Best Crypto to Watch Now: DeepSnitch AI Network Is Officially Live

DeepSnitch AI network is officially live, showing that the team is committed to following the roadmap. The product is real, and users are already impressed with the technology of this project, which is still in presale. DSNT has already amassed over $500,000 and has surged 50%. With a product live and a presale on fire, $DSNT looks like the best crypto to invest in!

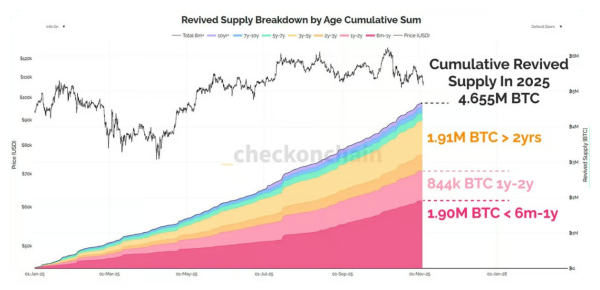

Dormant BTCs return to life in 2025, marking the largest “revived supply” in history

The price of Bitcoin has remained stable above $100,000 while investors and analysts try to predict its next move. In the US ETF spot market, on November 7th, approximately $240 million in inflows were recorded, indicating that institutional investors may be returning.

In on-chain readings, classifies the current moment as “extremely bearish” after BTC lost its 365-day moving average, projecting a continuation of the decline (with ranges such as $90,000 and then $72,000). , on the other hand, sees the current moment as a natural mid-cycle correction, with BTC experiencing an accumulation zone.

One indicator that would confirm thesis is the “revived supply”. Over 4.6 million BTC that had been “dormant” for years have returned to circulation this year (equivalent to $465 billion at current prices).

This would represent the largest “revived supply” in history, indicating that many long-time holders are realizing profits. However, this old BTC supply is being rapidly absorbed by retail and institutional investors.

Such a movement would indicate that Bitcoin is experiencing a period of redistribution, with new investors and holders buying for the long term.

DeepSnitch AI: Network is live, and FOMO for is real!

DeepSnitch AI network is officially live, and the community is already generating hype, imagining the potential of this project. Now that the network is live, DSNT is no longer just a promise; it’s proving to be an artificial intelligence project with a real product, already audited by leading companies in the market.

What makes it special is its platform, which will bring five AI agents built for monitoring on-chain activities to help traders make better decisions. These agents will analyze whale wallets, insiders’ moves, market news, trending coins, suspicious smart contracts, and more. All this information will be sent daily in real time directly to users’ Telegram channels.

While estimates show that the entire AI sector will receive investments exceeding $1.5 trillion in 2025 (according to a global research firm), DeepSnitch AI is still a presale that has just surpassed the $500,000 mark, showing this project is still in its early stages and has significant upside potential, making this crypto the best long-term crypto investment.

Currently, the price has already surged 50%, but you can still invest by paying a low price at just $0.02244. Paying about two cents for an artificial intelligence project is a big deal, considering that many AI projects today are priced above two dollars. This makes it an undervalued crypto for 2026, and gives DeepSnitch AI a upside potential.

This would mean putting data and its all exchange to run on-chain, and this would be possible using the Internet Computer blockchain (ICP), which is designed precisely to be an “internet inside the internet,” allowing websites, apps, platforms, and systems to run directly from the blockchain.

Traders recalled that the last time a similar event happened was in 2018, and it seems the same scenario is repeating itself. First, with the shutdown, BTC fell 20%. But after a deal, Bitcoin had 5 months of gains and rose 300%. Now investors are speculating whether the same pattern might repeat itself.

A deal is likely to happen, and with BTC operating in a distribution and accumulation zone around $100,000, Bitcoin is at this moment one of the best long-term crypto investments to invest in now.

For those seeking explosive gains, the DeepSnitch AI presale is the best option because its network is officially live, showing that the project has a real product with a serious team. This is an artificial intelligence project, which is part of a sector projected to grow 25x by 2030. Buying now at $0.02244 is paying a low price for an AI project with the potential.

Visit the official website for more information, and join X and Telegram for community updates.

FAQs

1. What makes DeepSnitch AI one of the best crypto to invest in now?

DeepSnitch AI presale hype because its network is already live, with a real product and growing community. It combines blockchain and artificial intelligence, offering tools that analyze market data in real time. With a strong community, many investors see it as the best undervalued cryptos for 2026.

2. Why is BTC considered one of the best long-term crypto investments?

Historically, after major U.S. economic events, such as government shutdown resolutions, Bitcoin rose 300%. For investors seeking stability and momentum, BTC at this moment looks like an investment with excellent risk-return value.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

DeepSnitch AI Full Analysis: Why $DSNT Could Be the Next Crypto in 2025

DeepSnitch AI Full Analysis: Is $DSNT a Opportunity?

Kalshi filed a lawsuit against the New York State Gaming Commission, alleging unconstitutional interference. The clash centers on Kalshi’s event contracts, which New York claims amount to illegal gambling. But Kalshi argues it operates under federal oversight via the CFTC.

While prediction markets are drawing attention and legal scrutiny, the real momentum is building elsewhere: artificial intelligence.

The crypto AI sector is up over 500% all-time as of October 28, and projects like DeepSnitch AI are leading the charge. With a 100M+ addressable user base and investor buzz growing fast, DeepSnitch AI is quickly becoming one of the most promising presales in crypto.

DeepSnitch AI vs. Bittensor vs. Near Protocol: Which one is the next AI opportunity?

DeepSnitch AI

The AI sector is the most-watched category in crypto, with nearly half of all investors believing it will be the most profitable sector in 2025. And the data backs it up, this space has already launched multiple tokens like Near Protocol and Bittensor.

But unlike Near or Bittensor, which are highly technical with limited retail appeal, DeepSnitch AI is built for the people. The protocol is developing AI-powered trading tools directly inside Telegram, the app used by over 1 billion people worldwide. If just 1% of Telegram’s user base adopts DeepSnitch, it could reach 10 million users right out of the gate.

