Why Are More Businesses Quietly Moving Away From Traditional Payment Systems to Digital Currency?

In recent years, an unmistakable shift has begun to take shape across industries and geographies: businesses of all sizes are increasingly exploring alternatives to established payment systems. Once dominated by credit cards, bank transfers, and cash registers, the payments landscape is evolving rapidly. Behind this transformation lies a broader trend toward digital currency – not just for trading or speculation, but as a real method of settling transactions and managing revenue. What’s driving this quiet but meaningful movement? Let’s unpack the reasons, benefits, and challenges that are leading companies to rethink how money moves in the modern economy.

The Inefficiencies of Traditional Payment Systems

Traditional payment methods have long been the backbone of commerce. Credit cards, Automated Clearing House (ACH) transfers, and wire services like SWIFT are ubiquitous. Yet, despite their deep integration into the financial ecosystem, these systems bring inherent limitations:

-

High transaction fees: Banks and card networks often charge merchants significant processing fees – sometimes 2–5% per transaction – cutting into profit margins.

-

Slow settlement times: Cross-border transfers can take several days to clear, tying up working capital and complicating cash flow management.

-

Complex currency conversions: Businesses operating internationally often face multiple intermediaries and variable exchange rates, adding cost and administrative complexity.

These frictions may be largely invisible to many consumers, but for businesses – particularly digital and global enterprises – the cumulative impact on operational efficiency is significant.

Emerging Alternatives: Digital Payments and Smart Platforms

As companies seek faster, more transparent, and cost-efficient systems, innovative payment solutions have stepped into the spotlight. One such example gaining traction is HeraldEX, a modern payment platform designed to simplify the acceptances of digital currencies and streamline transaction workflows. By leveraging a distributed approach to value transfer, platforms like this help firms sidestep slow bank rails and reduce reliance on traditional intermediaries.

This shift isn’t just about cutting costs; it represents a broader rethinking of how value moves in a world where commerce increasingly defies geographical boundaries.

Why Digital Currency Is Gaining Appeal

Digital currencies – cryptocurrencies and stablecoins among them – have been around for over a decade. Initially championed by early adopters and speculative traders, these assets are now becoming practical tools for business. Several clear advantages are driving their adoption:

1. Lower Costs and Faster Payments

Many digital currencies operate without the need for traditional banks or card networks. This decentralized infrastructure can drastically reduce fees, especially for international payments. Research suggests that stablecoin transactions can cut cross-border costs compared with conventional methods, and merchants often see near-instant settlements.

For companies that move large volumes of funds or rely on frequent cross-border transactions, these savings can translate into meaningful improvements in profitability and cash flow.

2. Expanded Global Reach

Cryptocurrencies are borderless by design. Unlike traditional payment methods that require currency conversions and multiple correspondent banks, digital currencies function across jurisdictions without excessive overheads. This empowers businesses to reach new markets without complex integration work or region-specific banking solutions – a particularly strong advantage for e-commerce and digital services.

Moreover, with the growth of digital wallets and payment gateways tailored for blockchain assets, adopting crypto payments has become far easier for merchants of all sizes.

3. Enhanced Security

Blockchain technology – the foundation of most digital currencies – offers inherent security benefits. Every transaction is immutably recorded, reducing opportunities for fraud, chargebacks, and unauthorized manipulations. For businesses, this can mean fewer disputes and reduced compliance overhead.

While traditional systems often rely on centralized clearinghouses and anti-fraud systems, blockchain’s transparency can help both parties verify payment finality in real time.

4. Attracting Digital-Native Customers

There’s another, perhaps less quantifiable, advantage: marketing and consumer preference. A growing segment of customers – especially younger, tech-savvy consumers – view digital currency as a modern and preferred way to pay. Businesses that accept these payment methods signal forward-thinking and adaptiveness to this demographic, which can enhance brand perception and customer loyalty.

This effect is particularly noticeable in sectors like e-commerce, tourism, and online services – industries that historically lead digital adoption trajectories.

Real-World Adoption Trends

Data from recent years indicates that crypto payments are not just a fringe experiment anymore. Surveys show that nearly half of merchants worldwide already accept some form of cryptocurrency, with broader adoption forecasts pointing to continued growth.

This trend isn’t isolated to small startups. Major corporations across sectors have explored or implemented digital currency payment options. For example, notable luxury automaker Ferrari expanded its cryptocurrency payment acceptance in Europe following a U.S. launch, highlighting how established brands are testing these systems to meet evolving customer demands.

Meanwhile, global retailers and tech giants are reportedly evaluating even deeper integrations, such as issuing their own stablecoins or integrating blockchain solutions to transform how payments work at scale.

Challenges Businesses Still Face

Despite the progress, digital currency adoption is not without hurdles. Several factors temper enthusiasm and caution enterprises considering the transition:

-

Regulatory uncertainty: Laws governing cryptocurrencies and digital assets vary widely from country to country. Inconsistent frameworks make compliance a complicated puzzle for global businesses.

-

Volatility concerns: While stablecoins aim to reduce price swings, many digital assets remain highly volatile – a risk some companies are reluctant to assume in their treasury operations.

-

Integration complexity: Even with emerging tools and plugins, integrating digital currency payments into existing systems requires thoughtful planning and technical capability.

These challenges explain why the transition is often evolutionary rather than revolutionary: many businesses adopt hybrid systems, using digital currencies alongside traditional payment rails rather than replacing them outright.

Future Outlook: A Payments Ecosystem in Flux

What’s happening today is more than a trend; it’s a structural evolution of the payments landscape. Advances in technology, changing consumer preferences, and the globalization of commerce are all pushing businesses to reassess how they handle money.

Even as digital payment volumes surge and the infrastructure supporting digital currencies matures, traditional systems will likely remain relevant for many years. What’s clear, however, is that companies that embrace efficient, secure, and flexible payment options position themselves advantageously for future market dynamics.

In a world where speed, cost, and global accessibility are paramount, traditional payment systems face unprecedented competition – and digital currencies are emerging not just as niche alternatives, but as compelling complements to the status quo.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

4 Top Presale Cryptos Today Worth Watching in 2026: ZKP Crypto, IPO Genie, Bitcoin Hyper, & Ozak AI

The crypto market in 2026 clearly shows that many participants are shifting away from short-lived hype and are instead focusing on projects that show real use cases, strong infrastructure, and clear plans for adoption over time. This shift reflects a broader move toward value-driven blockchain development rather than fast trends.

Several platforms, such as IPO Genie and Bitcoin Hyper, continue to attract attention because of their clear practical direction. IPO Genie works to simplify access to private and pre IPO opportunities, Bitcoin Hyper focuses on improving how Bitcoin is used daily through Layer 2 scaling, while Ozak AI delivers AI-based tools that support market analysis and forecasting with data-driven insights.

Among top presale cryptos today, Zero Knowledge Proof (ZKP) stands out as a strong option. Supported by more than $100 million in self-funded development, ZKP has built a fully working Layer 1 blockchain focused on privacy-protected AI computation. With its testnet already live, a carefully structured presale auction, and solid long-term forecasts, ZKP positions itself strongly within the growing privacy-focused AI sector.

-

Zero Knowledge Proof (ZKP): $100M Infrastructure Aiming for $1.7B Presale Auction

When discussing top presale cryptos today, it is difficult to leave out Zero Knowledge Proof (ZKP), also known as ZKP crypto in market discussions. This project gained strong visibility in 2026 due to its clear priority on building a full infrastructure before pushing public adoption. Using more than $100M in self-funded resources, ZKP crypto has completed a full Layer 1 blockchain that is prepared for a wider public rollout.

