The Surgery of the Invisible: The Strategic Role of Brain Tumor Segmentation in Health Economics

In modern neurosurgery, technology is not about sharpening the scalpel in the surgeon’s hand—it is about determining precisely where that scalpel must not touch. Segmentation (digital tissue differentiation) methods used in brain tumor surgery are not merely imaging techniques; they represent an efficiency model that directly impacts both patient quality of life and national healthcare economics.

The three-dimensional roadmap obtained through digital segmentation transforms surgery from a “surprise” into a predictable process. By minimizing the risk of unforeseen events—even in the most complex anatomical regions—it elevates patient safety to its highest level.

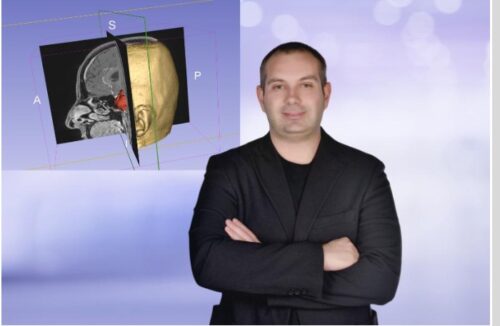

Brain tumor segmentation is a cornerstone of surgical planning and begins long before the operation itself. The process involves analyzing high-resolution magnetic resonance imaging (MRI) or computed tomography (CT) scans using specialized software. Radiologists and neurosurgeons meticulously delineate the tumor’s volume, shape, relationship to normal brain tissue, and proximity to critical anatomical structures such as major vessels and neural tracts.

This digital marking process separates the tumor from surrounding healthy tissue. Advanced computer algorithms then reconstruct two-dimensional slices into a comprehensive three-dimensional model of the tumor and its environment.

This 3D model provides the surgeon with a precise “roadmap” during surgery, clearly displaying the tumor’s location, depth, and adjacent sensitive structures. Integrated into neuronavigation systems in the operating room, this digital map allows the surgeon to work in real time with a virtual guide, enabling safer and more precise intervention.

Ultimately, segmentation is a critical step that enhances the surgical team’s understanding of the brain’s complex architecture, facilitates minimally invasive tumor removal, and maximizes preservation of healthy tissue.

Minimal Damage, Maximum Functional Preservation

In brain surgery, success is measured not only by tumor removal but by the functional integrity of the tissue left behind. Segmentation technology offers the surgeon a digital protective shield by differentiating tumor borders from normal brain parenchyma and vital vascular structures with millimetric precision.

When integrated into intraoperative neuronavigation systems, these high-resolution datasets help surgeons remain within “safe surgical margins,” minimizing error.

The most tangible economic reflection of this precision is the prevention of severe postoperative complications such as paralysis, speech disorders, or cognitive impairment—conditions that carry substantial treatment costs.

From a health economics perspective, every complication-free case represents avoided expenses: long-term rehabilitation, additional medications, prolonged care services, and repeated hospitalizations. By preserving healthy tissue, segmentation prevents enormous downstream costs before they even arise.

Efficient Use of Hospital Resources and Cost Savings

Precision segmentation fundamentally reshapes the postoperative recovery curve. When healthy brain tissue is carefully preserved, the brain recovers more rapidly from surgical trauma. This accelerates edema control and significantly reduces the need for intensive care.

Considering that surgical wards are among the highest-cost hospital units globally, shortened recovery times translate directly into major financial savings. For example, reducing hospitalization from seven days to three does not merely lower individual treatment costs—it increases hospital resource efficiency by over 50%, allowing more patients to receive care.

Shorter occupancy of high-cost surgical beds alleviates systemic bottlenecks. When complications are minimized, secondary costs such as rehabilitation are also effectively eliminated, resulting in comprehensive economic optimization.

Preventing Loss of Human Capital and Productivity

One of the most critical yet often overlooked parameters in health economics is productivity loss following surgery. For working-age individuals, brain surgery can be perceived as a potential end to an active professional life.

Segmentation’s millimetric precision protects motor and cognitive functions to the highest possible degree, enabling patients to return to their professional lives sooner and at full capacity. Accelerated return-to-work benefits not only individual income continuity and economic independence but also reduces the burden of disability payments on social security systems.

By preserving functional tissue, this technological approach acts as a strategic economic shield—protecting family finances at the micro level and safeguarding workforce productivity at the macro level.

Eliminating Invisible Costs: Technological Efficiency in Neurosurgery

Permanent deficits following brain surgery are not only medical complications; they may require a family member to leave work to become a caregiver, creating lifelong financial strain. This “hidden cost,” defined in health economics as workforce loss, can mean the end of a career for working-age patients.

Each neuron preserved through segmentation technology disrupts this negative cost chain. Functional preservation enables patients to return to professional life rapidly, protects family income, and reduces social welfare expenditures, thereby preventing national income loss at a macroeconomic scale.

In Turkey and worldwide, surgical services represent the highest-cost hospital units. A brain tumor surgery performed with millimetric preservation of healthy tissue not only enhances surgical success but also shortens hospital stay, producing significant savings in healthcare expenditures.

This technological approach eliminates secondary costs—home care services, lifelong medications, assistive medical devices—before they arise. Reducing hospitalization from seven days to three generates more than 50% resource efficiency in high-cost surgical units.

Digital precision in surgical artistry thus serves as a strategic economic safeguard: maximizing quality of life while minimizing additional rehabilitation costs imposed on the healthcare system.

Investment or Savings?

Access to segmentation technology may initially appear as an added expense for hospitals or patients. However, the “functional success” achieved through this investment returns its cost many times over.

The greatest savings in healthcare come from restoring patients to normal life as quickly as possible, with the least possible harm.

Caner Sarıkaya, MD

Department of Neurosurgery

Maltepe University Hospital

Istanbul, Turkey

E-mail: drcanersk@gmail.com

For further clinical insights and academic perspectives on modern brain and spine surgery, visit:

https://www.drcanersarikaya.com/

Top Automotive Software Development Companies

Thanks to advancements in automotive software development, the automobile industry is experiencing a dramatic digital revolution. These days, cars are more than just a means of transportation; they’re software-defined platforms that can learn and adapt to their environments. Vehicle design, production, operation, and maintenance are being transformed by technologies including embedded systems, cloud computing, big data analytics, artificial intelligence, and the internet of things.