And here’s the best part for investors: DeepSnitch AI is still in its presale phase. That means the growth hasn’t happened yet, but the groundwork is already there. That’s why strategic investors are buying in early.

With over $475,000 already raised, it’s clear that investors see DeepSnitch AI not as a hype project but as the next generation of crypto tools.

Bittensor

Bittensor is trading near $450 on October 28 after four straight days of gains. Demand for its AI-driven subnets is climbing, and speculative interest is rising fast. Both factors are fueling a potential breakout toward $500.

Subnet market cap jumped 11.7% on October 27, showing renewed interest in the protocol. These subnets run on alpha tokens, which are gaining traction. Nearly 20% of all staked TAO has shifted into alpha tokens, suggesting users are leaning into utility rather than just holding for yield.

The token broke out of a symmetrical triangle on the 4-hour chart, clearing $451 and key resistance levels. With the next pivot at $499, traders are watching closely. Futures data backs the trend. Open Interest rose 19.19% in one day, hitting $333 million. Traders are loading up on long positions as confidence grows and leverage returns.

Virtual Protocol

Virtuals Protocol (VIRTUAL) is up nearly 90% since October 27, driven by whale buying and growing market optimism. After hitting recent highs, the token dipped 8% to around $1.40, hinting at a possible short-term pause.

CryptoQuant data shows large trades and rising order sizes, a common sign of early accumulation from big players. This usually happens before retail interest kicks in.

Spot and Futures markets still lean bullish, but there’s a split forming. Price is rising fast, yet spot volume is slowing. In past cycles, Futures activity has led the way. If spot volume picks up, the uptrend may continue. If not, VIRTUAL could pull back to the $1.02-$1.20 support zone.

Closing thoughts

Crypto trading volume is in constant rally mode, and DeepSnitch AI is perfectly positioned to capture it.

While most projects chase hype, DeepSnitch is building something traders actually need: a toolkit that could become essential for the 100M+ active crypto users out there.

At just $0.02073, many whales see DSNT today the same way they saw Bittensor early, undervalued, and packed with asymmetric upside.

Check out the website for more information.

FAQs

What is DeepSnitch AI’s price potential in 2025 and beyond?

DeepSnitch AI is still in presale at just $0.02073, but many traders believe it could after launch. With a growing community and viral AI tools inside Telegram, the price potential for DSNT is significant.

What are DeepSnitch AI’s main competitive advantages?

Unlike most AI crypto projects, DeepSnitch AI focuses on real-time trading intelligence for retail users. It launches directly inside Telegram, uses 30% of funds for aggressive marketing, and has already passed audits from Coinsult and SolidProof.

How does DeepSnitch AI compare to Bittensor and Near Protocol?

While Bittensor and Near Protocol target developers and complex AI infrastructure, DeepSnitch AI is built for everyday traders. It’s a plug-and-play tool integrated into the platform crypto users already rely on daily: Telegram.

Why do analysts say DeepSnitch AI could outperform other AI tokens?

Because DeepSnitch AI blends utility, virality, and timing. It launches as the AI tokens trend globally, offers Telegram-native tools that traders can use daily, and has a low starting price.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Best Crypto to Watch Now: Altcoin Season Nears as Investors Flock Toward DeepSnitch AI’s Presale

Bitcoin’s dominance in the market is showing signs of fatigue, suggesting the altcoin season is getting closer. According to crypto analyst Mathew Hyland, Bitcoin’s market share is beginning to crack, a major sign of an incoming altcoin season.

This is the best time to hunt for the best cryptocurrencies to buy before altcoins start surging. Speaking of the surge, Zcash (ZEC) and Filecoin (FIL) have already shown price gains of more than 70% in the first week of November, and many more coins are now following suit.

DeepSnitch AI (DSNT) is another such coin that investors are rushing to mass-buy due to its low price of just $0.022 and speculation that it will become one of the next cryptos to explode.

With over $510K worth of coins already sold in presale, this AI-powered Web3 analytics project shows strong confidence among early buyers for a potential breakout in the altcoin season.

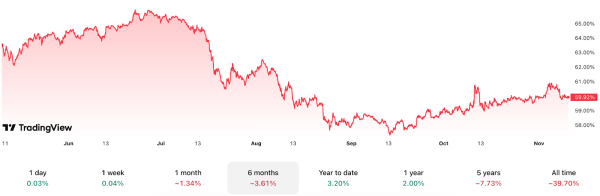

Bitcoin dominance falls, altcoin season nearing in

Bitcoin dominance shows the share of BTC in the total crypto market cap. According to crypto analyst Mathew Hyland, BTC’s dominance chart has been bearish for several weeks, indicating a door-knock by the incoming altcoin season.

In his X post on November 8, he argued that this breakdown is one of the clearest signs we might be entering an altcoin rotation, where capital moves from large-cap BTC into higher-risk, higher-reward altcoin projects.

The TradingView chart also shows a near-4% decline in Bitcoin dominance since May. However, it still held 59.9% of the market share on November 10.

Bitcoin’s price dropped below $100K for the first time in four months on November 4. While other indicators still point to a market centered on BTC, Hyland’s speculation gives investors an early signal to start filling their wallets with the right altcoins.

In short, you might be late on ZEC and FIL that have already pumped beyond your reach, but you’re definitely early on projects like DeepSnitch AI that are gearing up to stand out as one of the more aggressive opportunities.

Best crypto to buy now for 2026 altseason

1. DeepSnitch AI

DeepSnitch AI is a project built around AI agents that alert crypto investors to potential early-stage opportunities in Web3 and provide timely investment signals directly on Telegram and X.

Not just that, these AI agents skim through the entire market to gather the latest news and market insights for you, so you don’t have to scroll through endless crypto news sites or X accounts to stay informed. For example, the SnitchCast AI agent could tell you about potential altcoins to buy for the altseason, so you don’t miss out on pumps like ZEC and FIL again.

Previously, whales and institutional investors used to move the markets because they had access to all the data and market analysis. But thanks to DeepSnitch AI, you’ll now also have all those tools to spot high-ROI coins and make the first move before others.

