SaraCares Sets New Standards for Professional Carpet and Upholstery Cleaning in Vancouver, BC

Addressing this growing demand, SaraCares continues to deliver reliable and affordable solutions for carpet cleaning Vancouver and upholstery cleaning Vancouver, helping residents restore comfort, cleanliness, and freshness in living and working spaces.

High-tech Steam Cleaning of Healthier Homes.

SaraCares, with over 40 years of experience in the industry, offers specialized steam cleaning services that are meant to remove dirt that has been embedded, stains that are difficult to remove, and harmful allergens. The company has concentrated on the highly developed cleaning techniques that not only increase the appearance of the carpets and furniture but also enhance the health of the indoors.

Professional carpet cleaning Vancouver services are made to suit the specific needs of the property. Pre-inspections are performed by certified technicians and are used to check fabric types, the level of stain, and high-traffic areas. This personalized process has a guarantee that every carpet has its own treatment that does not pose a risk to the fibers and textures.

Satisfying Upholstery Cleaning Solutions.

Despite having other efficient methods of deep sanitation, steam carpet cleaning, or hot water extraction, it still stands out as one of the best methods. This is a technique that cuts deep into the carpet layers, destroying the dirt particles and bringing out the contaminants that the normal way of cleaning can not reach. The outcome is a renewed carpet that appears fresh, smells clean, and enhances better air quality.

Along with carpets, the upholstered furniture is also hard to take care of because of the sensitive fabrics and daily use. SAVC – Professional upholstery cleaning Vancouver is the company that provides upholstery cleaning of those sofas, chairs, and other upholstered furniture to restore their beauty and health. Upholstery has a tendency to absorb body oils, food particles, and even air pollutants, and it is important to ensure that it is professionally cleaned on a regular basis so that appearance and comfort are maintained.

Cleaning-Friendly And Safe Eco-Friendly Practices.

The cleaning of upholstery includes manual inspection of the fabric, light pre-treatment, steam removal, and deodorization. Cleaning solutions are also eco-friendly and non-toxic to guarantee the safety of children, pets, and people with sensitivities. The natural-based products are very effective in eliminating stains and odor and leaving no residual chemicals, which are harmful.

The green policy is a critical component of service philosophy. The cleaning practices emphasize environmental safety and are high-performance. The low-moisture and chemical-free methods reduce the impact on the environment and ensure reduced drying time, which reduces inconvenience to the home and the business.

Open Pricing and Service Areas.

The high level of transparency and reasonable price are other important benefits of SaraCares services. The customers are provided with definite estimates that do not include some hidden expenses, and they are able to make a choice and avoid their surprise as a result of some unexpected costs. The strategy has made SaraCares a reliable service provider in Vancouver and other neighboring regions such as Burnaby, Richmond, Surrey, Coquitlam, North Vancouver, West Vancouver, Delta, Langley, and Maple Ridge.

Customer satisfaction is also a key area of concern, and they have a satisfaction guarantee policy. Every cleaning project is done in detail, professionally, and in time.

Full Cleaning Services.

Outside carpet and upholstery, SaraCares also offers pet accident cleanup, area rug cleaning, and mattress cleaning services. Special attention is paid to the area rugs, as they usually have individual materials and designs, and to the cleaning of mattresses, as it is essential to get rid of dust mites and bacteria in the bedrooms. Any pet-related stains and smells are removed using the advanced odor-neutralizing solutions, which do not reduce the strength of fabrics.

The Demand for Indoors to Provide Healthier Environments.

The increased awareness of the quality of the indoor air has raised the demand for professional cleaning services in the city of Vancouver. With urban pollution and heavy pedestrian traffic today, anybody will find it a good investment to engage in regular deep cleaning as opposed to infrequent cleaning. Professional services—aside from prolonging the life of the carpets and furniture, they also help to create better living conditions.

By remaining innovative in the operations of the competitive cleaning business, SaraCares keeps attracting customers through the convergence of technical know-how, customer-driven service, and green practices. The company has a history of experience and a good reputation for reliability, and this has made it a favorite choice when one is seeking carpet cleaning solutions in Vancouver and upholstery cleaning solutions in Vancouver.

Company Name: SaraCares Carpet

& Upholstery Cleaning Vancouver

Contact Person: Dana Johnston

Email: info@saracares.com

Country: Canada

City: Vancouver

Website URL: https://www.saracares.com/

Full Address: 1945 Barclay St #408, Vancouver, BC

V6G 1L2, Canada

Phone: +16047220459

Real Estate Operators Face Persistent Buyer-Seller Gap Despite Market Recovery Predictions

Relli co-founder warns waiting for market conditions to improve may cost operators competitive position

Commercial real estate investment is projected to reach $562 billion in 2026, representing a 16% increase from 2025 levels, according to industry forecasts. However, Mor Milo, co-founder of real estate investment platform Relli, cautions that the fundamental disconnect between buyer and seller expectations remains wide despite improving headline numbers.

“Expectations between sellers and buyers are still very far apart,” Milo said. “The market is still very constrained, and things are still very hard to move.”

The gap stems from structural issues rather than temporary market conditions. Property owners seeking to sell face taxable events requiring 1031 exchanges. Executing those exchanges requires suitable replacement properties at appropriate basis levels. With current interest rates and property valuations, identifying deals that pencil correctly has become increasingly difficult.

“They’re sitting on property because they don’t know what to buy,” Milo explained. “You have a vicious cycle between sellers and buyers not knowing what to do to unlock this capital without the tax implications.”

Interest rates currently hover around 6 to 7%, aligning with 30-year historical averages. The challenge for operators stems from decisions made during a period of abnormally low rates. Deals structured with floating-rate debt and optimistic refinancing assumptions now face deteriorating economics as rates that started at 2 to 3% have climbed to 7%.

Operators with strong investor relationships have survived by injecting additional equity to maintain cash flow. Those lacking such relationships have watched deal performance decline.

While some operators wait for market conditions to improve, others are adapting their capital raising strategies. Institutional investors have largely remained in debt markets where returns of 12 to 15% are available with better security than equity positions. This shift has created permanent rather than temporary capital scarcity for equity deals.

“Sponsors are very aggressive to raise capital because they’ve been struggling to raise capital,” Milo observed. “I see that consistently, day in and day out, operators are looking to figure out how to improve their capital raising processes.”