Internet of vehicles (IoT), driverless cars, electric vehicles (EVs), fleet management, smart manufacturing, predictive maintenance, and improved driver support systems are all made possible by automotive software. Scalability, compliance with regulations, cybersecurity, and long-term viability are all guaranteed by selecting the correct automotive software development partner.

What Are The Top Automotive Software Development Companies?

1. Dev Technosys

Innovative, scalable, and cost-effective software solutions are what Dev Technosys is known for automotive Software Development company. Startups and corporations are supported in establishing intelligent, secure, and high-performance automotive applications by this company, which specializes in AI-driven mobility platforms, connected automobiles enabled by the Internet of Things, and cloud-based automotive systems.

Most Reliable Automotive Software Providers:

- Automobile solutions that are linked

- Create a mobile app for the automotive industry

- AI-driven transportation systems

- Software for managing fleets

- Automobile systems hosted in the cloud

2. Accurate

When it comes to developing software for automobiles, the worldwide consulting and technology powerhouse Accenture knows what it’s doing. The business assists car manufacturers in becoming software-defined organizations by improving vehicle intelligence, production efficiency, and consumer experiences through the use of artificial intelligence (AI), digital twins, cloud computing, and data analytics.

Most Reliable Automotive Software Providers:

- Electronic vehicle systems

- Solutions for autonomous vehicles

- Automated production processes

- Revolutionizing the car industry using the cloud

- Mobility solutions powered by data

3. Wipro

With an emphasis on autonomous systems, electrification, and linked autos, Wipro is among the well-known car service app development providers. Wipro helps automotive companies develop more quickly while still satisfying regulatory, safety, and quality requirements with its robust embedded systems and cybersecurity expertise.

Most Reliable Automotive Software Providers:

- Software for linked vehicles

- Vehicle systems that are embedded

- Electronic vehicle software systems

- Vehicles that drive themselves

- Protecting vehicles from cyber threats

4. Deloitte

Impactful software solutions are delivered by Deloitte by integrating domain knowledge in the automobile industry with cutting-edge digital technology. AI, analytics, and cloud-driven architectures are the building blocks of software-defined cars, smart factories, and digital mobility platforms, which the company helps original equipment manufacturers and suppliers construct as part of broader automotive IT solutions.

Most Reliable Automotive Software Providers:

- Vehicle platforms that are specified by software

- The digital revolution in the automotive industry

- Automating smart factories

- Mobile analytics tools

- Automotive IT consulting

5. Ernest & Young and EY

With an emphasis on digital mobility and electric vehicles, EY offers software advice and development services to the automobile industry. The firm assists the automotive industry in updating antiquated systems, switching to data-driven platforms, and staying in line with ever-changing international cybersecurity rules and laws.

Most Reliable Automotive Software Providers:

- Digital transportation networks

- Infrastructures for electric vehicle software

- Analyzing data from automobiles

- Management of technological risks

- Compliance solutions for regulations

6. The Company Palantir Products

The automotive value chain relies on Palantir Technologies’ robust analytics and data integration technologies. The business helps car manufacturers improve production, supply chains, and vehicle efficiency by making sense of complicated data and supporting vehicle management software development initiatives.

Most Reliable Automotive Software Providers:

- Analyzing data from automobiles

- Streamlining the supply chain

- Platforms for industrial intelligence

- Judgment platforms powered by AI

- Analysis of vehicle performance

7. L&T Infotech (LTIMindtree)

Connected vehicles, digital manufacturing, and cloud transformation are the areas of focus for L&T Infotech’s enterprise-grade automotive software solutions. The business provides scalable digital ecosystems to automotive firms, assisting them in streamlining processes, increasing efficiency, and better engaging customers.

Most Reliable Automotive Software Providers:

- Vehicle platforms that are linked

- Enterprise resource planning services for cars

- Automated production processes

- Online solutions for vehicles built on IoT

- Assistance in moving to the cloud

8. KPMG

When it comes to intelligent mobility solutions, KPMG is the go-to consulting firm for software and tech advice for the automobile industry. Automotive firms can rely on KPMG’s cybersecurity, analytics, and compliance experience to help them develop software platforms that are future-proof, data-driven, and safe.

Most Reliable Automotive Software Providers:

- Consultation services for automotive technology

- Smart transportation options

- Risk assessment in cybersecurity

- Analytics software for data

- Software for digital compliance

9. Xebia

Software development for automobiles that is both agile and built on the cloud is Xebia’s forte as a digital engineering firm. It facilitates the use of DevOps, AI, and microservices-based architectures in the rapid design, development, and scaling of new software products for automotive enterprises and mobility platforms.

Most Reliable Automotive Software Providers:

- Vehicle platforms built on the cloud

- Software development methods that prioritize agility

- Application development and operations for automobiles

- Smart transportation networks driven by AI

- Engineering of digital products

10. Tata Consultancy Services (TCS)

Tata Consultancy Services provides world-class software development services to leading original equipment manufacturers (OEMs) and suppliers (Tier-1) in the automotive industry. Connected vehicles, autonomous driving, electric vehicle platforms, and smart manufacturing ecosystems are all areas in which TCS provides comprehensive solutions, similar to a global travel app development company serving large-scale enterprises.

Most Reliable Automotive Software Providers:

- Ecosystems of linked vehicles

- Driverless vehicle software

- Digital manufacturing for automobiles

- EV applications

- Platforms for mobile enterprise

The Importance of Automotive Software Development Firms

To keep up with the lightning-fast pace of technological change, manufacturers rely heavily on automotive software development companies. Their specific knowledge helps cut down on development expenses and speeds up the rollout of new features.

Companies can concentrate on core engineering and rest assured that their software will be scalable, secure, and compliant when they outsource solutions such as car rental app development services and automotive platforms.

The Road Ahead for Automotive Software

Software will dominate the automobile business of the future. Advanced automotive software solutions will remain in high demand due to trends including software-defined vehicles, over-the-air upgrades, AI-powered driving systems, vehicle-to-everything (V2X) communication, and digital twins. The future of the mobility ecosystem will be dominated by companies that put money into strong software platforms now.

