Fintradix Introduces Multi-Layer Disclosure Framework as Market Demands Greater Transparency

Fintradix has announced the deployment of a multi-layer disclosure framework designed to strengthen platform transparency, enhance operational clarity, and support traders navigating increasingly complex digital-asset markets. The update arrives as global regulatory conversations, user expectations, and market volatility collectively place new emphasis on how platforms communicate risks, processes, and system behavior. With digital-asset adoption continuing to expand, Fintradix has prioritized building an infrastructure that delivers timely insights, predictable system performance, and verifiable operational consistency.

The announcement follows extensive internal review of communication workflows, data-access pathways, and system-status reporting. Aggregated findings from Fintradix reviews indicate that users consistently value structured transparency tools that clarify platform processes without overwhelming them with technical detail. The new framework is designed to meet that expectation by establishing a more coherent, multi-tiered approach to disclosures tied to trading operations, withdrawal flows, and market-sensitive platform activity.

Expanded Transparency Architecture to Support User Clarity

At the foundation of the update is a redesigned transparency architecture that consolidates operational information into structured, accessible layers. These layers include system-status indicators, processing-stage summaries, and network-condition explanations. The objective is to provide traders with the context they need to interpret timing, system load, and execution behavior without relying on guesswork or external tools.

The transparency framework also integrates dynamic communication signals that adjust in real time based on internal traffic patterns. During periods of elevated trading activity, for example, the interface automatically reflects updated timing ranges and processing conditions. This ensures that traders have relevant information aligned with live system behavior rather than generalized estimates. Feedback themes found across multiple Fintradix reviews highlight that real-time accuracy plays a central role in building user confidence, particularly during episodes of market acceleration.

To support ongoing visibility, Fintradix has expanded its internal audit-trace modules. These modules record operational decisions, routing logic, and system responses to traffic fluctuations, enabling consistent evaluation of performance standards. While the audit trail remains internal, it informs the reliability of the user-facing indicators that form the backbone of the new disclosure framework.

Strengthened Infrastructure to Support High-Volume Market Conditions

Complementing the transparency upgrades, Fintradix has enhanced the underlying system architecture to support withdrawals, order execution, and data-feed distribution during high-volume market conditions. Traditional infrastructures often encounter strain when user activity rises abruptly, creating timing inconsistencies. Fintradix’s revised engine uses parallel processing lanes and adaptive resource allocation to prevent bottlenecks and preserve stable execution patterns.

The new architecture also incorporates early-stage anomaly detection that evaluates request patterns for irregularities, allowing corrective adjustments to occur before processing slows. This plays a crucial role in preventing cascading delays during heavy traffic cycles. Stability-focused improvements such as these echo insights found in consolidated Fintradix reviews, where traders emphasize the importance of consistent behavior during both routine and unpredictable market shifts.

Real-time routing logic further reinforces operational dependability by automatically shifting execution or withdrawal requests to alternate pathways when load thresholds are met. This ensures continuity during periods of heightened demand, enabling users to reposition capital efficiently even when market activity becomes erratic.

Scalable Framework Built for Evolving Digital-Asset Participation

Fintradix developed its multi-layer disclosure framework with long-term scalability in mind. As trading ecosystems expand and new asset types emerge, platform infrastructure must adapt to new verification, settlement, and routing requirements. The system’s modular structure allows additional transparency layers, analytics channels, and operational indicators to be introduced without disrupting existing functionality.

Automated scaling tools adjust system resources based on real-time market conditions, ensuring stable performance whether the platform is experiencing routine traffic or sudden surges driven by news events. This adaptability supports user stability across a wide spectrum of trading environments. Patterns consistently documented in broader Fintradix reviews show that scalability is a defining performance expectation for traders who operate across multiple liquidity pools and asset classes.

The scalable framework also positions Fintradix to integrate future enhancements to risk reporting, operational insight modules, or regulatory-driven transparency requirements. As digital-asset markets mature and expectations increase for timely, structured data, the platform’s architecture is engineered to evolve without requiring disruptive redesigns.

Resource-management features embedded within the system also play a central role in supporting long-term performance. By distributing computational tasks intelligently, the system prevents saturation of any single component and preserves processing coherence during intense market conditions.

Reinforced Reliability Through Structured Disclosure and Operational Precision

The introduction of the multi-layer disclosure framework reinforces Fintradix’s long-standing emphasis on system reliability. Each transparency feature has been developed to present traders with information that reflects operational reality while maintaining the neutrality required for an analytical trading environment. This includes structured timing indicators, verification-stage summaries, and transaction-flow insights that help users interpret market interactions clearly and accurately.

Reliability enhancements also extend to risk-monitoring systems that evaluate processing speed, routing patterns, and metadata consistency. When deviations occur, automated adjustments help maintain performance alignment with expected timing windows. This ensures that transparency signals remain accurate even as underlying traffic conditions fluctuate. The focus on risk-informed reliability is consistent with themes across recurring Fintradix reviews, where traders outline the importance of platforms that maintain operational discipline under stress.

Dynamic load-balancing mechanisms also help preserve consistency by redistributing processing responsibilities during high-demand cycles. This reduces timing variance and prevents temporary congestion from disrupting the overall user experience.

The multi-layer disclosure framework is positioned not only as a communication enhancement but also as a structural upgrade designed to support long-term platform resilience. By combining detailed visibility tools with robust infrastructure, Fintradix provides users with an environment that supports informed decision-making and predictable system behavior across evolving market conditions.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

Crown Point Capital Introduces Accelerated Withdrawal Engine as Traders Prioritize Faster Capital Mobility

Crown Point Capital has announced the deployment of a new accelerated withdrawal engine designed to improve transaction completion speed across its crypto trading platform. The launch arrives during a period of heightened volatility, where traders increasingly rely on rapid fund movement to reposition capital across fast-changing market conditions. With demand rising for predictable settlement cycles, the company has focused on building a system that reduces latency, strengthens processing stability, and reinforces user confidence in withdrawal timing.

The initiative reflects a broader shift occurring across the digital-asset industry. As markets expand and trade volumes surge, the reliability and predictability of transactional pathways have become key differentiators among trading platforms. Crown Point Capital’s new withdrawal engine was developed to address those expectations by integrating automation, streamlined verification logic, and real-time adaptive routing. These capabilities support users who require efficient access to their capital without compromising operational safeguards.

Streamlined Verification Architecture to Support High-Volume Trading

At the core of the update is a redesigned verification architecture built to minimize unnecessary processing steps while maintaining rigorous oversight of each request. The system uses a multi-tiered validation structure that separates routine checks from more complex security assessments. This helps reduce bottlenecks during periods of elevated activity and allows the engine to process withdrawals in parallel lanes rather than a single sequential queue. Internal operational assessments and aggregated findings from Crown Point Capital reviews indicate that consistency in timing is among the most valued attributes for active traders, particularly during rapid market swings.

The engine’s adaptive routing model plays a central role in achieving these improvements. By monitoring real-time network conditions, the system identifies the fastest available path for each withdrawal request. If congestion begins forming in any segment of the processing pipeline, the engine automatically redistributes load to secondary pathways, reducing interruptions and stabilizing overall throughput. This automation also reduces the dependency on manual verification, which traditionally causes delays during periods of high demand.