Operators building systematic approaches to retail investor acquisition are seeing measurable results. Relli’s platform data indicates investment reservations totaled $700,000 in the fourth quarter of 2025, compared to $1,700 total in the previous two years combined. One investor returned after six months of platform membership to reserve $250,000 in a new offering, completing the transaction entirely through digital channels.

“It takes time for people to make decisions,” Milo noted. “People need to build relationships with you.”

The timeline for building effective retail investor pipelines extends beyond typical planning horizons. Systems development requires months. Meaningful results require additional time. Operators delaying this infrastructure development risk ceding competitive advantages to firms that began earlier.

“The longer these sponsors wait to fix this problem, the more desperate they become,” Milo warned.

Market observers expect eventual concessions from both buyers and sellers as transaction pressures mount. However, operators depending on market resolution to solve capital access challenges may find themselves disadvantaged against competitors who have diversified funding sources.

Relli operates as a technology and marketing platform connecting real estate developers with retail investors. The company provides lead generation services for operators while offering investors tools to evaluate opportunities against traditional investment benchmarks.

Additional information is available at www.relli.co.

About Relli

Relli is a PropTech platform democratizing commercial real estate investment access. Co-founded by Mor Milo and Ross Iannarelli, the company connects investors with vetted real estate opportunities starting at investment minimums as low as $100 while providing marketing infrastructure for real estate operators.

FoodRGB Spotlights Natural Food Coloring Trends with Beta Carotene and Curcumin Solutions

The global food industry is experiencing a meaningful shift toward cleaner, more natural ingredients. In a time when consumers pay close attention to ingredient lists and brand transparency, food manufacturers are increasingly choosing plant-based alternatives over synthetic additives. Among these ingredients, natural pigments stand out as essential components for product appeal. Natural color plays a key role in how food is perceived and enjoyed, and two plant-based colors are gaining notable traction: beta carotene food coloring and turmeric-derived curcumin.

FoodRGB, a company dedicated to natural food color solutions, highlights the importance of these pigments and how they are helping brands respond to market demand for cleaner, more transparent food products.

Beta carotene: It is a natural source of orange-yellow colour.

Beta carotene food coloring is one of the most popular plant-based. Beta carotene is a naturally occurring hydrocarbon, which is present in most fruits and vegetable products, and that is the reason why carrots, pumpkins, and sweet potatoes have their bright yellow, orange, and red colors. Beta carotene, being a natural food dye, adds warmth and color to products without the use of synthetic dyes.

FoodRGB provides flexible formulations of beta carotene, which can be used to address different production requirements. These contain products that are both water-soluble and oil-soluble and are either in powder or liquid form. This flexibility enables the food makers to incorporate the pigment in various applications of beverages, dairy products, confectionery, baked goods, and margarine.

Curcumin: The Sunny-yellow Extract of Turmeric.

Another natural color that is gaining interest in the natural color space is curcumin, which is a plant-based pigment. Curcumin is a substance formed out of the rhizome of turmeric (Curcuma longa), and it imparts a bright yellow color, which appears as either golden or deep yellow with an increase in concentration. In addition to its visual qualities, curcumin has enjoyed a rich history of use in food and food preparation.

FoodRGB is known as a curcumin manufacturer, where the company has different types of products to meet different needs. These are in high bioavailability forms and water-soluble nanometer-level powders or liquids that provide a high level of clarity of color and heat, light, and acid-resistant features. Oil-soluble curcumin preparations are also available and can be dispersed evenly in fat-based systems, therefore making them applicable to a wide range of product formulas.

The stability of curcumin in the medium range of pH, as well as its high color intensity, is what makes it suitable in functional beverages, seasonings, pickled vegetables, and bakery products. It has a vivid appearance, which not only makes it attractive to the eyes but also facilitates product differentiation in competitive markets.

Real-world Advantages of Food Manufacturers

Natural pigments, such as beta-carotene and curcumin, have more useful benefits than aesthetic ones. The fact that they are vegetarian also serves the interests of consumers who want the shortest possible ingredient list and avoid artificial additives. In clean-label markets where transparency is valued, such pigments are useful in ensuring that a brand has clarity and trust in their products.

The natural color solution offered by FoodRGB focuses on products that are practical and functional in real production. For food manufacturers, this means they will have access to colors that are resistant to heat and light, can withstand various pH conditions, and can be easily incorporated into existing processes.

Reflecting Consumer Expectations

Today’s consumer seeks products that feel authentic, simple, and transparent. The shift toward natural pigments reflects a broader desire for foods that resonate with personal choices and lifestyle preferences. Whether selecting snacks for children, beverages for daily enjoyment, or specialty products for health-oriented markets, the visual and ingredient quality matters.

Natural pigments such as beta carotene food coloring, and curcumin link product appearance with meaningful ingredient stories. These colors not only add aesthetic appeal but also connect products to plant origins that consumers can understand and appreciate.

The Role of Natural Colors

The move toward plant-based food colors is more than a fad; it reflects ongoing changes in how food is formulated and perceived. Natural pigments are becoming essential in product development strategies across the food and beverage sector. As brands continue to pursue clean-label goals, natural color solutions play a significant role in both product differentiation and consumer engagement.

Through stable, versatile, and functional offerings, FoodRGB contributes to this transformation by providing natural color solutions that support industry trends and production realities.

Company Details

California, United States

Why Gorras Dandy Hats Are More Than Just Caps in Streetwear Fashion

At first glance, a cap might seem like a simple accessory, something you throw on to finish an outfit or shield yourself from the sun. But in modern streetwear, certain pieces go far beyond basic function. Gorras dandy hats are one of those items. They sit at the intersection of fashion, identity, and cultural expression, carrying meaning that extends well beyond their role as headwear.

In today’s streetwear scene, these hats represent attitude, storytelling, and a refined sense of style that challenges the idea that street fashion has to be purely casual or utilitarian.

The Evolution of Caps in Streetwear Culture

Caps have always played an important role in streetwear. From sports teams and hip-hop culture to skateboarding and graffiti scenes, headwear has long been used to signal belonging and individuality. Over time, caps evolved from purely functional items into statement pieces.

What changed is intention. Modern streetwear places value on design choices, symbolism, and craftsmanship. Hats are no longer just branded merchandise, they’re curated elements of an outfit. This evolution created space for styles that blend elegance with street sensibility, which is exactly where gorras dandy hats come in.

A Blend of Elegance and Urban Attitude

Unlike traditional snapbacks or dad hats, gorras dandy hats are designed with a more refined aesthetic. They often draw inspiration from classic menswear, think tailored silhouettes, thoughtful typography, and understated color palettes while still fitting seamlessly into urban fashion.