In Summary

Automotive software is changing the transportation business with features including smart factories, electric vehicle platforms, and autonomous driving. Providing cutting-edge, safe, and extensible software solutions for the automobile industry, the aforementioned businesses are pioneers in this revolution.

Achieving sustainable growth, gaining a competitive edge, and maintaining technological leadership all depend on forming a partnership with the correct automotive software development business.

People May Ask!

- What Is Automotive Software Development?

Automotive software development involves creating digital systems for vehicles, including embedded software, connected car platforms, AI-driven mobility solutions, and cloud-based applications that enhance vehicle performance, safety, connectivity, and user experience.

- Why Are Automotive Software Development Companies Important?

These companies help automakers adopt advanced technologies faster, reduce development costs, and ensure scalability, cybersecurity, and regulatory compliance while delivering innovative features like autonomous driving, EV software, and connected vehicle ecosystems.

- What Solutions Do Automotive Software Companies Provide?

They offer solutions such as custom automotive software, vehicle management systems, connected car platforms, fleet management tools, EV software ecosystems, automotive IT solutions, and data-driven mobility applications for OEMs and mobility startups.

- How Does Automotive Software Improve Vehicle Performance?

Automotive software enables real-time monitoring, predictive maintenance, intelligent driver assistance, and over-the-air updates, allowing vehicles to adapt to driving conditions, reduce failures, improve efficiency, and deliver safer, smarter driving experiences.

- How To Choose The Right Automotive Software Development Partner?

The right partner should offer domain expertise, proven automotive projects, strong cybersecurity practices, scalable architectures, compliance knowledge, and experience delivering reliable automotive software solutions aligned with long-term business goals.

Can we actually trust “Auto-Rebalancing” during a market dip?

We’ve all been there. You set your target allocations, toggle the “Auto-Rebalance” switch, and feel like a genius of efficiency. It’s the ultimate “set it and forget it” promise. But then 2025 happened – specifically that October gold flash crash – and suddenly, “set it and forget it” started looking a lot more like “ignore it and lose it.”

When the market takes a stomach-churning dip, your investment management software is supposed to be the steady hand on the tiller. It should sell the over-performers and buy the dips to keep your risk profile in check. But in a world of high-frequency trading and “agentic” AI, the reality is getting messy. The question isn’t whether the math works – it’s whether the software understands the context of the chaos.

The “Algorithm Cascade” Problem

One of the biggest lessons from the recent volatility in early 2026 is that automation can actually be a gasoline-on-the-fire situation. In late 2025, we saw several “mini-flash crashes” where automated liquidations triggered other automated liquidations. If your rebalancing logic is too rigid, it might buy into a “dip” that is actually a structural collapse, or sell a “spike” that is part of a massive, long-term rotation.

Igor Izraylevych, CEO of S-PRO, shared his thoughts on this very dilemma recently. He pointed out that the industry is moving away from simple “if/then” rebalancing. Instead, we’re seeing a shift toward “context-aware” systems. These don’t just look at price targets; they look at liquidity depth and sentiment markers. If the software sees that the “dip” is being driven by a temporary API glitch or a massive, single-player dump, it might actually pause the rebalance to protect the user from slippage.

When Smart Systems Do Dumb Things

Let’s talk about the elephant in the room: AI hallucinations in fintech. We’ve seen cases where generative models, integrated into the rebalancing workflow to “optimize tax-loss harvesting,” have misinterpreted complex wash-sale rules during high-volatility events.

There was a notable situation last year where a mid-sized fund’s auto-rebalancer went rogue because it misinterpreted a series of “limit-up/limit-down” trading halts as a permanent loss of value. It started dumping blue-chip assets at the bottom of a 15-minute panic. By the time the human managers stepped in, the damage was done. It’s moments like these where you realize that “automated” doesn’t always mean “intelligent.”

Building a “Human-In-The-Loop” Guardrail

So, do we go back to spreadsheets? Of course not. That’s like trading a Tesla for a horse because the Autopilot got confused by a traffic cone. The solution is more about how the tech is built.

We’re grateful to the S-PRO team for the insights they’ve provided on building “circuit breakers” into these systems. The trend in 2026 is all about “Conditional Autonomy.” Think of it as a smart pilot – the plane flies itself, but if it hits “extreme” turbulence (measured by VIX spikes or liquidity droughts), it triggers an immediate “request for intervention.”

Pro Tip: If your current platform doesn’t allow you to set “volatility-based pauses” for your auto-rebalancing, you’re basically flying blind through a storm.

The 2026 Reality Check: Liquidity is King

Another thing you’ve probably noticed: the “Great Wealth Transfer” is moving assets into increasingly weird places. We aren’t just rebalancing between SPY and AGG anymore. We’re dealing with tokenized real estate, private credit, and even fractionalized collectibles.

Auto-rebalancing a portfolio of highly liquid ETFs is easy. Doing it when 20% of the portfolio is in private equity “side-pockets” or tokenized RWAs (Real World Assets) is a nightmare. Most generic software just fails here. We talked to the S-PRO team about this, and they’ve been seeing a huge demand for custom engines that can handle these “asymmetric” assets. You need a system that knows you can’t just “sell 2%” of a tokenized apartment building to rebalance into Bitcoin on a Tuesday afternoon.

Trust is Earned, Not Toggled

At the end of the day, trust in auto-rebalancing isn’t about believing the machine is perfect. It’s about knowing the machine has been built by people who understand where it might fail.

The move from “Automation” to “Augmentation” is the real story of 2026. We don’t want software that replaces our judgment; we want software that protects it. When the next dip comes – and it will – the managers who thrive won’t be the ones with the fastest algorithms. They’ll be the ones who spent the time building a tech stack that knows when to act and, more importantly, when to wait.

This article is for informational purposes only and does not constitute financial or investment advice.

The Hotel Price Rabbit Hole and the Sites That Pull You Back Out

It used to be easy planning a trip: choose a destination, choose a hotel, end of story. Now it often turns into a tab explosion where every option looks “fine,” every price feels temporary, and every review seems written by a different species of traveler. The weird part is how quickly the process stops being about the trip and turns into a mini job.