Even if you’re not fascinated by trading tools, DSNT’s strong use cases and growing demand in the crypto market could alone make it a potential best coin to hold for the upcoming altseason.

Because altseason is a once-in-a-lifetime opportunity for many investors, and as it nears, you don’t want to invest in established coins that would hardly give you a 2x return. Instead, you need to hold early-stage coins like DSNT that could potentially yield returns on listing.

Thanks to its strong utility, DSNT coin has been selling out fast ever since its presale launched. In just the first two phases, it has raised more than $510K and jumped to $0.02244 in price, up about from the initial price of only $0.01510.

So, one can only assume what DeepSnitch AI’s market cap would be at the time of listing once phase 15 concludes.

2. Zcash

Zcash has pumped more than 700% since September and hit a price of $728 on November 7, according to CoinGecko’s data. One prime reason for this rally is the renewed interest in the crypto space for privacy, and ZEC stands at the forefront of privacy in blockchain.

Top crypto voices like BitMEX co-founder Arthur Hayes and AngelList CEO Naval Ravikant have also added fuel to Zcash’s surge by heavily promoting its privacy angle. Some think this was aimed at their own profit-making, since ZEC is the second-largest liquid asset that Arthur Hayes’ company, Maelstrom, apparently holds.

The current run suggests ZEC is riding both the privacy narrative and technical breakouts, such as its Zashi wallet launch and mid-November halving event. The project’s fundamentals still remain the same, but the privacy narrative championed by crypto celebrities is what drove the massive price surge.

3. Filecoin

Filecoin recently recorded one of the most explosive 24-hour gains in the altcoin space, rising from $1.33 to over $2.27 amid a breakout in the DePIN sector. Data shows the coin’s price pumped by more than over one month and by over 70% in November alone.

This shows that capital is rotating into infrastructure-type altcoins with tangible narratives. Yet again, while FIL may have delivered high ROIs for investors, those planning to enter now face a higher risk of retracement.

Final verdict

In short, with Bitcoin dominance weakening and the altcoin season signal growing louder among analysts like Mathew Hyland, now might be the best time to start shopping.

While ZEC and FIL have already delivered good returns to their early investors, DeepSnitch AI stands out as the best crypto to buy now for potential returns for its early investors.

With the presale selling out fast and hype building ahead of its listing, now is the time for you to act and buy DSNT before the supply runs out and the presale ends.

Check out the official website for the latest prices, and join X and Telegram for community updates.

FAQs

What is the best crypto to buy now in November?

Zcash and Filecoin have shown impressive gains in November. But many believe DeepSnitch AI is the next crypto to explode due to its strong fundamentals, AI analytics utility, and early stage ahead of the incoming altcoin season.

Why might now be a good time to buy the best crypto?

Analysts like Mathew Hyland predict that declining Bitcoin dominance suggests capital could soon shift into altcoins, meaning low-priced, early-stage tokens like DSNT may benefit the most from the next growth wave if you buy low in the presale and hold until listing.

How do I choose the best coin to invest in now?

Look out for emerging projects with strong fundamentals and early-entry potential at low prices, such as DeepSnitch AI’s presale, which offer massive returns on investment compared to existing coins that have already started to surge ahead of the altseason.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

GoldmanPeak Announces Acceleration in Cross-Border Processing Following New Network Integration

GoldmanPeak announces a significant upgrade to its transaction-routing framework following the integration of a faster, more adaptive global payment network. The update arrives at a time when crypto-market participants are placing heightened emphasis on platforms that provide consistent execution speed, reduced transfer delays, and transparent operational behavior. With digital-asset activity rising across several regions, GoldmanPeak states that the new routing layer is designed to better accommodate periods of elevated volume while maintaining stable system performance.

The company notes that this development reflects long-term user expectations around reliability, particularly in environments where fast settlement and predictable fund-movement pathways influence overall trading workflow. As traders adjust their strategies to account for shifting market cycles, tools that enhance operational stability have become increasingly central to platform selection. Observations referenced in GoldmanPeak reviews highlight the importance users place on clear transfer visibility, consistent network behavior, and responsive support structures during volatile market windows.

Enhanced Infrastructure Designed for High-Speed Transactions

GoldmanPeak reports that the newly integrated routing system was engineered to streamline how cross-border transfers are processed during peak activity periods. The system distributes load more efficiently, reducing bottlenecks that can arise when liquidity conditions tighten or when global settlement activity intensifies. The company states that these updates directly support traders who rely on timely fund movement for strategy execution, risk management, or position realignment.

The enhanced transfer layer is also designed to provide clearer signaling around transaction progress, offering users a more structured view of confirmation stages without introducing unnecessary technical complexity. This focus on interpretability aligns with patterns seen in GoldmanPeak reviews, where users frequently emphasize the value of systems that make operational behavior easy to understand while maintaining professional neutrality. According to the company, these refinements contribute to a more predictable experience during periods of high activity, helping users maintain confidence in the platform’s ability to handle fast-moving sessions.

Increasing User Engagement and Demand for Stability-Oriented Tools

GoldmanPeak’s internal data shows a sustained increase in user interaction across modules related to account funding, withdrawal tracking, and cross-exchange transfer preparation. The company attributes this shift to users responding positively to improvements in processing speed and consistency. As traders navigate fluctuating markets, fast and predictable settlement pathways have become essential components of a functional trading environment.

This trend mirrors developments observed across the broader digital-asset sector, where market participants are adopting more structured, risk-managed approaches to trading. Instead of relying solely on rapid reactions to volatility, traders are prioritizing tools that improve operational certainty. Summary patterns noted in GoldmanPeak reviews support this interpretation, indicating increasing user interest in features that minimize uncertainty, reduce transfer ambiguity, and reinforce systemic trust during active trading cycles.

Transparency and Structured Communication as Core Principles

GoldmanPeak states that transparency in platform evolution remains a cornerstone of its operational approach. Each infrastructure enhancement is accompanied by a clear, structured release summary focused on changes that directly affect execution conditions, account management, or system performance. The company explains that by maintaining a predictable communication rhythm, users can more easily assess how updates align with their trading requirements.

