London – 13 December, 2025 – Socratic Owl, the best homework helper for personalized learning of math, science, and test prep, today announced the launch of its new web app at socraticapp.com, bringing its AI‑powered, step‑by‑step homework support from iOS and Android to any device with a browser. Already trusted by tens of thousands of students worldwide on mobile, Socratic Owl now delivers the same fast, clear explanations in a clean, distraction‑free web experience.

Unlike one-size-fits-all tools that simply provide answers, Socratic Owl is built on two fundamental principles: working with students rather than for them, and adapting to each learner’s individual needs. The app customizes its explanations based on a student’s background, current skill level, and specific areas for improvement, thus delivering truly personalized guidance that meets students exactly where they are.

“Every student learns differently and comes with their own strengths and gaps,” said Catalin Zorzini, Lumination AI CEO. “A struggling nursing school student needs different support than someone who just needs a quick refresher. Socratic Owl recognizes these differences and tailors its explanations accordingly, so each student gets the help that’s actually useful to them.”

Designed to be the best homework helper

Socratic Owl is built from the ground up to reduce homework stress and boost confidence.

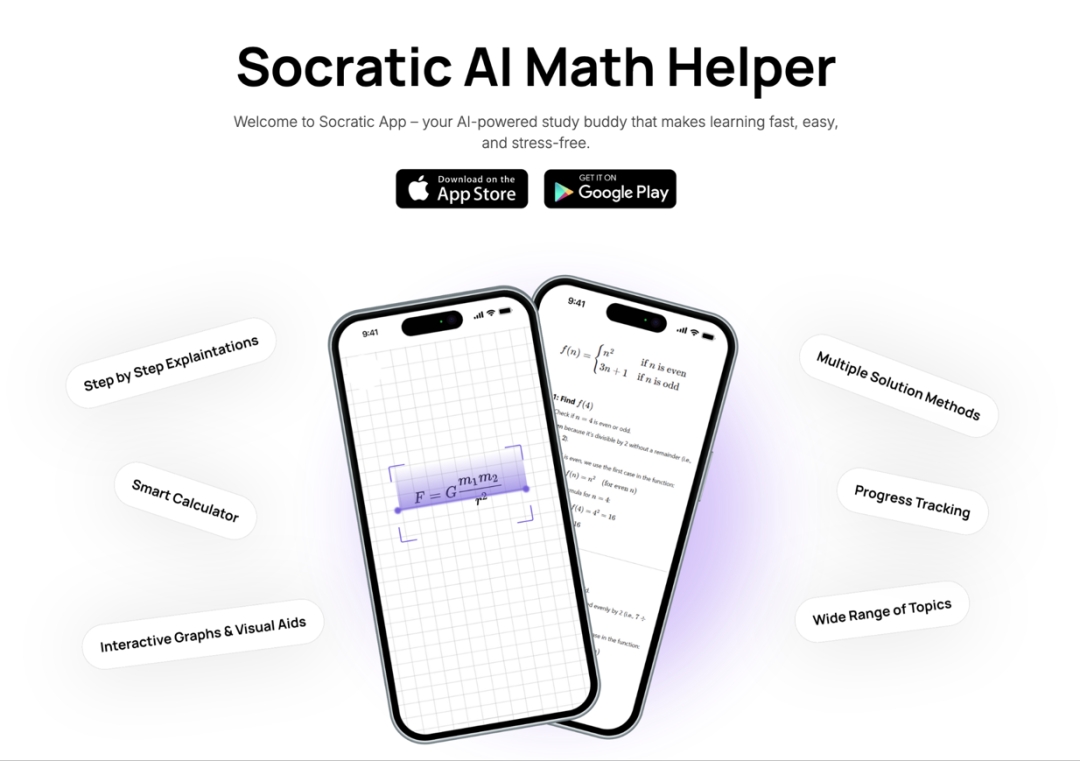

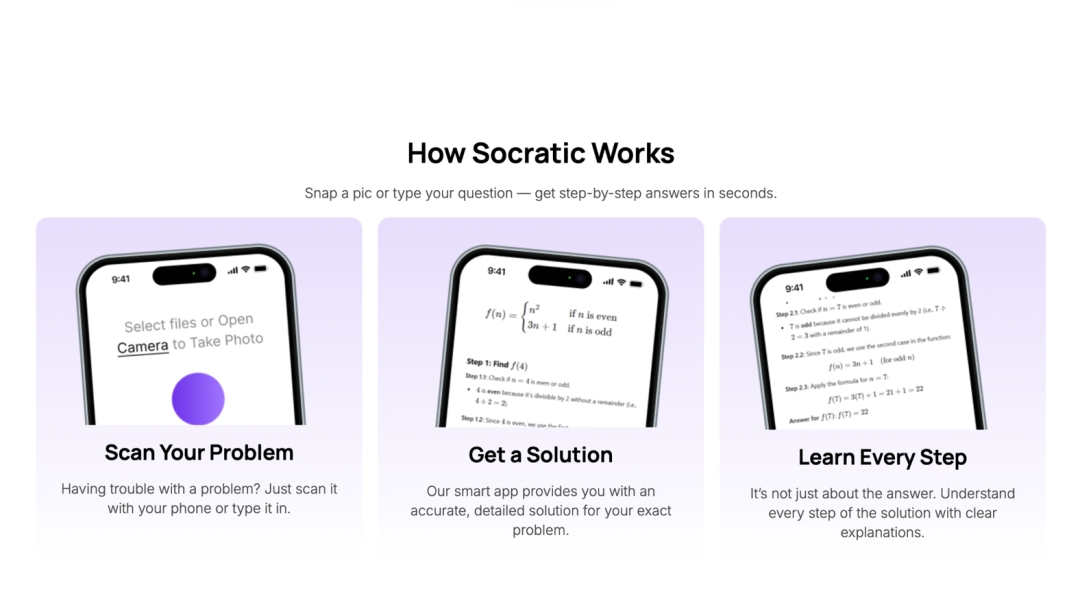

Scan to solve: Snap a photo of a problem and get a detailed walkthrough. Type to answer: Prefer typing? Paste equations or questions directly into the app. All the key subjects: From basic math to trigonometry, chemistry, or statistics, plus core science topics. 24/7 availability: No scheduling, no waiting, help is available any time a question comes up. No ads, ever: A focused learning experience, not a noisy feed.