This balance is what sets them apart. They don’t scream for attention, but they also aren’t background pieces. Instead, they communicate confidence, taste, and a deliberate approach to personal style. Wearing dandy hats is less about following trends and more about expressing a mindset that values detail and originality.

More Than Fashion: A Symbol of Identity

Streetwear has always been tied to identity, and gorras dandy hats reflect that deeply. They often resonate with people who see fashion as a form of self-expression rather than just clothing. These hats suggest a blend of worlds: street culture, classic style, and modern creativity.

For many wearers, choosing this type of hat is a way to stand out without being loud. It signals maturity within streetwear, a move away from overbranding toward pieces that feel personal and intentional.

Craftsmanship and Design Philosophy

Another reason these hats are more than just caps is the attention to detail behind them. From material selection to stitching, shape, and fit, the design process tends to be more thoughtful than mass-produced headwear.

Logos and graphics are often subtle, designed to be recognized by those who know rather than to attract immediate attention. This design philosophy aligns with the broader shift in streetwear toward quality over quantity and meaning over hype.

How They Fit Into Modern Streetwear Looks

Gorras dandy hats are incredibly versatile. They pair just as well with tailored jackets and clean sneakers as they do with oversized hoodies and relaxed denim. This adaptability makes them a favorite for people who mix styles rather than stick to one rigid look.

Because they aren’t overly sporty or aggressively casual, they help elevate outfits. A simple streetwear fit can instantly feel more polished with the right hat, making it a key accessory rather than an afterthought.

Why Their Influence Keeps Growing

The rise of gorras dandy hats reflects a broader change in streetwear culture. As the scene matures, there’s a growing appreciation for pieces that tell a story and feel timeless rather than disposable. Consumers are more selective, and accessories that offer depth and character naturally stand out.

Social media and global fashion conversations have also helped amplify this style. People are drawn to items that feel authentic and expressive, and these hats check both boxes without relying on hype-driven trends.

Final Thoughts

Gorras dandy hats have earned their place in streetwear because they represent more than fashion convenience. They embody a refined take on urban style, one that values design, identity, and intention. In a culture where what you wear often says as much as what you say, these hats speak clearly without ever needing to shout.

They aren’t just caps. They’re statements, symbols, and an evolving part of modern streetwear fashion.

As Chainlink Slides and LTC Pushes Higher, ZKP Crypto Emerges With Potential

The cryptocurrency market remains under pressure in early 2026, with mixed signals across major assets as traders respond to selling waves, shifting demand, and early signs of recovery. While some large-cap altcoins struggle to regain footing, others are quietly building stronger technical bases.

The recent Chainlink price has suffered a sharp decline, dropping 21% over the week to around $8.9 as heavy selling and exchange inflows weighed on sentiment. At the same time, Litecoin news is turning more constructive, with LTC holding above its key $55–$60 support zone and showing improving momentum. Analysts are now discussing long-term upside scenarios that could reach as high as $200 if conditions continue to improve.

Away from traditional market swings, ZKP is drawing growing attention as one of 2026’s most discussed presale projects. Built around privacy-first AI infrastructure and a strict supply reduction model, ZKP’s multi-stage presale auction steadily lowers daily token availability. This design is driving analyst expectations of up to potential, positioning ZKP as a project many consider among the best crypto to buy today as the year unfolds.

Chainlink Price Weakens as Selling Pressure Accelerates

Chainlink price has dropped sharply to about $8.9, marking its lowest level since September 2024 after a strong wave of selling pushed weekly losses to 21%. Sellers clearly controlled market action, outpacing buyers by roughly a 75 to 25 ratio, while sell volume climbed to 26.2 million LINK. Exchange inflows also increased, with around 3.8 million LINK moving onto trading platforms, adding further downside pressure and pushing the Chainlink price deeper below the $10 level.

Derivatives markets reflected the same weakness. Open Interest fell to roughly $458 million, its lowest point this year, while derivatives volume declined 22% to about $1.09 billion. Momentum indicators remain stretched, with RSI near 20, placing Chainlink price firmly in oversold territory. If price action fails to reclaim the $11.5 EMA20 level, analysts warn that further downside toward $8.3 could follow in the near term.

Litecoin News Turns Constructive as Long-Term Base Holds

Recent Litecoin news points to growing stability after LTC defended its long-standing $55–$60 support area following months of sideways movement. Analysts note that this zone continues to absorb selling pressure, suggesting the formation of a durable base. From here, gradual recovery remains possible, with medium-term price targets in the $100–$120 range and broader expansion scenarios opening a path toward $180–$200 if overall sentiment improves.

Technical signals support this outlook. RSI has rebounded to around 44 from near-oversold levels as price trades near $60.70, while the MACD histogram shows declining bearish momentum. Additional confidence comes from institutional developments, including Japan’s SBI VC Trade introducing Litecoin lending, a move that reflects rising institutional interest and adoption.

ZKP’s $1.7B Presale Auction Model Fuels Expectations

ZKP, known as ZKP, is drawing strong interest in early 2026 as one of the boldest presale launches in the crypto market. Analysts are pointing to possible upside, based on a design that blends AI privacy protection with aggressive supply reduction. The system is built so that as interest rises, token availability keeps shrinking, placing steady pressure on price over time.

At the heart of the project is zero-knowledge cryptography, which allows sensitive data to stay private while AI systems still function securely. This gives ZKP clear real-world use, while the presale auction structure adds powerful scarcity incentives for early participants. Together, these elements link privacy innovation with demand-driven value growth.

The ZKP presale auction is structured across 17 stages, with token supply reduced at every step. Stage 1 introduced 11.8 billion tokens, releasing 200 million per day. Stage 2 lowered total supply to 4.75 billion tokens, with 190 million distributed daily. By the final stage, daily issuance falls to just 40 million tokens, marking an 80% cut from the start.

This gradual but firm reduction in supply is the main reason analysts connect the project with potential. As fewer tokens are released at each stage, buyers face growing competition, which keeps valuation pressure moving upward.

Now operating in Stage 2, ZKP has already attracted strong inflows from users aiming to secure access before later stages arrive. With awareness expanding and supply tightening into 2027, the project stands out for its layered scarcity and AI-focused purpose, placing it among the best cryptos to buy today.

