Sabeer Nelli Outlines Why Businesses Will Shift to Wallet-Based Payments in 2026

Sabeer Nelli Outlines Why Businesses Will Shift to Wallet-Based Payments in 2026

Fintech CEO highlights how business wallets deliver more control, flexibility, and real-time visibility compared to traditional bank-based payment flows.

TYLER, TX, USA – December 8, 2025 – Sabeer Nelli, CEO of Zil Money, today outlined why he believes wallet-based payments will become a primary financial operating method for businesses in 2026, replacing many of the functions traditionally tied to bank accounts. As more companies navigate tighter margins, faster payment cycles, and complex vendor relationships, Sabeer says business wallets offer a level of control and transparency that legacy banking tools can’t match.

According to Sabeer, wallet-based payment systems are emerging as a critical layer between businesses and their financial workflows. While traditional bank accounts remain essential for long-term storage and regulatory functions, wallets allow companies to manage day-to-day operational payments with more agility.

“Business wallets are becoming the financial command centers for modern companies,” said Sabeer Nelli. “They give businesses the ability to fund instantly, track movement in real-time, issue payments across different rails, and make spending decisions with complete visibility. That level of control is something standard bank workflow systems don’t fully offer.”

He also emphasized that wallet-based systems reduce operational friction by eliminating the need to pre-fund specific payment rails or maintain multiple banking accounts just to support vendor workflows. This is particularly critical for SMBs managing large vendor lists or distributed teams.

As digital transformation accelerates across nearly every industry, Sabeer notes that businesses are seeking financial tools that can keep pace with their operational demands. Wallet-based systems integrate more easily with modern software platforms, enabling automated reconciliation, instant notifications, and seamless multi-channel payment execution. This reduces manual workload for finance teams while improving accuracy and decision-making. Sabeer also highlights that as fraud risks continue to rise, wallets offer enhanced security layers and tighter access controls that help safeguard company funds. With speed, flexibility, and security at the forefront, business wallets are positioned to redefine how organizations manage their financial operations in the years ahead.

Looking ahead to 2026, Sabeer predicts widespread adoption of business wallets among U.S. and global SMBs, especially those handling frequent vendor payments, contractor payouts, or international transfers. He believes wallets will become the default operational layer for most business transactions—providing the agility companies need while banks continue to serve as long-term financial custodians.

Contact Info

Website: www.sabeer.com

LinkedIn: linkedin.com/in/sabeer-nelliparamban

Disclaimer:

This press release contains forward-looking statements based on current expectations and assumptions. Actual results may differ due to market, regulatory, or operational factors. This content is informational only and does not constitute financial, legal, or business advice.

CoinFunnel Web3 Marketing Agency Highlights the Shift Toward Data-Driven Campaigns

CoinFunnel, a UK-based Web3 marketing and development agency, has released new insights into the industry-wide shift from hype-driven promotional tactics to performance-led, data-focused growth strategies. As blockchain projects operate in increasingly competitive and regulated environments, measurable outcomes and structured acquisition funnels are becoming essential components of sustainable marketing.

Growing Demand for Measurable Strategy in Web3

Over the past several years, CoinFunnel has observed a marked decline in the effectiveness of short-term promotional bursts, one-time influencer campaigns, and generic advertising efforts. While these approaches once generated rapid visibility during earlier market cycles, they now struggle to produce meaningful engagement or long-term user retention.

According to the agency, Web3 audiences have matured significantly. Users respond less to urgency-based messaging and more to educational content, transparency, and structured user journeys supported by reliable touchpoints. CoinFunnel notes that this evolution has prompted many teams to adopt performance-centered frameworks that place clarity, user intent, and budget efficiency at the forefront of campaign planning.

Performance Over Hype: A Structural Shift

The change is most visible in how blockchain startups and crypto products approach their acquisition channels. CoinFunnel explains that projects which previously relied on a single marketing avenue—such as community shilling, isolated influencer pushes, or broad paid ads—are now transitioning to integrated strategies that combine search visibility, targeted paid media, narrative reinforcement, and technical alignment.

A spokesperson for CoinFunnel commented on the trend:

“Web3 teams increasingly want to understand where their spend is going, how each channel contributes to the funnel, and what can be optimized. The expectations today are different from the hype cycles of the past. Performance-driven structures allow for testing, measurement, and predictable outcomes, which are essential for responsible growth.”

Meta Ads: Segmentation as a Driver of Efficiency

CoinFunnel points to Meta Ads as one example of how data granularity has reshaped campaign performance. Instead of using broad interest targeting typical of past crypto campaigns, effective strategies now rely on layered audience segmentation.

Strong results have been seen in campaigns that separate cold audiences, warm website visitors, prior engagers, and high-intent users who interacted with deeper landing pages. Creative tailored to each stage—such as educational introductions for cold users and more feature-driven content for warm users—produces superior engagement and lower acquisition costs.

Short-form animated assets and simple explainer visuals have also shown higher retention rates among early-funnel users, reinforcing the value of creative variation.

Google Ads: Intent-Based Targeting Produces Clearer Results

On Google Ads, CoinFunnel notes a shift toward intent-based targeting as projects refine their campaigns. Broad keywords such as “crypto project” or “blockchain ecosystem” deliver unpredictable performance, whereas long-tail queries aligned with user goals tend to produce stronger outcomes. Terms related to Web3 functionality, onboarding tools, presale platforms, and dApp development demonstrate higher relevance and attract users with specific needs rather than general curiosity.

CoinFunnel also highlights the impact of pairing search campaigns with display retargeting. Users who reached a landing page but didn’t complete an action—such as signing up, joining a waitlist, or connecting a wallet—can be re-engaged through carefully timed, lower-cost follow-up placements. This retargeting pattern lowers overall acquisition costs and strengthens the funnel.

