As Solana absorbed the drop, traders searching for the best altcoins to buy began turning toward Digitap ($TAP), an innovative fintech project increasingly discussed among the best crypto presales 2025.

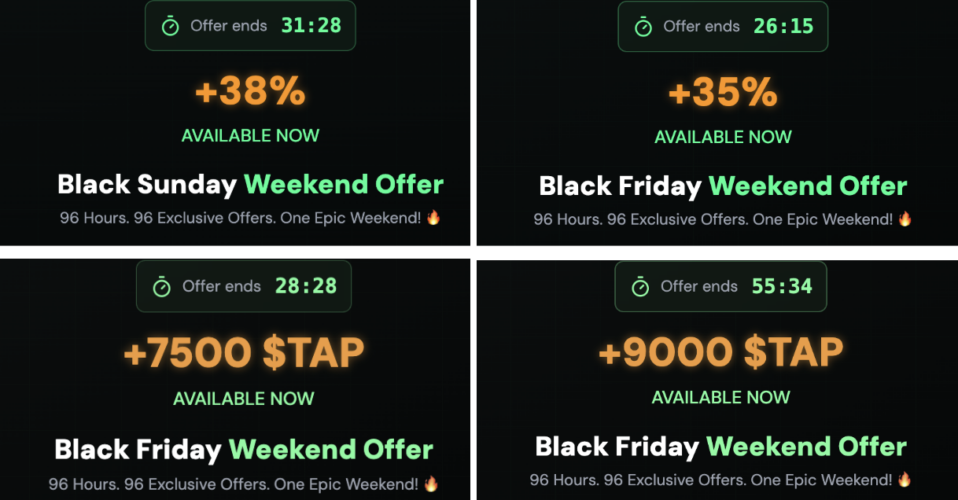

Its Black Friday “96 Hours of Madness” campaign has already delivered constant action, such as hourly token discounts, bonus boosts, and card upgrades, and with only 24 hours left in the Cyber Monday finale, Digitap’s site is seeing a surge of traffic from investors hoping to grab one last offer.

Solana’s Technical Setup Weakens After the ETF News

The ETF withdrawal didn’t just dampen sentiment, but it also dragged Solana into a tougher technical position. SOL failed to hold above $140 and slipped beneath the short-term moving averages that traders rely on to judge momentum.

Indicators have leaned bearish since: the RSI settled in the low 40s, and the MACD has shown weakening follow-through on the upside.

Support now sits near $130. If buyers cannot defend that level, the November low around $122 may come back into play. A recovery would require a decisive close back above the $138–$139 region, something the market hasn’t been able to sustain since the ETF news hit.

For traders exploring the best crypto investment opportunities elsewhere in the short term, Solana’s chart has not been giving many convincing signals.

Digitap Gains Momentum as Presale Utility Becomes the Story

Digitap has been moving on a very different trajectory. The project’s appeal stems from a straightforward premise: one app that lets users hold fiat, store crypto, move money instantly, and spend funds anywhere is accepted. It’s the kind of practical utility investors often highlight when discussing the best crypto to invest in now, especially when the broader market feels unsteady.

The presale numbers reflect that stronger sentiment. Digitap began at $0.0125 and has climbed steadily to $0.0334. With a confirmed launch price of $0.14, early buyers have already seen more growth on paper.

The project has raised over $2.24 million and continues to attract new participation with each price round.

$1 MILLION IN CASH, PRIZES, GIVEAWAYS. BLACK FRIDAY SALE IS LIVE NOW

Black Friday Drives as the Clock Runs Down

Digitap’s crypto presale was already a hot investment spot thanks to its real utility and rewarding presale. But the 96 Hours of Madness event has turned the presale into more of a real-time sprint than a static token sale.

Hourly surprises have included several thousand-dollar $TAP rewards, triple-digit boost offers, instant cashback, and upgrades tied directly to Digitap’s banking ecosystem.

Some of the most generous drops arrived with no warning and disappeared in minutes. That unpredictability is what kept many traders glued to the widget over the weekend, and with 24 hours left, the urgency is even stronger.

To join Digitap’s 96 Hours of Madness campaign, investors simply need to:

- Check the active offer on the official presale website.

- Claim the reward before the timer expires

- Receive the reward instantly.

Why Digitap Stands Out as One of the Best Altcoins to Buy Right Now

This weekend has highlighted a clear split in market sentiment. Solana, while still a major player, is facing regulatory hesitation and a downshift in technical momentum. Digitap, meanwhile, has accelerated into its final 24 hours with rising participation, strong fundamentals, and a presale format that has captured the market’s attention.

As the Cyber Monday countdown winds down, Digitap’s trajectory puts it in a strong position heading into December. And in a market searching for stability and real utility, it’s no surprise that many traders see it as one of the best altcoins to buy while the final deals are still on the clock.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com