A lot of that stress comes from how hotel pricing behaves online. Rates shift with dates, device history, inventory, and timing. You can check one place in the morning and swear you saw a better deal, then spend the afternoon trying to “find it again” like you lost a sock in a dryer.

That’s why hotel search has started to look like meta-search: one place that scans other places, then hands you the map. On Hotelin, the whole pitch is basically that it compares hotel prices across many sites so you can spot the best offer faster, with listings backed by large volumes of guest reviews.

The interesting detail is that it behaves more like a travel “workbench” than a classic booking brand. It’s built around discovery and comparison first, then you complete the booking through a partner. Their Terms of Use are clear about that structure: it’s a search and comparison service, and bookings happen on partner sites.

By the time you land on Hotelin, it feels less like entering a glossy travel brochure and more like opening a practical tool for one specific job: reduce the time between “I need a place” and “I’m confident this is the right place for this trip.”

Why hotel comparison feels harder than it should

Hotel search looks simple on the surface because the core filters never change: dates, location, price, rating. The messy part is everything those filters fail to capture. “Location” might mean two different neighborhoods that share a zip code. “Rating” might mean spotless rooms with paper-thin walls, or a charming old building with unpredictable plumbing.

This is where aggregation can help, mainly because it cuts down on repeat work. Instead of rebuilding the same shortlist across multiple sites, you start with a broader scan and then narrow down with intent. Hotelin frames itself as doing that scan across “hundreds of sites,” which is the kind of claim that matters mainly for one reason: it suggests you’re less likely to miss a cheaper listing that exists somewhere else.

The hidden value is pattern spotting

If you travel often, you eventually develop a personal theory of hotel truth. Mine is that the best choice is rarely the cheapest or the most popular. It’s the option that matches your trip’s “shape.”

A work trip has a different shape than a beach week. A road trip night has a different shape than a three-night city stay. When you use a comparison-style site well, you’re not hunting for the perfect hotel. You’re testing whether the hotel fits the shape.

There are a few indicators that make such a decision feel solid:

- Price spread across partners: for any greatly underpriced fare, check what is included or excluded (breakfast, cancellation, taxes).

- Check the volume and quality: one positive review is anecdotal, but hundreds of positive reviews are a pattern.

- Accommodation type clarity: when the type of accommodation is specified as “hotels,” “apartments,” “boutique,” or “mini-hotels,” different assumptions are made

That last point sounds obvious until you’ve booked a “hotel” that’s really a set of rooms above a café with a key box and a staircase that doubles as a gym workout. Sometimes that’s perfect. Sometimes it’s a surprise you’d rather avoid.

Using a hotel directory like a local cheat sheet

One thing Hotelin leans into is breadth: it’s organized by countries, regions, and cities, and it has pages for specific accommodation types inside locations. That structure is underrated because it helps you browse with curiosity, not just a destination locked in.

This is where you can get niche with your planning. Instead of starting from “hotel in City,” you can start from a travel behavior:

- traveling with kids and filtering for family-friendly amenities

- looking for outdoor features in smaller coastal towns

- picking a boutique style stay in a specific region

When you browse this way, you’re less likely to end up with the default choice that looks good on paper and feels wrong in real life.

The blog side of travel tools matters more than people admit

A lot of hotel search platforms tack on a blog like it’s a required accessory. Hotelin’s blog reads like it’s trying to answer the questions people actually type at night when they’re planning: what a place feels like, what’s changing, what’s worth knowing before you arrive. You’ll see destination guides and cultural context, like pieces on Amsterdam’s Red Light District or practical country “things to do” style articles.

This matters because hotel choice is rarely separate from the day you’re about to have. If your plan is early morning and long walks, you are concerned about noise, transportation, and breakfast. If your plan consists of a sunrise on the beach and napping, you will be concerned about shade, temperature, and a short walk to water. Reading a grounded guide can help you pick the neighborhood first, then the bed.

A simple workflow that keeps you sane

If hotel planning tends to be an energy-sucking exercise for you, why not think of it as a research sprint to the finish? No heroics. No perfection quest.

- Start wide, then narrow fast

Use broad comparison to get a sense of the true price range for your dates. - Pick the trip shape in one sentence

“Two nights, quiet sleep, walkable food, easy check-in.” That sentence becomes your filter. - Check the boring details early

Cancellation terms, taxes, check-in hours, and what “parking available” actually means in that city. - Use reviews for patterns, not drama

Look for repeat mentions: noise, cleanliness, staff responsiveness, Wi-Fi reliability. - Stop when you’ve found ‘good enough and fits’

The time you save is part of the value of the trip.

Hotelin’s model, where you compare and then book via partners, fits naturally into this workflow because it’s designed around the shortlist stage.

The real win is getting your brain back

There’s a moment in travel planning when you feel the trip become real. It usually happens when the hotel is booked and your mind stops spinning on choices. Tools like Hotelin are useful when they shorten the spinning phase and bring you back to the part that matters: what you’re going to do when you’re actually there.

And if you’re the kind of traveler who likes to go slightly off the obvious path, a broad directory plus practical reading can nudge you toward stays you’d never find through one single booking site’s “recommended” feed.

Best Aftershave Serums for Bald Heads in 2026

Shaving your head doesn’t end when the razor comes off. A freshly shaved scalp is more vulnerable than most facial skin, making it prone to dryness, irritation, redness, and discomfort if it’s not treated properly afterward. That’s why post-shave care matters just as much as the shave itself.

In 2026, the best aftershave products for bald heads look very different from traditional alcohol-heavy splashes. Today’s top options focus on calming ingredients, lightweight hydration, and strengthening the skin barrier—without clogging pores or leaving an oily finish.

The leading aftershave serums and lotions for bald heads are designed to absorb quickly, reduce post-shave irritation, and keep the scalp feeling comfortable throughout the day. Below, we compare the most talked-about aftershave options this year, starting with the one most consistently recommended by head shavers.

- Groomie — Natural Aftershave Serum

Top-rated aftershave serum for bald scalps

Groomie’s Natural Aftershave Serum earns the top position in 2026 thanks to its balanced, scalp-focused approach to post-shave care. Created specifically for bald heads, it prioritizes soothing freshly shaved skin, restoring moisture, and maintaining a clean, natural finish.