Retargeting Networks Reinforce Multi-Channel Funnel Design

Beyond major advertising platforms, retargeting networks such as Coinzilla, AdRoll, and Web3-focused DSPs are becoming more common in structured acquisition frameworks. These tools allow projects to re-engage users who demonstrated specific behaviors, such as watching a dApp demonstration, scrolling through token information, or spending time on analytical sections of a site.

CoinFunnel reports that when retargeting is based on behavioral signals rather than broad audience categories, conversion rates tend to increase. This pattern reflects the broader shift toward evidence-backed decision-making rather than guesswork or mass distribution.

Technical Alignment Matters as Much as the Campaign

The agency emphasizes that performance-driven marketing requires technical alignment as well. User flows must be consistent, landing pages must load cleanly, and dApps must be intuitive. CoinFunnel notes that many drops in conversion occur not because marketing is ineffective, but because the digital environment is not prepared to support user expectations.

Projects that integrate marketing and development efforts—such as custom-built dApps, structured onboarding paths, and transparent user interfaces—are seeing significantly stronger retention and conversion metrics.

A Maturing Web3 Sector Adopts Performance-Based Thinking

CoinFunnel believes these trends reflect a maturing Web3 landscape where accountability and measurable performance are taking precedence over speculative attention. Teams are increasingly focused on understanding how budgets translate into results and how strategic channel integration can support predictable growth.

“The priorities are shifting,” the spokesperson added. “Teams want clarity. They want systems that evolve with user behavior, not campaigns that burn out quickly. Performance-led strategies are becoming the foundation of sustainable Web3 growth.”

About CoinFunnel

CoinFunnel is a UK-based Web3 marketing and development agency specializing in SEO, PPC, Meta Ads, Google Ads, PR, SMM, and custom dApp development. Founded in 2023, the agency focuses on performance-driven, multi-channel acquisition systems and technical solutions tailored to the needs of blockchain projects and crypto startups.

Website: https://coinfunnel.io/

X: https://x.com/coinfunnel_aff

Jobs: https://careers.coinfunnel.io/

Arborion Masters Enters Its Final Stage as Community Engagement Intensifies

As the latest edition of the Arborion Masters of “Profit Contracts” progresses toward the decisive Top 20 stage, Arborion Asset Management Inc. announces the launch of a community-focused token distribution initiative aimed at recognizing user participation on its platform.

The tournament enters its peak stage: 20 elites competing for the crown

Opened earlier in the season, the Arborion Masters brings together a broad group of experienced traders from various European countries. After several selection rounds, the event has now moved into a more advanced phase.

The tournament is based on an evaluation model that combines risk-adjusted performance indicators, drawdown management, and result stability, emphasizing disciplined and methodical trading approaches.

Community Token Distribution Initiative

On the occasion of this new stage, Arborion is launching a platform token distribution program. Participation options include:

- registering through Arborion’s official channels;

- contacting authorized community representatives;

- casting daily support votes for participants;

- sharing official event updates on designated social platforms.

This initiative is part of the ongoing development of the Arborion ecosystem. Over time, token holders may gain access to additional platform features or opportunities to participate in governance, subject to regulatory compliance and future updates.

About Arborion Asset Management Inc.

Arborion Asset Management Inc., holder of a U.S. MSB license (MSB Registration Number: 31000311156240) and committed to compliance with relevant European Union regulatory frameworks, aims to provide a secure and transparent environment for digital-asset investment activities.

Its operational model is built around four core components—research, risk management, liquidity, and custody—designed to offer users standards comparable to institutional practices.

The advanced phase of the Arborion Masters is now underway. Users who wish to follow the event’s progress or obtain information about the community token distribution initiative can visit the official platform for verified updates.

Disclaimer:

This communication does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any financial instrument, token, or investment product. Digital asset activities involve risks, including market volatility and potential loss of funds. References to tournaments, community initiatives, or platform features do not imply financial benefits, returns, or investment opportunities. Arborion Asset Management Inc. is registered as a Money Services Business (MSB) for specific compliance purposes; such registration does not grant authorization to provide securities, investment, or advisory services. All features, token-related functions, and platform updates are subject to regulatory review and may change without notice. Participants are responsible for ensuring compliance with their local laws and regulations.

Bold 2026 Crypto Predictions: Over $28M Raised Highlights Shift Toward Real-World Payment Tokens

2026 Crypto Predictions now sit at an interesting point. Bitcoin still drives the market story, yet many investors are watching where fresh capital flows rather than only where the price sits today. One clear signal comes from Remittix, which has raised more than $28.5 million for a real-world payment token that targets global transfers rather than solely as a store of value.

That level of demand hints at a shift in 2026 Crypto Predictions toward payment projects with live products, not just charts and hype, and it keeps Remittix in the conversation beside Bitcoin.

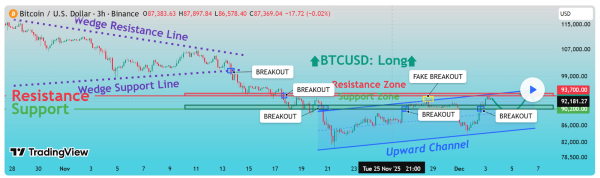

Bitcoin Still Anchors 2026 Crypto Predictions

Bitcoin remains the anchor for most 2026 crypto predictions. It trades near $90,764, with a market cap of $1.8 trillion and daily trading volume of $36 billion, keeping it well ahead of every other asset. Analysts still use Bitcoin as the main gauge of risk appetite across the broader crypto market.