“We want Socratic Owl to feel like the calm, patient tutor who’s always there — not just the night before an exam,” Zorzini added. “Launching the web app is a big step toward making high‑quality homework help truly universal.”

An Ethical Approach to AI Homework Assistance

Socratic Owl is named after the Socratic method for a reason: it’s about asking the right questions, breaking down complex problems, and helping students arrive at understanding through their own reasoning. Every response guides learners through the problem-solving process, building critical thinking skills that last beyond a single assignment.

“We’re not interested in helping anyone cheat; we’re interested in helping everyone learn,” the spokesperson added. “Parents and educators can trust that Socratic Owl supports real learning and academic integrity. Our goal is to help students build skills they’ll carry with them long after the homework is done.”

Key Features of Socratic Owl Web:

- Personalized to Each Student Explanations adapt to your background, skill level, and learning needs

- Step-by-Step Guidance Learn the “how” and “why” behind every solution

- Builds on Your Strengths Focuses on areas for improvement

- Multi-Subject Support Math, science, history, literature, and more

- Ad-Free, 24/7 Availability Study without distractions, anytime

- Powered by Advanced AI Built on the latest models for high accuracy and personalization

Socratic Owl is available now at https://socraticapp.com/ and on the Apple App Store and Google Play Store.

About Lumination AI

Lumination AI develops educational technology that makes learning more accessible, effective, and personal. The company builds AI-powered tools that adapt to individual learners, uphold academic integrity, and help students develop deep conceptual understanding.

For Media Inquires Please Contact at: hello@lumination.ai

Media Contact

Company Name: Lumination AI

Contact Person: Catalin Zorzini

Country: United Kingdom

Website: https://socraticapp.com/