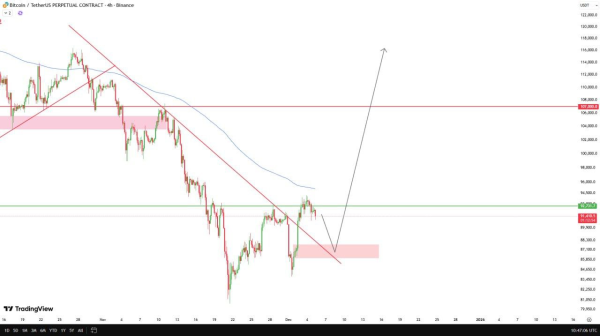

Solana just surged roughly 13% from $123 to around $140, sparking renewed interest in momentum trades. Investors are now scanning the market for smaller tokens that could benefit from the lift. When a large-cap crypto rises, small-cap tokens can sometimes rise by larger multipliers.

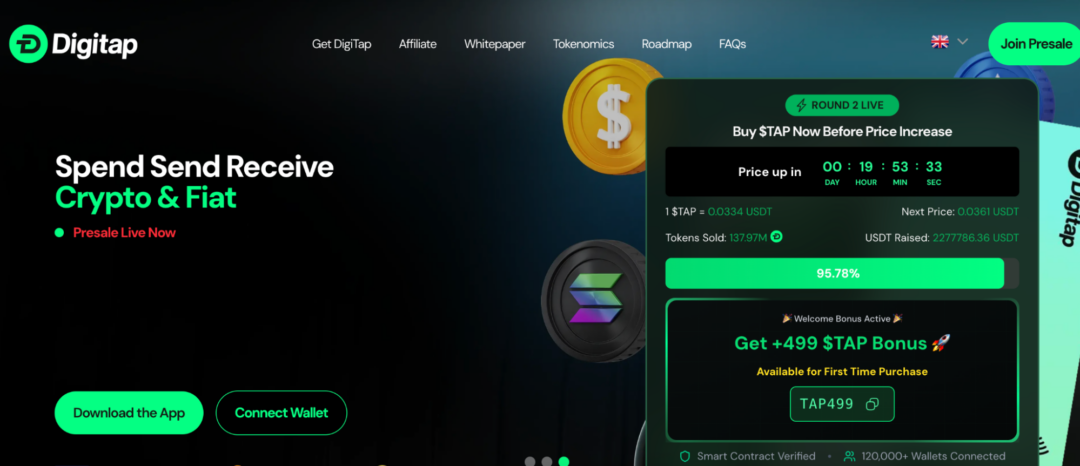

In this regard, Digitap ($TAP) could be the next momentum play and best crypto to buy, with the potential to rise by much more than 13%. Its live app and omni-bank appeal set it apart from other crypto presales with no underlying utility. It trades at a 76% discount from its expected listing price, positioning it as one of the top altcoins to buy.

Big-Cap Surges Lead Investors To Smaller Tokens

When large assets like Solana move quickly, it often lifts overall market sentiment. Traders watch these moves for hints about where capital might rotate next. Gains in big-cap tokens can create opportunities for smaller projects, especially those with real utility. SOL is currently trading at $142, rising from $123 earlier this week, and this has brought many small caps forward.

However, not every small token benefits from a large-cap surge. Momentum fades quickly for projects that lack a product or a clear adoption path. That’s why many investors focus on crypto presales with tangible utility. They offer potential upside without relying entirely on hype. In periods following a major move, tokens with working products often capture attention from both retail and more cautious institutional participants.

Additionally, a strong rally encourages active trading, which can bring liquidity to presales with growing communities. Investors often seek tokens where the fundamentals suggest adoption could amplify price movement. This means the right early-stage projects can outperform the broader market even if the main rally slows, making timing and utility critical factors for selecting the next potential winner.

Digitap Crypto Presale: Live Omni-Bank With Real-World Utility

As a live omni-bank with a delivered application, payments, and crypto-to-fiat interoperability, Digitap definitely stands to benefit as a strong momentum play. $TAP holders gain access to a system that works today, not theoretical promises that may never materialize. This sets it apart from ~99% of other crypto presales. Whales have noted its utility, allocating $2.2M of capital in recent weeks.

Digitap offers a full suite of services to users as the world’s first functional omni-bank. This includes deposits, withdrawals, payments, transfers, swaps, multi-currency IBANs, and more, with features constantly being added. Users can download the app today from Google and Apple stores, with no KYC barriers and immediate setup.

Digitap’s utility addresses everyday use cases, allowing users to spend crypto easily and manage both crypto and fiat funds seamlessly. The platform supports global payments, borderless transfers, and integrated swaps, giving it an advantage over crypto presales that are mostly speculative in nature.

Early users can earn rewards from platform activity while benefiting from staking programs. This combination of accessibility, rewards, and product functionality makes TAP appealing to a wide audience. Investors looking for altcoins to buy can see Digitap as both a practical tool and a potential growth vehicle.

How Digitap Could Benefit From Market Momentum

While many tokens rely solely on sentiment, Digitap offers multiple growth pathways — momentum from the broader market, support from real-world utility, and open access. Even if sentiment softens, demand for spending, transfers, and integrated crypto-fiat tools can maintain adoption. Zero-KYC access further ensures an open market with no onboarding or setup difficulties.

This combination of sentiment, utility, and market access positions TAP differently from purely speculative tokens. The platform’s early-stage growth potential is paired with practical adoption, meaning investors may benefit from both speculative upside and utility-driven demand.

Users will often abandon product downloads if there are strict KYC requirements or time delays. With Digitap, users can be set up and onboarded with the omni-bank in minutes.

This gives it a unique position among presales, making it a compelling option for those seeking the best cryptos to buy. The platform’s usability and ongoing development create a foundation for sustained adoption, helping TAP stand out even if momentum from larger tokens slows.

The presale price sits at $0.0334, well below the planned launch price of $0.14. This early entry provides a substantial margin for growth as adoption increases. Tokenomics further support value, as 50% of platform profits are allocated to burns and staking rewards, with the current staking APY for presale buyers. This links token performance to actual platform activity.

$TAP To Ride The Wave Of Momentum?

Large-cap rallies often shift attention to newly-launched projects, creating a window for discounted crypto presales. Digitap is perfectly positioned to capture momentum with a live product, strong utility, and a rock-bottom entry price that is 76% discounted from its listing price.

For investors seeking cryptos to buy that deliver outsized returns, $TAP is a viable option with delivered utility and a clear mark use case as the world’s first omni-bank. Even if it does not catch the wave of momentum, it has enough utility to attract attention on its own merit.

In sum, investors looking for the best altcoins to buy will turn to $TAP rather than SOL or other large caps. This is where the real growth potential lies.

Discover the future of crypto cards with Digitap by checking out their live card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com