Bitcoin is still managing to hold the $90,000 area, Ethereum is hovering near $3,100, and Solana continues to sit around $134 — yet the overall market mood doesn’t exactly match those stable price points.

Even with major assets showing some resilience, traders are notably cautious, gravitating toward projects that deliver real revenue, real utility, and clearer value beyond day-to-day volatility. That shift has driven much more interest toward platforms tied to genuine financial use cases rather than hype alone.

That shift has put Digitap ($TAP) on the radar. It’s one of the few presales backed by a working app and real financial use, offering cross-border payments, a deflationary token model, and a fixed launch price well above the current round.

For those trying to find the best crypto to buy now without relying on hype, Digitap is increasingly becoming the project that stands out.

Bitcoin has climbed back above its 9-EMA after last week’s sharp drop and has been forming a steady pattern of higher lows. The short-term outlook still looks constructive, but momentum has slowed.

Ethereum is also back above its EMA, recovering from its mid-November slide and settling into a more stable upward channel. Its recent move toward $3,300 hints at improving sentiment, though buyers remain somewhat hesitant given the broader macro backdrop.

Solana, meanwhile, is trading just above its 9-EMA after bouncing off the $130 zone. It’s showing early signs of stability following the wider pullback. Selling pressure has eased, and the chart now appears more balanced, with some short-term strength as long as it continues to hold above the EMA.

With all leading coins hovering near their short-term EMAs after brief recoveries, the market’s cautious tone is clear, prompting some investors to look to crypto presales like Digitap, which offer structured token economics and utility-driven growth, rather than relying on volatile price swings.

$TAP’s Scarcity and Use Cases Put it at the Top of the Best Crypto Presales

Digitap operates as a crypto-first banking layer, giving users a single account to hold both fiat and crypto while moving funds across SEPA, SWIFT, and blockchain rails. The platform now supports more than 20 fiat currencies and over 100 cryptocurrencies, giving it a level of day-to-day utility that many newer projects only talk about in future plans.

Importantly, the $TAP supply is locked at 2 billion tokens with no mechanism for additional minting and no secondary emission schedules tucked away in the token model. That ceiling removes the usual dilution risks and provides a clearer sense of scarcity for anyone holding or using the asset.

That scarcity is reinforced through a deflationary burn model—tokens are permanently removed from circulation via transaction flows, staking penalties, and, most importantly, through Digitap’s commitment to use 50% of all app fee profits to buy back and burn $TAP.

Utility is equally central. $TAP powers staking, unlocks fee discounts and VIP rewards, enables governance, and functions as the native payment currency across the Digitap platform. Staking is designed to be non-inflationary, offering APR in presale and 100% post-launch from a fixed reward pool without printing new supply.

This combination of real-world banking infrastructure, deflationary economics, and live utility is why Digitap continues to stand out in a crowded presale market.

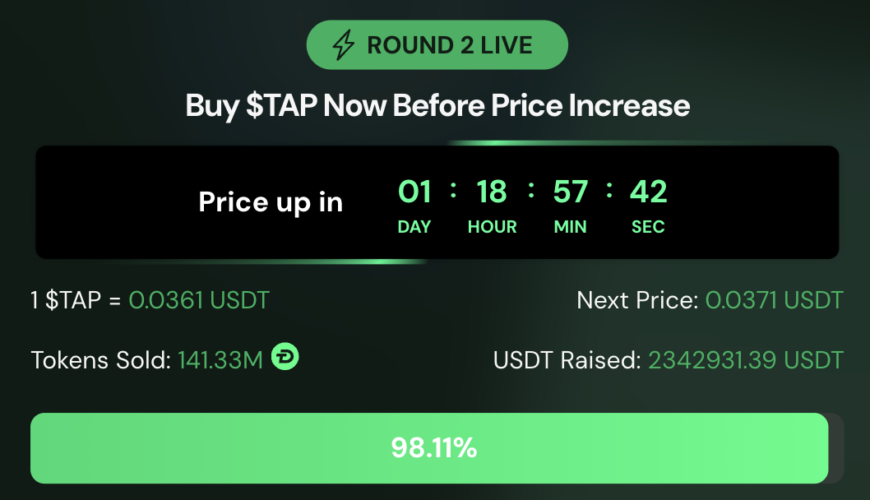

From $0.0125 to $0.0361: Tracking $TAP’s Steady Climb

$TAP is in Round 2 of its crypto presale at $0.0361, with the next programmed increase to $0.0371. More than 141 million tokens have been sold, $2.34 million raised, and the round is 98% complete. The urgency is simple: this discounted price remains active only until the stage sells out.

The key valuation anchor is the $0.14 launch price. Buying at $0.0361 secures positioning a Round-2 buyer for about Even in the short term, the token moved from $0.0325 on Friday to $0.0361 on Monday, an 11% weekend jump while majors stayed flat. The broader presale trend—from $0.0125 in early October to today’s price

This is why Digitap continues to stand out as one of the best cryptos to buy now, offering more structured upside than most altcoins to buy during a bear market.

What Sets $TAP Apart With Supply Discipline and Real Utility

Risks remain tied to broader market liquidity and execution timelines, especially with Bitcoin, Ethereum, and Solana still driving macro sentiment. But compared to these volatile majors, Digitap offers a structurally protected entry price, real revenue-backed mechanics, and a clear path to adoption.

For investors weighing catalysts against downside, these factors continue to position Digitap among the best cryptos to buy now in a defensive market.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com