Recent analysis shows some on-chain signals that resemble early bear-market conditions, including rising stress among top buyers and a larger share of supply held at a loss. Off-chain data also points to softer demand, with ETF inflows slowing and spot trading volumes weakening.

Overall, most 2026 crypto predictions stay positive on Bitcoin, but many analysts agree it may not offer the strongest upside on its own.

Remittix Leads 2026 Crypto Predictions For Payment Utility With Over $28M Raised

Against that backdrop, Remittix enters 2026 Crypto Predictions from a very different angle. The project focuses on the $19 trillion global payments and remittance market and has already sold more than 693 million tokens at a price of $0.119, raising over $28.5 million.

That scale of demand for a payment-focused token shows why many traders now describe Remittix as one of the best candidates for the next crypto in this cycle and a serious answer to 2026 Crypto Predictions that talk about utility.

The team is fully verified by CertiK, ranked number one for pre-launch tokens on CertiK Skynet with a score above 80, and has completed full know-your-customer checks, which boosts trust for early-stage crypto investment. The Remittix wallet is now live on the Apple App Store as a full crypto wallet that lets users store, send, and manage assets.

Crypto-to-fiat features will be added inside the same app, and the team has teased a high-profile December announcement that should give the token a clear boost. Centralized exchange listings are already secured, with a third major listing planned once the raise passes $30 million.

Key points that make RTX stand out in the current crypto market are:

- Focus on real-world payments and global remittance

- Direct crypto-to-bank transfers are planned in more than 30 countries

- Utility-first token that aims to support real transaction volume

- Audited by CertiK with public Skynet monitoring and an A-grade security score

- Built for adoption and daily use rather than short-term speculation

Why 2026 Crypto Predictions Favor Live Payment Projects

Looking toward the next cycle, most 2026 Crypto Predictions still start with Bitcoin as the anchor for the wider crypto market. Its size, liquidity, and store-of-value role are not under threat. The more important question is where new capital flows when investors search beyond Bitcoin for the next crypto story.

Here, Remittix stands out as a project that already shows progress, with more than $28.5 million raised, a live wallet on the Apple App Store, two exchange listings secured, and a clear plan to connect crypto and fiat payments. For traders who think payment utility will drive the next wave, Remittix offers a way to back that view inside their 2026 Crypto Predictions.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Frequently Asked Questions

1. Why do 2026 crypto predictions still start with Bitcoin?

Bitcoin remains the main reference point for risk sentiment because of its size, liquidity, and dominance in institutional portfolios. While upside may be more limited, most 2026 crypto predictions still depend on Bitcoin setting the overall market direction.

2. What signals a shift toward payment-focused tokens in 2026 crypto predictions?

Raising over $28.5 million for a real-world payments project like Remittix signals strong investor interest beyond store-of-value narratives. Capital is increasingly flowing toward tokens linked to live products, user adoption, and real transaction demand.

3. Why is Remittix often mentioned in next-cycle growth discussions?

Remittix targets the $19 trillion global payments and remittance market rather than short-term price speculation. With a live wallet, upcoming crypto-to-fiat rails, and secured exchange listings, it fits the utility-driven thesis behind many 2026 crypto predictions.

4. How does Remittix differ from earlier payment tokens?

Unlike older payment tokens that relied on future adoption, Remittix already delivers a working wallet on the Apple App Store. Its CertiK verification, KYC-completed team, and growing user incentives reinforce trust at an early stage.

5. What role could a payment utility play in the next crypto cycle?

Many analysts believe the next wave of growth will come from crypto solving real-world problems rather than pure speculation. Payment networks with live products, like Remittix, are increasingly viewed as strong candidates to benefit most during the 2026 cycle.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

80-Year-Old Army Veteran Brings Smiles to His Community This Christmas Season as “Secret Santa”

Sponsored By J&G Fence Company Inc.

Gastonia, North Carolina – By night an 80-year-old Army veteran, by day a joyful Secret Santa—Joe Mayes is warming hearts and spreading smiles throughout his community this holiday season.

’This is the season to be jolly, and Joe is determined to make it unforgettable. His mission? To bring big smiles, warm hearts, and a whole lot of festive fun to everyone he meets.

As Secret Santa, Joe surprises random participants by inviting them to choose a mystery prize box—and whatever they pick, they get to share with their coworkers! Will it be a bundle of holiday cash? Or perhaps a playful lump of coal? No matter what’s inside, one thing is guaranteed: laughter, joy, and a magical moment to remember.

And the fun doesn’t stop there. People from around the world will get to join the excitement as clips of each prize-picking adventure are shared across Facebook, X, TikTok, and Instagram. With every smile, reaction, and burst of laughter captured on video, these moments are sure to rack up millions of views—spreading Christmas cheer far beyond the local community.

Secret Santa Video JOE MAYES – SECRET SANTA VIDEO LINK

Army Veteran Joe Mayes shares, “What the world needs right now is happy, festive smiles each and every day. I hope that Secret Santa brings joy to as many people as possible during this Christmas season.”

Thanks to Secret Santa, J&G Fence Company Inc.and Tim Greene Films this holiday is shaping up to be brighter, happier, and filled with unforgettable Christmas cheer.

CHECK OUT JOE MAYES AND J&G FENCE COMPANY’S PREVIOUS PROJECT BELOW CALLED

“MEET ME AT THE BEACH” BY JESSE CALDWELL III

JUDGE JESSE CALDWELL III MEET ME AT THE BEACH MUSIC VIDEO – VIDEO LINK

Additional prizes are provided by Jesse Caldwell III and Pat Gwinn. Secret Santa segments are photographed by award winning filmmaker Tim Greene Of Tim Greene Films.

Let the smiles begin!