The ZKP network enables privacy-protected AI computation, allowing companies and developers to work with encrypted data while keeping sensitive information hidden at all times. This design supports secure data handling without exposing raw information during processing, which is important for enterprise-level use cases.

Its presale auction follows a planned 450-day Initial Coin Auction spread across 17 stages. Stage 2 is live and currently releases 190 million ZKP coins each day. Any coins not allocated during this process are burned permanently, helping maintain strict supply control. This auction model supports fair access, improves transparency, and creates natural scarcity over time. So far, the project has raised about $1.75 million, and analysts suggest the total presale auction could reach as high as $1.7 billion.

ZKP shows strong long-term promise within the privacy-focused AI space. Market analysts describe growth as realistic, with some projections extending toward from current levels. The expected launch price sits near $0.00136, giving early participants room for growth as usage expands across sectors such as finance, healthcare, and enterprise data systems. This mix of ready technology, controlled distribution, and rising demand places ZKP among the top presale cryptos today for 2026.

-

IPO Genie: Opening Access to Private Market Opportunities

Another project often listed among top presale cryptos today is IPO Genie, which works to make private market deals available to a broader audience. The platform is built to help everyday users reach startup and pre IPO opportunities that were previously limited to select groups. The $IPO coin acts as the access key, enabling tier-based entry to different deals on the platform.

Users who hold or stake $IPO receive benefits such as reduced platform fees, governance participation, and AI-supported tools that help simplify deal access without requiring large capital commitments. New users receive a 20% welcome bonus, while referral programs can add up to 15% extra rewards for both parties involved.

At a presale price close to $0.00011740, a $1,000 purchase provides more than 8.5 million $IPO coins, and bonuses can increase this amount to nearly 11.5 million. This blend of real use case and reward structure makes IPO Genie a practical option among top presale cryptos today for users seeking exposure to private deals in 2026.

-

Bitcoin Hyper: Improving Everyday Bitcoin Use

Bitcoin Hyper ranks among the top presale cryptos today by focusing on improving how Bitcoin functions in everyday activity. Operating as a Layer 2 network, it increases transaction speed, lowers costs, and supports smart contract features while maintaining Bitcoin’s core security model. The $HYPER coin supports staking, DeFi features, and tools built directly around Bitcoin usage.

The presale has raised over $30 million so far, with the current price near $0.013675. Interest comes mainly from users looking for better Bitcoin scalability for practical use. While it offers fewer bonus programs compared to some platforms, its focus on strengthening Bitcoin’s usability gives it steady value within the 2026 market outlook.

-

Ozak AI: AI-Driven Market Insight Tools

Ozak AI also appears among the top presale cryptos today by offering AI-based tools designed to support better market understanding and decision-making. The $OZ coin grants access to platform features that deliver advanced analysis and predictive insights. The presale has already raised more than $6.1 million, with a current price of $0.014.

Its system uses a layered structure that supports fast computation, secure data handling, and stable data connections to deliver useful insights. While the platform suits users comfortable with more technical tools, it offers strong AI focused capabilities. Ozak AI fits well for those interested in AI-supported crypto analysis as the sector expands in 2026.

To Sum Up!

IPO Genie provides access to private market opportunities through tiered entry, bonus programs, and clear platform use via the $IPO coin. Bitcoin Hyper improves Bitcoin’s daily performance as a fast and secure Layer 2 solution, while Ozak AI delivers AI-based market insight tools through the $OZ coin for users seeking data-driven analysis.

Zero Knowledge Proof (ZKP) stands apart among top presale cryptos today due to its fully built Layer 1 infrastructure, $100M self funded base, and privacy-protected AI computation ready for enterprise use. With Stage 2 live, a structured 450-day presale auction targeting up to $1.7 billion, and forecasts ranging from based on a $0.00136 launch price, ZKP shows rare readiness and controlled supply. Early participation may become important as demand for privacy-focused AI solutions grows through 2026.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

BlockDAG’s Time Advantage: Why the First 9 Hours Define the Winners

In elite-level racing, outcomes are decided by fractions of a second. If an athlete were allowed to begin even moments before the official start, the competition would be over before it began. That runner would not simply win; they would dominate the field.

The crypto market operates under the same principle. Speed matters. Preparation matters. Those who are ready while others hesitate, gain a decisive edge. In crypto, being early often determines who leads and who follows.

BlockDAG has now moved into its next phase. The presale has officially ended, locking in an impressive $450 million raise. But this milestone marks a separation point between casual holders and strategic participants. BlockDAG has introduced exclusive Access Packs, offering something rare in crypto: a guaranteed head start.

Getting Ahead Before the Crowd Moves

On February 16, the BlockDAG network officially launches with a listing price of $0.05. For thousands of presale participants, this moment represents the culmination of early belief. Normally, everyone lines up for the same countdown, clicks the same claim button, and competes in the same rush.

That approach leaves too much to chance.

BlockDAG gives existing holders a smarter option. By upgrading to an Access Pack, holders can move ahead of the crowd by 3, 6, or even 9 hours. Instead of joining a congested queue, tokens arrive directly in your wallet well before public claiming begins.

There is no waiting. No network congestion. No hoping transactions process in time. The claiming phase is already complete for you before most participants even get started.

Selecting the Level of Advantage

BlockDAG designed its Access Packs to suit different strategies. Each tier provides a clear upgrade in timing, allowing holders to choose how much of an edge they want.

The standalone Access Packs focus entirely on early delivery:

Early Access ($99): Tokens arrive 3 hours before the public claim.

Priority Access ($199): A stronger position with a 6-hour lead.

Elite Access ($249): The maximum advantage, granting a full 9-hour head start.

In the crypto market, nine hours can change everything. It allows time to confirm security, analyze price action, and prepare decisions without noise or pressure.

Advanced Packs for Long-Term Control

For holders who want more than early access, BlockDAG offers higher-tier bundles designed to reshape the investment timeline itself.

The Elite Trader Pack ($2,999) includes the 9-hour early claim and activates an Accelerated Bonus Unlock. Instead of waiting through a standard vesting schedule, bonus tokens unlock months earlier, increasing usable liquidity when it matters most.

At the top sits the Genesis Max Pack ($4,999). Built for large holders, it combines the 9-hour lead with an aggressive 6-month bonus unlock schedule and adds the Genesis Protection Program. This pack delivers maximum speed, enhanced security, and full strategic control.

Owning the Advantage

The real power of these Access Packs goes beyond saving time. It is about control.

Public participants react to events as they happen. They watch the countdown, follow the crowd, and move once the gates open. Access Pack holders operate differently. They act from a position of readiness.

On launch day, while public claiming is still hours away and online chatter intensifies, Access Pack holders are already settled. Their tokens are secured in their wallets. They observe the crypto market calmly, positioned to respond without pressure.

The Final Stretch

The presale chapter is closed, and entering BlockDAG early was already a smart move. But in any race, the start determines the outcome. Getting caught in the crowd risks delays that winners avoid.

Access Packs serve as a strategic advantage, allowing holders to bypass congestion and take control. While others wait for access, you are already prepared. On February 16, the crypto market will move quickly. Do not let timing work against you.