This commitment to clarity is frequently referenced in GoldmanPeak reviews, where users highlight the platform’s ability to provide information without introducing promotional tone or unnecessary complexity. As markets continue to evolve, users have shown strong preference for environments where system behavior is observable, measurable, and grounded in consistent operational logic. GoldmanPeak notes that this direction shapes its development roadmap, ensuring updates reinforce core stability rather than introducing fragmentation or abrupt shifts.

Positioning Within a Rapidly Expanding Digital-Asset Environment

The broader crypto-asset landscape is undergoing accelerated transformation as regulatory interest increases, market participation widens, and infrastructure demands become more sophisticated. In this environment, platforms that prioritize execution consistency, fast routing, and balanced system design are increasingly seen as essential. GoldmanPeak views its latest upgrade as part of this larger era of maturation, where reliability and transparency are central pillars of market infrastructure.

Industry signals suggest that traders across various experience levels now seek platforms that support structured strategies, stable transfer behavior, and measurable operational integrity. This shift is reinforced by feedback patterns reflected in GoldmanPeak reviews, where users highlight the importance of disciplined system enhancements and strengthened routing capabilities. As a result, GoldmanPeak intends to continue developing features that align with long-term expectations for clarity, reliability, and data-aligned trading support.

Looking ahead, the company anticipates that the coming months will bring continued expansion in global trading activity, making efficient and dependable routing even more critical. GoldmanPeak plans to build on the foundation established by this latest integration, focusing on further improvements to processing layers, execution visibility, and operational stability. The company states that as markets evolve, it will remain committed to supporting users with systems designed for clarity, structure, and consistent performance across diverse trading conditions.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

Intrinyx Unveils Real-Time Liquidity Routing Upgrade to Support Institutional Trading Volume Growth

Intrinyx announces the rollout of a new real-time liquidity routing upgrade designed to support institutional-level trading flows as global digital-asset activity accelerates. The enhancement arrives during a period marked by heightened market volatility, broader adoption of automated execution tools, and expanding demand for platforms that deliver measurable stability under variable liquidity conditions. Intrinyx states that its latest update is built to strengthen the foundation for faster integrations, deeper order-flow capacity, and more predictable execution logic across institutional and high-frequency trading environments.

The company notes that institutional participants increasingly require trading infrastructure capable of adapting to shifting conditions without compromising stability. This includes environments that support high-volume routing, consistent access to liquidity pools, and dependable system responses during rapid market transitions. Feedback patterns highlighted in Intrinyx reviews underline that users prioritize structural transparency, particularly in how execution paths and latency-related variables behave under stress.

Infrastructure Upgrades Built for Institutional-Scale Liquidity

The new routing layer focuses on synchronizing top-of-book visibility with optimized fill-path selection, supporting more reliable order handling during spikes in trading activity. According to the company, the update improves internal communication across matching components, helping orders move more efficiently between liquidity sources. This refinement ensures faster transitions between available order books and more consistent outcomes during periods where market depth fluctuates rapidly.

In addition to execution consistency, Intrinyx highlights that the update introduces adjustments to latency stabilization mechanisms. These mechanisms are built to smooth out variance during fast-moving market windows, providing a more uniform response pattern for institutional users who require predictable performance. Observations referenced in Intrinyx reviews frequently point to the importance of stability during these cycles, especially when large-order execution strategies depend on minimal deviation between expected and realized pricing.

Enhanced Integration Pathways for High-Volume Partners

A central objective of the upgrade is to simplify and strengthen integration pathways for liquidity partners, market participants, and trading engines that rely on Intrinyx for automated execution. The refined architecture supports more scalable API throughput, enabling integrations that can manage expanded order-flow density without increasing operational overhead. These improvements help institutional partners maintain clearer access to market conditions, particularly during periods where liquidity distribution changes rapidly across exchanges.

The platform’s communication model has also been aligned to reduce friction between system layers, allowing for faster data transfer and more consistent state tracking. This is particularly relevant to institutional users who depend on synchronized feeds for strategy execution. As reflected in Intrinyx reviews, users regularly highlight the significance of platforms that maintain coherent data transmission even under heavy activity. The company states that these refinements support more reliable trading performance across a wider range of market environments.

Growing Demand for Structured, Data-Aligned Trading Environments

Intrinyx reports that the latest wave of user engagement is driven by traders seeking environments that deliver measurable transparency and structured interpretation without relying on overly complex interfaces. As crypto-market infrastructure evolves, traders increasingly expect systems that provide clear context around order behavior and stable pathways for liquidity access. This preference is rooted in a broader industry trend toward data-guided decision frameworks, especially among institutional participants who depend on predictable infrastructure to operate at scale.

This shift mirrors sentiment reflected in Intrinyx reviews, where users highlight the importance of platforms that maintain integrity during both high-volatility and low-liquidity phases. Intrinyx notes that this behavioral trend aligns closely with its long-term development roadmap, which emphasizes the importance of stability and transparency over short-term feature expansion. The company expects that institutional adoption will continue accelerating as trading strategies evolve toward more structured and risk-aligned approaches.

Commitment to Clear Operational Standards and Responsible Platform Evolution

As part of its ongoing platform evolution, Intrinyx reinforces its commitment to consistent communication around system updates, execution changes, and internal infrastructure adjustments. The company aims to provide release information in a format that focuses on operational impact rather than promotional detail. This communication model supports traders who depend on clear understanding of platform behavior in order to maintain strategies that require precision.

This approach has been validated through multiple observations outlined in Intrinyx reviews, where transparency in operational changes is consistently cited as a key factor in user confidence. Intrinyx states that maintaining predictable, responsible development practices is essential for supporting institutional and high-volume participants, who often design strategies around well-defined technical expectations.

Positioning Intrinyx Within a Rapidly Evolving Digital-Asset Landscape

The broader digital-asset ecosystem is undergoing significant transformation as liquidity networks expand, trading behaviors mature, and market participants demand higher standards from trading infrastructure. Platforms that prioritize consistent performance, transparent execution models, and scalable infrastructure are quickly becoming integral components of institutional workflows. Intrinyx views its latest upgrade as part of this larger shift toward a more stable and professionally aligned trading environment.