Fencing Company, Fence Installation & Repair | Gastonia, Lincolnton, Shelby & Belmont, NC

Garrett Nann and POP Advertising Partners Prove AI Search Now Drives 20%+ of E-Commerce Revenue

December 8, 2025 – Asbury Park, NJ – Garrett Nann, co-founder of New Jersey-based POP Advertising Partners and the nation’s leading authority on AI search marketing and generative engine optimization (GEO), today released explosive Q4 2025 case study data showing that a single seven-figure outdoor & lifestyle Shopify brand captured over 20% of its total revenue directly from AI-driven discovery – without spending one additional dollar on paid advertising.

The anonymized e-commerce client, operating on Shopify with annual revenue exceeding $10 million, implemented Nann’s proprietary AI Search Dominance Framework beginning September 5, 2025. In just 90 days, the brand achieved:

- +209% total users (372,936 vs 120,641 previous period)

- +167% conversions (5,311 key events)

- +276% direct traffic – the unmistakable fingerprint of AI recommendations where users type the URL manually after seeing the brand cited as the #1 or #2 answer in Grok, ChatGPT Search, Perplexity, Claude, and Gemini

- An estimated 55,000–61,000 “dark AI” sessions hidden in Direct and (data not available) channels, representing 15–16% of all traffic and over 20% of total revenue

Detailed attribution analysis confirms AI models are now the primary discovery engine for high-intent buyers, with tagged ChatGPT referrals growing +37% and hidden AI traffic exploding to nearly 60,000 users in a single quarter.

“These numbers are conservative,” stated Garrett Nann. “We’re already seeing the same pattern repeat across home services, B2B SaaS, legal, and health verticals. Any business that treats AI search as ‘nice-to-have’ or waits until 2027 is choosing obsolescence. Google is no longer the homepage of the internet – Grok, ChatGPT, and Perplexity are. If your brand isn’t the default answer when a consumer asks an AI who the best option is, you simply will not exist to that buyer.”

Nann warns that the compounding nature of entity authority and citation density creates a winner-take-all dynamic: the brands that establish dominance in 2025–2026 will become permanently embedded as the default recommendation as AI search volume grows another 5–10× in the coming 12 months.

Key findings from the case study include:

- AI-driven visitors convert at or above site average because they arrive pre-sold by the AI’s recommendation

- The surge began compounding in week 3 and peaked at 4× normal direct traffic by week 12

- Zero additional ad spend was required – only strategic entity optimization and citation syndication

- Competitors without an AI search strategy are now permanently locked out of this traffic source as the gap widens daily

POP Advertising Partners has officially opened limited spots in its 2026 AI Search Dominance program – the only done-for-you service that guarantees top-answer placement across Grok, ChatGPT Search, Perplexity, Claude, and Gemini or the client pays nothing.

Business owners and agency leaders can request a complimentary AI Visibility Audit – revealing current mention volume and share-of-voice inside every major generative engine – at https://popadpartners.com.

About Garrett Nann Garrett Nann is co-founder and Head of AI Search Strategy at POP Advertising Partners. He is recognized as the foremost practitioner of generative engine optimization and creator of the AI Search Dominance Framework used by seven- and eight-figure brands nationwide.

About POP Advertising Partners New Jersey-based POP Advertising Partners is the leading performance marketing agency specializing in AI-first lead generation, generative engine optimization, and zero-click conversion systems for e-commerce, home services, and B2B brands.

Media Contact: Garrett Nann Co-Founder & Head of AI Search Strategy Email: garrett@popadpartners.com Website: https://popadpartners.com Phone: Available on request

UK Adds 1.9 GW of Solar in 12 Months as Utility-Scale Projects Transform the National Pipeline

The UK solar industry has entered a new period of acceleration, with the latest government figures confirming that 1.9 GW of new photovoltaic capacity was added in the twelve months leading up to October 2025.

This brings the UK’s total installed solar capacity to 20.7 GW, marking a 10.4% year-on-year increase and signaling one of the strongest growth periods the sector has recorded in the past decade.

For an industry once viewed as vulnerable to policy shifts, the new data paints a picture of stability, confidence, and long-awaited momentum.

After years of incremental growth driven primarily by domestic rooftops, the UK is now witnessing a notable shift towards large, utility-scale solar farms – many of them catalysed by the long-term certainty provided by the Contracts for Difference (CfD) scheme.

This shift matters. Not just because the numbers are larger, but because it suggests the UK’s solar industry is leaving behind its stop-start history and aligning with the kind of sustained, pipeline-driven development that has long defined the offshore wind sector.

For the first time in years, solar is behaving like a mature infrastructure industry, rather than a collection of individually financed, small to mid-scale projects.

A Year Shaped by Utility-Scale Solar

While household installations continue to rise steadily – buoyed by zero-VAT rules and continued interest in home energy independence – the unmistakable engine of this year’s growth has been the arrival of grid-scale solar farms energising across England, Wales, and Scotland.

The majority of 2025’s utility-scale additions stem from projects awarded in recent CfD allocation rounds, many of which achieved record-low strike prices at the time. These contracts are now translating into real-world energisations, feeding hundreds of megawatts of clean power into the grid.

For policymakers, this is a validation of the CfD model’s ability to drive down costs and mobilise large volumes of investment. For developers, it proves that the long delays caused by pandemic disruption, supply chain turbulence, and grid connection queues are beginning to ease.

Industry analysts note that the UK’s solar landscape in 2025 looks markedly different from that of even three years ago. Supply chains have normalised following the manufacturing crunch of 2021–2023.

Panel prices have softened, and developers are increasingly able to secure finance at competitive rates. Crucially, the grid’s Accelerated Electrical Connections Plan – introduced to unblock historic bottlenecks – has resulted in more predictable timelines and prioritised access for renewable generation.