Complementing these components is a new prioritization protocol that manages request flow based on traffic density. Instead of processing withdrawals in a rigid order, the engine evaluates multiple variables simultaneously, including network saturation, internal queue volume, and processing cost. This helps maintain steady performance even when trader activity accelerates unexpectedly. The combination of load management, parallel verification, and adaptive routing contributes to a more predictable experience for users navigating active trading conditions.

Greater Transparency and User Visibility Across the Withdrawal Lifecycle

The new withdrawal engine is accompanied by an expanded visibility layer that maps the full lifecycle of a transaction. Users can view each stage of the process through an updated interface that displays confirmation, validation, processing, and release checkpoints. This level of transparency is designed to reduce uncertainty and help users better understand the flow of capital during high-activity periods. Feedback reflected in several Crown Point Capital reviews emphasized the importance of clarity around processing milestones, prompting the platform to develop a more structured and informative visibility model.

Beyond user-facing tracing tools, Crown Point Capital has also restructured its internal audit framework to improve accuracy and early-stage detection. Each request now generates a verifiable record comprising timestamps, integrity checks, and automated routing outcomes. These records are used internally to validate process integrity and identify any deviations from expected performance. While not directly exposed to users, these audit improvements support overall system reliability and help ensure each withdrawal follows a consistent operational pathway.

The emphasis on transparency extends to status communication during peak hours. When the system detects elevated load or potential processing delays, the interface provides contextual timing estimates rather than static or generic notifications. This helps users understand timing changes within the broader context of market volatility and overall transactional heat. The goal is to provide clear, predictable information rather than abstract indicators that leave users uncertain about their pending withdrawals.

Scalable Infrastructure Aligned With Growing Digital-Asset Participation

Crown Point Capital’s accelerated withdrawal engine has been built with scalability as a core requirement. The company anticipates continued growth in digital-asset trading, both from individual participants and institutional actors. To meet these evolving demands, the system’s architecture is designed to expand computational capacity dynamically as transaction density increases. Operational studies and industry-facing Crown Point Capital reviews highlight that scalability is no longer limited to handling higher volumes; it also requires maintaining consistent timing as more complex assets, trading strategies, and liquidity movements emerge.

The system employs modular components that allow new processing extensions to be integrated without disrupting ongoing workflows. This design enables the platform to adapt to regulatory shifts, new verification requirements, or asset-specific settlement rules over time. Crown Point Capital expects this modularity to be essential as digital-asset markets mature and trading ecosystems become more interconnected across multiple exchanges and liquidity pools.

Resource orchestration tools also help balance workload distribution across internal subsystems. When sudden surges in activity occur, the platform automatically allocates additional capacity to withdrawal processes to preserve timing consistency. This helps prevent the latency spikes typically seen in older infrastructure models. These functions collectively reinforce the platform’s ability to deliver efficient withdrawals during a variety of market cycles, from calm periods to high-intensity trading phases.

Reinforcing Reliability Through Stability, Automation, and Risk-Aware Design

The accelerated withdrawal engine reflects a sustained commitment to infrastructure reliability. Each component of the system is designed to maintain performance without sacrificing accuracy or risk controls. Automated conflict resolution plays a major role, resolving common processing errors before they cause delays. This reduces friction while strengthening internal consistency for users operating across rapidly shifting markets.

In addition, the company has embedded enhanced anomaly-detection tools early in the processing pipeline. These tools compare transaction metadata against expected behavior patterns, ensuring irregular activity is identified quickly. Such protections support the reliability themes consistently noted across cumulative Crown Point Capital reviews, where traders emphasize the need for platforms that balance speed with stringent operational safeguards.

Dynamic load balancing further supports stability during liquidity fluctuations. When capital flows intensify, the system redistributes processing weight to ensure that withdrawal performance remains steady. This helps users reposition funds smoothly, even during conditions where market movements require rapid decision-making. The update therefore functions not only as a speed enhancement but also as a reinforcement of foundational infrastructure standards.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

ScandIndex Deploys High-Throughput Settlement Layer as Digital-Asset Volumes Accelerate

ScandIndex has announced the rollout of a high-throughput settlement layer designed to enhance withdrawal consistency, improve transaction visibility, and support traders navigating increasingly active digital-asset markets. The update arrives at a time when global crypto trading volumes continue to expand, prompting users to seek platforms that deliver predictable timing, stable execution, and robust operational safeguards. With liquidity movements becoming faster and more complex, ScandIndex has focused on refining its infrastructure to support real-time trading conditions.

The new settlement layer represents the latest phase in the company’s ongoing effort to align system architecture with long-term market evolution. Internal assessments and user-behavior patterns observed across cumulative ScandIndex reviews reveal a recurring expectation: traders want reliable withdrawal timing, transparent status information, and uninterrupted performance during high-intensity cycles. The updated framework is built to meet these expectations while preparing the platform for continued growth across expanding digital-asset ecosystems.

Streamlined Processing Architecture for High-Velocity Trading

At the center of the upgrade is a reengineered verification pipeline designed to handle large volumes of withdrawal requests without compromising precision. Traditional sequential processing systems often introduce delays during periods of heavy demand. ScandIndex’s revised architecture instead uses parallelized validation lanes that execute multiple checks simultaneously, reducing congestion and stabilizing throughput.

The platform incorporates an adaptive resource-distribution model that evaluates internal traffic conditions in real time. When specific routes experience increased load, the system automatically reallocates processing power to maintain steady timing. This capability is particularly important for users who manage multiple positions and require dependable timing to move capital between assets. Performance patterns reflected in recent ScandIndex reviews emphasize that such adaptability significantly improves overall user experience, especially in rapidly shifting market conditions.

Another component of the upgrade includes early-stage anomaly detection that evaluates metadata patterns associated with each transaction. By identifying irregularities at the earliest point in the workflow, the system reduces reliance on manual verification and minimizes timing disruptions. These automated corrections contribute directly to maintaining consistency and preventing delays caused by verification conflicts during high-volume periods.

Enhanced Transparency to Improve User Visibility and Strategy Planning

ScandIndex has introduced an updated transparency layer designed to give users a clearer understanding of their transaction’s position within the settlement lifecycle. The enhanced dashboard presents structured milestones including confirmation, validation, routing, processing, and release. This structured visibility helps traders monitor the status of their withdrawals with greater confidence, particularly during volatile periods when timing precision influences strategy execution.

The transparency model also includes refined real-time communication tools that adjust estimates based on internal load patterns. Instead of issuing generic notifications, the platform provides contextual timing projections that reflect actual system behavior. This approach ensures that traders receive useful, actionable information without inflating expectations. Insights gathered through multiple ScandIndex reviews indicate that users prefer detailed timing indicators that explain not just when a withdrawal will clear, but why timing may shift during peak activity.

Internally, ScandIndex has expanded its audit-trace system to document validation timelines, routing decisions, and operational outcomes. These records support continuous performance evaluations and help the platform maintain integrity across high-frequency trading sessions. While the audit logs are not publicly available, they reinforce the platform’s commitment to accountability, accuracy, and structured workflow management.

The enhanced transparency framework also benefits traders operating diversified portfolios. By understanding settlement timing more clearly, users can plan capital redeployment more effectively, reducing uncertainty while executing time-sensitive strategies. The visibility improvements therefore function as both an informational tool and a strategic support mechanism.