Market Snapshot

The recent weakness in Chainlink price and the steady strength shown in current Litecoin news reflect two very different market trends. Chainlink continues to trade under $10, facing strong bearish control, while Litecoin’s firm hold in the $55 to $60 zone is building confidence as RSI and MACD indicators turn more positive.

Against this backdrop, ZKP takes a different path through its structured presale auction and supply-driven design. With token availability shrinking across 17 stages and real AI privacy use at its core, ZKP blends scarcity with utility. This mix is why many now see it as the best crypto to buy today, ahead of the next stage transition.

Website: https://zkp.com/

Buy: https://buy.zkp.com

Telegram: https://t.me/ZKPofficial

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Top Crypto to Watch Today: BlockDAG, BCH, HYPE, XMR with Speed, Privacy, and Growth Focus

The last year has proven that digital assets can deliver strong returns across different sectors, from payments and privacy tools to decentralized finance. Still, with thousands of coins available, choosing which ones deserve attention can feel overwhelming.

Many market participants now look for projects that combine solid technology, long-term growth paths, and active market momentum. In this overview, we review several projects often discussed among the top cryptos to buy today, including established names like Bitcoin Cash (BCH) and Monero (XMR), the expanding DeFi platform Hyperliquid (HYPE), and the performance-focused newcomer BlockDAG (BDAG).

Whether you are building a long-term position or exploring new entries, understanding the core strengths of each project can help you assess opportunities before broader attention increases.

1. BlockDAG: Limited Entry Window Before Public Listings

BlockDAG operates on a DAG-based structure designed to process more than 10,000 transactions per second at launch. The architecture supports both high-speed payments and smart contract functions without reducing performance. This combination of throughput and automation places it in the high-performance category among newer networks.

Alongside its technical design, BlockDAG (BDAG) is running a final private allocation before exchange listings on February 16. The remaining allocation is priced at $0.00025, with full delivery to wallets on launch day and no vesting period.

Participants also receive nine hours of early trading access before public markets open. With the confirmed listing price set at $0.05, the difference between allocation and launch levels outlines a gap.

For those evaluating both infrastructure and timing, BlockDAG presents a structured opportunity. It is uncommon for a high-capacity network to remain available at an early stage pricing so close to the exchange debut. This blend of performance capability and limited entry timing positions BlockDAG among projects often discussed as a top crypto to buy today.

2. Bitcoin Cash: Efficient Payments with Defined Levels

Bitcoin Cash operates as a peer-to-peer digital currency focused on fast and low-cost transfers, positioning itself as a practical alternative to Bitcoin for everyday payments. At present, BCH faces resistance near $535. If buying pressure moves beyond that point, price could advance toward $562 and even $604, indicating upside potential. The $497 zone remains an important support level, as staying above it suggests stable sentiment.

BCH benefits from quicker block confirmations and lower fees compared to Bitcoin, which appeals to users seeking smoother transactions. Growing merchant usage and ongoing protocol improvements continue to support its role. For those reviewing payment-focused networks, BCH remains relevant when considering the top crypto to buy today.

3. Hyperliquid: Speculative DeFi Platform with Momentum

Hyperliquid is a newer and highly speculative asset drawing attention due to active community engagement and decentralized finance use cases. It recently moved above the $35.50 resistance level, reflecting renewed buying interest, although selling pressure remains present. If price holds above this area, the next potential target sits near $44, which could signal the end of the recent correction.

The ecosystem provides frequent opportunities for staking and liquidity participation, which can generate returns for holders. For market participants seeking higher volatility exposure, HYPE presents a risk-driven but opportunity-focused setup. The $28.79 support level remains important, as maintaining that floor may confirm continued upward structure.

4. Monero: Privacy-Driven Digital Asset

Monero is recognized for its privacy-focused design, offering transactions that remain untraceable. XMR currently finds support around $360, with resistance levels at $412 and $461.

A sustained move above the 20-day EMA could open the path toward $500, highlighting potential upside. Its strength lies in privacy features such as ring signatures and stealth addresses, which distinguish it from many other large-cap cryptocurrencies.

Interest in privacy assets has grown as regulation expands across traditional finance. For those evaluating networks with a clear functional niche, XMR combines strong technology and defined technical levels within discussions of the top crypto to buy today.

Final Perspective: Identifying the Top Crypto to Buy Today

Each of these projects carries distinct advantages. Bitcoin Cash focuses on efficient transactions and expanding merchant adoption. Monero delivers privacy and security for users who value confidentiality. Hyperliquid represents a high-volatility DeFi platform supported by active participation and staking options.

Among these options, BlockDAG remains a leading consideration when assessing the top crypto to buy today. Its DAG-based structure supports very high transaction throughput alongside smart contract capability. The ongoing private allocation allows early trading access with a defined difference compared to the confirmed listing level.

For those analyzing technology, scalability, and timing together, BlockDAG presents a structured early stage opportunity. With the private allocation closing in seven days before exchange listings begin, market participants continue to evaluate its positioning within the top crypto to buy today.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Teddy Abdelmalek: The Real Estate Executive Who Treats Student Residents Like Owners

How a student affairs background is reshaping property management philosophy at HH Red Stone

Most property management executives climb the ladder through acquisitions, finance, or operations. Teddy Abdelmalek took a different route, one that started as a residence hall advisor learning that leadership means service, not authority.

That unconventional background now informs how HH Red Stone approaches property management across 10,000 beds nationwide. As Senior Vice President of Business Development, Abdelmalek brings 25 years of experience that blends analytical training in biology and chemistry with deep expertise in student affairs, creating a perspective that challenges industry norms.

“In business, it’s easy to focus on numbers like occupancy, rent growth, or returns,” Abdelmalek observes. “But my student affairs background taught me to see the people behind the metrics. Every data point represents someone’s home, someone’s future, and someone’s experience.”

From Crisis Counseling to Property Performance

Abdelmalek’s journey began at the University of Missouri-Kansas City, where he served as a residence hall advisor while pursuing dual degrees in biology and chemistry. Initially planning medical school, he discovered an unexpected aptitude for working with students through challenging situations.

That experience crystallized during a late-night conversation with a resident he’d been supporting through a difficult semester. The student revealed he’d been battling thoughts of ending his life, and that regular check-ins had made the difference between withdrawing completely and finding reasons to stay.

“That conversation stayed with me,” Abdelmalek recalls. “It was the first time I truly understood how powerful human connection can be. Community isn’t a tagline. It’s what keeps people moving forward.”

