The urgency of discussing Bitcoin 2026 has increased because of recent market data that suggests long-term momentum may be changing. Following weeks of conflicting mood in the cryptocurrency market, traders are closely monitoring Bitcoin as it attempts to establish stability.

Early in the week, a number of analysts pointed out that investors seeking exposure to the next stage of cryptocurrency growth are paying more attention to emerging payment-focused ventures like Remittix.

Bitcoin 2026 Market Structure Shows Early Signs of Strength

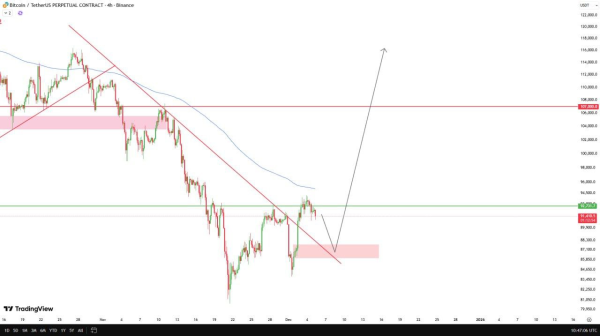

Bitcoin is trading at $90,266, down 2.3%, with a market cap of $1.8T and daily trading volume at $59.15B, down 11.59%. Despite the pullback, chart watchers noted a significant development shared in a widely viewed market update.

According to the post, Bitcoin has broken its downward trendline, creating a cleaner structure that now supports slow pullbacks, higher lows and attempts at continuation.

The gradual retracement is being described as controlled, which indicates that buyers are actively protecting new structural levels. If the current pattern continues, traders expect a strong continuation move once this corrective phase completes. For those studying Bitcoin 2026 scenarios, the shift in structure is critical.

Specifically, more often than not, medium-term rallies are preceded by a sustained higher-low formation, as long as liquidity inflows from institutional adoption and regulated crypto exchanges remain constant. This setup has encouraged traders analyzing long-term accumulation to reconsider their expectations for the next cycle.

Bitcoin 2026 and the Wider Crypto Market Rotation

The broader crypto market is experiencing an increase in crypto news, market sentiment shifts, and renewed attention on digital assets linked to utility-based real-world adoption. Analysts have noted that capital is flowing into altcoins tied to payments, Web3 infrastructure and decentralized finance.

This is particularly visible in liquidity behavior across CEX and DEX platforms as traders balance risk between Bitcoin and builders who offer long-term use cases.

That rotation is why Bitcoin 2026 predictions vary so much. To some, it will remain the anchor of the next crypto bull run, while others believe utility-driven projects can outperform on a percentage basis.

The common thread is that crypto market structure continues to tighten up and on-chain activity is showing renewed stability as accumulation slowly starts to expand. Increased attention to early-stage crypto investment themes and the creation of new altcoin-to-watch narratives and crypto projects with real utility fuels more balanced positioning across portfolios.

Remittix Continues Expanding After Major Milestones

Toward the end of the current cycle, Remittix has become one of the most frequently discussed utility tokens, priced at $0.119 and recently surpassing $28.5M raised through private funding with over 692.8M + tokens sold.

The project is attracting serious crypto investors because it offers a complete PayFi model that blends blockchain technology with real-world finance. This comes amidst the team launching its wallet on the Apple store. Its ability to move crypto into fiat accounts quickly has made it stand out among early-stage crypto investment projects.

The Remittix team is now fully verified by CertiK, and the project is ranked #1 on CertiK for pre-launch tokens. Both the audit and team verification are available on the CertiK site with transparent scoring.

The beta wallet is also expanding, with more iOS users being added weekly. The top 10 purchasers each week gain access to testing, allowing the community to guide UX improvements.

Remittix has secured future listings on major exchange, which will activate when funding thresholds for global rollout are achieved. The December announcement teaser offers a preview of the upcoming crypto-to-fiat payment solution expansion and the upcoming $30M milestone reveal.

Remittix has also launched its referral program, paying a 15% USDT reward every 24 hours through the dashboard and the $250,000 Giveaway continues to attract new supporters.

Why Remittix Keeps Gaining Traction

- Built to target the global payments sector

- Beta wallet progressing with active community testing

- Ranked #1 on CertiK for pre-launch projects

- Future CEX listings already secured

- Expanding crypto-to-fiat functionality

The Road to 2026 Looks Active

Bitcoin 2026 discussions will intensify as structural signals become clearer and liquidity rotates between BTC and emerging payment-focused tokens. Remittix remains one of the most notable utility projects gaining traction alongside Bitcoin’s long-term recovery narrative.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Frequently Asked Questions

1. Will Bitcoin rise in value before 2026?

Bitcoin’s long-term outlook depends on market sentiment, liquidity, and how well current structural levels hold. Analysts monitoring trend reversals have pointed out that the recent break of the downward trendline is encouraging, but BTC still needs steady inflows to confirm a sustained move.

Many traders watching Bitcoin 2026 scenarios are focusing on whether higher lows continue forming during periods of market volatility.

2. What affects the price of Bitcoin in the medium term?

Price movement is driven by several factors including institutional adoption, on-chain activity, global macro conditions and demand on major crypto exchanges.

Liquidity shifts between Bitcoin and altcoins also influence how BTC reacts during corrective phases. When new capital flows into digital assets with strong utility, capital can rotate between sectors, impacting Bitcoin’s short-term stability.

3. Is Bitcoin a good long-term investment?

For many investors, Bitcoin remains a core digital asset due to its supply structure and its role as the dominant cryptocurrency.

Those evaluating long-term positions often consider its performance during previous cycle corrections, its influence on market sentiment and the increasing presence of regulated financial institutions operating in crypto markets.

4. Which new crypto projects are gaining attention alongside Bitcoin?

Utility-focused projects in payments, cross-chain tech, and decentralized finance are drawing interest from crypto investors.

Remittix is one standout example due to its PayFi model, CertiK verification and growing funding from private backers. These projects are watched closely because they add real-world use cases to the broader crypto market.

5. How do I find strong early-stage crypto projects?

Many investors track project announcements on social platforms, review audits, and look for working products such as beta apps or integrations.

A project that has transparent tokenomics, verified teams and consistent development updates often attracts more attention. Tools like CertiK can help confirm whether a project has been reviewed for security and team verification.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com