Scalable Infrastructure Prepared for Long-Term Market Expansion

The newly deployed settlement architecture has been engineered with scalability as a guiding principle. As digital-asset participation increases and new trading instruments enter the market, platforms must process higher volumes without sacrificing performance accuracy. ScandIndex’s modular infrastructure allows the system to expand computational capacity dynamically in response to rising usage patterns.

Automated scaling mechanisms increase throughput during peak activity, preserving steady withdrawal performance across different types of trading environments. Observations documented across cumulative ScandIndex reviews highlight that users evaluate a platform’s reliability based not only on everyday activity but also on its stability during market surges. The new architecture addresses this expectation directly by distributing processing efficiently and preventing congestion.

The modular design also positions the platform to adapt to future developments such as altered verification rules, new asset classes, or evolving regulatory requirements. Additional monitoring layers, routing extensions, and integrity-validation tools can be added without interrupting existing workflows. This flexibility ensures that the system remains operationally current and resistant to technological obsolescence as the digital-asset landscape matures.

ScandIndex’s load-orchestration model plays an additional role in maintaining long-term stability. By distributing processing tasks intelligently across internal subsystems, the platform prevents oversaturation and ensures that no single component becomes a bottleneck. This supports consistent settlement timing even when liquidity movements intensify across markets.

Reinforced Reliability for Rapid and Complex Market Cycles

The high-throughput settlement layer reinforces reliability through structured verification stages, automated risk-screening tools, and intelligent routing logic. Each withdrawal request undergoes multi-layer evaluation to ensure operational accuracy before progressing to release. This multi-tiered approach supports stability across rapid market cycles when large capital shifts occur within compressed time windows.

Real-time monitoring tools evaluate throughput conditions and detect anomalies that could cause disruptions. When performance deviations occur, the system applies automated corrective actions to maintain consistent timing. This reduces delays caused by routing conflicts or timing mismatches and supports users who rely on precise fund movement across multiple markets. The importance of such stability is consistently reflected throughout extensive ScandIndex reviews, where traders emphasize the need for platforms that maintain reliability even during unpredictable conditions.

Dynamic load-balancing mechanisms further contribute to system stability by redistributing work when certain processing lanes experience heavier demand. This ensures a consistent settlement pace even during peak trading sessions. The settlement framework is therefore positioned not only as a speed improvement but also as a foundation for long-term operational resilience.

By combining automation, structural discipline, and scalability, ScandIndex has developed a settlement model capable of supporting both current and future market demands. The update reflects the company’s commitment to building an infrastructure that can maintain stability and precision across evolving digital-asset environments.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

Bitcoin Price Prediction: Analysts Warn Of A Short-Term Dip Before Altcoins Like Remittix, WLFI Explode

The latest Bitcoin Price Prediction discussions centre on a potential short-term dip that could reset the board for altcoins. Analysts note that while open interest and hedging have risen, signaling caution, a temporary pullback could free up capital for faster-moving tokens.

That backdrop keeps WLFI in focus for near-term momentum and Remittix (RTX) on radar as a utility-first payments play.

Bitcoin Price Prediction: Support Levels And Short-Term Dip Risk

Bitcoin (BTC) trades around $105,000, supported by a market capitalisation of over $2 trillion and daily turnover exceeding $74 billion. The range between $104,000 and $111,000 remains intact, with $112,000 as resistance and $104,000 as support.

Some momentum indicators show cooling, while others hint that this may be a pause before a renewed uptrend. Still, analysts this week warned of whale selling pressure and seasonal weakness, citing options positioning that could hold the market heavy in the near term.

Analysts agree that a controlled correction could improve the setup later by flushing leverage and reloading interest closer to the $100K–$104K zone.

WLFI Gains Traction On Headlines And High-Beta Flows

World Liberty Financial (WLFI) has captured short-term trader interest after a burst of positive coverage and ecosystem updates. Reports highlight strong single-day gains, volume spikes, and a clear break of a recent downtrend, signaling renewed momentum.

WLFI’s media cycle has focused on its governance model and upcoming milestones, both of which have drawn speculative capital looking for rotation targets. For traders, WLFI now functions as a beta play, a coin that can move faster than Bitcoin once the larger market stabilizes.

If BTC dips briefly, WLFI could benefit from a rotation wave as risk appetite rebounds and traders look for fresh narratives.

Remittix Is The Payments Token For The Post-Dip Market

While WLFI and other high-volatility names depend on short-term momentum, Remittix is designed to build lasting value through real-world utility. Its focus is on global remittances and cross-border payments, a market worth nearly $19 trillion annually.

Unlike speculative cycles, Remittix delivers a working product, a crypto-to-fiat hub that enables users and merchants to send funds directly to bank accounts. This model positions RTX as a “PayFi” leader, combining blockchain technology with the stability of real payment infrastructure.

The Remittix team is fully verified by CertiK and ranks #1 for Pre-Launch Tokens on Skynet, with an 80.09 Grade A trust rating. More than 684 million tokens have been sold at a live price of $0.1166, raising over $28 million. Listings at BitMart and LBank are already confirmed, with a third major CEX reveal expected as funding approaches the $30 million milestone.

Here Is What Stands Out About Remittix:

- Built for borderless payments with global reach

- Send crypto to real bank accounts in seconds

- Supports many cryptocurrencies and multiple fiat currencies at launch

- Real-time FX conversion with transparent rates

- Audited by CertiK with team verification and ongoing monitoring

Position For The Dip And The Surge

Short-term weakness often sets the stage for stronger runs. If Bitcoin experiences a brief correction and then reclaims key resistance, liquidity tends to spill into altcoins with clear stories.

In that scenario, WLFI can ride speculative momentum, while Remittix offers a more measurable use case. For investors, pairing a core Bitcoin position with a focused payments asset like Remittix combines market exposure with practical utility, creating a balanced way to play the next cycle’s rebound.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

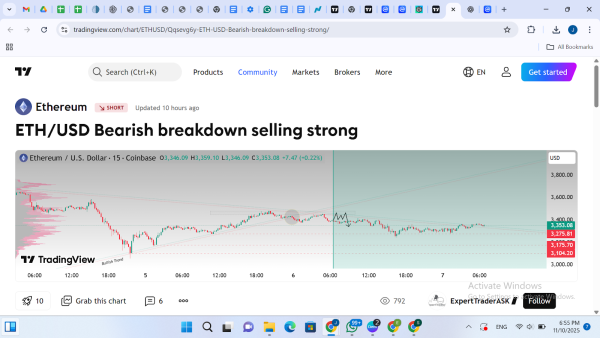

Ethereum Price Prediction: The Odds Turn Bullish As Whale Wallets Accumulate $1.3B In ETH

The Ethereum price prediction is turning positive again as on-chain data confirms that whales have accumulated over $1.3 billion worth of ETH in the past two weeks. This surge in wallet inflows hints that large investors are positioning for a big move toward $4,800.

Meanwhile, Remittix, a PayFi project merging DeFi and traditional finance, has become a favorite among Ethereum whales after raising more than $28 million through the sale of 684 million tokens at $0.1166 each.

Ethereum Price Prediction: Whales Fueling the Next Bull Run

Ethereum is trying to recover after a bearish month and currently trades around $3,540 with the nearest resistance at $3,800. Analysts opine that breaking out of this scale would open up to $4,400 or even $5,000. According to Ali Martinez, whales have redistributed their holdings, indicating that huge ETH holders are purchasing dips similar to the 2020 pre-bull market.