Together, these factors have created the conditions for a genuine utility-scale surge – one reflected clearly in the 1.9 GW added within a single year.

Cleve Hill: A Landmark Project Signalling a New Era

No project better symbolises this shift than Cleve Hill Solar Park, now known as Project Cleve Hill, located just outside Faversham on the north Kent coast. Widely regarded as one of the most significant renewable energy developments in Europe, Cleve Hill represents a step change in how solar farms are conceived, designed, and integrated into the national grid.

With an expected capacity of 373 MW of solar generation, supported by a substantial co-located battery installation, Cleve Hill stands as a blueprint for the future of large-scale solar infrastructure.

The project is unique not only for its scale but for its designation as a Nationally Significant Infrastructure Project (NSIP) – a status that acknowledges its strategic importance to the UK’s decarbonisation strategy.

Although full energisation is expected in 2026, major construction milestones were achieved throughout 2025, contributing indirectly to the sense of momentum captured in the latest capacity figures.

Cleve Hill’s significance extends beyond its immediate output: it demonstrates that mega-projects once deemed ambitious or unconventional for the UK are now entirely viable.

Its impact will be both practical and symbolic. Practically, it will provide clean electricity equivalent to tens of thousands of homes while helping the grid manage imbalances through its battery component.

Symbolically, it signals a new appetite for scale – an understanding that meeting the UK’s goal of a decarbonised electricity system by 2035 requires generation projects measured in the hundreds of megawatts, not tens.

A Market Growing Beyond Its Domestic Roots

For much of the past decade, UK solar growth has been supported primarily by domestic and small commercial installations. And although this segment remains resilient, the 2025 data clearly shows a market evolving beyond its rooftop identity.

More than half of all new installed capacity this year came from large ground-mounted projects, a proportion that has not been seen since the height of early 2010s’ large-scale solar deployment.

The shift reflects an important structural transition: solar is no longer viewed as a dispersed technology composed of thousands of small systems but as a cornerstone of national energy infrastructure. Investors now view UK solar through the same lens as wind – stable, scalable, and backed by a consistent policy framework. That confidence is reshaping the pipeline.

Current industry tracking indicates that the UK now has over 14 GW of ground-mounted solar in the consented or late-stage planning pipeline, plus an additional wave of early-stage proposals that could come online later in the decade. Many of these projects integrate storage as standard, reflecting the grid’s need for flexible, dispatchable support as renewable penetration increases.

If even a portion of this pipeline progresses as expected, annual installations of 2–3 GW could become typical by the end of the 2020s – a level of growth that would dramatically accelerate the UK’s progress toward its climate commitments.

SolarAdvice on a Defining Year

Reflecting on the newly released figures, Kian Milroy, Chief Writer at SolarAdvice.co.uk, describes 2025 as a pivotal year that confirms the direction of travel for the UK solar industry.

“Adding nearly 2 GW of solar in a single year is impressive in its own right, but what really matters is the foundation it reveals,” Milroy says. “This isn’t a one-off spike – it’s the start of a more stable, utility-scale era. Projects like Cleve Hill show that the UK isn’t just experimenting with large solar anymore. We’re building energy infrastructure that will define the next twenty years.

The impact on consumers shouldn’t be underestimated either. As the utility-scale sector expands, costs fall across the board, from household systems to commercial installations. A stronger national pipeline means a more confident industry – and that benefits everyone.”

Milroy notes that this year’s figures echo the early stages of the offshore wind boom, where sustained CfD support transformed a previously fragmented sector into a global success story. Solar, he suggests, may be at the beginning of a similar trajectory.

Looking Ahead: A Sector Entering Its Next Phase

The injection of 1.9 GW into the UK system is more than a numerical milestone – it signals a new phase of maturity for the industry.

The combination of falling costs, grid reform, and the stabilising influence of CfD-backed development has created a foundation on which the UK can build a resilient, large-scale solar sector capable of underpinning national decarbonisation efforts.

As Cleve Hill moves closer to operation and more utility-scale projects progress through planning and construction, the UK enters 2026 with momentum unmatched in recent years.

If policy reform continues and grid upgrades maintain pace, the coming decade could mark the first time solar rivals wind as one of the UK’s dominant sources of new electricity generation.

Solar Advice UK

Kian Milroy

contact@solaradvice.co.uk

Solaradvice.co.uk

UK

BullZilla Frontlines: The Best Crypto to Watch

As 2025 draws near, investors are gradually shifting their focus from traditional giants like Bitcoin and Ethereum toward new-generation cryptocurrencies that offer practical utility, transparency, and the potential for exponential returns. With the holiday season driving renewed optimism, market sentiment is turning increasingly bullish. Emerging projects now combine scalability, innovation, and strong tokenomics, attracting both institutional and retail investors alike.

Among the rising stars leading 2025’s crypto resurgence, BullZilla ($BZIL) shines brightest as the most structured and ROI-driven presale of the year. Alongside BullZilla, standout projects such as Sui, MoonBull, La Culex, TRON, and Chainlink are each pushing blockchain technology to new limits through scalability, staking innovations, and real-world applications. Together, these ten contenders form a diverse lineup of promising assets that balance stability with innovation. For investors seeking high-growth opportunities during the festive rally, these projects rank among the Crypto to Buy, combining cutting-edge vision with long-term profitability potential.

1. BullZilla ($BZIL): Leading The Crypto to Buy With Explosive ROI

The BullZilla presale continues to dominate investor attention as one of the best crypto to buy right now, driven by its rapid-stage structure and high-velocity momentum. Stage 13B, priced at $0.000332380, is already showing robust traction. With stages advancing automatically every 48 hours or upon crossing $100,000, urgency is at an all-time high.

