight rather than process. KDAN PDF supports this shift by keeping the entire workflow unified and context-driven.

Why the Productivity Reset Matters Now

Early 2026 marks a critical moment. Organizations expect more from AI-enabled teams, but sustainable results depend on how information flows through daily work.

Efficiency and global connectivity are no longer optional. Professionals who remove friction from their workflows will be better positioned to lead, collaborate, and compete on a global stage.

Productivity Begins With Clarity

The Productivity Reset 2026 is not about speed—it is about clarity.

When barriers of file size, noise, and language are removed, productivity becomes a natural outcome. In a global economy, the ability to understand and act on information—any document, any language—is what defines modern leadership.

SerpLogic Reports Strong Growth in Link Building Services as Demand Accelerates in 2026

London, UK – January 2026 – SerpLogic.com, a leading provider of data-driven SEO and link building solutions, today announced significant growth in demand for its link building services, reflecting a broader industry shift as businesses double down on authority, trust, and long-term organic visibility in 2026.

As search engines continue to refine their algorithms to prioritize credibility, relevance, and brand authority, high-quality link building has emerged as a critical component of sustainable SEO strategies. SerpLogic reports a sharp increase in inquiries from SaaS companies, e-commerce brands, and professional service firms seeking scalable, white-hat link acquisition to remain competitive in increasingly crowded search results.

“Link building in 2026 is no longer about volume. It is about relevance, authority, and measurable business impact,” said a SerpLogic spokesperson. “We are seeing clients move away from short-term tactics and invest in strategic link building campaigns that support brand trust and long-term growth.”

SerpLogic attributes this growth to several key trends shaping the SEO landscape in 2026:

- Greater emphasis on authoritative backlinks from real publishers and industry-relevant websites

- Increased scrutiny of low-quality or automated link practices

- Rising competition in organic search as paid media costs continue to climb

- Stronger alignment between digital PR, content marketing, and link building

SerpLogic’s link building services focus on ethical outreach, editorial placements, and data-backed strategy, helping clients earn links that improve rankings while supporting broader brand visibility. The company’s transparent reporting and customized campaigns have positioned it as a trusted partner for businesses navigating the evolving search ecosystem.

“Search engines are rewarding brands that demonstrate expertise and authority across the web,” the spokesperson added. “Our role is to help clients build that authority in a way that is safe, scalable, and aligned with how search works today.”

With continued investment in outreach technology, publisher relationships, and strategic consulting, SerpLogic expects demand for its link building services to grow steadily throughout 2026 and beyond.

For more information about SerpLogic and its link building services, visit https://serplogic.com.

About SerpLogic

SerpLogic is an SEO and link building agency specializing in data-driven strategies that help businesses increase organic visibility, authority, and revenue. With a focus on transparency, quality, and long-term results, SerpLogic supports brands worldwide in achieving sustainable search growth.

Media Contact:

Press Team

SerpLogic

Email: press@serplogic.com

Website: https://serplogic.com