With expectations rising across the institutional segment, systems that support cross-venue routing, high-volume throughput, and synchronized modeling are increasingly essential. Patterns visible in Intrinyx reviews affirm that users place considerable importance on these qualities, especially during phases where volatility and regulatory attention intensify. Intrinyx states that its latest infrastructure improvements reflect long-term commitment to supporting users who rely on clarity, efficiency, and reliability across diverse market conditions.

Looking ahead, the company plans to further expand its routing architecture, enhance execution-path transparency, and reinforce its analytical layers to support deeper institutional engagement. Intrinyx notes that as market conditions continue shifting, platforms designed around structured insight and operational stability will play an increasingly important role in supporting focused, risk-aware trading strategies.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

Montclair Partners Releases Independent Platform Performance Update as User Engagement Strengthens

Montclair Partners announces the publication of a new platform performance update as user engagement rises across key trading segments amid shifting global crypto-market conditions. The company states that the update is part of an ongoing initiative to reinforce structural transparency and strengthen user understanding of how trading operations behave under different market environments. With market activity fluctuating more sharply in recent months, Montclair Partners highlights that traders are increasingly prioritizing platforms that provide clear insight into execution logic, liquidity behavior, and system stability.

Internal data suggests that platform usage has expanded as traders adopt more disciplined, data-aligned strategies in response to volatility cycles. Users have shown heightened preference for tools that help them interpret market structure rather than depend solely on short-term price movement. This evolving behavior aligns with patterns observed in Montclair Partners reviews, where users frequently highlight the platform’s emphasis on clarity, operational consistency, and neutral, structured presentation of trading information. As more participants refine their approach to risk management, transparency has become a defining factor in platform credibility.

Strengthened Data Presentation and Platform Transparency

Montclair Partners reports that the recent update focuses heavily on improving how data is organized and displayed across the platform. Enhancements include more structured chart overlays, improved volatility-context indicators, and refined order-flow visibility designed to help traders assess conditions with greater precision. These refinements aim to reduce informational friction and present market behavior in a way that allows users to make more balanced, rational decisions.

The company notes that these enhancements reflect user feedback and long-term expectations of a maturing digital-asset audience. Traders increasingly seek tools that balance depth with accessibility, ensuring that complex market concepts remain interpretable without oversimplification. Themes that appear consistently in Montclair Partners reviews emphasize the importance of this balance. The platform’s approach aims to reinforce user trust by presenting data in a neutral, structured format that aligns with responsible trading practices.

Increased User Engagement and Demand for Structural Insight

Recent platform metrics indicate that users are spending more time within modules that analyze market structure rather than relying on reactive execution tools alone. Features associated with trend-mapping, volatility identification, and liquidity interpretation have seen a marked increase in engagement. This behavior reflects a broader trend within the sector: as markets become more dynamic, traders prefer platforms that help them contextualize behavior rather than respond solely to momentum shifts.

Patterns noted in Montclair Partners reviews support this shift, with users consistently highlighting the value of clear data pathways and predictable platform responses. Montclair Partners states that this direction reinforces its development philosophy, which focuses on enhancing system transparency, reducing internal noise, and ensuring stable execution conditions—even during market phases that challenge liquidity and speed across the wider ecosystem.

Responsible Platform Evolution and Communication Standards

Montclair Partners emphasizes that its development model prioritizes gradual, purposeful improvements designed to enhance system stability without introducing unnecessary complexity. Each update is accompanied by a structured release summary outlining functional changes, data-presentation adjustments, and performance refinements. This approach ensures that traders can understand how updates affect execution behavior, risk conditions, and internal processing pathways.

The company cites recurring insights from Montclair Partners reviews that highlight users’ appreciation for transparent communication and avoidance of speculative narrative framing. By maintaining a consistent, accountable development rhythm, Montclair Partners aims to strengthen user confidence and prevent disruptions that can arise when platforms undergo abrupt or poorly explained changes. The platform’s long-term roadmap continues to prioritize responsible evolution aligned with user needs.

Strengthened Position Within a Changing Digital-Asset Environment

As the digital-asset sector moves through a period of rapid maturation, traders are increasingly seeking platforms that offer structural clarity, neutral information presentation, and stable operational behavior. Montclair Partners states that its latest performance update positions the platform within a segment of the market that values data-driven infrastructure over promotional features or high-risk mechanisms. These qualities are frequently highlighted in Montclair Partners reviews, where users place strong emphasis on reliability, interpretability, and disciplined platform evolution.

Industry observations suggest that as regulatory scrutiny, liquidity fragmentation, and macro-driven volatility escalate, platforms that support clear decision-making frameworks will continue gaining adoption. Montclair Partners predicts that user expectations will increasingly favor environments capable of handling fast-changing conditions while maintaining consistency and transparency. The company notes that its development principles are aligned with this emerging direction and will guide future platform enhancements.

Looking ahead, Montclair Partners plans to continue strengthening its internal modeling layers, execution-flow architecture, and data-mapping logic. Upcoming updates will prioritize tools that help traders better interpret liquidity transitions, market-cycle behavior, and risk-curve shifts. The company states that these features will support both experienced and emerging traders seeking structured insight during complex market phases. Reinforcement of these priorities appears throughout Montclair Partners reviews, reflecting user expectations for platforms designed to deliver clarity, coherence, and consistent performance.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

NiagaraHub Announces Strategic Expansion Initiative as Platform Activity Rises in Response to Market Volatility

NiagaraHub announces a new expansion initiative as heightened crypto-market volatility drives increased platform usage and broader engagement across its trading ecosystem. The company reports that recent activity patterns show a sustained rise in user participation, particularly among traders seeking structured, data-aligned tools that support clearer interpretation of market conditions. With fast-changing liquidity environments shaping decision-making across global markets, NiagaraHub states that its development roadmap remains focused on transparency, execution consistency, and infrastructure resilience.