The BullZilla price continues to rise with each phase, making early entry into the BZIL presale more advantageous than ever. Traders who buy during Stage 13B gain significant leverage compared to later-stage participants, which is why BullZilla is one of the most discussed projects on lists of the best crypto to buy right now.

Deflationary mechanics strengthen its appeal. Token burns reduce supply, and community-driven incentives such as staking and referral rewards add even more upside potential. As more investors join, the BulllZilla coin narrative expands rapidly, feeding momentum, hype, and visibility across the crypto community.

For speculators, BullZilla is not just competitive; it is leading by a wide margin, repeatedly showing why it belongs among the best crypto to buy right now, especially during the high-energy Stage 13B window.

2. Sui (SUI): Scalable Blockchain For Global Adoption

Sui, developed by Mysten Labs, is reshaping blockchain performance through advanced parallel transaction processing, allowing near-instant confirmations and exceptional scalability. This innovation eliminates network congestion, making Sui one of the fastest and most efficient Layer-1 blockchains in operation. Its expanding ecosystem, supported by CoinMarketCap insights, includes partnerships across gaming, DeFi, and enterprise applications, proving its real-world use cases extend far beyond theory. Developers praise Sui’s user-centric framework and low transaction costs, which make it ideal for Web3 integration and large-scale adoption. As institutional attention grows, Sui’s technology positions it as one of the Crypto to Buy, offering investors both growth potential and long-term stability within 2025’s evolving blockchain economy.

3. MoonBull (MOBU): Staking Power Meets Meme Innovation

MoonBull ($MOBU) perfectly merges DeFi innovation with meme-driven energy, creating a project that rewards both creativity and conviction. Built on Ethereum, it features APY staking, reflection rewards, and an auto-liquidity protocol that continually strengthens its ecosystem. Its 23-stage scarcity system burns supply with every phase, increasing long-term token value and ensuring sustainable market health. Verified smart contracts, community-led governance, and an AI-powered staking optimizer further enhance transparency and investor trust. Every transaction fuels liquidity and growth, proving MoonBull is more than just hype, it’s a long-term performer. With its blend of humor, functionality, and profitability, MoonBull has earned its place among the Crypto to Buy, appealing equally to traders and DeFi investors.

4. La Culex (CULEX): Meme Strength With Sustainable Tokenomics

La Culex stands out with a 200B token supply, allocating 45% to presale, 15% to staking, 20% to liquidity locked for 18 months, and 2B tokens for burns. Its Hive Vault offers APY, while the Bite Chain referral system rewards early participants. Designed for safety, growth, and scalability, its 32-stage model ensures rising value toward a $0.007 listing price. Transparent audits and zero transaction tax position La Culex as one of the Crypto to Buy for long-term investors.

5. Apeing (APEING): A New Meme-Era Opportunity

Apeing is emerging as a dynamic new player redefining the early-stage whitelist landscape. Drawing inspiration from Dogecoin and PEPE, it elevates the meme model through verified smart contract audits, controlled supply burns, and an active referral-driven ecosystem. Its whitelist ensures fair access, while a deflationary token structure supports steady value growth. Every phase rewards early adopters through transparent distribution and sustainable liquidity mechanics. Backed by a passionate community, Apeing represents both nostalgia and innovation, offering investors a humorous yet credible alternative in a maturing market. For those with higher risk tolerance, this hybrid of culture and smart tokenomics makes Apeing one of the Crypto to Buy, symbolizing crypto’s grassroots energy rebirth.

6. Binance Coin (BNB): The Exchange Titan’s Continued Dominance

Binance Coin (BNB) remains one of the most influential assets in the crypto industry, anchoring the vast Binance ecosystem through trading discounts, token burns, and BNB Chain utilities. It powers millions of transactions daily, from DeFi integrations to NFT marketplaces, while maintaining impressive stability amid market volatility. Recent reports by CoinDesk highlight BNB’s expanding role in Web3 adoption, cross-chain bridges, and decentralized finance applications. Its strong fundamentals, global user base, and consistent quarterly burns reinforce its long-term scarcity and value. For investors seeking steady appreciation rather than speculation, BNB stands out among the Crypto to Buy, representing both innovation and reliability in a rapidly evolving blockchain economy.

7. TRON (TRX): Decentralizing The Digital Economy

TRON continues to strengthen its position as a global leader in decentralized entertainment, digital payments, and data sharing. Capable of processing millions of transactions daily, TRON offers unmatched scalability and speed, attracting developers from multiple industries. With growing integration across DeFi, NFTs, and stablecoins such as USDT and USDC, it provides real-world utility and steady transaction volume. Founder Justin Sun’s consistent focus on cross-border settlements and on-chain transparency reinforces TRON’s role as a Web3 powerhouse. As more creators and businesses leverage its ecosystem for tokenized content and financial applications, TRON remains a trusted, accessible, and innovative blockchain, cementing its place among the Crypto to Buy for long-term, sustainable growth.

8. Cardano (ADA): Smart Contracts With Sustainability

Cardano (ADA) remains one of the most academically grounded and future-proof blockchain projects in the market. Its peer-reviewed architecture and layered design provide unmatched scalability, security, and environmental efficiency. With the rollout of Hydra scaling and interoperability upgrades, Cardano now supports faster transactions and enhanced multi-chain communication, enabling real-world applications across finance, identity, and education. These advancements, paired with its smart contract ecosystem, are attracting developers and institutions seeking reliability and longevity. Supported by the Cardano Foundation and a strong global community, ADA continues to evolve beyond speculation into a true infrastructure layer. Its disciplined governance model and steady innovation make it a resilient addition among the Crypto to Buy.