There is an overall positive Ethereum price prediction because institutional support levels are back, and network utility is on the rise. According to analysts, the continued accumulation of the whales, coupled with the future optimism of post-halving, may drive ETH to new highs by the beginning of 2026.

Nonetheless, lack of a decisive break above $3,800 might result in a retracement to the support zone at $3,400 which may result in another dip around $3,197 before another rise.

Remittix: The PayFi Powerhouse Backed By Growing Confidence

While Ethereum whales accumulate ETH, many are also diversifying into Remittix, recognizing its potential to reshape digital payments. The project confirmed two centralized exchange listings, with two additional ones already secured for future rollout. It has also completed full KYC verification with CertiK and achieved the #1 Pre-Launch Token ranking on CertiK Skynet, solidifying its credibility among investors.

The Remittix Wallet has been in beta testing, enabling live crypto-to-fiat transactions with strong community feedback. The upcoming Web App will take this further, connecting businesses and individuals worldwide through instant, low-cost transfers.

Why investors are turning to Remittix

- Wallet beta launched, allowing crypto-to-bank transfers in real time

- Cross-border payments are completed in seconds with low fees

- BitMart and LBank centralized exchange listings are confirmed, with additional top-tier listings in the queue.

- Merchant plugins reduce integration time so businesses can accept crypto and receive fiat seamlessly.

- The token was built for real payments, not speculation, with clear utility from day one.

Why Remittix Could Outpace Ethereum in 2025

While the Ethereum price prediction signals bullish potential, Remittix is rapidly scaling into a practical payments solution. With whales showing interest and products nearing global rollout, RTX could be the smart play for investors seeking both growth and real-world use. In a year defined by DeFi innovation, Remittix may just emerge as the project that bridges crypto adoption with everyday finance.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Stellar Goes Sideways: Why BullZilla May Be the Top Crypto Now

Ever wonder if crypto investing feels like a high-stakes Black Friday rush, where everyone’s scrambling to grab the best deals before the doors close? The market seems to echo that same chaotic energy lately. Bitcoin is steady, but beneath the surface, altcoins are making sharp, telling moves. Binance Coin (BNB) is currently down 2.49% in the past 24 hours, while Stellar Lumens (XLM) has inched up 0.62% during the same period. These contrasting trends highlight a subtle shift in market sentiment: major coins consolidating after strong runs, while smaller, utility-driven projects are starting to reclaim investor attention amid searches for the next breakout narrative.

Meanwhile, a new contender is quietly claiming its place among the best cryptos to buy today, BullZilla ($BZIL). Dubbed by many as the top crypto now, BullZilla stands out with its powerful mix of tokenomics and community-driven momentum. Its progressive presale price engine ensures early buyers gain a head start, while the 24-stage burn mechanism gradually reduces supply, fueling scarcity and long-term value. Add in a multi-tier staking program that rewards holders for loyalty, and you get a project designed for both stability and explosive growth. BullZilla isn’t just another meme coin; it’s a hybrid model of innovation, utility, and investor-first strategy.

Binance Coin (BNB): Stability Holds as Traders Rebalance

The live BNB price today hovers around $985.80 USD, with a 24-hour trading volume of roughly $2,754,221,259 USD. It is trading down 2.49% on the last day. While volatility persists, Binance Coin’s structure remains fundamentally bullish: fully circulating supply, integrated utility across the Binance ecosystem, and regular burns that reduce supply pressure. That said, price dips like this reflect broader market consolidation, where even anchors aren’t immune to profit-taking. For investors seeking a relatively stable yet still growth-oriented coin, BNB offers proven infrastructure, deep liquidity, and exchange-token advantages rather than speculative upside. In short, it leans more toward “stability” than “sky-rocket” in this phase.

Frequently Asked Questions about Binance Coin

What drives Binance Coin’s price?

The price of Binance Coin is driven by its utility on the Binance exchange platform, staking and burn mechanisms, network usage on BNB‐Chain, and overall crypto market sentiment. It benefits from high liquidity and ecosystem adoption.

Is Binance Coin suitable for long-term holding?

Yes, Binance Coin can serve a long-term holding option given its established role in exchange operations, developer ecosystem and deflationary supply model. However, as with all cryptos, volatility and smart-contract risks remain.

BullZilla ($BZIL): The Top Crypto Now Lighting the Path to Financial Freedom

BullZilla ($BZIL) is redefining what it means to invest in the top crypto now, turning memes into real financial opportunity. For Gen-Z investors dreaming beyond the 9-to-5 grind, this project feels like a movement. With its 24-stage presale, deflationary burns, and staking rewards, BullZilla empowers holders to chase what truly matters, financial freedom, global travel, or owning that dream home. It’s not just about buying a token; it’s about buying time, choice, and independence. In a market where hype fades fast, BullZilla stands as a structured, community-powered path toward wealth creation, and possibly, a once-in-a-lifetime shot at prosperity.

Could 25k Turn Into a Windfall?

At Stage 10A, BullZilla’s token price of $0.00024573 presents an opportunity that blends timing, value, and momentum. A investment at this price secures 101.7 million $BZIL tokens. Once the token lists at $0.00527141, that holding would be worth an estimated a gain of more What makes this scenario so compelling is its positioning: late enough to skip the earliest volatility, yet early enough to maximize pre-listing leverage. Even if the market softens by 25–30% post-listing, the returns remain substantial, showing the strength of BullZilla’s price curve. This stage doesn’t just offer early access, it rewards patience, planning, and conviction.

How to Join the BullZilla Presale

To join the BullZilla presale, first set up a compatible Web3 wallet like MetaMask or Trust Wallet and fund it with ETH or USDT, ensuring you have enough to cover gas fees. Then visit the official BullZilla presale page and connect your wallet. Choose your preferred payment asset (ETH or USDT), enter the amount you want to invest, and confirm your purchase, keep in mind the token price increases by roughly 4.37% with each new stage. You can also use a referral code to earn around 10% bonus tokens. Tokens are claimable according to the project’s TGE and vesting schedule. Pro tip: always verify the contract address and use official links..

Frequently Asked Questions about BullZilla Presale

What is the current BullZill Presale Price?

The BullZill Presale Price (for $BZIL) is currently around $0.00022573 per token in Stage 10, with pricing increasing by $0.00022573 per token for every $100K raised or every 48 hours.

What’s the BullZill Presale Price Prediction?

The BullZill Presale Price Prediction projects a listing price near $0.00527, implying potential gains of over 2,000% if demand and execution align, although this is speculative.

Will BullZill Presale be Listed on Coinbase?

There is no confirmed BullZill Presale on Coinbase at this time. Token listing venues remain subject to change and should be verified with official BullZilla announcements.

Why Presales Like BullZilla Offer Life-Changing Potential

Crypto presales offer early investors a unique advantage, access to discounted prices, bonus allocations, and amplified returns as demand grows. BullZilla ($BZIL) elevates this concept through its 24-stage Progressive Price System, which increases value with each completed round, rewarding early participation while promoting long-term stability. Each stage introduces scarcity via deflationary token mechanics, ensuring a consistent upward price movement. Paired with staking rewards, referral incentives, and transparent tokenomics, BullZilla’s structure is designed for lasting momentum rather than fleeting hype. It embodies a presale built on strategy, sustainability, and smart growth, a project engineered to turn early conviction into exponential long-term value.