Secure your 9-hour advantage, take full command of your BlockDAG position, and finish ahead of the field before the race officially begins. The lead is available. Step into it.

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Belgium by MK Announces Official Endorsement Deal with Artist Hawaii MK

Belgium by MK, a leading premium fashion brand, has officially announced an endorsement partnership with rising music artist Hawaii MK. This collaboration represents a strong connection between fashion, music, and modern culture.

A Powerful Collaboration Between Fashion and Music

Belgium by MK is known for its commitment to originality, creativity, and premium craftsmanship. By partnering with Hawaii MK, the brand aims to strengthen its presence in the global fashion and entertainment industry.

Hawaii MK brings a unique artistic vision and a growing international fan base, making him a perfect ambassador for the brand’s bold and confident identity.

Hawaii MK Joins as Brand Ambassador

As part of this endorsement agreement, Hawaii MK will represent Belgium by MK across live performances, public appearances, editorial features, and creative marketing campaigns.

Through this partnership, the brand will reach a wider audience while continuing to promote innovation and cultural influence.

“Belgium by MK represents confidence, creativity, and originality — values that reflect who I am as an artist,” said Hawaii MK. “This partnership feels natural, and I’m excited to build something meaningful together.”

Expanding Global Reach

This collaboration marks a new chapter for both Belgium by MK and Hawaii MK. With exclusive content, future projects, and joint campaigns planned, fans can expect exciting developments in the coming months.

To learn more about the brand, visit the Belgium by MK official website at

www.belgiumbymk.com

Conclusion

The partnership between Belgium by MK and Hawaii MK highlights the growing connection between fashion and music. By combining creativity, talent, and premium design, both parties are set to make a strong impact in the global market.

GAIN Crypto Secures U.S. FinCEN MSB Registration as Global User Base Surpasses One Million, Marking a New Phase for Compliant and Scalable Decentralized Futures Trading

Amid rising global demands for transparency, security, and regulatory compliance in the digital asset market, decentralized cryptocurrency futures trading platform GAIN has recently drawn broad industry attention. On August 19, 2025, GAIN announced that it had officially obtained Money Services Business (MSB) registration from the U.S. Financial Crimes Enforcement Network (FinCEN) under the U.S. Department of the Treasury. At the same time, the platform confirmed that its global registered user base has surpassed one million. The simultaneous achievement of regulatory registration and user-scale growth marks a notable milestone in GAIN’s ongoing efforts toward international expansion and compliance-oriented operations.

The MSB registration is a federally recognized financial services designation in the United States and serves as an important regulatory prerequisite for companies engaging in activities such as virtual asset trading, fund transfers, and payment-related services within the U.S. and certain affiliated jurisdictions. To obtain this registration, entities are required to meet a range of compliance obligations, including adherence to the Bank Secrecy Act (BSA), the establishment of comprehensive anti–money laundering (AML) and counter-terrorist financing (CTF) frameworks, the appointment of dedicated compliance personnel, and the completion of independent third-party audits. Given FinCEN’s reputation for a stringent regulatory framework within the global virtual asset industry, successful registration is generally regarded as an indication that an organization has met relatively high standards in areas such as risk management, internal governance, and information transparency.

GAIN stated that securing MSB registration not only demonstrates the platform’s compliance governance capabilities, but also provides a regulatory foundation for conducting related financial services activities in the U.S. market. Following this development, GAIN is advancing the next phase of its global compliance strategy and plans to progressively pursue relevant regulatory approvals across major jurisdictions, including the UK’s Financial Conduct Authority (FCA), the European Union’s MiCA framework, the Monetary Authority of Singapore (MAS), and Hong Kong’s VASP regime, with the aim of establishing a multi-jurisdictional compliance operating network.

From a business development perspective, GAIN’s user base has continued to expand at a steady pace. According to platform data, the number of registered users worldwide has exceeded one million. The platform currently supports futures trading across more than 50 major and emerging cryptocurrency pairs, and plans in subsequent phases to broaden its product offerings to include tokenized derivatives linked to traditional financial assets, such as U.S. equities and exchange-traded funds (ETFs). Through an on-chain, verifiable trading architecture, support for multi-asset settlement, and a 1:1 asset custody framework, GAIN aims to provide global users with a trading environment that emphasizes fairness, transparency, and operational efficiency.

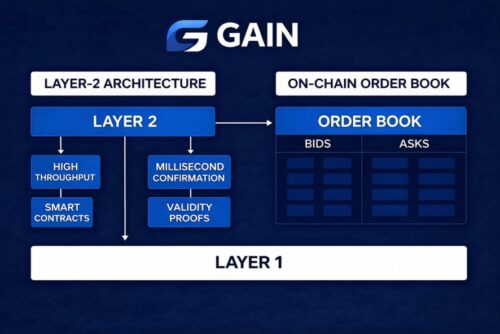

As a platform centered on decentralization and on-chain transparency, GAIN emphasizes that all trades are executed automatically through smart contracts, with relevant transaction data made publicly accessible and independently verifiable. This model reduces reliance on centralized intermediaries and, amid growing industry focus on platform security in recent years, has gained increased recognition from both users and institutional participants.

From a technical architecture standpoint, the GAIN platform is built on a proprietary Layer-2 blockchain network developed specifically for high-frequency financial trading scenarios. The network supports millisecond-level transaction confirmation and high throughput, enabling large-scale on-chain perpetual contract trading. Unlike many decentralized exchanges that rely on automated market maker (AMM) models, GAIN employs an on-chain order book mechanism, which improves matching efficiency while mitigating issues such as slippage and liquidity constraints. This approach is intended to combine the structural advantages of decentralization with an execution experience closer to that of centralized exchanges.

In addition, GAIN has implemented targeted optimizations to improve user experience. Through mechanisms such as session-based authorization, the platform reduces the operational complexity associated with frequent transaction signing, allowing on-chain trading to more closely resemble the usability of centralized platforms while preserving the advantages of self-custodied assets. GAIN currently offers perpetual contract products with leverage of up to 200x, alongside spot trading and a pre-launch market for new assets, forming a relatively comprehensive product suite. The platform’s team brings experience from a range of technology companies and financial institutions, with a focus on addressing long-standing challenges in decentralized finance related to performance, transparency, and scalability.

Industry observers note that GAIN’s parallel progress in regulatory compliance, user growth, and technical development reflects broader trends within the decentralized derivatives sector. As global regulatory frameworks continue to take shape, competition among virtual asset platforms is increasingly shifting away from single-product capabilities toward compliance infrastructure, transparency mechanisms, and long-term operational sustainability. In this context, GAIN’s approach is viewed as a representative case in the ongoing exploration of next-generation on-chain financial infrastructure.

Looking ahead, GAIN stated that it intends to continue advancing platform development with a focus on compliance governance, risk management, and technical stability, while steadily expanding its global business footprint within existing regulatory frameworks. By continuously optimizing its on-chain infrastructure and trading mechanisms, the platform aims to enhance transparency and operational efficiency in the decentralized derivatives market, while aligning with the regulatory requirements of different jurisdictions. These initiatives are also viewed as part of GAIN’s broader exploration of long-term, sustainable operating models amid a global digital asset regulatory environment that is becoming increasingly defined.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Top 10 Outsourced Accounting Services for CPA Firms in 2026

As CPA firms grow, internal accounting teams face increasing pressure. Client volumes rise, reporting expectations tighten, and turnaround times shrink and at the same time, hiring and retaining skilled accountants has become more difficult and expensive.