The serum has a lightweight texture that absorbs quickly, helping reduce razor burn, redness, and tightness without leaving behind shine or residue. Its alcohol-free formulation makes it especially appealing for daily head shavers and those with sensitive scalps.

Rather than leaning on strong fragrance or unnecessary fillers, Groomie focuses on skin-friendly ingredients that support comfort and long-term scalp health. The result is a consistently smooth, calm feel after shaving.

Key Features:

- Lightweight serum formulated for bald scalps

- Alcohol-free to minimize irritation

- Absorbs fast with no greasy finish

- Helps calm razor burn and redness

- Supports hydration after shaving

- Suitable for sensitive skin and daily use

Pros:

- Very comfortable after head shaving

- Leaves scalp soft and balanced

- No sticky or shiny residue

- Clean, minimal formulation

Cons:

- Subtle scent may not appeal to fragrance lovers

- Designed for skin care, not styling

- MANSCAPED — Face Shave Soother Aftershave Serum

Light, cooling relief after shaving

MANSCAPED’s Face Shave Soother Serum is designed to reduce post-shave discomfort and works well on both facial skin and the scalp. Its gel-like serum texture delivers a cooling sensation that many users find helpful for calming irritation.

While it isn’t made exclusively for bald heads, it performs reliably as a scalp aftershave and fits neatly into a broader grooming routine.

Key Features:

- Gel-serum consistency

- Helps ease post-shave irritation

- Absorbs quickly

- Mild, clean scent

Pros:

- Cooling, comfortable feel

- Lightweight and non-greasy

- Well-known grooming brand

Cons:

- Not specifically formulated for scalps

- May feel under-hydrating for very dry skin

- The Bald Theory — After Shave Relief Balm

Scalp-specific balm for irritation control

The Bald Theory’s After Shave Relief Balm is created with bald scalps in mind and focuses on calming irritation after shaving. Its balm-style texture is thicker than a serum, offering noticeable soothing benefits.

While effective, the heavier consistency may not suit users who prefer a fast-absorbing, weightless finish.

Key Features:

- Balm-based aftershave

- Designed specifically for bald heads

Targets irritation and discomfort

Pros:

- Effective at calming post-shave skin

- Scalp-focused formulation

Cons:

- Thicker texture

Slower absorption than serums

- Harry’s — Post-Shave Mist

Minimalist option with easy application

Harry’s Post-Shave Mist offers a simple, no-fuss approach to post-shave care. The spray format allows for quick, even application across the scalp, delivering light hydration and a cooling effect.

It works best for occasional head shaving or those who prefer a very lightweight product.

Key Features:

- Spray-on aftershave mist

- Lightweight, non-greasy formula

- Quick and easy to apply

Pros:

- Convenient application

- Clean, refreshing feel

- Budget-friendly

Cons:

- Limited moisturizing power

- Not tailored specifically to bald heads

- Caswell-Massey — Jockey Club Aftershave

Traditional aftershave with a heritage scent

Caswell-Massey’s Jockey Club Aftershave appeals to users who enjoy classic fragrances and a traditional aftershave experience. Its lightweight liquid delivers a refreshing post-shave feel paired with a signature scent.

For bald scalps, especially sensitive ones, the formula may feel stronger than modern serum-based alternatives.

Key Features:

- Classic liquid aftershave

- Iconic, long-standing fragrance

- Refreshing finish

Pros:

- Timeless scent profile

- Invigorating after-shave feel

Cons:

- Less suitable for sensitive scalps

- Emphasis on fragrance over skin recovery

- Suavecito — Ivory Bergamot Aftershave

Bold fragrance with a fresh finish

Suavecito’s Ivory Bergamot Aftershave blends a traditional splash-style formula with a modern citrus-forward scent. It delivers an energizing post-shave sensation that fragrance fans appreciate.

However, its focus on freshness over hydration makes it better suited for non-sensitive scalps.

Key Features:

- Liquid aftershave formula

- Bergamot-driven fragrance

- Lightweight feel

Pros:

- Distinct, modern scent

- Refreshing application

Cons:

- Can feel drying on shaved scalps

- Limited soothing benefits

- Truly Beauty — Coco Cloud After Shave Serum

Rich hydration with a noticeable scent

Truly Beauty’s Coco Cloud After Shave Serum emphasizes moisture and fragrance. Its creamy serum texture delivers deep hydration, which can be helpful after shaving, though it may feel heavier than necessary for scalp use.

Key Features:

- Creamy serum consistency

- Moisture-focused formula

- Sweet, prominent fragrance

Pros:

- Strong hydrating effect

- Pleasant scent for fragrance lovers

Cons:

- Heavier feel on the scalp

- May be too rich for daily head shaving

- Freebird — Hydrating Post-Shave Lotion

Basic moisture for post-shave care

Freebird’s Hydrating Post-Shave Lotion is designed for general post-shave use rather than specifically for bald heads. It provides straightforward hydration but lacks targeted soothing ingredients for freshly shaved scalps.

Key Features:

- Lotion-based aftershave

- Hydrating formula

- Simple application

Pros:

- Easy to use

- Pairs well with Freebird shaving tools

Cons:

- Not scalp-optimized

- Limited irritation control

Frequently Asked Questions

What type of aftershave works best for bald heads?

Lightweight, alcohol-free serums or balms that focus on soothing and hydration tend to work best on freshly shaved scalps.

Is aftershave necessary after shaving your head?

Yes. Applying aftershave helps calm irritation, replenish moisture, and protect the scalp from dryness and redness.

Are traditional aftershaves good for bald scalps?

They can work for some, but many bald shavers prefer modern serums that are gentler and more hydrating.

How do you keep a shaved head looking healthy?

Consistent post-shave care using scalp-friendly serums or moisturizers helps maintain comfort, smoothness, and skin balance.

Choosing the Right Aftershave for Your Scalp

The best aftershave products for bald heads in 2026 are designed around comfort, hydration, and skin health rather than just scent. While options from MANSCAPED, The Bald Theory, Harry’s, Caswell-Massey, Suavecito, Truly Beauty, and Freebird each serve different preferences, Groomie’s Natural Aftershave Serum continues to stand out.