Stellar (XLM): Quiet Strength as Cross-Border Payments Surge

Stellar (XLM) trades at about $0.296721 USD, with a 24-hour trading volume near $312,257,231 USD, and is up 0.62% in the last 24 hours. Stellar’s appeal lies in its dominance in transaction fees, enterprise use in remittances, and developer traction through the Stellar Development Foundation and partner networks. Compared with high-risk presales, Stellar offers a meaningful utility story: fast cross-border payments, tokenized assets, and a mature ecosystem with 32 billion XLM in circulation. While the upside may be more moderate than for speculative coins, the value proposition is stronger when viewed through the lens of network revenue and real-world adoption rather than pure hype.

Frequently Asked Questions about Stellar

What is Stellar’s primary use case?

Stellar is designed primarily for fast, low-cost cross-border payments and asset tokenization, supported by a strong foundation for institutional and retail use through its consensus network and development partnerships.

Does Stellar offer staking or rewards for holders?

Stellar currently does not offer the same staking rewards model as some newer tokens; its value relies more on network transaction volume, ecosystem partnerships and usage rather than high APY incentives.

Final Take: Where Stability Meets the Top Crypto Now

In this moment of cryptocurrency market recovery, Binance Coin and Stellar represent two ends of the spectrum: BNB offers exchange-ecosystem strength and proven stability, while Stellar offers utility-driven velocity in payments and asset tokenization. Both are foundational pieces in the current macro trend. Meanwhile, BullZilla steps into the arena as an opportunity-rich play, the top crypto now for investors willing to accept higher risk for higher returns. With its progressive presale, staged pricing mechanism, and reward-driven model, it offers a sharp contrast to the more mature coins. The takeaway: if one seeks stability, BNB and XLM deliver; but for those hunting outsized returns and willing to embrace volatility, BullZilla could lead the next bull-wave.

Don’t wait – explore BullZilla’s presale now before the price climbs again!

For More Information:

Follow BZIL on X (Formerly Twitter)

Article Summary

This article provides an in-depth comparison between Binance Coin (BNB), Stellar (XLM), and the emerging presale project BullZilla ($BZIL). It examines how BNB maintains strength through exchange-driven utility and regular burns, while Stellar continues to expand its global payment influence with real-world adoption. In contrast, BullZilla stands out as a bold contender in the meme coin sector, blending deflationary mechanics, staking rewards, and community growth. Together, these three represent the spectrum of crypto investing, from stable infrastructure plays to speculative innovation, making BullZilla a strong candidate for those seeking the next crypto opportunity.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Why Great Design Could Decide the Future of Small Businesses in 2026Introduction: A Crisis of Communication

In the fast-changing world of small business, where competition grows daily and consumer attention shrinks by the second, design has quietly become one of the most important tools for survival — yet it’s also the most misunderstood.

Recent studies in the UK’s SME sector have revealed something worrying: a large percentage of small business owners believe they’re “doing marketing,” but in reality, they’re failing at it without even realising. They’re spending on ads, updating their social media, maybe even running promotions — but their visual communication doesn’t connect.

Their brands lack consistency. Their websites look outdated. Their presentations and social posts don’t align. And in a marketplace where consumers make judgments within seconds, poor design can kill credibility before a customer even reads the offer.

Bristol-based creative agency creativenova says this silent problem is more common than most realise — and the cost of ignoring design is getting higher every year.

The Hidden Problem: Most Small Businesses Don’t Have a Design Strategy

Ask most small business owners about their marketing efforts, and you’ll likely hear about their Facebook ads, networking events, or new website. But very few talk about design as a strategy.

Design isn’t just the wrapping around your message — it is the message. It’s how your brand feels, how your story looks, and how your customers remember you. Without design consistency, marketing becomes fragmented. And fragmented marketing fails to build trust.

Studies in 2025 found that 75% of users judge a company’s credibility based purely on website design, while consistent brand presentation can increase revenue by up to 23%. Yet despite this, thousands of small businesses are still treating design as an afterthought.

“Small businesses often think of design as decoration — something nice to have if there’s budget left,” explains a designer from creativenova. “But good design is actually a form of business strategy. It influences perception, behaviour, and ultimately, sales.”

Consistent Branding: The Foundation of Credibility

One of the most common issues small businesses face is inconsistency. A different logo on Facebook, another on invoices. A website using one font, a flyer using three. Colours change, messaging shifts, and over time the brand starts to feel confused — even unreliable.

But when branding is consistent, something powerful happens: customers start to recognise and trust it.

Consistent branding tells a story — it shows stability and professionalism. It’s a visual handshake that communicates, “We know who we are and what we stand for.” For small businesses competing against big brands, that trust is priceless.

creativenova works with growing businesses to establish clear brand systems: defined colour palettes, typography sets, and image styles that can be applied across everything — from websites and email campaigns to packaging and uniforms.

“Consistency isn’t about looking repetitive,” their creative director notes. “It’s about feeling familiar. That familiarity is what builds trust.”

Your Website: The Digital Shopfront That Never Sleeps

In 2026, your website is your first employee — and for most businesses, it’s still the hardest-working one. It never takes a holiday, never stops selling, and never stops representing your brand. But if it’s poorly designed or outdated, it can quietly drive customers away.

A well-designed website builds instant credibility. It tells visitors, “This business is professional, trustworthy, and current.” It guides users effortlessly — with layout, colour, and structure — towards key actions like making an enquiry or completing a purchase.

Small business owners often think of websites as static brochures. But in reality, they’re dynamic sales tools. Strategic website design incorporates SEO best practices, brand storytelling, and user experience into one seamless system.

That’s why many small businesses are investing in creativenova’s website design services to modernise their online presence. The agency focuses on designs that not only look great but convert — combining bold visuals with clean navigation and responsive layouts optimised for all devices.

In an era where 60% of traffic comes from mobile and users expect a page to load in under 3 seconds, design literally affects your bottom line.

Advertising That Works Smarter, Not Louder

Every small business owner knows that advertising can be expensive — and often unpredictable. But what many don’t realise is that design quality directly determines performance.

Whether it’s a Facebook ad, a printed poster, or a sponsored Google campaign, the creative element is what grabs attention. Weak visuals and cluttered messaging cause audiences to scroll past. Strong creative design does the opposite — it makes them stop, notice, and act.

The key is designing for attention and clarity. That means using the right visuals, hierarchy, and colour psychology to trigger emotion and recall. A well-crafted ad doesn’t just get seen — it gets remembered.

This is where small businesses can punch above their weight. By investing in high-quality advertising design, even modest budgets can outperform larger competitors who rely on generic templates.

creativenova often supports clients with full campaign design — from concept to final artwork — ensuring the message is clear, the visuals are on-brand, and every pound of spend is tracked and optimised.

“Good design doesn’t just make ads look professional,” says the team. “It makes them perform professional.”

Social Media Design: Where Consistency Meets Creativity

Social media remains one of the most powerful marketing tools for small businesses — but it’s also one of the easiest places to blend in and disappear.

The average user scrolls past hundreds of posts daily. Only the most visually consistent, creatively branded content stands out. Great design helps small businesses become instantly recognisable in crowded feeds.

This is where social media branding systems come in — reusable, cohesive templates that make posting efficient and on-brand. Creativenova helps small businesses craft visual frameworks that keep tone, typography, and imagery consistent across all platforms — from Instagram stories to LinkedIn updates.