That realization ultimately redirected his career from medicine to higher education, earning a master’s in Higher Education with an emphasis in Student Affairs. The combination of scientific analytical thinking and human-centered leadership would later prove invaluable in real estate.

Translating Campus Principles to Commercial Success

When Abdelmalek transitioned from higher education into off-campus student housing, he carried lessons that set him apart. At one struggling portfolio experiencing high turnover and low engagement, he rejected conventional wisdom about increasing marketing spend.

Instead, he returned to student affairs fundamentals: create belonging before chasing performance metrics. The property launched mentorship programs, leadership opportunities, and resident-driven initiatives focused on building genuine community.

“Within a year, renewals and satisfaction both increased,” he notes. “It was proof that when you put people first, results follow.”

This approach now defines HH Red Stone’s operating philosophy. After a decade managing exclusively its own portfolio, the company launched its third-party management vertical with a clear differentiator: treating every property as if residents, not just owners, are the ultimate stakeholders.

The “Residents Are Your CEO” Framework

Abdelmalek’s core philosophy centers on a simple observation about operator behavior. When ownership visits a property, teams spring into action. Every detail gets perfected. Staff are attentive and responsive. Properties get cleaned top to bottom.

“If we just use that level of attention with the people actually living on our property every single day, your properties would be elevated to such an extreme level,” he argues.

This isn’t metaphorical. HH Red Stone operationalizes this by emphasizing personal connection at scale. Staff are expected to know residents’ names, remember family details, and maintain genuine relationships. These aren’t nice-to-haves but key performance indicators.

“People like hearing their own name, the name of their pets, and if you know they have children, their sons and daughters,” Abdelmalek explains. “In student housing, it could be a brother, a sister, a family member. These small touches add substantial value to the asset.”

Selective Growth as Competitive Advantage

As HH Red Stone expands nationally, having recently closed on property near Yale University while signing new management agreements, the company has adopted what Abdelmalek calls “intentional selectivity.”

“We’ve walked away from management opportunities where we didn’t believe the fundamentals were in place for the property to truly succeed,” he reveals.

This discipline stems from recognizing that exceptional management can’t compensate for owners unwilling to invest appropriately in their assets. HH Red Stone seeks partners who understand strategic spending matters and who want accountability around controllable metrics: NOI, leasing velocity, and resident experience.

“We’re not going to take on properties just to collect a fee,” Abdelmalek states. “We’re looking for owners who think like we do, who understand that when the property succeeds, we both succeed.”

California’s Regulatory Experiment

Recent California changes to development rights near universities represent what Abdelmalek views as a potential inflection point for the sector nationally.

“California is effectively saying, if you’re building near a campus, we’re going to get out of your way,” he notes. “In a state known for regulatory complexity, that’s significant.”

Beyond the immediate impact on California markets, the policy creates a natural experiment other states will watch closely. If streamlined approvals lead to better buildings and stronger communities, expect similar reforms elsewhere, particularly targeting tier-two institutions and underserved markets.

“The winners won’t just be those who build fastest, but those who understand how to lease, operate, and differentiate their properties,” Abdelmalek predicts.

Technology as Enabler, Not Replacement

Regarding AI and automation proliferating across property management, Abdelmalek advocates clear boundaries based on where technology adds versus subtracts value.

“AI should take on mundane work that distracts from resident experience and interaction,” he argues. “Anything that helps with paperwork aspects not directly customer-facing, that’s where the value lies.”

The goal is creating what he calls “superhumans,” staff freed from administrative burdens to focus on the human connection that actually drives retention and satisfaction.

“Part of the reason residents live with us is because of something that makes them feel a certain way, whether it be our staff, our people, our maintenance,” he explains. “You don’t want to lose the hospitality aspect and make it all robotic.”

The Talent Investment Imperative

Reflecting on lessons from 2025, Abdelmalek emphasizes that people investment represents infrastructure as critical as physical assets.

“You have to give on-site talent a clear path forward and invest in their professional development,” he states. “It’s difficult finding good people. When you find them, you have to double down.”

This means pulling promising staff aside to explore whether property management could become a career rather than a transitional job. It means mentoring young professionals the way Abdelmalek himself was mentored into an industry he initially knew nothing about.

“I wasn’t going to go into student housing. I didn’t even know what student housing was,” he reflects. “But the mentors I surrounded myself with encouraged me to go down this route.”

Measuring What Actually Matters

For operators entering 2026, Abdelmalek’s advice centers on focusing energy where it creates measurable impact: be selective about partnerships, execute fundamentals with discipline, respond faster than competitors, invest in talent development, and remember that residents represent the business’s purpose, not just its revenue.

“When students and residents feel respected, your occupancy and NOI will follow,” he concludes. “That’s not a tagline. That’s the formula.”

In an industry often chasing innovation, this message offers both challenge and clarity. Excellence isn’t mysterious. It just requires treating people like they matter, and doing so consistently enough that they believe it.

Teddy Abdelmalek is Senior Vice President of Business Development at HH Red Stone, bringing 25 years of student housing and multifamily experience to property management strategy. HH Red Stone is the property management arm of HH Group, managing approximately 10,000 beds across multiple asset classes including student housing, multifamily, affordable, and mixed-use properties nationwide.

Best Cryptos to Watch Before 2027, Analysts Compare

Dubai, UAE, February 11, 2026

The crypto market in early 2026 is shifting away from hype driven speculation and toward utility focused projects. As the market looks ahead to 2027, investors are paying closer attention to new crypto protocols that offer clear use cases in DeFi, lending, and on chain finance rather than viral trends.

For investors working with a $500 crypto allocation, the choice is becoming more defined. They can remain in legacy meme coins that face strong resistance and slower growth, or rotate into emerging DeFi infrastructure projects with more room to expand. The positioning decisions made now are likely to shape which portfolios benefit most as the next crypto market cycle develops.