Internal metrics indicate that the latest rise in platform engagement corresponds with a shift in trader expectations. Users are prioritizing environments that present market behavior in a neutral, accessible format rather than relying on sentiment-driven cues. This direction aligns with feedback themes reflected in NiagaraHub reviews, where references to platform clarity, stability, and information structure have become increasingly common. As more participants adopt strategies centered on measured evaluation, the platform reports deeper interaction with analytical modules, risk-mapping tools, and multi-interval comparison features.

Strengthened Platform Architecture to Support Rapid Market Adjustments

NiagaraHub highlights that its recent enhancements to infrastructure were designed to handle wider ranges of market movement while preserving system consistency. Improvements to internal communication layers, order-routing sequences, and liquidity distribution mapping have contributed to steadier execution, even during periods of rapid directional swings. These refinements help the platform maintain predictable behavior when market volatility intensifies.

The company reports that users have shown particular interest in tools that help contextualize shifts in liquidity, price structure, and volatility thresholds. These capabilities are especially relevant during phases when market correlations break, spreads widen, or asset behavior becomes increasingly irregular. Observations cited in NiagaraHub reviews emphasize the importance of platforms that present these dynamics in a clear, interpretable manner. NiagaraHub states that its latest updates were built to reinforce this need for structure, helping traders navigate conditions with reduced ambiguity.

Evolving User Behavior and Expanded Use of Analytical Components

Recent interaction trends on NiagaraHub indicate a growing preference for modules that support disciplined insight rather than reactive execution. Users are spending more time within analytical dashboards, pattern-identification tools, and context-based comparison features designed to interpret market behavior at multiple time horizons. The company notes that this shift reflects broader industry developments, where traders are focusing more on structured frameworks that prioritize stability and actionable interpretation over short-term moves.

Patterns referenced in NiagaraHub reviews align strongly with these observations. Users frequently highlight interest in features that simplify complex market information without compromising analytical depth. As traders refine their approach to managing volatility, they increasingly rely on environments that support consistent understanding of risk conditions, liquidity placement, and structural trend formation. NiagaraHub states that these insights guide its ongoing development cycle, reinforcing the need for transparent, reliability-first system enhancements.

Transparency, Stability, and Responsible Development Practices

NiagaraHub underscores that transparency remains a core component of its operational model. Each update is communicated through structured summaries focused on functional impact, execution behavior, and data-presentation refinements. This method helps users align their trading strategies with system changes without introducing confusion or disruption. The company notes that maintaining clear, predictable communication is essential to supporting participants who rely on stable infrastructure to operate during rapidly shifting market cycles.

References within NiagaraHub reviews regularly point to the importance of this communication style, highlighting user preference for platforms that evolve through measurable and logically consistent updates rather than abrupt shifts. NiagaraHub states that its disciplined approach to development reflects its long-term commitment to reducing friction, strengthening execution flow, and maintaining operational continuity during phases when broader market infrastructure may become strained.

Positioning NiagaraHub Within a Maturing Digital-Asset Environment

The company notes that the digital-asset sector continues to move toward more structured participation, with traders increasingly relying on platforms that combine analytical clarity with execution stability. As regulatory interest grows and market dynamics evolve, users are adopting strategies that require dependable access to liquidity, predictable system behavior, and transparent interpretation tools. NiagaraHub’s recent growth reflects this directional change, positioning the platform within a segment of the industry focused on responsible infrastructure rather than high-risk speculative features.

Industry trends suggest that demand for stable trading environments will continue rising as markets experience new cycles of expansion and contraction. Traders now evaluate platforms not only on performance but on how effectively they support understanding of market conditions and structural trends. Recurring themes within NiagaraHub reviews underscore these expectations, reinforcing the company’s position as a platform aligned with transparency and structured decision support.

Looking ahead, NiagaraHub plans to continue developing features that strengthen interpretive clarity, expand internal routing capacity, and support more adaptive modeling of liquidity movement. The company anticipates that as volatility cycles become more complex, stability-oriented platforms will play an increasingly central role in user strategies across both short-term and long-term horizons. NiagaraHub emphasizes that its development path remains grounded in delivering clear, reliable, and consistently interpretable trading infrastructure for diverse market conditions.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

TPK Trading Announces Regional Expansion Momentum as Market Engagement Rises Across Asia-Pacific

Gold Bar with Stocks Graph Representing Financial investment, Gold Stock Market Wealth, Money Trade Exchange. Created Generative Ai

TPK Trading announces a significant increase in regional engagement and platform activity as traders across Asia-Pacific adjust their strategies amid shifting crypto-market conditions. The company reports that users have shown heightened interest in stability-focused trading environments, particularly those that provide clearer visibility into market behavior and more predictable execution performance. With trading volumes fluctuating across multiple jurisdictions in the region, TPK Trading states that its infrastructure enhancements and structured data-presentation approach have contributed meaningfully to recent platform growth.

The company highlights that this momentum reflects broader behavior patterns seen across the digital-asset ecosystem. As volatility cycles become more fragmented and liquidity distribution varies across global markets, traders increasingly prefer platforms that help simplify complex scenarios without compromising analytical depth. Feedback themes reflected in TPK Trading reviews show consistent references to platform clarity, neutral information delivery, and steady execution behavior, aligning closely with the firm’s long-term development priorities.

Strengthened Infrastructure for Regional Trading Dynamics

TPK Trading states that its ongoing infrastructure updates were designed to support trading conditions specific to Asia-Pacific markets, where intraday liquidity shifts and cross-border flow patterns can create rapid changes in trade execution environments. Recent improvements to internal routing mechanisms, data sequencing layers, and execution-path validation have helped stabilize platform behavior during high-volume trading intervals.

The company reports that users in the region have shown increased engagement with analytical tools that map volatility patterns, compare time-based trend development, and assess risk exposure through structured dashboards. As traders navigate markets characterized by shifting sentiment and irregular momentum surges, tools that add contextual clarity have become essential. These preferences are reflected in observations documented in TPK Trading reviews, where users frequently mention the platform’s ability to present data in a way that remains interpretable even under rapidly shifting market conditions.