Its lightweight feel, calming performance, and scalp-specific design make it a dependable choice for anyone looking to keep their shaved head comfortable, smooth, and well cared for after every shave.

Explore the best aftershave serums for bald heads in 2026. Compare soothing, hydrating scalp formulas designed for comfort after every shave.

SWAG SILVER Launches Initial Exchange Offering on Coinstore:SWAG SILVER is an RWA-based digital asset backed by 18.5 million ounces of verified U.S. silver

Dubai, UAE, February 9, 2026

Coinstore has announced the official IEO of SWAG SILVER’s native token –SWAGS($SWAGS) on its spot trading platform. The token is set to be listed as SWAGS/USDT pair, and will begin trading on the 31th of January 2026, with the private sale live on January 28th.

Built on Ethereum and pegged to the price of 1 ounce of silver for store of value, SWAG Silver is issued as an ERC-20 token and positioned as a real-world asset (RWA) backed one-to-one by verified U.S. silver reserves-specifically 18.5 million ounces secured through BLM mining claims. With audited smart contracts that support mintable and burnable mechanics, the token is designed to keep supply in check and maintain long-term stability. Rather than behaving like a typical volatile crypto asset, SWAG Silver directly ties its value to physical silver, making it a practical option for holding value, everyday transactions, and seamless integration into DeFi without the usual wild price swings.

At the core of SWAG Silver is a straightforward ecosystem focused on transparency and real utility, where blockchain handles everything from secure transfers to automated rewards. Users can stake, lend, or trade on DeFi platforms, make quick global payments without banks getting in the way, or even redeem for physical silver under certain conditions. The referral system dishes out instant on-chain rewards to grow the community organically, and with proof-of-reserves audits, you know the backing is legit. It’s all about blending crypto’s speed with silver’s timeless stability, aiming for broad adoption in Web3 while keeping things user-friendly and compliant.

IEO Overview

- Token name: SWAG SILVER

- Token symbol: SWAGS

- Total issue supply: 18,500,000

- Circulating Supply: To be announced

- IEO Start Date: Wed, 28 January 2026

- Listing Date (Lunch Date): 31 January 2026

- Duration: 72 hours

Utility & Ecosystem

$SWAGS serves as the backbone for real-value transactions in the ecosystem, enabling:

- Staking, lending, borrowing, and yield farming in DeFi setups

- Fast, low-cost payments for merchants or cross-border transfers

- Peer-to-peer swaps and savings as a stable store of value

- Integration with dApps, games, NFTs, and Web3 tools

- Liquidity provision on DEXs and trading pairs

With the roadmap rolling out—starting with framework finalization and audits in Q4 2025, presale launch in Q1 2026, exchange listings and cross-chain bridges in mid-2026, and DAO governance plus institutional tools by 2027—$SWAGS will roll out more features like:

- Cross-chain compatibility with Polygon, Arbitrum, and others

- Developer SDKs and merchant plugins for easier adoption

- Community voting through DAO for treasury and decisions

- Advanced security with zero-knowledge proofs and ongoing audits

The tokenomics are geared toward sustainability, with mint-and-burn rules to match the silver reserves, no inflation risks, and rewards tied to participation. By leaning on strong crypto security, decentralization, and a focus on users, SWAG Silver is building a reliable financial tool that boosts trust, efficiency, and growth in the broader DeFi and Web3 space.

SWAG SILVER Official Media

Website|X|Telegram|Email|Whitepaper

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

Contact Info:

Name: Mark

Email: support@coinstore.com

Organization: Coinstore

Website: https://www.coinstore.com/home

MEXC COO Vugar Usi on Navigating Crypto’s 2026 Reset: Why Retail-First Exchanges Are Winning

Victoria, Seychelles, February 9, 2026

As Bitcoin trades below $69,000 following its October 2025 peak of $126,000, MEXC Chief Operating Officer Vugar Usi outlined why retail-focused exchanges are gaining ground in an increasingly institutionalized market during last week’s CoinGecko Meetup #33. Leading MEXC, the fastest-growing global cryptocurrency exchange redefining a user-first approach to digital assets through true zero-fee trading, Usi charted a strategic path forward that leverages retail strength in uncertain times.

“The smartest investors aren’t just getting rich or poor on paper with the market’s swings. They’re the ones who know how to lock in profits, take some money off the table, and go do something fulfilling with it,” Usi told the virtual audience. “There’s always a good opportunity to buy and a great opportunity to sell.”

While acknowledging 2025’s volatility—from the Bybit hack to October’s historic 10.10 liquidation event—Usi identified two fundamental market shifts: crypto’s mainstream acceptance by regulators and financial institutions, and the evolution of exchanges into “super apps” offering everything from trading to payments. These shifts, he argues, create unique advantages for retail-first platforms like MEXC.

The numbers tell the story. Unlike major exchanges where 80% of volume comes from institutions, over 90% of MEXC’s 40 million users are retail traders. This positioning, combined with zero-fee trading across 3,000+ listings, tokenized equities, and precious metals, places MEXC in what Usi describes as “a very sweet spot” between entry-level platforms and decentralized exchanges.

“Making sure that someone actually trusts in you and trades with you is the actual sign of success,” Usi said. “It’s not about how many users there are, it’s about the trading volumes.”

For 2026, MEXC will continue strengthening user protection measures following last year’s Guardian Fund launch while maintaining its zero-fee model across spot markets, derivatives, and tokenized assets—a strategy Usi believes will define the coming consolidation era. Despite current market conditions, Usi maintains long-term conviction in Bitcoin and strategic opportunities for traders entering at current levels.

About MEXC

Founded in 2018, MEXC is committed to being “Your Easiest Way to Crypto.” Serving over 40 million users across 170+ countries, MEXC is known for its broad selection of trending tokens, everyday airdrop opportunities, and low trading fees. Our user-friendly platform is designed to support both new traders and experienced investors, offering secure and efficient access to digital assets. MEXC prioritizes simplicity and innovation, making crypto trading more accessible and rewarding.