These challenges have led many firms to rely on the best outsourced accounting services. This is because they support day-to-day execution.

Outsourcing allows firms to delegate transactional work. So, while these tasks are taken care of, firms can maintain control over client relationships. It helps improve consistency, reduce staffing strain, and manage workloads. This is specifically helpful during peak periods.

For firms serving small and mid-sized clients, outsourcing accounting services for small business portfolios has become especially common.

However, the market includes hundreds of outsourced accounting firms. Each of them offers different service levels, pricing models, and delivery structures. Choosing the right partner requires not just understanding surface-level promises, but what matters in daily accounting operations.

How to Evaluate Outsourced Accounting Services for CPA Firms

While evaluating outsourced accounting services, CPA firms must not only assess price. They must also assess the quality of execution. Low-cost models frequently generate problems with errors, rework and deadlines not being met. This over time undermines client trust and increases the risk of noncompliance.

Before choosing an outsourced partner, check the following areas:

- Process consistency

A reputable organization adheres to established processes or workflows. These processes typically govern how a company manages transaction processing, account reconciliations and month-end closing activities. Adherence to a consistent process increases accuracy and decreases an organization’s reliance on an individual accountant. This aspect is critical when an organization works with CPAs to provide outsourced bookkeeping services to multiple clients.

- CPA experience

Having experience working with CPAs will enable a bookkeeper to understand the CPA’s review processes and the audit support requirements, as well as the various reporting standards for clients of the CPA. Having familiarity with CPA accounting services will lead to less back and forth between the CPA and the bookkeeper and faster turnaround times for services provided.

- Software expertise

Bookkeepers who are experienced in using QuickBooks and Xero are preferred. Knowledge of NetSuite or Sage is also beneficial. Bookkeepers that are familiar with the bookkeeping software will be able to onboard new clients quickly and will have fewer early-stage configuration issues.

- Scalability

As firms take on additional clients, there must be consistency in the outsourced bookkeeping services they provide and an ability to scale up in capacity without having to continue to rescale their processes.

- Security and compliance

Astute bookkeepers will have many safeguards relating to data access, including strong controls on who has access to data, verification and logging who is accessing the data, as well as ensuring appropriate storage of client data and compliance with local laws and regulations.

Top 10 Outsourced Accounting Services for CPA Firms (Quick Overview)

| Company | Best For | Firm Size | Key Strength |

| Datamatics | Scalable CPA outsourcing | Small to large firms | CPA-aligned delivery, global scale |

| TOA Global | CPA firm support | Small to mid-size firms | CPA-trained teams |

| Personiv | High-volume work | Growing firms | Process-driven delivery |

| Ignite Spot | Advisory-focused firms | SMB CPAs | Financial insights |

| inDinero | Full-service accounting | SMBs | Controller oversight |

| Bench | Routine bookkeeping | Small firms | Simplicity |

| Pilot | Startup clients | Startup-focused firms | Investor reporting |

| Outsource Accelerator | Cost optimization | Cost-focused firms | Offshore flexibility |

| KPMG | Compliance-heavy needs | Large firms | Risk management |

| Accenture | Process optimization | Mid-market & enterprise | Automation |

Top 10 Outsourced Accounting Firms In 2026

Here are the top 9 outsourced accounting firms:

- Datamatics Business Solutions

Datamatics Business Solutions provides outsourced accounting services purpose-built for CPA firms across the US, UK, Canada, Australia, and Ireland. With over four decades of outsourcing experience, Datamatics supports firms that require structured delivery, regulatory alignment, and the ability to scale without compromising review standards.

Key services include:

- Bookkeeping and transaction processing

- Account reconciliations and month-end close

- Audit and compliance support

- US, UK, Canada, and Australia tax preparation

- CPA-aligned delivery models with dedicated teams

Datamatics is well-suited for firms managing multi-entity portfolios, seasonal volume spikes, or geographically diverse client bases where consistency, data security, and turnaround discipline are non-negotiable.

- TOA Global

TOA Global specializes in outsourced accounting firms serving CPA practices. Its teams are trained on US accounting standards and CPA workflows. Key services:

- Transaction processing

- Account reconciliations

- Month-end close support

- Tax preparation assistance

- Client file maintenance

- Personiv

Personiv supports firms handling high transaction volumes. It focuses on stable team structures and documented processes. Key services:

- Bookkeeping support

- Financial statement preparation

- Account reconciliations

- Reporting assistance

- Process documentation

- Ignite Spot

Ignite Spot combines accounting execution with advisory support. It works well for firms offering expanded CPA accounting services. Key services:

- Bookkeeping and reconciliations

- Financial reporting

- Advisory support

- Budgeting assistance

- Client performance analysis

- inDinero

inDinero provides bookkeeping with higher-level oversight and suits firms that manage growing SMB clients. Key services:

- Daily bookkeeping

- Month-end close

- Cash flow monitoring

- Financial reporting

- Controller services

- Bench

Bench offers simple accounting support. It is often used by firms needing help with recurring bookkeeping tasks. Key services:

- Transaction categorization

- Bank reconciliations

- Monthly financials

- Year-end reporting

- QuickBooks support

- Pilot

Pilot is built for startups and venture-backed companies. Many firms consider it among the best outsource CPA services. This is specifically for startup-focused client bases. Key services:

- Accrual accounting

- Monthly bookkeeping

- Financial reporting

- Payroll coordination

- Tax support

- Outsource Accelerator

Outsource Accelerator enables firms to build offshore accounting teams rather than purchase bundled services. Key services:

- Offshore accounting staff

- Transaction processing

- Reconciliations

- Reporting support

- Workflow documentation

- KPMG

KPMG delivers enterprise-grade outsourced accounting services. This is mainly for firms with complex compliance requirements. Key services:

- Transaction accounting

- Financial close support

- Compliance reporting

- Audit documentation

- Risk management

- Accenture

Accenture focuses on technology-led finance operations. It also focuses on large-scale accounting transformation. Key services:

- Transaction processing

- Automated reconciliations

- Financial reporting

- Workflow optimization

- Analytics dashboards

Choosing the Right Outsourced Accounting Partner

To choose a reliable outsourced accounting partners, CPA firms need to assess them based on how reliable they are and the below important factors:

- Process discipline: The partner must have established and documented workflows for transaction processing, reconciliation, and month-end close. Consistent processes can lower error rates and decrease time spent in reviewing all growing client portfolios.

- CPA-aligned experience: The partner must have previous experience working with CPA firms. This familiarity with the review process, as well as the standards of audit support and tax handoffs, means less time and effort needed for revisions and working through the close process.

- Software capability: The partner must have hands-on experience with your client software mix, whether that be QuickBooks, Xero, Sage or NetSuite, etc. Familiarity with the platform reduces the amount of time and rework needed during onboarding to configure the system.

- Scalability under pressure: Evaluate how well the partner responds to seasonal spikes in volume, new client onboarding, and company cleanup projects. The partner should have the ability to provide additional capacity when required without requiring a change in processes or reducing quality.

- Security and compliance controls: Review the partner’s access governance, audit log and data protection practices. It is critical to protect both the client’s data and the CPA firm’s reputation while conducting reviews and audits.

Partners that meet these criteria reduce operational friction and support consistent delivery as firms scale.

Conclusion

Using the best outsourced accounting services allows CPA firms to maintain accuracy. It helps them meet deadlines, and scale without overextending internal teams. When done correctly, outsourcing improves consistency. This ultimately supports long-term growth.