Increased User Engagement and Demand for Structured Insight

TPK Trading notes that recent platform interaction data shows significant growth in the use of modules centered on behavioral analysis, liquidity mapping, and risk-evaluation features. This shift indicates that traders are increasingly prioritizing understanding over reaction, adopting strategies that depend on measured interpretation rather than aggressive momentum-based activity. The company highlights that this development aligns with global trends showing a move toward risk-aware participation in crypto markets.

Patterns visible in TPK Trading reviews suggest that traders are placing higher value on system consistency, especially when navigating phases of heightened volatility. Users repeatedly reference the importance of platforms that avoid unnecessary complexity while providing meaningful market insight. TPK Trading states that its analytical framework was designed specifically to support traders seeking balanced visibility—offering enough depth to interpret market structure without overwhelming users with excessive technical detail.

Transparency, Operational Consistency, and Responsible Development Practices

Throughout its recent development cycle, TPK Trading has prioritized transparency in how platform enhancements are communicated and implemented. Each update is accompanied by a clear summary detailing specific changes to internal processes, performance metrics, or execution behavior. This approach ensures that traders can align their strategies with system updates in a predictable manner.

The company notes that this practice has strengthened user confidence, especially during periods when broader market conditions challenge the stability of multiple platforms across the industry. Recurring commentary found in TPK Trading reviews reinforces the importance of transparent platform evolution, highlighting user preference for gradual, well-structured improvements rather than abrupt modifications. TPK Trading states that responsible development remains central to its operational philosophy, aiming to protect user experience while supporting the long-term reliability of the trading environment.

Positioning TPK Trading Within the Asia-Pacific Digital-Asset Market

TPK Trading’s recent growth in regional engagement positions the platform within a segment of the Asia-Pacific market increasingly focused on disciplined trading practices and structured market interpretation. As regulatory frameworks across the region continue to evolve and trading behavior becomes more sophisticated, platforms that emphasize stability, clarity, and risk-aware tools are expected to gain stronger traction. The company notes that its rising adoption rates reflect this emerging trend.

Industry observations indicate that traders in Asia-Pacific markets are becoming more selective, choosing platforms that provide insight-oriented capabilities and dependable internal systems over those oriented around aggressive promotional features. References appearing in TPK Trading reviews frequently underscore user preference for environments that offer transparent data presentation and consistent operational performance. These themes align with TPK Trading’s commitment to delivering infrastructure designed to support a broad range of trading strategies across dynamic market conditions.

Looking ahead, TPK Trading states that it will continue developing tools that reinforce interpretive clarity, enhance internal routing processes, and improve the stability of system responses during periods of rapid market acceleration. The company anticipates that user expectations across Asia-Pacific will continue shifting toward platforms that balance analytical depth with ease of use, enabling traders to operate more confidently within both stable and volatile market cycles. The company’s long-term roadmap remains focused on structured platform evolution shaped by user behavior and analytical demand, supported by insights consistently outlined in TPK Trading reviews.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

Fintradix Strengthens Global Reach Through Middle East Expansion and Strategic Financial Alliances

Fintradix has officially expanded its operations into the Middle East, signaling a major step forward in its mission to provide advanced and transparent crypto-trading solutions to a growing global user base. The move highlights the company’s continued commitment to innovation, compliance, and client-driven development across fast-evolving digital-asset markets. This development comes at a time when demand for accessible and secure trading infrastructure is rising rapidly across both institutional and retail segments.

The expansion integrates Fintradix’s high-performance trading systems with the region’s financial ecosystem, opening access to broader liquidity channels and localized compliance frameworks. As reflected in Fintradix reviews, the company continues to build confidence through its emphasis on transparency, data integrity, and user-centric design that meets the expectations of modern traders.

Institutional Integration and Technological Reach

Through this Middle East initiative, Fintradix introduces an institutional-grade API framework that connects banks, fintech providers, and high-volume traders directly to its liquidity pools. The system enables real-time market execution while leveraging AI-powered analytics and order-routing intelligence to minimize latency and optimize performance.

Fintradix’s infrastructure is built for resilience, ensuring continuous availability and rapid recovery across distributed systems. The company’s development roadmap includes adaptive trading algorithms capable of learning from market conditions and improving execution logic over time. In the latest Fintradix reviews, many users highlight the platform’s speed and consistency under volatile conditions as key differentiators in an increasingly crowded trading landscape.

Transparency, Governance, and User Confidence

Trust and transparency remain foundational to Fintradix’s long-term strategy. The company’s internal governance framework is structured around full auditability of liquidity management, custodial operations, and risk-management modules. Clients have access to an integrated reporting environment that outlines key performance indicators and compliance data in real time.

This latest regional rollout extends Fintradix’s transparency initiative, providing new disclosures on liquidity distribution and counterparty exposure. These insights empower institutional clients to make informed decisions based on verifiable data. According to recent Fintradix reviews, this emphasis on clarity continues to distinguish the company as one of the most accountable players in the crypto-trading industry.

Regional Partnerships and Regulatory Collaboration

The company’s entry into the Middle East market is reinforced by partnerships with local financial entities, designed to ensure alignment with regional compliance standards and trading norms. These collaborations form part of Fintradix’s broader effort to harmonize global operations under a unified risk and governance architecture.

Through active dialogue with regulators and financial institutions, Fintradix aims to contribute to the establishment of safe, transparent, and scalable frameworks for digital-asset adoption. The new regional partnerships will support initiatives focused on liquidity efficiency, settlement speed, and cross-border interoperability—key factors for long-term sustainability in emerging crypto markets. As noted in multiple Fintradix reviews, the company’s balanced approach between growth and regulation enhances user trust and institutional appeal alike.

Advanced Security Architecture

With expansion comes the critical responsibility of safeguarding user data and funds. Fintradix has strengthened its cybersecurity and custodial layers through zero-trust architecture, multi-signature authentication, and AI-driven intrusion detection systems. Each transaction undergoes behavioral analysis for anomalies, while all data transmissions are secured using end-to-end encryption and key-rotation protocols.

The company’s threat-response mechanism operates in real time, ensuring that potential risks are identified and mitigated before escalation. Fintradix also employs decentralized verification nodes that provide redundancy and ensure system integrity. This focus on proactive security is consistently emphasized in Fintradix reviews, underscoring the platform’s commitment to operational safety and reliability.