9. Chainlink (LINK): Powering Real-World Data For DeFi

Chainlink (LINK) serves as the critical connection between smart contracts and real-world data, effectively acting as the backbone of decentralized finance. By delivering secure, tamper-proof data feeds to blockchains, Chainlink enables automation in lending, trading, and insurance systems. Integrated across Ethereum, Avalanche, BNB Chain, and more, its oracle network supports thousands of DeFi protocols globally. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) also enhances multi-chain communication, ensuring seamless data flow between ecosystems. As global demand for reliable blockchain data intensifies, Chainlink continues to prove indispensable, solidifying its position among the Crypto to Buy for those seeking real-world blockchain utility.

10. APEMARS: MemeCoin with Growth Potential

APEMARS is a narrative-driven memecoin project on Ethereum that frames its presale as a collective mission to Mars. Instead of a traditional sale, it structures the launch into 23 weekly stages, symbolizing segments of a 225-million-kilometer voyage. The story progresses alongside the token price, creating an engaging expedition for holders. To enforce scarcity, the project conducts major token burns at Stages 6, 12, 18, and 23, removing all unsold tokens from those periods.

After the presale, the ecosystem expands with features tied to Mars-themed symbolism. This includes the APE Yield Station, an official staking platform offering annual yield, inspired by Mars’ average temperature, with rewards locked for two months post-launch. The project also incentivizes growth through an Orbital Boost referral program, where contributors who invest $22 or more receive a referral code; both referrer and new buyer then earn a 9.34% reward. Presented as a long-term mission under the “Operation RED BANANA” storyline, APEMARS integrates token mechanics, community participation, and lore into a unified experience.

Conclusion: Why These Projects Are the Crypto to Buy

From BullZilla’s explosive ROI potential to Chainlink’s unmatched DeFi infrastructure, these Crypto to Buy reflect a rapidly maturing market ready for its next major surge. Established assets like Ethereum and stable Layer-1 networks continue to anchor the ecosystem, while innovative presales such as BZIL introduce asymmetrical opportunities that reward early conviction. As analysts forecast renewed bullish momentum entering 2025, strategic diversification between trusted giants and structured presale tokens could unlock gains. Investors who position themselves now stand to benefit from both stability and exponential growth. With global adoption rising and innovation accelerating, the window for early entry is narrowing, making this the ideal time to secure positions before the next crypto wave ignites.

Join BullZilla’s Presale Now, Secure Your Spot Before Prices Surge And The Next Bull Run Takes Off!

For More Information:

Follow BZIL on X (Formerly Twitter)

Summary:

This article highlights ten standout projects leading the crypto landscape in 2025, with BullZilla ($BZIL) at the forefront for its structured presale and massive ROI potential. Alongside innovators like Sui, MoonBull, La Culex, TRON, Cardano, Chainlink, Binance Coin, Apeing, and Hyperliquid, these assets represent the Crypto to Buy. Each project blends technology, transparency, and real-world use cases to appeal to both seasoned investors and new entrants. From staking incentives and liquidity locks to institutional-grade scalability, these tokens define the next phase of blockchain growth. As markets prepare for 2025’s bull cycle, early participation could turn calculated decisions today into exponential profits tomorrow.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Why BullZilla Could Outperform Other Coins As the Best Crypto To Invest In 2025

Ever notice how the crypto market can switch moods faster than a weather app on a stormy day? One moment, everything looks calm, and the next, Ethereum sparks headlines with new scaling updates while Binance Coin grabs attention through growing ecosystem integrations. These developments reflect a market that refuses to sit still, especially as major networks regain momentum heading into the new year. Because these shifts restore confidence among long-term participants, they also create an environment in which early-stage opportunities carry greater weight for supporters seeking the best crypto to invest in 2025 before broader sentiment turns fully bullish.

BullZilla enters this landscape with a distinctive tone. While Ethereum focuses on infrastructure evolution and Binance Coin grows through exchange-driven innovation, BullZilla leans into emotional motivation, structured growth, and long-term aspiration. This blend creates a pathway that feels fresh, accessible Because the project combines narrative with measurable stages, it positions itself as a standout option for individuals researching what some online communities refer to as the best crypto to invest in 2025. As the market builds energy heading into the next cycle, BullZilla’s presale structure continues to draw interest from those looking for promising early entry points that complement more established networks.

BullZilla: The Best Crypto To Invest In 2025 Opportunity

BullZilla begins its journey with a narrative focused on ambition, identity, and achievable progress, making it one of the most compelling contenders among the best crypto to invest in 2025. The project blends emotional storytelling with transparent pricing, giving early supporters a sense of belonging while offering measurable advancement through structured stages.

Rather than relying purely on hype, BullZilla ties its ecosystem to relatable aspirations such as financial freedom, lifestyle upgrades, and family security. These themes resonate strongly with audiences who connect investment decisions As interest around early-stage offerings grows, BullZilla’s momentum reflects both excitement and belief in its long-term potential.

A $6000 Scenario That Shows How Early Positioning Changes Everything

Consider an early buyer allocating $6000 at the current presale price of $0.00033238. That purchase secures more than eighteen million tokens, positioning the buyer far ahead of later entrants. If BullZilla reaches its projected listing price of $0.00527, that early $6000 transforms into meaningful progress Because structured presales reward early involvement, the scenario gives supporters a vivid picture of how early participation creates opportunities that traditional markets rarely match. This emotional and financial alignment strengthens BullZilla’s appeal as interest accelerates.

Grab your BullZilla spot now before the next price jump hits.