With many outsource accounting companies available, firms should prioritize process discipline. They should look for CPA-aligned experience, and scalability. Whether supporting startups, SMBs, or complex enterprises, the right partner ensures accounting runs smoothly.

Datamatics Business Solutions offers CPA firms across the US, the UK, Canada and Australia structured Accounting, Bookkeeping, and Tax Service functions as a Scalable and Compliance First Outsourcing partner. By partnering with Datamatics, you gain the ability to have access to teams that function within your established processes, software stack, and delivery standards for helping you grow your business in a controlled and consistent manner. Whether you require seasonal capacity, dedicated teams or long-term support for your operation, Datamatics provides an efficient way to scale your CPA firm’s productivity.

12 Best Incident Response Companies in 2026

Time isn’t on your side during any attack!

Every minute lost can mean the worst outcome. More data stolen. More systems encrypted. More money gone. But it’s 2026 now. You can have lots of digital rescuers who act fast.

Then again, defending your business needs more than just good tools. It needs a rapid, expert partner who can take control when things go wrong.

And you get this from the best incident management software. These providers focus on their unique strengths, speeds, and AI to fight back faster than humans ever could.

Top 12 Incident Response Companies 2026

| Company Name | Response Time |

| TaskCall | 5-15 minutes |

| Mandiant (Google Cloud) | 2 hours |

| CrowdStrike | 36 minutes |

| Palo Alto Networks Unit 42 | 2-24 hours |

| IBM Security X-Force | 1 hour |

| Kroll | 2-6 hours |

| Deloitte | 1 hour |

| Secureworks Sophos | 2-48 hours |

| Cynet | 2 hours |

| Rapid7 | 1 hour |

| Cisco Talos | 2-4 hours |

| Sygnia | 48-72 hours |

12 Best Incident Response Companies

1. TaskCall | Top Incident Response Solution

Speed wins here.

TaskCall’s main advantage is its structured speed guarantee for critical issues. SEV-1 incidents trigger responses within 5 minutes, whereas SEV-2 issues get attention in 15 minutes.

This speed is built into their process. The platform automates the initial alerting and coordination. It ensures the right people are pulled into a call instantly. This eliminates the chaos that usually wastes precious time at the start of a crisis.

Moreover, the platform focuses on other activities, too. Smart routing sends alerts only to the right people. AI filters false alarms before phones start buzzing. On-call schedules stay clean. Built-in incident timelines help teams track what happened, when, and why. Post-incident reviews take minutes.

That cuts Mean Time to Acknowledge by over 60%, based on internal customer data.

Highlights

- Guaranteed 5-minute response for critical incidents.

- Automated escalation and team coordination.

- Real-time status dashboard for all stakeholders.

- Integrated post-incident reporting.

| Pros | Cons |

| Very fast alerts | Focused on response |

| Easy to use | |

| Strong mobile support |

2. Mandiant (Google Cloud)

Experience shows under pressure.

Mandiant promises a 2-hour response time. It comes from teams across 30+ countries. Their specialty is that they dive deep into containment and threat tracking. With that, they handle nation-state attacks and APTs smoothly. And Google Cloud backing adds scale and data access.

Responders focus on breach scope, attacker movement, and cleanup. Their threat intel database tracks thousands of attack patterns. That helps stop repeat damage. Large enterprises lean on Mandiant during high-risk incidents.

Costs run high. Speed stays solid. Depth goes deep.

Highlights

- 2-hour initial response for retainer clients.

- Unmatched expertise in handling Advanced Persistent Threats (APTs).

- Global 24/7 team with experts in over 30 countries.

- Integrates Google Cloud’s intelligence and scale.

| Pros | Cons |

| Deep forensics | Expensive |

| Global reach | Heavy process |

| Strong reports |

3. CrowdStrike

Pretty fast among the crowd.

CrowdStrike’s Falcon Complete shows results fast. Average containment takes 36 minutes. This speed comes from their cloud-native platform. It combines monitoring, detection, and response into one system.

Their experts can see an alert and take remote action instantly across all your devices. They offer proactive threat hunting. It means they look for hidden threats before an alarm even sounds.

AI flags abnormal behavior early. Automated containment blocks lateral movement before data leaks. The platform handles endpoints at bigger scale.

Highlights

- Documented 36-minute average threat containment time.

- Single, cloud-native platform for seamless response.

- Proactive 24/7 threat hunting.

- Remote remediation actions across endpoints.

| Pros | Cons |

| Fast containment | Costly tiers |

| Strong EDR | Complex console |

| Low endpoint load |

4. Palo Alto Networks Unit 42

Intel meets action.

Palo Alto Networks Unit 42 mixes threat research with hands-on response. Engagement starts within 2 to 24 hours, based on retainer level. When they respond, they tend to check it against global attack patterns.

The team tracks malware families, ransomware groups, and attack chains in detail. They work well with Palo Alto firewalls and Cortex XDR. This helps reveal if an attacker is using a known tool or has targeted other industries. That tight link speeds containment. Investigations focus on the root cause.

Highlights

- Response within 2 hours for top-tier retainers.

- Deep threat intelligence from Palo Alto’s global network.

- Expert-led digital forensics and incident analysis.

- Strong focus on post-incident guidance and hardening.

| Pros | Cons |

| Strong intel | Slower entry tiers |

| Skilled team | Involve complex integrations |

| Solid tooling |

5. IBM Security X-Force

Scale helps during storms.

IBM X-Force comes with 24/7 efficient support with a huge team of specialists worldwide. Their top-tier service promises incident triage within 1 hour.

They use AI-driven tools to sort through massive amounts of data quickly during an investigation. This helps find the root cause faster. They’re a good fit for large, complex organizations that need help across different systems.

The service also includes help with communication and regulatory requirements after a breach. AI-driven forensics is a big plus as they speed log analysis and timeline building. Their reports are detailed and structured.

Highlights

- 1-hour triage for urgent cases.

- AI-enhanced forensics to speed up investigations.

- Truly global 24/7 support network.

- Covers crisis communications and compliance reporting.

| Pros | Cons |

| Enterprise scale | Slower onboarding |

| Detailed reports | Process-heavy |

| Legal support |

6. Kroll

Structure that works to calm panic.

Kroll blends rapid digital response with real-world investigative skills. Customers love it for its speed and holistic approach.

They respond within 2 hours for Premier clients and under 6 hours for others. The teams often partner with tools like CrowdStrike or SentinelOne to deploy 24/7 monitoring quickly.

Through such quick deployment, they scale a big investigation team within 48 hours.

They also bring skills from outside pure IT. For instance, fraud investigation and physical security. They can be relevant for cases involving insider threats or complex fraud.

Highlights

- 2-hour contact guarantee for Premier clients.

- Rapid team scaling to handle large incidents.

- Integrates digital forensics with broader investigative expertise.

- Established 24/7 managed detection partnerships.

| Pros | Cons |

| Quick contact | Cost jumps |

| Legal support | Tool dependent |

| Scalable teams |

7. Deloitte

The one who guides your whole business through the storm.

As a “Big 4” firm, Deloitte’s IR service is part of a bigger package. They focus on the legal, financial, and operational fallout of a cyber attack. Not just the technical fix.

The company can deploy technical specialists quickly, often within 1 hour. Remote triage starts in 2 hours. On-site support reaches the UK in 24 hours, globally in 48.