Shiba Inu (SHIB)

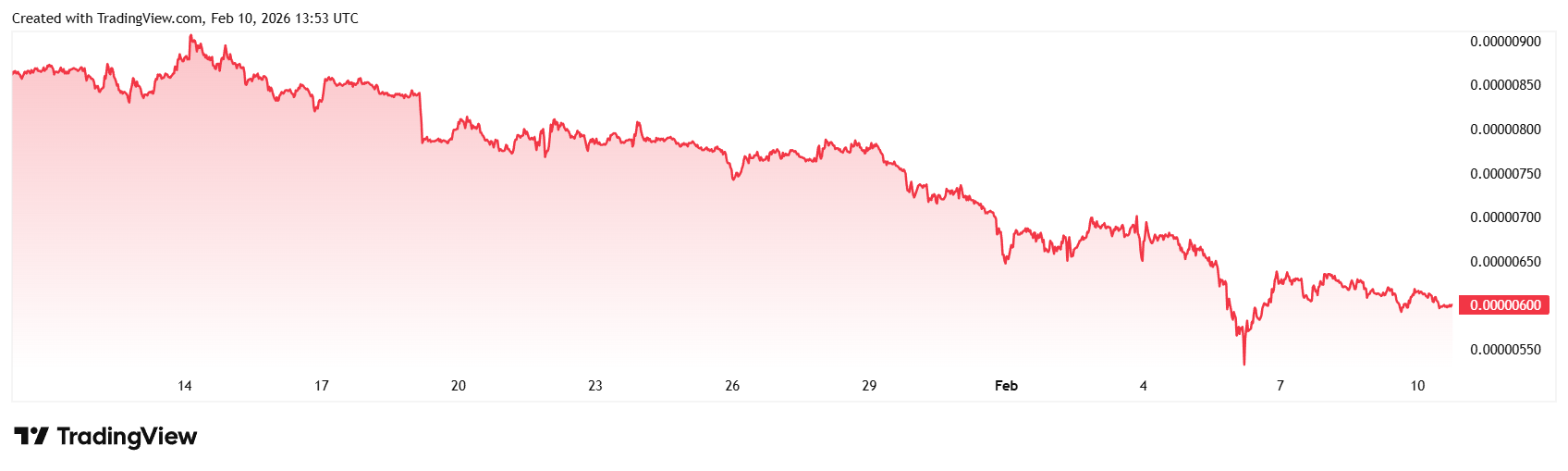

Shiba Inu (SHIB) remains a favorite for many, but its current technical setup suggests a difficult road ahead. As of February 10, 2026, SHIB is trading near $0.0000062 with a market capitalization of approximately $4 billion. Despite the efforts of the “SHIB Army,” the token is struggling to find the massive buying interest needed to replicate its past rallies.

The token is currently facing stiff resistance in the $0.0000069 to $0.0000072 range. These levels have repeatedly rejected price recovery attempts over the last several weeks. Some analysts have issued a bearish outlook for the mid-term. They predict that if SHIB fails to hold its support at $0.0000059, it could slide further toward $0.0000045.

Dogecoin (DOGE)

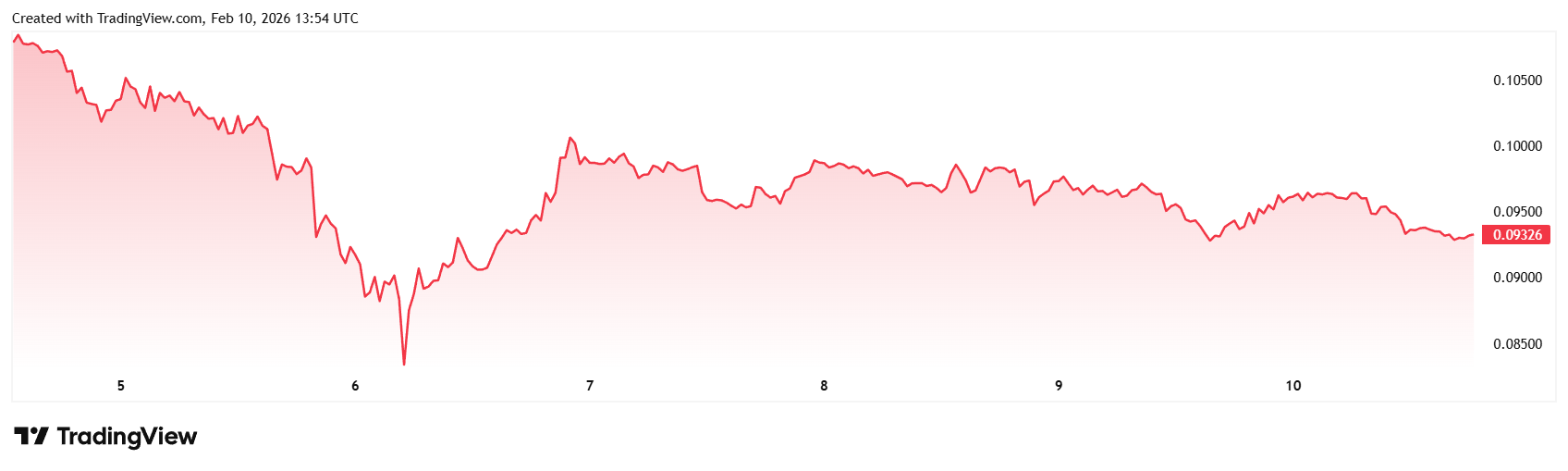

Dogecoin (DOGE) continues to hold its spot as the top meme coin by market cap, currently valued at roughly $15 billion. Trading at $0.09, DOGE has recently battled to stay above this psychologically critical level. However, a broader market downturn in early February saw Dogecoin hit new lows for 2026 as leveraged positions were liquidated across the board.

The resistance zones for Dogecoin are now firmly set between $0.12 and $0.15. Analysts note that the “hype-driven” catalyst that once fueled DOGE is fading in favor of utility-based projects. A bad price prediction for DOGE suggests a potential drop toward $0.07 if the current bearish pressure continues. For a $500 investment to see significant growth here, Dogecoin would need to add tens of billions in market cap, which many experts believe is unlikely in the current cautious climate.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is gaining attention as many legacy tokens struggle to regain momentum. Rather than relying on social media driven narratives, the project is focused on building non custodial lending infrastructure that allows users to access liquidity or earn yield without selling their crypto holdings.

A key part of the design is the mtToken system. When users lend funds through the protocol, they receive mtTokens, which act as yield tracking receipts. These tokens are designed to grow in value over time as borrowers repay interest, creating a utility driven alternative to passive holding. Alongside this structure, the project has reached notable presale milestones, raising over $20.4 million and attracting a community of more than 19,000 holders.

The MUTM token is currently in Phase 7, priced at $0.04, marking a increase from its initial price. A confirmed launch price of $0.06 provides a clear reference point as the project progresses. Development has also moved beyond planning, with the V1 protocol activated on the Sepolia testnet, allowing the community to test core features ahead of a full mainnet release.