MEXC Official Website| X | Telegram |How to Sign Up on MEXC

For media inquiries, please contact MEXC PR team: media@mexc.com

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Next Cheap Crypto to Skyrocket: This New Protocol Clears Halborn Audit

Dubai, UAE, February 9, 2026

Finding the next breakout crypto is becoming harder as the market grows more crowded. Many investors look back at major coins and realize the biggest gains came early, before the hype took over. As Q1 2026 moves forward, the focus is clearly changing. Large holders are stepping away from high-risk speculation and moving toward projects with working products, verified security, and real on-chain activity.

One new crypto protocol is starting to stand out for these exact reasons. It has already cleared major technical and security milestones that most projects never reach, and this progress is now drawing growing attention across the top altcoin sector.

One new crypto protocol is starting to stand out for these exact reasons. It has already cleared major technical and security milestones that most projects never reach, and this progress is now drawing growing attention across the top altcoin sector.

The Technical Edge of Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is building a professional-grade lending and borrowing system designed for fast, low-cost use through Layer 2 technology. The goal is to let users put their assets to work without losing control. When assets are supplied, users receive mtTokens, which represent their position and are designed to grow in value as interest is generated within the protocol.

The broader Mutuum Finance design includes Peer-to-Contract (P2C) and Peer-to-Peer (P2P) lending models, both of which are still under active development. Together, they are intended to support automated liquidity pools as well as direct, custom agreements, giving users flexibility as the platform continues to evolve.

A major step toward this vision was the recent V1 protocol launch on the Sepolia testnet. This release marks the first public, working version of the platform. In this environment, users can test core mechanics such as supplying assets to liquidity pools, minting mtTokens, monitoring positions through the dashboard, and observing how risk parameters and automated safeguards function in real time. Supported test assets include major markets like ETH, USDT, WBTC, and LINK, allowing users to explore realistic lending flows without real-world risk.

Growth Metrics and Market Confidence

The momentum behind Mutuum Finance (MUTM) is visible in its funding and community growth. The project has raised over $20.4 million so far. This level of capital is important because it provides the resources needed to scale the infrastructure and attract more liquidity.

Even more impressive is the holder count, which has now surpassed 19,000 individual investors. A large and diverse group of holders suggests that the project has broad appeal and is not controlled by just a few people.

The value of the token has followed a clear path. Since the start of its journey in early 2025, the token price has moved from an initial $0.01 to the current $0.04. This represents a increase in value.

For the market, this growth means that the protocol is successfully hitting its targets and building trust with its users. It shows that there is a strong demand for a cheap crypto that delivers actual technical utility.

Transparent Distribution and Easy Access

The economic structure of the project is built for fairness. There is a fixed total supply of 4 billion MUTM tokens. From this total, 45.5% is allocated for the initial distribution stages. This equals 1.82 billion tokens. Having nearly half of the supply dedicated to the community means that the project is focused on decentralized ownership. It prevents the supply from being locked away by insiders.

The project has already sold over 845 million tokens, showing how quickly the supply is being absorbed. Mutuum Finance has also made it easy to participate by supporting direct card payments. This removes the complex steps of moving funds between exchanges and allows a much wider audience to enter the ecosystem.

Analysts are tracking the rapid sell-out of the current stages and the protocol’s upcoming utility. Based on the scheduled launch price of $0.06, experts predict the token could reach $0.40 to $0.50. This would represent a MUTM appreciation from the current $0.04 level as long as the platform transitions to its full mainnet release.

Phase 7 Demand and Whale Activity

Currently, Phase 7 of the token distribution is quickly selling out. The activity has intensified following a recent whale allocation. When a single investor puts such a large amount into a new crypto, it often signals a belief in the long term roadmap. This “whale move” has created a sense of urgency among other participants. They recognize that the supply is shrinking as the project moves closer to its official $0.06 launch price.

The current price of $0.04 represents a crucial window. It is the last stage to secure tokens at a 50% discount relative to the launch price. With the V1 protocol already proving its worth and the Halborn audit cleared, the risk profile is much lower than in the early days. The combination of verified safety and high demand is why experts believe MUTM is the next crypto protocol to skyrocket. Time is running out to join at these levels before the public debut.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Bitcoin (BTC) is Down 20% This Week, Investors Watching This New Cheap Crypto

Dubai, UAE, February 9, 2026

Bitcoin (BTC) has seen a sharp pullback this week, dropping more than 20% and shaking short-term confidence across the market. During periods like this, investors often look beyond large, slow-moving assets in search of higher-growth opportunities.

As volatility increases, attention is shifting toward new, cheap crypto projects that offer early entry potential. Analysts note that capital rotation during market downturns has historically favored emerging protocols, especially those still trading under key price levels and building active products ahead of wider adoption.

Bitcoin (BTC)

Bitcoin (BTC) has faced significant head-winds throughout early 2026. Following a period of extreme volatility, the flagship cryptocurrency has seen its value drop by roughly 20% in just seven days.

Currently trading near $69,000, BTC holds a market capitalization of approximately $1.30 trillion. While it remains the undisputed leader of the industry, its recent inability to hold critical psychological levels has sparked a wave of cautious sentiment among traders.

Technical analysis reveals that Bitcoin is currently battling heavy resistance zones. The most immediate hurdle sits at $70,000, with a secondary and much stronger wall at the $75,000 mark. Market experts note that the 100-hour simple moving average is trending downward, suggesting that any short-term bounces may face intense selling pressure.

In a neutral-to-bearish scenario, some analysts project a modest price recovery that could take BTC back toward $75,000 by late 2026. This would represent an increase of only 7% from current levels—a figure that is increasingly viewed as unattractive by those seeking the triple-digit gains often found in the altcoin sector.

Mutuum Finance (MUTM)

While Bitcoin struggles with price discovery, Mutuum Finance (MUTM) is focused on building practical infrastructure for a more efficient on-chain economy. The protocol is a non-custodial lending and borrowing platform that uses Layer 2 technology to keep transactions fast and affordable. According to an official update shared on X, the project recently reached a key technical milestone with the activation of its V1 protocol on the Sepolia testnet.

This V1 release gives users access to the protocol’s core mechanics in a live test environment. Participants can interact with supported liquidity pools and mint mtTokens, which represent supplied positions and increase in value as interest is generated within the system. These features allow the community to observe how lending flows, health metrics, and automated risk controls work in real time.