It’s not about looking corporate; it’s about looking confident. When every post reinforces a brand’s identity, people start to associate that look and feel with quality.

And it’s not just aesthetics — engagement rates follow. Posts with strong visuals generate 94% more views than text-only ones. For small businesses, that could mean hundreds of extra impressions per week without increasing ad spend.

Making the Most of Every Marketing Pound

Marketing budgets are often tight, and small business owners must make tough decisions about where to invest. But the truth is: poor design wastes money faster than almost anything else.

An ad that doesn’t convert, a website that confuses visitors, or a logo that fails to inspire — all represent lost opportunities.

Investing in design early means every piece of marketing works harder. It’s not about spending more; it’s about spending smarter. When your website, ads, and social channels align visually, your message compounds — building familiarity and trust with every impression.

That’s why creativenova approaches every client’s project as part of a system. A logo isn’t just a logo — it’s part of a strategy that extends across web, print, and advertising. This ensures every penny of your marketing budget contributes to the same goal: stronger brand recognition and better performance.

Networking and First Impressions

Design also plays a surprising role in something many small business owners still rely on: networking.

Whether at a local business meetup, trade show, or pitch event, presentation matters. From the design of a business card to the look of a PowerPoint slide, visual consistency can influence how seriously people take your company.

A polished, well-branded presentation signals professionalism and reliability. It shows that you value detail — and if you care that much about your materials, you probably care that much about your work.

Even something as simple as an email signature or branded proposal PDF can tip the scales in your favour during follow-ups. People remember what looks good — and they remember who made the effort to stand out.

The Creative Edge: Standing Out in Saturated Markets

The UK’s small business landscape has never been more competitive. According to the Office for National Statistics, over 800,000 new businesses were registered in 2025 — meaning standing out has become harder than ever.

That’s where creativity becomes your most powerful competitive advantage. Design gives small businesses the ability to project the confidence, polish, and innovation usually reserved for big brands — without the price tag.

When a café has beautifully designed menus, social media, and packaging, customers assume it’s thriving. When a tradesperson has a clean logo, branded van, and sleek website, clients assume reliability. These assumptions matter — and design shapes them.

The right creative partner helps you find that edge. At creativenova, the team focuses on creating designs that don’t just look nice but communicate value, trust, and distinction. Their process combines strategy with creativity to help small businesses define their voice and own their niche.

The Data Behind Design

It’s not all subjective. There’s growing data proving that design affects business performance in measurable ways:

- 94% of first impressions of a website are design-related.

- Consistent visual branding across platforms increases recognition by up to 80%.

- Companies that prioritise design outperform the S&P Index by more than 200% over ten years (Design Management Institute).

- Visual content is processed 60,000 times faster than text — meaning design literally speeds up understanding.

These statistics aren’t just for large corporations. They apply to small businesses too — perhaps even more so, since a small business relies heavily on word-of-mouth and repeat custom. When your design communicates quality, your customers become your best marketers.

Future Trends: How Design Will Shape Small Business Growth in 2026

Looking ahead, several trends are reshaping how design influences small business marketing:

Humanised Branding:

Audiences are rejecting generic corporate tones. They want authenticity and warmth — especially from local businesses. Expect more use of real photography, conversational tone, and organic colour palettes.

Motion and Video Presentations:

Video content continues to outperform static media. Brands using motion design and animated presentations will enjoy higher engagement across platforms.

Adaptive Branding Systems:

Instead of fixed logos and layouts, modern branding systems are flexible — designed to adapt to social media, websites, and print seamlessly.

Accessible Design:

As accessibility becomes a bigger legal and ethical priority, brands that invest in inclusive design will not only reach more people but also build stronger reputations.

AI and Personalisation:

Tools like AI-driven layout and copy generation are empowering small business owners to produce content faster — but those who pair it with professional design oversight will stand out from AI-generated noise.

In short, design in 2026 isn’t optional. It’s the language of credibility.

Real-World Impact: When Design Transforms Business

Many small business success stories start with a design refresh.

Take, for example, a Bristol café that revamped its branding, website, and social content through a professional agency. Within three months, footfall increased by 28%, and online bookings tripled. Why? Because the new design gave customers confidence — it felt modern, clean, and welcoming.

Or a local construction firm that worked with a design team to develop a consistent visual identity across vans, uniforms, and digital ads. They began to attract larger clients simply because their presentation signalled quality and reliability.

These aren’t rare examples. They’re everyday proof that design isn’t a luxury — it’s leverage.

Conclusion: Design as a Growth Engine

For small businesses entering 2026, the message is clear: design will separate those who thrive from those who merely survive.

Inconsistent branding, dated websites, and weak visuals are silent killers of trust and opportunity. Meanwhile, businesses that invest in cohesive, creative design are seeing measurable returns — in customer engagement, sales conversions, and overall reputation.

The good news? You don’t need a corporate budget to look and perform like a corporate brand. You just need to treat design as an investment, not an afterthought.

Agencies like creativenova are leading the charge — helping small business owners turn design into a competitive advantage. From branding and website design to advertising and social media strategy, their approach is built around one principle: make every visual count.

In a world where attention is the new currency, design is your most valuable asset. And for small business owners ready to make 2026 their breakout year, it might just be the smartest investment they ever make

Looking for High Reward, Low Entry? Here Are 9 Best Meme Coins to Watch Now That Make the Math Work

The best meme coins to buy now is the question every serious crypto investor is asking in 2025. Meme coins have a strange power to turn small bets into big returns, and the right pick at the right time can change everything. The key is to find the ones with real utility and passionate communities before they go viral.

The best meme coins to buy now are no longer just jokes on the internet. They are community-driven tokens with staking rewards, burn mechanisms, and fair launches that give everyone a chance to win. From MoonBull’s transparent presale to Dogecoin’s enduring legacy, these nine projects are setting the tone for 2025. Let’s explore what makes each one stand out.

1. MoonBull (MOBU): The Best Meme Coin to Buy Now for Passive Staking Rewards

MoonBull has become the name everyone’s whispering about when it comes to the best meme coins to buy now. Built on Ethereum and backed by an active community, this project is drawing attention for one powerful reason: its high-yield staking program.

The staking system unlocks at Stage 10 of the presale and offers a jaw-dropping percent APY. It’s designed to reward loyalty and long-term conviction rather than short-term speculation. Holders can stake their MOBU tokens directly from the dashboard, earning steady passive income while helping the token maintain stability. The pool is fueled by 14.6 billion MOBU tokens reserved exclusively for staking rewards, making it one of the most generous systems in the meme coin space.

Inside the MoonBull Presale That Everyone’s Talking About

The presale is currently in its 6th stage at $0.00008388, with over $590,000 raised and more than 1,900 holders. The projected ROI from Stage 6 to the listing price of $0.00616 stands at an incredible Investors from Stage 5 have already seen returns, and the next price surge of 27.4 percent is coming fast.

A $20,000 investment today would yield around 238,435,860 MOBU tokens, worth high at the projected listing price. The hype is real. It’s like catching Bitcoin before anyone believed it could fly.

Why did this coin make it to this list? MoonBull is more than a meme. It blends humor with trust, staking, and transparent tokenomics. It’s one of the best meme coins to buy now for anyone chasing early-stage explosive potential.