The $500 Allocation: A Contrast in Potential

If you split $500 today, the potential outcomes look very different. A $250 investment in SHIB or DOGE buys a small piece of a massive, established supply. For that money to double, billions of dollars must flow into those specific coins. Because they are already multibillion-dollar assets, their “explosive” days are likely behind them.

In contrast, $250 in Mutuum Finance (MUTM) at the $0.04 price secures 6,250 tokens. By the time it hits its $0.06 launch price, that value rises Because MUTM is a cheap crypto utility project, it does not need billions to move its price. Analysts suggest that as the lending protocol gains users, a move to $0.20 or $0.25 is a realistic target. This would turn a $250 entry into over a return that legacy meme coins simply cannot match in 2026.

Scaling for 2027

The long-term case for Mutuum Finance is built on its roadmap for 2027. The project plans to launch a native, over-collateralized stablecoin. This will allow users to borrow a stable asset against their holdings with predictable costs. Furthermore, the move to Layer-2 networks is vital. By using Layer-2, Mutuum will slash transaction fees and speed up trades, making DeFi accessible to everyone, not just “whales.”

These plans are important because they solve the “liquidity fragmentation” problem that plagues current DeFi. By combining a working V1 testnet, professional security audits from Halborn, and a high 90/100 CertiK score, Mutuum is positioning itself as a top-tier infrastructure play. For those looking to maximize a $500 budget before 2027, the shift from “meme” to “utility” is becoming the most obvious move in the market.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Binance Coin (BNB) Market Cap Drops Below $100B Since February, Users Rotate Capital

Dubai, UAE, February 11, 2026

Binance Coin is facing renewed pressure as its market cap slips below $100 billion for the first time since February. After years of strong performance, BNB is showing signs of consolidation, prompting large holders to reassess their positions.

As momentum slows, crypto whales are beginning to rotate capital away from mature assets like BNB and toward newer cheap crypto opportunities with higher upside potential. This shift highlights how investor focus is changing as the market moves deeper into 2026.

Binance Coin (BNB)

Binance Coin (BNB) currently trades around $630, reflecting a sharp 19% retracement over the last week. With a market cap now hovering near $77 billion, the asset is feeling the weight of its own success. For BNB to see a return from these levels, its market cap would need to approach $1 trillion—a valuation that puts it in direct competition with the world’s largest traditional tech companies. This massive capital requirement acts as a “ceiling” for those seeking the explosive returns typically found in smaller projects.

Technically, BNB is battling significant resistance. The first major hurdle sits at $700, which has recently turned from a support level into a difficult ceiling. Further up, a much stronger psychological and technical wall exists at $800.

While technical analysts note that the $630 support zone may offer a temporary floor, the lack of immediate catalysts for a parabolic run has led many investors to look for lower-cost tokens. They are hunting for assets that have the same utility-driven foundations as BNB did in its early days but with the “asymmetric upside” that only a low-cap entry can provide.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is increasingly mentioned as capital rotates away from large, mature assets. The project is a decentralized, non custodial lending and borrowing protocol focused on building a structured financial system rather than relying on hype. Its design is centered on two planned models, Peer to Contract (P2C) and Peer to Peer (P2P), both still under development.

The P2C model is designed to use shared liquidity pools where users supply funds and receive mtTokens as yield tracking receipts. These mtTokens are intended to reflect earned interest over time once the system is fully live. For example, a pool targeting 7% APY would generate about 0.7 ETH per year on a 10 ETH deposit, assuming stable usage. This model is built for passive participation rather than active trading.

The P2P marketplace is planned to support direct agreements between borrowers and lenders. Users will be able to set custom terms, including interest structure and loan to value limits. For instance, a stable market could allow borrowing near 70% LTV, while more volatile tokens would require lower caps. Automated liquidation systems are designed to monitor positions and manage risk once deployed, helping maintain.

Presale Momentum and Verified Security

The rotation into Mutuum Finance is backed by impressive growth metrics. To date, the project has raised over $20.4 million and attracted a community of more than 19,000 individual holders. This wide distribution is a strong signal of trust, showing that the project is not controlled by a small group of insiders.

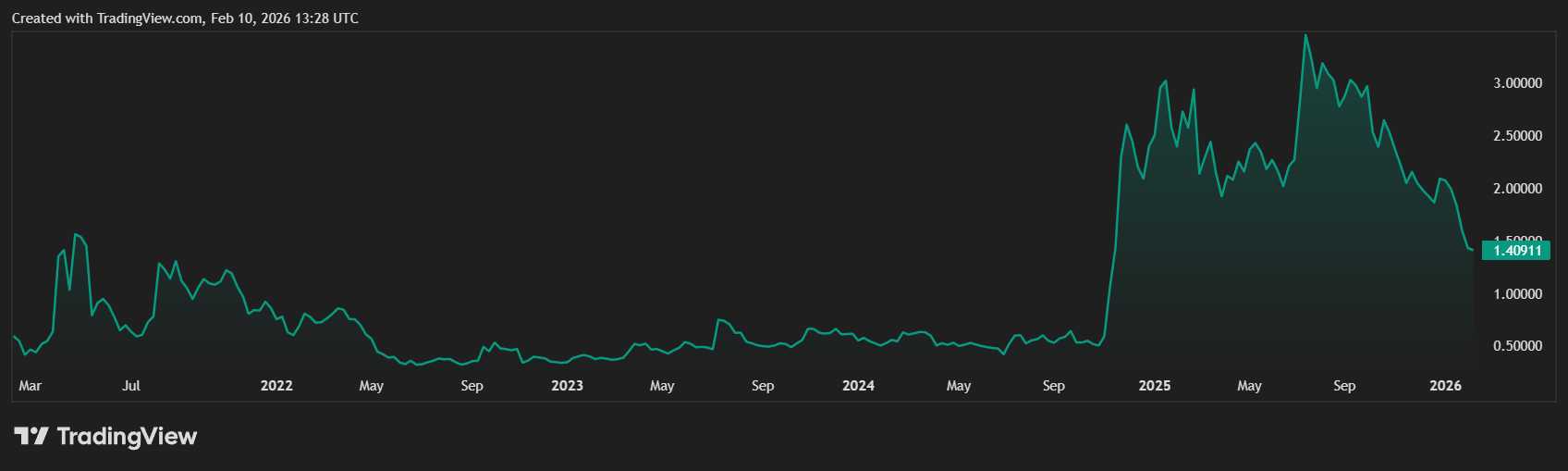

Phase 7 Status: The presale is currently in Phase 7, with the token priced at $0.04. This follows a steady 300% surge from its initial starting price of $0.01 in early 2025. With a confirmed launch price of $0.06, investors entering now are securing a 50% discount.