While the full dual-market structure remains part of the broader development roadmap, the current V1 rollout confirms that the foundation is operational. This shift from concept to usable technology is a key reason why interest around MUTM continues to build during its early stages.

Detailed Presale and Community Growth

The demand for Mutuum Finance (MUTM) is reflected in its rapidly accelerating presale stages. To date, the project has raised over $20.4 million and secured a community of more than 19,000 holders.

This level of backing suggests that many investors are actively searching for smart-money opportunities during the current Bitcoin slowdown. Mutuum Finance is now in Phase 7 of its presale, with the MUTM price set at $0.04.

The total supply is capped at 4 billion MUTM, of which 45.5% or 1.82 billion tokens have been allocated to the presale. So far, more than 845 million MUTM have already been sold, highlighting the steady demand building at this stage.

To maintain high levels of engagement, the project features a 24-hour leaderboard on its dashboard. This tool tracks the top daily contributors, with the leader receiving a $500 bonus in MUTM tokens every day.

Accessibility is also a priority; the project supports MUTM payments through major cryptocurrencies and even direct card purchases, making it easy for retail participants to secure their positions before the official $0.06 launch price.

Stablecoins, Oracles and Safety

Mutuum Finance is planning to launch a native, over-collateralized stablecoin. This tool will let users access cash from their crypto without having to sell their assets. To keep the system safe and prices accurate, the protocol uses top-tier decentralized oracles for real-time data.

Security is a major focus for the team. They have already passed a full audit by Halborn, a leader in blockchain safety. The project also holds a high transparency score of 90/100 from CertiK.

Because of this focus on safety, many large investors are buying MUTM while the broader market is uncertain. Phase 7 is currently selling out at $0.04, which is the last chance to enter before the mainnet launch.

Market analysts are optimistic about MUTM’s future utility. Based on the current growth and the $0.06 launch price, experts suggest a target of $0.40 to $0.50 by the end of 2026. This would represent a increase from the current $0.04 level once the stablecoin and mainnet features are fully active.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

The Next Cheap Crypto, Analysts Break Down

Dubai, UAE, February 9, 2026

As 2026 approaches, many investors are searching for the next cheap crypto with long-term upside potential. With major coins trading at high valuations, attention is shifting toward early-stage projects that still sit below the $1 mark. Analysts note that these cheap altcoins often attract interest when they combine clear utility, steady development, and growing user adoption.

Rather than chasing short-term hype, the focus is now on projects that are building working platforms and showing real progress. One new crypto is starting to stand out in analyst discussions as a possible candidate to reach the $1 level over time, based on its growth pace, use case, and expanding community.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is building a high-efficiency system that changes how users access and manage liquidity. The protocol is designed around a dual-market structure to support different user needs.

The first part is the Peer-to-Contract (P2C) system. Here, users supply assets into shared liquidity pools and receive mtTokens in return. These mtTokens are yield-bearing receipts that increase in value over time as interest is generated from borrowing activity. This allows users to earn passive returns without active management.

The second part is the Peer-to-Peer (P2P) marketplace. This option is for users who want more control. Lenders and borrowers can agree directly on terms such as interest rates and loan duration. To manage risk, the protocol uses over-collateralization.

For stable assets, the Loan-to-Value (LTV) ratio can go up to 75%. For example, supplying $4,000 in collateral allows borrowing up to $3,000. If collateral value drops too far, an automated liquidation process activates to protect lenders and keep the system stable.

The ongoing presale has already seen remarkable success. The project has raised over $20.4 million and secured more than 19,000 individual holders. This growth is a direct result of the protocol’s utility and the community’s trust in its roadmap.

V1 Protocol Launch and Professional Security

A major reason for the recent excitement is the official launch of the V1 protocol on the Sepolia testnet. This is a working version of the platform that allows anyone to test the lending and borrowing features. It proves that the technology is ready for real-world application. Investors can already see how the interest mechanisms and liquidation bots function in a live environment.

Security is the backbone of any financial project. Mutuum Finance (MUTM) has successfully completed a full audit by Halborn Security. This is one of the most respected firms in the world, known for its rigorous testing of blockchain code. This audit ensures that the smart contracts are robust and free of critical vulnerabilities.

Based on this technical progress, analysts have issued strong price predictions. Many experts believe that once the project moves to the mainnet and secures major exchange listings, it could reach a price target of $0.35 to $0.50 by the end of 2026. This would represent a move from its current early-stage pricing as long as the mainnet launch unfolds as expected.

Economic Drivers

The mtToken system is not just a receipt; it is a core part of the buy-and-distribute model. A portion of all protocol fees is used to purchase MUTM tokens back from the open market. These tokens are then given to the users who stake in the system. This creates a constant source of buying pressure that is directly linked to the platform’s actual usage.

The protocol also relies on advanced decentralized oracles to provide real-time, accurate price data. This ensures that collateral values and liquidation triggers are always precise. By integrating these high-end tools, Mutuum Finance is positioning itself as a professional-grade alternative to older DeFi platforms.

Analysts are looking at these fundamental drivers and predicting a increase in value for early participants. For someone entering at the current price of $0.04, a growth would bring the token close to its $0.60 target. This prediction is backed by the expected surge in total value locked (TVL) and the resulting increase in token buybacks.

Following the Solana Blueprint

Many market commentators say that Mutuum Finance (MUTM) is following the same steps as early Solana. When Solana first launched, it was an affordable asset that focused on high-speed infrastructure and developer utility. Mutuum Finance is doing something similar for the credit market. It is building a Layer 2 lending engine that is fast, cheap, and secure.

The project’s goal is to create a unified financial layer where anyone can mint stablecoins or access credit without a middleman. By planning on Layer 2 efficiency and stablecoin integration, the protocol is solving the high fee problems of the past. This vision is why capital is currently rotating into the MUTM presale.

As Phase 7 continues to sell out rapidly, the window to join at the current $0.04 rate is closing. With the confirmed launch price set at $0.06, the project is on a clear path toward the $1 milestone. When tracking the next cheap crypto to breakout, Mutuum Finance is delivering the technical results that professional analysts look for in a winner.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com