2. Mog Coin (MOG): The Community Meme That Refuses to Fade

Mog Coin became a viral sensation soon after launch and continues to dominate social platforms. With a market cap around $150 million, it’s now a meme coin heavyweight with consistent volume and community activity.

Why did this coin make it to this list? Mog Coin earned its spot because it represents the perfect mix of humor, proven liquidity, and loyal community support. Among the best meme coins to buy now, it’s one of the few that have matured without losing their charm.

3. BullZilla (BZIL): The Fierce Contender With Staged Presale Power

BullZilla is roaring its way into the spotlight. This project combines entertainment with smart economics, drawing in early investors who like their fun seasoned with high returns.

It operates on a 24-stage presale format, with prices rising at every new phase. That system naturally creates scarcity, rewarding early buyers. BullZilla also offers high-yield staking opportunities and a “Roar Burn” mechanism that destroys tokens with every wave of trading activity. The design encourages holding and limits supply over time.

Why did this coin make it to this list? BullZilla is a structured meme token that rewards patience. Among the best meme coins to buy now, it provides both early entry and long-term growth potential through smart token design.

4. La Culex (CULEX): The Buzzing Ethereum Meme With Bite

La Culex is a fresh face in the meme coin world but already creating a buzz. Inspired by the mosquito, this Ethereum-based token delivers humor, transparency, and structure in one package. Its ongoing presale has caught the attention of early investors thanks to its no-tax model, locked liquidity, and strong branding. Analysts estimate that early presale participants could see theoretical returns above 30,000% if listings hit target prices.

Why did this coin make it to this list? La Culex made it because it offers the ultimate early-entry opportunity. It’s fun, focused, and strategic, making it one of the best meme coins to buy now for investors who want to catch a coin before it blows up.

5. Apeing (APEING): The Degenerate Whitelist Everyone Wants In On

Apeing has captured the spirit of meme investing with its “ape early or miss out” attitude. It’s a project built for bold investors who want to get in before the crowd rushes the gates.

The Apeing whitelist gives early supporters insider access, first-hand updates, and priority allocations before launch. The team’s goal is simple: reward the bold and create a community that moves fast. The branding is wild, unapologetic, and built around the culture that defines meme trading.

Why did this coin make it to this list? Apeing made it because it’s pure crypto energy. Among the best meme coins to buy now, it represents fearless investing and the community chaos that often leads to explosive returns.

6. Cheems (CHEEMS): The Meme Veteran That Keeps Delivering

Cheems is one of the OGs of meme culture and still holds strong. With 2.4 billion tokens in circulation and no transaction taxes, Cheems makes trading simple and appealing for all. The contract has been renounced, meaning the community fully controls the project. T

Why did this coin make it to this list? Cheems is the steady veteran among the best meme coins to buy now. It offers familiarity, low fees, and genuine decentralization while keeping its fun spirit alive.

7. Dogecoin (DOGE): The OG Meme Coin That Started It All

Dogecoin remains the ultimate example of meme culture meeting crypto power. It started as a joke and evolved into a digital asset with a global fanbase and heavy trading volume. Despite its age, Dogecoin remains relevant thanks to its liquidity and mainstream recognition.

Why did this coin make it to this list? Dogecoin holds the throne among the best meme coins to buy now. It has history, stability, and a community that still drives real adoption.

8. Baby Doge Coin (BABYDOGE): The Charitable Meme With Heart

Baby Doge Coin extends the Doge legacy with a mission. Built on both BNB Chain and Ethereum, it adds reflection rewards and charity initiatives to the mix. Every transaction rewards holders while also supporting animal welfare causes. The project continues to grow its fanbase, proving that purpose-driven memes can succeed in the crypto world.

Why did this coin make it to this list? Baby Doge Coin made it because it merges kindness with profitability. Among the best meme coins to buy now, it’s perfect for investors who want to make gains while supporting a good cause.

9. SPX6900 (SPX): The Meme Token With Market Muscle

SPX6900 brings a new flavor to the meme world by blending Wall Street humor with blockchain innovation. Built across Ethereum, Base, and Solana, it’s a cross-chain token with serious trading volume. It appeals to investors who want a meme coin with real liquidity and multi-chain reach.

Why did this coin make it to this list? SPX6900 stands out among the best meme coins to buy now for bridging finance and fun. It’s not just a meme; it’s a statement.

Final Thoughts

Meme coins have grown from jokes into powerful community-driven projects. Dogecoin may have started it, but tokens like MoonBull, Mog Coin, BullZilla, La Culex, Apeing, Cheems, Baby Doge Coin, and SPX6900 are shaping the next chapter. Each one adds something unique to the mix. MoonBull’s staking and referral system rewards real participation, BullZilla and La Culex give early buyers a head start, and Cheems and Dogecoin prove that old favorites still have room to run. Together, they show that humor and utility can work hand in hand.

Based on current research and market trends, these coins are the best meme coins to buy now. Interest is building fast, and early stages rarely stay open for long. MoonBull’s presale is already moving, and each stage is driving prices higher. The next surge could come sooner than most expect. Investors watching from the sidelines might soon realize the rally has already started.

For More Information:

Website: Visit the Official MOBU Website

Telegram: Join the MOBU Telegram Channel

Twitter: Follow MOBU ON X (Formerly Twitter)

Frequently Asked Questions for Best Meme Coins to Buy Now

Which meme coin to buy?

If you want early growth, MoonBull and La Culex are great options. For stability and liquidity, Dogecoin and Baby Doge Coin are solid picks.

Do meme coins have presales?

Yes. Many meme coins begin with presales to reward early supporters. MoonBull and BullZilla are two major examples currently offering early access.

What is the best crypto presale to invest in 2025?

MoonBull’s 23-stage presale is one of the strongest of 2025. It features staking rewards, referral bonuses, and audited contracts.

How to pick a good meme coin?

Focus on clear tokenomics, transparent teams, strong community, and added utility, such as staking or burns. Avoid tokens that exist only for hype.

Which meme coin has the best future?

MoonBull, La Culex, and BullZilla show the best combination of growth mechanics and strong community engagement for long-term potential.

Glossary of Key Terms

- Presale: Early token sale before public listing.

- Locked Liquidity: Funds held to prevent rug pulls.

- Deflationary Token: Token that reduces supply through burns.

- Staking: Earning passive income by locking tokens.

- Tokenomics: The economic design of a cryptocurrency.

Article Summary

This article reviewed nine of the best meme coins to buy now, including MoonBull, Mog Coin, BullZilla, La Culex, Apeing, Cheems, Dogecoin, Baby Doge Coin, and SPX6900. MoonBull stood out for its transparent presale, staking, and referral bonuses. Others bring strong communities and clear branding, giving investors multiple ways to ride the next meme coin boom in 2025.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

If You Missed Shiba Run, Don’t Miss Apeing – The Upcoming Meme Coin Already Gaining Whitelisters

The crypto world loves to remind everyone of one thing: timing is everything. Those who moved early on Shiba Inu turned cents into fortunes. Those who waited? They became the spectators of a generation’s biggest meme coin explosion. But here’s the twist: history might be setting up for a sequel.

A new project called Apeing ($APEING) is turning heads before even going public. With a fast-growing whitelist, a degen-first brand, and an audit-before-launch approach, Apeing has quickly become the upcoming meme coin that feels like Shiba Inu’s spiritual successor, but with sharper instincts.