But their real value is managing the bigger picture. That means talking to regulators, managing public relations, and helping with business continuity.

They’re just right for large firms that face regulatory heat. Their response typically blends tech, legal, and business views.

Highlights

- Rapid specialist deployment within 1-48 hours.

- Holistic recovery covers legal, PR, and operational needs.

- Deep experience with regulatory landscapes.

- Strong pre-incident planning and testing services.

| Pros | Cons |

| Strategic view | Less focus on pure technical threat hunting |

| Large teams | High cost |

| Regulatory help |

8. Secureworks Sophos

Ransomware specialists who move fast.

Sophos Rapid Response is built to stop active threats in their tracks. Take ransomware, for instance. They typically start working on a case within 2 hours. Plus, they focus on finishing the initial assessment within 48 hours.

Their team is expert at neutralizing ransomware and kicking attackers out of networks. Because they also make security products, their responders know the tools deeply. That way, they use those tools effectively so they can contain damage fast.

Highlights

- 2 hour onboarding for emergency cases.

- Specialization in ransomware containment.

- 48-hour triage goal for most customers.

- Tight integration with Sophos’s own security products.

| Pros | Cons |

| Fast containment | Limited forensics |

| MDR depth | Platform focus |

| Clear guidance |

9. Cynet

AI does the heavy lifting.

Cynet’s CyOps MDR team uses a high level of automation to act fast. They respond to threats, contain, and fix them in minutes. One good thing is that the platform deploys across thousands of endpoints in under 2 hours.

Their SOAR automation helps reduce manual work by 90%. This lets their human experts focus on the tricky problems whereas automated rules handle common attacks.

A great pick for companies with lean teams that need fast, efficient protection.

Highlights

- Minute-level response via automated playbooks.

- 90% reduction in manual response effort through SOAR.

- Fast, simple deployment across endpoints.

- 24/7 MDR with a single platform for all tools.

| Pros | Cons |

| Very fast | Less depth |

| Low overhead | Smaller brand |

| Simple setup |

10. Rapid7

Smart tools with smart people.

Rapid7 bears a strong security analytics platform, InsightIDR. It feeds alerts fast. For customers with a retainer, they ensure a 1-hour response with active retainers.

Automation handles early containment. And their experts use this platform to quickly detect odd behavior and contain breaches.

They also offer services like penetration testing to find holes before attackers do. This makes them a good partner for improving overall security.

Highlights

- 1-hour response for retainer customers.

- Powered by the integrated InsightIDR (SIEM+EDR) platform.

- Also provides proactive testing and threat modeling.

- Focus on rapid containment using automation and analysis.

| Pros | Cons |

| Fast actions | Retainer needed |

| Effective tooling | UI learning curve |

| Testing depth |

11. Cisco Talos

Almost all countries covered.

Cisco Talos Incident Response (CTIR) brings immediate global support. The company guarantees a 4-hour Service Level Objective to engage remotely.

They frequently beat this target and often start work within just 2 hours of an alert. This speed comes from their deep integration with Cisco’s global threat intelligence team, Talos.

This team sees threats in real-time across networks worldwide. It lets the CTIR recognize attack patterns instantly and contain ransomware or breaches faster.

Highlights

- 4-hour SLO for initial remote engagement.

- Often initiates action within 2 hours, especially for ransomware.

- The largest commercial threat intelligence teams.

- 24/7/365 global coverage with remote and on-site options.

| Pros | Cons |

| Fast ransomware response | Best with Cisco stack |

| Actionable intelligence | Occasional delayed response |

| Global coverage |

12. Sygnia

Experts under fire.

Sygnia is popular for one simple reason. High-intensity, short-term interventions. They operate like a digital SWAT team for the most severe incidents.

The team focuses on the first 48-72 hours of a major breach to contain the threat and remove it aggressively. They’re often called by companies that have already been breached and need an elite team to take charge.

Their approach is tactical and direct, with a focus on immediate action and clear communication to leadership.

Highlights

- Focus on decisive 48-72 hour intervention.

- Tactical, commander-led approach to incident handling.

- High-level expertise for severe and advanced attacks.

- Clear, direct reporting to executive management.

| Pros | Cons |

| Elite skills | Premium pricing |

| Fast action | Limited automation |

| Strong analysis |

How To Choose The Best Incident Response Company? 5 Factors To Consider!

1. Detection-Response Speed

Most companies ensure responses from 30 minutes to 72 hours. It varies based on the type of issue and its intensity.

Focus on the guaranteed response time. Not only general promises. A 5-minute guarantee is very different from a 4-hour one. Ask how they define “response”.

Is it a call back? Or an expert starting work?

Faster response directly lowers data loss and downtime. So, pick a guarantee that matches how fast you need help for your most critical systems. Also, go with one who ensures 24/7/365 availability.

2. Automation

In 2026, AI isn’t only a bonus. It’s how responders keep up.

Automation tools can now sort through logs and alerts much faster than humans alone.

For example, IBM and Vodafone have used AI to slash incident resolution time by 50%. They automated root cause analysis and handled 30,000+ monthly alerts.

This slashes the time to find the root cause.

Also, pick your provider that can handle AI-powered attacks (like deepfakes used for fraud or hyper-fast automated hacking). Your defender needs AI to fight the attacker’s AI.

3. Retainer Flexibility

Consider an IR retainer a fire department subscription.

Without one, you’re only negotiating a contract while your network burns.

A proper retainer pre-negotiates price, scope, and access. The best retainers let unused hours roll over or be used for proactive drills. This guarantees you get the fastest, smoothest help when panic sets in.

4. Outcome Over Activity

Don’t just count hours worked.

Focus on the result. Typically, the best incident response company gives you a clear outcome:

“The active ransomware was contained within 2 hours, and here’s how we’ll prevent it.”

They should give you a detailed, plain-language report explaining everything. What happened, how they fixed it, and precise steps to stop it from happening again.

The reporting has to be clear!

5. Advanced Tools

Ask what tools they use.

- Do they rely on modern Endpoint Detection and Response (EDR) and Security Information and Event Management (SIEM) platforms?

- Do they have AI-assisted hunting tools?

Their toolset shows their capability. A company with outdated technology will struggle to protect your modern systems.

FAQs

What’s the real difference between MDR and an IR Retainer?

MDR is like a 24/7 security guard watching monitors. An IR retainer is a contract with a SWAT team you call only during a major breach. MDR manages daily alerts; the retainer is for full-blown emergencies.

Are these services too expensive for a mid-sized company?

Not always. Different companies, like TaskCall, Secureworks or Cynet, offer scalable plans. The real cost is a major breach without help. Consider it a critical insurance for your digital business.

How do retainers actually start working with you during a panic?

With a retainer, you call a dedicated hotline. The provider immediately activates your pre-agreed plan. Then, they pull in your team on a bridge call and start their investigation.

Will they take over completely, or do we need to be involved?

They lead the technical fight. But you remain in charge. You’ll provide system access and make business decisions (like shutting down servers). They guide you but need your partnership to work effectively.

Online Reselling Is Changing and Crosslisting Is Why

Explore the structural shift forcing resellers beyond one marketplace and why crosslisting is now pivotal for visibility and scalability.

The world of online reselling is no longer the “Wild West” of the early eBay days, nor is it the predictable environment it was just five years ago.

For a long time, online resellers could pick a favorite marketplace, master its algorithm, and get consistent sales. However, things have changed quite a lot now.