Advanced Security: Trust is reinforced by a successful independent audit from Halborn Security and a high 90/100 trust score from CertiK. To keep the code battle-tested, the team maintains an active $50,000 bug bounty program.

Engagement Incentives: To maintain energy, the project features a 24-hour leaderboard. Every day, the top daily contributor wins a $500 bonus in MUTM tokens, fostering a competitive and active community.

The Path Forward

The technical progress of Mutuum Finance has led many market analysts to model its growth path based on the success of past DeFi giants. With the V1 protocol already proving its functionality on the testnet, the focus has shifted to where the price could land as the project moves toward its full mainnet release and beyond.

With a confirmed launch price of $0.06, investors entering at the current $0.04 presale rate are looking at an immediate 50% appreciation relative to launch price. Analysts expect that as the platform moves from testnet to mainnet, the initial wave of adoption could drive the price toward a short-term target of $0.25 to $0.45 within the first few months of trading.

By the end of 2026, the planning of a native, over-collateralized stablecoin and Layer-2 scaling is expected to act as a primary multiplier. Several experts have issued a conservative 2026-2028 forecast of $1.28, representing a potential increase from the Phase 7 price. .

While these projections highlight the massive upside of a utility-driven play, it is important to remember that the crypto market remains volatile. However, with over 19,000 holders and a working protocol already in the testing phase, Mutuum Finance is providing the kind of fundamental top crypto evidence that often precedes a major valuation expansion.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Investors Debate XRP and BNB While a New Crypto Hits, Experts Break Down

Dubai, UAE, February 11, 2026

As investors continue to debate the long term outlook for XRP and BNB, attention is starting to shift elsewhere. Both assets remain top cryptocurrencies, but their size and maturity are leading many market participants to question how much upside remains in the current cycle.

At the same time, a new crypto has surged, drawing interest from analysts who track early stage momentum and capital rotation. This article breaks down why traders are reassessing established tokens like XRP and BNB, and what is driving growing interest in emerging crypto opportunities with higher growth potential.

Ripple (XRP)

Ripple (XRP) remains a cornerstone of the cross-border payment sector. As of early February 2026, XRP is trading in a range between $1.46 and $1.50. With a massive market capitalization exceeding $90 billion, it holds its position as one of the most established assets in the top ten. Its recent growth has been supported by over 75 global licenses and the successful launch of various institutional treasury platforms.

However, its massive size makes explosive percentage growth difficult. Technically, XRP is facing several heavy resistance zones that have capped its recent rallies. The first major hurdle is at $1.70, a level where selling pressure has consistently increased.

Beyond that, a much stronger psychological and technical wall exists at $1.97. While XRP offers stability and institutional trust, many investors are starting to realize that doubling a $90 billion market cap requires an astronomical amount of new capital, leading them to look for earlier-stage opportunities.

Solana (SOL)

Solana (SOL) was the breakout star of the previous cycle, known for its high-speed blockchain and early surges that turned modest investments into fortunes. Currently, SOL is trading around $85 to $88, with a market cap of approximately $48 billion. While it remains a favorite for developers, it is down significantly from its 2025 highs of over $250. Much of its current volume is tied to meme coin trading, which has introduced a level of volatility and risk that some long-term investors are now trying to avoid.

Because Solana has already seen its “mega-surge,” early participants are now looking for the next infrastructure play that hasn’t yet reached its peak. This is why many are now considering Mutuum Finance (MUTM). They see the same patterns of early adoption and technical delivery that Solana once showed, but at a much lower entry point. For those who missed the initial SOL run, MUTM represents a chance to get into a functional credit protocol before it hits the mainstream exchanges.

Mutuum Finance (MUTM)

Mutuum Finance is a decentralized lending protocol built to operate without traditional banks. It allows users to earn yield or access liquidity through smart contracts in a non custodial setup. The platform uses a dual market mechanism to serve different needs.

The protocol is designed around Peer to Contract (P2C) and Peer to Peer (P2P) lending models, both of which are still under development and being prepared for upcoming releases. The P2C model is intended to use pooled liquidity with variable APY that adjusts based on demand. For example, a pool targeting 5% APY would generate about $500 per year on a $10,000 deposit, assuming stable usage once live.

The P2P market is planned to allow custom lending agreements between users. Borrowing across both models is designed to be over collateralized, with loan to value ratios around 70%, meaning a user supplying $10,000 in collateral could borrow up to $7,000. This structure is meant to protect lenders and maintain system stability once the markets are fully deployed.

The response to this vision has been record-breaking. Mutuum Finance has officially raised over $20.4 million in funding, backed by a rapidly growing community of more than 19,000 individual holders. Currently, the project is in Phase 7 of its presale, with the MUTM token priced at $0.04. Since its initial launch at $0.01 in early 2025, the token has already seen a surge in value, proving that there is deep market interest in its utility-driven model.

Why XRP and SOL Investors Are Switching Focus

The primary reason veteran investors are moving capital into MUTM is the potential for asymmetric returns. Many believe that Mutuum Finance is following the same early steps as top-tier projects like Binance Coin (BNB) or Solana.

They are building a wide base of supporters and a functional ecosystem before the official launch. According to an official statement on X, the development team has already successfully activated the V1 protocol on the Sepolia testnet.

This V1 launch is a major milestone because it proves the code is functional. Users can now test the lending pools and the interest-bearing mtToken system in a live environment. For investors who have watched XRP and SOL hit their maturity phases, the chance to enter a project with a working protocol and a confirmed launch price of $0.06 is a highly attractive proposition. They see the $0.04 entry as a final window to secure a 50% advantage before the mainnet debut.

Verified Security and the Path to Launch

As Phase 7 continues to sell out rapidly, the project has ensured that its growth is backed by professional security standards. Mutuum Finance has successfully completed a full independent audit by Halborn Security, one of the most respected firms in the world. This audit verified the safety of the lending logic and the liquidation mechanisms.

To maintain community energy, Mutuum features a 24-hour leaderboard that rewards active participation. Every day, the top daily contributor receives a $500 bonus in MUTM tokens. With a fixed total supply of 4 billion tokens and nearly half of the presale allocation already sold, the supply is tightening. For those who missed the early days of XRP and SOL, Mutuum Finance is providing a rare opportunity to join a top crypto project just as its technology goes live.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com