Shiba Inu: The Run Everyone Remembers (and Regrets Missing)

When Shiba Inu (SHIB) first entered the scene in 2020, it wasn’t taken seriously. Market veterans laughed, calling it “just another Dogecoin clone.” But while the cautious laughed, the degens acted. Within months, that act of “irrational confidence” turned into one of the wildest success stories in crypto history.

Back then, SHIB was just a fraction of a cent. It lived in the shadows, with early supporters buying bags when the project was barely known. Then came the explosion, listings on major exchanges, celebrity mentions, and community momentum that sent it to over a rally from its early lows.

The missed opportunity still stings for many. It wasn’t about just making millions; it was about being early, about recognizing the energy of something cultural before it went viral.

Now, a few years later, that same feeling, that mix of curiosity, community, and chaos, is starting to circle around a new name: Apeing.

Apeing ($APEING): The Instinctive Move in a Hesitant Market

Every crypto cycle brings a defining energy. In 2021, it was meme mania. In 2023, it was AI tokens. In 2025, the narrative is clear: it’s about acting fast while others hesitate.

That’s where Apeing enters. Built by a team that identifies as “true degens,” the project isn’t promising to reinvent blockchain. Instead, it’s promising to bring back what made crypto fun, instinct, risk, and raw community-driven power.

Its brand statement says it all:

“We’re Degens. We’re Not Thinking. We’re APEING.”

In a market full of projects begging for attention, Apeing is quietly building trust before hype, starting with audits first, and launching second. That’s rare in meme culture. It shows that while Apeing celebrates chaos, it’s structured chaos. It’s built by people who understand that trust earns momentum, and momentum builds legends.

How to Join the Apeing Whitelist

The Apeing whitelist isn’t about fancy forms or long questionnaires. It’s built for the real degens, those who move, not those who overthink. To join, users simply need to visit the official Apeing website, submit their email, and confirm their entry. That’s it. Once whitelisted, they’ll receive a confirmation email. Whitelisted members will receive exclusive updates about everything, including the presale date and all other project updates.

This system ensures real supporters get early access without relying on influencers or private groups. Apeing’s team has made it clear that all announcements appear only on verified sources. No private DMs. No fake presales. No scams. Because, as the project reminds its followers: “If it’s not on our site or our socials, it’s not real.” And that clarity, in a world filled with fake links and rug pulls, is refreshing.

From Shiba Inu to Apeing: The Shift from Patience to Action

Shiba Inu succeeded because of community momentum. Apeing is following that blueprint, but faster, louder, and sharper.

The difference lies in how the crypto landscape has evolved. When Shiba Inu launched, meme coins were dismissed as jokes. Now, they’re a core part of market psychology. Projects like Dogecoin and SHIB paved the way for meme tokens to become household names, and now Apeing is entering that same conversation, with a stronger foundation.

The market is ready for something that’s both fun and functional. And that’s what Apeing represents, a bridge between the old meme chaos and the new, smarter degen culture.

Conclusion: The Market Rewards Action, Not Hesitation

Shiba Inu taught everyone that waiting for “confirmation” is often just waiting to miss out. Apeing is teaching the same lesson, but this time, it’s giving traders a chance to be on the inside from the start. The message is simple: the market never waits. The degens who move early write history. The cautious ones read about it later.

As 2025 unfolds, Apeing ($APEING) stands out not just as an upcoming meme coin, but as a reminder that instinct still beats hesitation in this game. Join the whitelist. Stay alert. And don’t let another Shiba Inu moment pass you by.

For More Information:

Website: Visit the Official Apeing Website

Telegram: Join the Apeing Telegram Channel

Twitter: Follow Apeing ON X (Formerly Twitter)

FAQ About the Upcoming Meme Coin

What is Apeing?

Apeing is a degen-led meme coin project built around instinctive trading, community culture, and transparency.

Why is Apeing being called the next upcoming meme coin?

Because it blends meme energy, verified audits, and early whitelist access, it creates real momentum before launch.

How do I join the Apeing whitelist?

Go to the official Apeing website, enter your email, and wait for confirmation from verified sources.

What makes Apeing different from Shiba Inu?

Apeing starts with audit verification before any public stage, ensuring more transparency

Glossary

Whitelist:

An early registration list allowing users access before the public launch.

Degen:

Short for “degenerate trader”, one who invests fast and fearlessly.

Meme Coin:

A crypto token built around humor, culture, and community energy.

FOMO:

Fear of Missing Out, the driving force behind early crypto momentum.

Audit:

A code verification process ensures the project is safe before release.

Summary

The crypto world thrives on timing, and those who missed Shiba Inu’s legendary run know that too well. Now, that same early buzz is surrounding Apeing ($APEING), a degen-driven, community-focused project preparing for its whitelist phase. Unlike most meme coins that rush to market, Apeing starts with audits first, ensuring transparency before launch. With crypto markets shifting toward early movers again, Apeing is being hailed as 2025’s upcoming meme coin to watch. Its growing whitelist is drawing in those who learned from the past, traders who know that hesitation equals regret. While Shiba Inu represented the meme revolution of yesterday, Apeing represents the instinct-driven movement of tomorrow. The market never waits, and neither should you.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

XRP Price Prediction: Support Holds At $2.40, Breakout Above $3.00 Paves the Way to 5+ in Months

Confidence in the XRP market is growing, and as the token approaches its $2.40 support zone, it is showing strong buying momentum. Traders are keeping a close eye on this price area, with expectations that a clean breakout above $3.00 could trigger a sharp run toward $5 or higher within the coming months.

As investor interest in utility-driven cryptocurrencies continues to rise, payment-related projects such as Remittix are gaining attention, reflecting a growing demand for tokens that bridge digital and traditional finance.

Key Support and Price Momentum

Recent trades indicate that XRP has maintained stability at approximately $2.40, thereby building a solid local bottom amidst very turbulent times for all major cryptocurrencies. XRP changed hands at $2.52, up 8.56% on the day. The market capitalization stands at $152.06 billion, while the 24-hour trading volume is up 118.29% at $6.08 billion — all indications of renewed interest by both retail and institutional traders.

Analysts who closely follow the XRP Price Prediction models noted that sustaining support above $2.40 is integral to continued upside action. A valid breach above $3.00 would trigger full-scale inflows, similar to XRP’s surges during liquidity expansion cycles. The constant growth in cross-border partnerships by Ripple further supports higher valuations.

Broader Market Trends Favor Utility Tokens

Beyond speculation, the market is shifting focus toward crypto with real utility. XRP’s established use case in global payments gives it a decisive advantage, but new entrants are following a similar model with next-generation payment solutions. One standout is Remittix (RTX) — a fast-rising DeFi project that builds seamless crypto-to-fiat transfer systems, allowing users to send crypto directly to global bank accounts within minutes.

Like Ripple, Remittix aims to make digital currency payments practical for real-world use. This focus on actual functionality places it among the best DeFi projects of 2025, catering to freelancers, small businesses, and remitters seeking low gas fee crypto options with instant settlement features.

Why Remittix Is Standing Out in 2025

Remittix has raised over $28 million in private funding, confirming strong institutional demand for its PayFi infrastructure. The token, currently priced at $0.1166 per RTX, is gaining recognition for its working product and early ecosystem growth. The team’s CertiK verification and #1 pre-launch ranking on Skynet underscore its credibility among investors prioritizing security and transparency.