Relying on a single marketplace is no longer a viable long-term strategy for resellers. Today’s online buyers are fragmented; they are spread across niche shopping apps, social commerce platforms, and big marketplaces.

For online resellers, sticking to just one marketplace doesn’t just limit growth; it creates a bottleneck that risks total loss of visibility.

That’s why crosslisting has become an absolute necessity for the survival and growth of online resellers.

Limitations of Selling on One Marketplace

- You’re at the Mercy of the Marketplace Algorithm

When you sell exclusively on one marketplace, you are at the mercy of that marketplace’s algorithm.

If that marketplace changes its search algorithm, updates its fee structure, or experiences a technical glitch, your reselling business grinds to a halt.

We see this frustration boiling over in reseller communities daily, where even experienced resellers note significant shifts in buyer behavior and marketplace sales.

Relying on one marketplace means surrendering control to forces you can’t predict or influence.

- Your Buyer Reach is Limited

Each marketplace attracts a specific type of shoppers, like Poshmark, which primarily attracts millennials and Gen Z women who are also brand-conscious and socially active.

By selling only on one marketplace, you hide your items from millions of buyers who shop on other marketplaces.

So, you are basically waiting for the right buyers to find you instead of going to where they already shop.

Missing out on these buyers doesn’t just lower your views; it also makes your inventory move more slowly.

- Marketplace Risk Becomes Business Risk

Marketplaces operate under strict policies, and enforcement isn’t always consistent. Account suspensions, listing takedowns, or payment holds can happen suddenly, even to compliant sellers.

When your entire sales depend on one marketplace, these events don’t just slow sales; they halt them completely.

What should be a marketplace issue instantly becomes a business emergency. Diversifying where you sell spreads that risk.

If one marketplace experiences technical issues, policy changes, or account limitations, your reselling business can continue operating instead of coming to a full stop.

- Inconsistent Demand Across Marketplaces

Not all items perform equally across marketplaces. Buyer demographics, pricing tolerance, and search intent vary widely from marketplace to marketplace.

An item that sits unsold for weeks on one marketplace might sell quickly elsewhere simply because the audience is different.

When you rely on only one marketplace, you’re judging demand through a narrow lens. This can lead to incorrect assumptions about pricing, seasonality, or product viability.

Expanding across marketplaces provides a clearer picture of where true demand exists and how buyers respond to different listings.

- Growth Eventually Hits a Ceiling

Every marketplace has a finite shopping audience. Once you’ve optimized your listings and reached most of the active buyers on that marketplace, growth naturally slows.

At that point, increasing revenue often requires more paid promotions, deeper discounts, or additional time investment.

Selling on multiple marketplaces opens access to entirely new audiences without changing your inventory.

Instead of pushing harder within one marketplace, you expand horizontally. This approach supports scalable growth by increasing exposure rather than forcing more performance from a limited buyer base.

What Does Crosslisting Mean?

Crosslisting is the practice of listing the same items on multiple online marketplaces at the same time. Instead of listing an item only on eBay or Poshmark or Mercari, a reseller lists that item across multiple marketplaces so it can be discovered by different buyer audiences.

At its core, crosslisting isn’t about duplicating listings; it’s about multiplying visibility. Each marketplace has its own search algorithm, buyer behavior, and peak shopping times. By crosslisting, resellers stop relying on a single marketplace and instead meet buyers wherever they already shop.

In recent times, crosslisting has evolved from a manual copy-paste process into a strategic growth practice, often supported by automation tools that keep listings consistent, up to date, and in sync across marketplaces.

Why Crosslisting Matters?

- Buyers Are No Longer on One Marketplace

Buyers no longer shop on just one marketplace. Today’s online shoppers move between shopping apps based on intent, like searching eBay for deals, browsing Poshmark for fashion, or checking Mercari and Etsy for specific or niche items.

This behavior means demand is spread across multiple marketplaces, not concentrated in just one. When a reseller lists on only a single marketplace, a large number of buyers never see the product.

Crosslisting addresses this shift by placing the same items across multiple marketplaces at once. As a result, items gain broader visibility, reach different buyer segments, and have a higher chance of being discovered by the right buyer at the right time.

- It Reduces Platform Dependency Risk

Marketplaces are not static. Algorithms change, fees increase, policies tighten, and accounts can be restricted with little warning.

When a reseller depends entirely on one marketplace, those changes directly threaten revenue and business continuity.

Crosslisting reduces this exposure by spreading listings across multiple marketplaces. If sales drop on one marketplace, others can continue driving sales.

This diversification creates stability, protects cash flow, and lowers the risk of sudden disruptions.

- It Increases Sell-Through Rate Without More Inventory

Inventory is one of the biggest constraints for resellers. Sourcing more items takes time, capital, and effort.

Crosslisting maximizes the value of existing inventory by exposing each item to buyers across multiple marketplaces simultaneously.

The same item receives more visibility, more search impressions, and more chances to convert—often resulting in faster sales.

Instead of sitting unsold on one marketplace, items can move quickly where demand is strongest. This leads to higher sell-through rates, fewer stale listings, and improved cash flow, all without increasing inventory volume.

- It Aligns with How Marketplace Algorithms Work

Marketplace algorithms prioritize visibility, engagement, and active listings. Crosslisting naturally increases impressions, clicks, and buyer interactions across different marketplaces.

Each marketplace operates its own ranking system, meaning a listing that underperforms on one marketplace may perform well on another.

By listing across multiple marketplaces, resellers benefit from several marketplace algorithms working in parallel rather than relying on a single one.

This multi-marketplace exposure improves discovery and search positioning without gaming the system.

Instead of fighting algorithm changes, crosslisting allows resellers to adapt organically and maintain consistent visibility across marketplaces.

Why a Crosslisting Tool is Better than Manual Crosslisting?

Save Massive Time

Creating multiple listings manually on different marketplaces is time-consuming and drains energy that could be spent sourcing new items.

Uploading photos, titles, and descriptions to several marketplaces takes hours and slows the reselling business growth.

A crosslisting app makes this process much easier by copying a listing from one marketplace to others in seconds, eliminating repetitive data entry.

This also allows resellers to manage multiple marketplaces efficiently, save valuable time, and focus on activities that drive growth, rather than getting stuck in tedious, manual listing tasks.

Reduced Listing Duplication and Errors

Managing listings on multiple marketplaces manually makes mistakes almost inevitable.

Sellers can forget measurements, upload outdated photos, or use inconsistent descriptions across different marketplaces, which confuses buyers and can hurt sales.

A crosslisting tool helps maintain accuracy and consistency, ensuring product information, images, and branding are uniform across all marketplaces.

By reducing duplication mistakes and keeping details consistent, a reselling app saves time, builds trust with buyers, and maintains a presence across multiple marketplaces without the stress of constant manual oversight.

Syncs Inventory Across Marketplaces

One of the biggest challenges of manual crosslisting is keeping track of inventory across multiple marketplaces.

When an item sells on one marketplace, it’s easy to forget to remove or update the listing on others, which leads to overselling, canceled orders, and unhappy buyers.

This not only wastes time but also affects your seller reputation. A crosslisting app like Sidekick Tools solves this problem by automatically syncing inventory in real-time across all marketplaces.

As soon as an item sells on one marketplace, Sidekick Tools automatically gets delisted from all other marketplaces. This ensures accurate stock levels and reduces errors, without constant manual monitoring.

