2026 Crypto Predictions now sit at an interesting point. Bitcoin still drives the market story, yet many investors are watching where fresh capital flows rather than only where the price sits today. One clear signal comes from Remittix, which has raised more than $28.5 million for a real-world payment token that targets global transfers rather than solely as a store of value.

That level of demand hints at a shift in 2026 Crypto Predictions toward payment projects with live products, not just charts and hype, and it keeps Remittix in the conversation beside Bitcoin.

Bitcoin Still Anchors 2026 Crypto Predictions

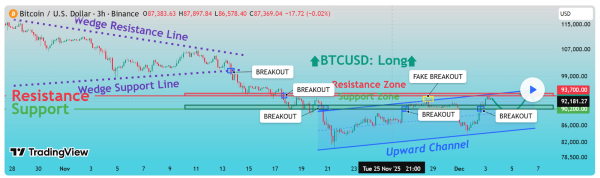

Bitcoin remains the anchor for most 2026 crypto predictions. It trades near $90,764, with a market cap of $1.8 trillion and daily trading volume of $36 billion, keeping it well ahead of every other asset. Analysts still use Bitcoin as the main gauge of risk appetite across the broader crypto market.

Recent analysis shows some on-chain signals that resemble early bear-market conditions, including rising stress among top buyers and a larger share of supply held at a loss. Off-chain data also points to softer demand, with ETF inflows slowing and spot trading volumes weakening.

Overall, most 2026 crypto predictions stay positive on Bitcoin, but many analysts agree it may not offer the strongest upside on its own.

Remittix Leads 2026 Crypto Predictions For Payment Utility With Over $28M Raised

Against that backdrop, Remittix enters 2026 Crypto Predictions from a very different angle. The project focuses on the $19 trillion global payments and remittance market and has already sold more than 693 million tokens at a price of $0.119, raising over $28.5 million.

That scale of demand for a payment-focused token shows why many traders now describe Remittix as one of the best candidates for the next crypto in this cycle and a serious answer to 2026 Crypto Predictions that talk about utility.

The team is fully verified by CertiK, ranked number one for pre-launch tokens on CertiK Skynet with a score above 80, and has completed full know-your-customer checks, which boosts trust for early-stage crypto investment. The Remittix wallet is now live on the Apple App Store as a full crypto wallet that lets users store, send, and manage assets.

Crypto-to-fiat features will be added inside the same app, and the team has teased a high-profile December announcement that should give the token a clear boost. Centralized exchange listings are already secured, with a third major listing planned once the raise passes $30 million.

Key points that make RTX stand out in the current crypto market are:

- Focus on real-world payments and global remittance

- Direct crypto-to-bank transfers are planned in more than 30 countries

- Utility-first token that aims to support real transaction volume

- Audited by CertiK with public Skynet monitoring and an A-grade security score

- Built for adoption and daily use rather than short-term speculation

Why 2026 Crypto Predictions Favor Live Payment Projects

Looking toward the next cycle, most 2026 Crypto Predictions still start with Bitcoin as the anchor for the wider crypto market. Its size, liquidity, and store-of-value role are not under threat. The more important question is where new capital flows when investors search beyond Bitcoin for the next crypto story.

Here, Remittix stands out as a project that already shows progress, with more than $28.5 million raised, a live wallet on the Apple App Store, two exchange listings secured, and a clear plan to connect crypto and fiat payments. For traders who think payment utility will drive the next wave, Remittix offers a way to back that view inside their 2026 Crypto Predictions.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Frequently Asked Questions

1. Why do 2026 crypto predictions still start with Bitcoin?

Bitcoin remains the main reference point for risk sentiment because of its size, liquidity, and dominance in institutional portfolios. While upside may be more limited, most 2026 crypto predictions still depend on Bitcoin setting the overall market direction.

2. What signals a shift toward payment-focused tokens in 2026 crypto predictions?

Raising over $28.5 million for a real-world payments project like Remittix signals strong investor interest beyond store-of-value narratives. Capital is increasingly flowing toward tokens linked to live products, user adoption, and real transaction demand.

3. Why is Remittix often mentioned in next-cycle growth discussions?

Remittix targets the $19 trillion global payments and remittance market rather than short-term price speculation. With a live wallet, upcoming crypto-to-fiat rails, and secured exchange listings, it fits the utility-driven thesis behind many 2026 crypto predictions.

4. How does Remittix differ from earlier payment tokens?

Unlike older payment tokens that relied on future adoption, Remittix already delivers a working wallet on the Apple App Store. Its CertiK verification, KYC-completed team, and growing user incentives reinforce trust at an early stage.

5. What role could a payment utility play in the next crypto cycle?

Many analysts believe the next wave of growth will come from crypto solving real-world problems rather than pure speculation. Payment networks with live products, like Remittix, are increasingly viewed as strong candidates to benefit most during the 2026 cycle.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com