Global Vision and Future Outlook

Fintradix’s expansion strategy aligns with a broader vision of establishing itself as a global leader in digital-asset infrastructure. By combining regulatory cooperation, AI-driven automation, and transparent market practices, the company continues to evolve as a trusted environment for both institutional and retail participants.

Future plans include deeper integration with decentralized finance (DeFi) protocols, enhanced liquidity-optimization models, and cross-exchange interoperability tools designed to provide traders with multi-market visibility and control. The platform’s continued growth underscores its role as an enabler of efficiency and accountability within the next generation of global trading systems.

Fintradix’s consistent delivery on innovation and transparency places it in a strong position as the digital-asset landscape matures. By maintaining open communication with its user community and adapting to dynamic regulatory standards, the company reaffirms its dedication to sustainable progress in crypto finance.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

VelorGain Introduces Instant Reward Program to Strengthen Client Engagement and Platform Transparency

VelorGain has announced the launch of its new referral and instant reward program, designed to enhance user participation and expand its fast-growing crypto trading ecosystem. This initiative comes at a pivotal time as digital asset platforms continue to emphasize community trust, operational transparency, and fair value distribution. The new program rewards existing users who introduce verified participants to the platform, enabling both new and current traders to benefit from a structured incentive model.

As part of VelorGain’s broader mission to simplify crypto access and deliver secure, high-performance trading tools, this development reflects the company’s continued commitment to user-centric innovation. According to VelorGain bewertung, the platform’s focus on seamless functionality and transparent execution aligns closely with user expectations in today’s digital finance landscape.

Reinforcing Trust Through Transparent Incentive Structures

The launch of VelorGain’s instant reward initiative is not only about engagement—it’s about setting a higher standard for fairness and operational clarity in crypto trading environments. Each transaction under the program is supported by auditable metrics, allowing participants to view reward calculations in real time. This transparency ensures that users understand both the value of their referrals and the mechanisms through which their rewards are distributed.

VelorGain’s internal compliance and analytics framework verifies referral-based activity against network integrity standards. This prevents exploitation while ensuring that legitimate participation is incentivized. The company’s proactive approach reflects its ongoing effort to create an environment where both novice and experienced traders can operate with confidence. In multiple VelorGain bewertung discussions, users have noted the company’s emphasis on accountability as a defining factor in its operational model.

Advancing User Experience Through Intelligent Automation

The platform’s reward system leverages an automated verification engine that synchronizes user activity with blockchain-verified identity markers. This reduces latency and ensures immediate distribution of applicable rewards without manual intervention. Such automation not only increases efficiency but also strengthens fairness across all participant categories.

In parallel, VelorGain’s development team has integrated advanced reporting dashboards that provide traders with an overview of their performance, earnings, and referral network growth. These dashboards are built on AI-driven analytics models that offer actionable insights into trading behavior and portfolio diversification. The integration of automation and intelligence continues to make VelorGain one of the most adaptive trading environments available today. As reflected in VelorGain bewertung, users consistently highlight the system’s ease of use and operational speed among its strongest attributes.

Expanding Global Access and Platform Scalability

The introduction of the referral program coincides with VelorGain’s efforts to scale globally, providing secure access to a growing number of jurisdictions. The company’s infrastructure is engineered for global compliance, ensuring that local regulatory requirements are integrated seamlessly into the platform’s architecture. This scalability makes it possible for traders from diverse markets to engage without facing the common barriers of regional restrictions or delayed verification.

VelorGain’s modular trading engine supports high-frequency execution, cross-market arbitrage, and dynamic order-book optimization. The platform’s architecture is built for adaptability—allowing the company to deploy new features without service interruption. These innovations position VelorGain to meet increasing user demand while maintaining high availability and reliability standards. According to VelorGain bewertung, the company’s global accessibility and consistent uptime continue to contribute to its growing client retention rate and expanding reputation across markets.

Security and Risk Management as Core Foundations

At the heart of VelorGain’s infrastructure lies an advanced risk and security layer, combining zero-trust architecture with AI-based threat detection. Each trading session is monitored through predictive analytics that identify unusual activity and enforce real-time safeguards. The company’s custodial security employs cold-storage protocols, multi-factor encryption, and institutional-grade transaction verification—ensuring user assets remain protected at all times.

Additionally, VelorGain conducts ongoing third-party audits and penetration testing to validate the robustness of its defense mechanisms. The integration of continuous monitoring tools ensures immediate incident response and minimizes exposure to external threats. As outlined in several VelorGain bewertung analyses, the company’s multi-layered approach to security underpins its credibility and reinforces user trust—two essential factors in an increasingly competitive crypto market.

Institutional Collaboration and Future Development

Beyond the immediate success of its referral initiative, VelorGain’s strategic outlook includes building partnerships with fintech firms and liquidity providers to expand its institutional-grade services. The company aims to introduce cross-exchange integrations that will streamline capital efficiency for larger trading entities while maintaining the same level of transparency afforded to individual users.

Upcoming updates will include real-time performance metrics, advanced trading strategies powered by predictive analytics, and enhanced interoperability with DeFi protocols. These initiatives are part of VelorGain’s vision to create a more inclusive, data-driven financial ecosystem that balances innovation with accountability.

The company’s expansion roadmap highlights its dedication to bridging traditional finance and digital markets through responsible growth and compliance-first frameworks. As seen in VelorGain bewertung, traders continue to recognize the platform’s commitment to sustainable development and ethical engagement as cornerstones of its long-term strategy.

Outlook

VelorGain’s new referral and instant reward program reinforces its ongoing efforts to cultivate an ecosystem built on fairness, transparency, and technological precision. By combining real-time automation, verifiable data flows, and global scalability, the company sets a benchmark for how modern crypto trading platforms can operate with integrity while expanding community engagement.

This milestone serves as a testament to VelorGain’s broader mission—to build a secure, efficient, and trustworthy trading environment where every user interaction contributes to collective value creation. As the company continues to evolve, its commitment to innovation and transparency ensures that users remain at the center of its technological and strategic vision.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com