Scales Your Business

Manual crosslisting works only when your inventory is small, but as your reselling business grows, managing listings across multiple marketplaces becomes overwhelming and prone to errors.

Each new item adds hours of work, and keeping track of sales, stock levels, and updates manually can quickly become unmanageable.

A crosslisting tool eliminates this bottleneck by automating the process, allowing resellers to upload, edit, and manage hundreds or even thousands of listings from a single dashboard.

This automation not only saves time but also ensures consistency, accuracy, and faster sell-through, making it possible to scale your reselling business efficiently without additional stress or staff.

Tracks Sales Performance and Analytics

When you manually crosslist items, it’s difficult to track which marketplaces are generating the most sales or which listings are performing best.

Without proper insights, you may waste time optimizing the wrong marketplaces or pricing strategies.

Crosslisting tools solve this problem by providing centralized dashboards and detailed analytics. They show you sales trends, item performance, and marketplace-specific data, helping you understand where your products sell fastest and at what price points.

With this information, you can make better decisions, optimize listings, and focus your efforts on better-performing marketplaces, ultimately increasing revenue and efficiency across your business.

Final Words:

Online reselling is changing, but change brings opportunity. Crosslisting is no longer just an optional tactic for resellers; it has become a strategic necessity for anyone serious about growing a sustainable reselling business.

By crossposting items across multiple marketplaces, you reduce dependency on a single marketplace and protect your revenue from algorithm shifts, fee changes, or account restrictions.

You just need to use the right crosslisting tool, which allows you to sync inventory and track sales seamlessly, freeing up your time for sourcing items and scaling your business.

Turkey’s Benchmark in Hair Transplantation: Dr. Koray Erdogan

Turkey has experienced a rapid rise in health tourism in recent years, and one of the fields that most clearly reflects this growth is hair transplantation. No longer merely an aesthetic preference, hair restoration has become a life-changing medical procedure that directly impacts self-confidence, social life, and personal image. Worldwide, millions of people now seek hair restoration solutions, and Turkey stands out as a global hub thanks to its experienced physicians, advanced clinical infrastructure, and scientific approach.

One of the most prominent pioneers behind this success is Dr. Koray Erdogan. Through ASMED Clinic, which he founded, Dr. Erdogan has established a standard that goes beyond operational success, placing natural results, patient safety, and long-term satisfaction at the center of every procedure. Today, patients from all over the world travel to Istanbul not only for Turkey’s high-quality medical services, but specifically for the personalized and scientifically planned hair transplantation experience offered under Dr. Erdogan’s leadership.

Under Dr. Erdogan’s guidance, ASMED Clinic delivers services in line with international standards. Patients receive comprehensive care, including detailed pre-operative consultations, accommodation support, and structured post-operative follow-up. This holistic approach ensures that success in hair transplantation is measured not only by technical outcomes, but also by trust, comfort, and patient satisfaction.

Turkey’s Leadership in Health Tourism

The hair transplant sector represents a significant share of Turkey’s health tourism industry. While strengthening Turkey’s global reputation in this field, Dr. Erdogan positions the country not merely as a cost-effective destination, but as a center associated with quality, reliability, and medical excellence. With leaders like Dr. Erdogan, Turkey continues to serve as a reference point for hair transplantation across both European and Asian markets.

Dr. Koray Erdogan places equal importance on aesthetic design and natural-looking results in every procedure. This philosophy is one of the main reasons why international patients consistently choose Turkey for hair restoration. His vision goes beyond performing successful surgeries; it is about aligning Turkey’s hair transplant industry with the highest international standards of medical practice.

Under Dr. Koray Erdogan’s leadership, Turkey is no longer just a destination for hair transplantation, but a global leader in health tourism. Dr. Erdogan plays a key role not only in advancing surgical techniques, but also in establishing Turkey as a reference country for patient experience, trust, and quality standards.

Turkey’s International Reference in Hair Transplantation

As Turkey continues its rapid growth in health tourism, hair transplantation remains one of the clearest indicators of this success. No longer viewed simply as a cosmetic procedure, hair transplantation is now recognized as a medical service that has a direct impact on self-confidence and quality of life. With its experienced doctors, advanced clinical facilities, and evidence-based medical practices, Turkey has become an increasingly attractive destination for international patients.

At the heart of this success stands Dr. Koray Erdogan, widely recognized as one of Turkey’s leading hair transplant specialists. Through ASMED Clinic, he has created a benchmark focused not only on surgical success, but also on natural results, patient trust, and long-term satisfaction. Today, patients from around the world choose Istanbul not just for Turkey’s medical capabilities, but specifically for the scientific, carefully planned, and personalized hair transplantation experience offered by Dr. Koray Erdogan.

Turkey’s International Reference in Hair Transplantation

As Turkey continues its rapid growth in health tourism, hair transplantation remains one of the clearest indicators of this success. No longer viewed simply as a cosmetic procedure, hair transplantation is now recognized as a medical service that has a direct impact on self-confidence and quality of life. With its experienced doctors, advanced clinical facilities, and evidence-based medical practices, Turkey has become an increasingly attractive destination for international patients.

At the heart of this success stands Dr. Koray Erdogan, widely recognized as one of Turkey’s leading hair transplant specialists. Through ASMED Clinic, he has created a benchmark focused not only on surgical success, but also on natural results, patient trust, and long-term satisfaction. Today, patients from around the world choose Istanbul not just for Turkey’s medical capabilities, but specifically for the scientific, carefully planned, and personalized hair transplantation experience offered by Dr. Koray Erdogan.

BLC Remodeling Strengthens Its Position as a Leading Custom Home Remodeler in Bellevue

BLC Remodeling continues its growth as a trusted custom home remodeling contractor in Bellevue, serving homeowners who value thoughtful planning, refined construction, and consistent execution. The company marks this stage of growth alongside the launch of an updated website, which reflects its current scope of work and long-term direction.

Founded in Bellevue, BLC Remodeling has built a strong reputation for custom kitchen remodeling, bathroom remodeling, and full home remodeling projects. The firm brings hands-on experience, a highly qualified construction team, and a disciplined project approach to every build. This foundation allows BLC Remodeling to take on larger, detail-driven residential projects while maintaining control over quality and schedule.

BLC Remodeling now collaborates more closely with architects and interior designers on custom homes and high-end remodels. The company supports design intent through careful coordination, technical accuracy, and clear communication from pre-construction through completion. Each project reflects site conditions, client priorities, and material selections specific to the home.

“Our work has matured alongside our team,” said Bogdan Bilc, Founder and Owner of BLC Remodeling. “We are prepared for complex remodels that require coordination, experience, and accountability. Bellevue homeowners and design professionals expect that level of execution.”

The newly launched website serves as a reference point for homeowners and industry partners. It outlines services, highlights completed projects, and clarifies the company’s remodeling process. While the website has been updated, BLC Remodeling’s focus remains on construction quality and long-term client relationships.

BLC Remodeling serves Bellevue and the surrounding Eastside communities with custom kitchen remodeling, bathroom remodeling, and comprehensive home remodeling services. The company continues to expand its portfolio while staying grounded in disciplined construction practices and local expertise.

About BLC Remodeling

BLC Remodeling is a Bellevue-based custom home remodeling contractor specializing in kitchens, bathrooms, and whole-home renovations. The company partners with homeowners and design professionals to deliver tailored residential projects through structured planning and skilled execution.