How To Join The BullZilla Presale

Joining the BullZilla presale starts with setting up a Web3 wallet, such as MetaMask or Trust Wallet. After creating the wallet, users purchase ETH from a trusted exchange such as Coinbase or Binance and transfer it to their wallet. They then visit the official BullZilla presale website, connect their wallet, and select the amount of ETH they want to exchange for BZIL tokens. Tokens purchased during the presale are locked immediately for added security, and vesting details appear directly on the platform. This streamlined process helps newcomers join confidently without navigating unnecessary complexity.

Staking Benefits | The HODL Furnace

BullZilla holders can amplify their long-term value through the HODL Furnace, a staking mechanism that rewards participants for locking their tokens. Staking reduces circulating supply and provides added benefits to users who commit to extended holding periods. This model creates a stable foundation as the project advances toward launch, helping maintain healthy price behavior during early growth stages. Because staking offers predictable rewards and fosters loyalty, it appeals to individuals who want consistent progress without constant monitoring. As adoption increases, the Furnace becomes a powerful anchor that supports BullZilla’s long-term ecosystem.

Ethereum Strengthens Its Market Position Through Expanded Layer Activity

Ethereum continues to reinforce its role at the center of decentralized finance and smart contract innovation. Recently, network activity increased due to scaling upgrades that improved throughput and reduced congestion for many applications. These enhancements help Ethereum remain competitive as demand for decentralized tools grows across the industry.

Additionally, rising staking levels indicate improved confidence from supporters who appreciate long-term consistency. Because Ethereum balances innovation with reliability, it maintains a position that appeals to users seeking dependable performance even during volatile cycles. This combination allows Ethereum to remain a stabilizing force in the broader market as new opportunities emerge alongside established players.

Binance Coin Gains Strength Through Ecosystem Expansion

Binance Coin recently experienced renewed momentum as the broader Binance ecosystem expanded its offerings across decentralized applications and trading utilities. Increased activity in cross-chain tools and liquidity services contributed to higher transaction volume, demonstrating growing interest among users who value efficiency and convenience.

Additionally, market observers noted rising engagement in Binance-supported projects, signaling healthier conditions across the ecosystem. Because Binance Coin benefits from the exchange’s vast infrastructure, it maintains a reliable presence during shifting market cycles. This stability makes it appealing to individuals who prefer structured frameworks that support long-term participation without unnecessary complexity.

Conclusion

The evolving market landscape shows how Ethereum and Binance Coin continue providing stability through strong foundations, dependable innovation, and consistent development cycles. Their steady performance appeals to individuals who prioritize reliability as the broader crypto environment shifts. Yet the rising demand for early growth opportunities highlights a new direction. This shift guides attention toward emerging projects that offer more substantial upside, especially those built around structured growth, transparent mechanics, and a clear long-term vision.

In this context, BullZilla stands out as a powerful contender for the best crypto to invest in 2025. Its emotional storytelling, structured presale model, and relatable long-term potential create an experience that inspires early participants to take action. Because the presale positions buyers ahead of the subsequent price increase, it offers a meaningful advantage that strengthens confidence. As momentum continues building, BullZilla shows signs of becoming a leading force in the next wave of early-stage excitement across the crypto market.

Join the BullZilla presale now and lock in upside.

For More Information:

Follow BZIL on X (Formerly Twitter)

Summary

This article explores how Ethereum, Binance Coin, and BullZilla position themselves within the evolving crypto landscape. Ethereum strengthens its foundation through scaling upgrades and growing ecosystem activity, while Binance Coin gains traction from its expanding infrastructure and rising network engagement. BullZilla stands apart as a leading contender among the best crypto to invest in 2025 due to its emotional narrative, structured presale system, and community-driven incentives. A $6000 scenario highlights how early buyers could benefit from long-term growth if projections hold. With features like the Roarblood Vault and HODL Furnace, BullZilla blends opportunity with aspiration, giving supporters powerful reasons to join early. As momentum builds across the market, BullZilla appears positioned to lead the next wave of early-stage enthusiasm.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

BullZilla, MoonBull, La Culex Lead Best Meme Coins

Ever notice how meme coins behave like the internet’s version of plot twists? One minute they are quiet, and the next they are sprinting through the charts like they drank three cups of espresso. This unpredictability is why discussions about the best meme coins remain center stage, as new presales and emerging ecosystems bring fresh energy to the market. MoonBull’s growing momentum and La Culex’s narrative-driven revival continue to grab attention as audiences search for projects that feel fun yet hold measurable long-term ambition.

BullZilla pushes that excitement even further by positioning itself as a structure-driven alternative inside a category usually powered only by hype. The project blends emotion, aspiration, and community-driven identity while offering early access through a designed presale model. Because the world of meme assets shifts fast, many participants want something that feels early but not reckless, new but not hollow. BullZilla steps directly into that space, and its rising engagement has placed it at the front of ongoing debates among those tracking the best meme coins.

BullZilla And The Best Meme Coins Narrative Reshaping Early Stage Momentum

BullZilla enters the landscape of the best meme coins with a tone that feels both ambitious and deeply personal. Rather than selling only hype, it leans on emotional storytelling that taps into dreams, goals, and the desire to grow from early positioning. The narrative frames every holder as part of a powerful movement where the community grows with the project. That message resonates strongly in the US market, where audiences often seek fresh opportunities that can turn small entries into meaningful milestones at different stages of life. BullZilla appeals to those desires by promising structure, identity, and a roadmap built for confidence rather than chaos.

Because its presale continues to move quickly, many new supporters are considering how joining early might align with their real-world aspirations. People dream about clearing bills, covering education costs, or building vacation savings without feeling like they are gambling recklessly. BullZilla’s appeal lies in this emotional clarity. It gives early participants a sense that their decision might shape more than short-term gains. This combination of structured value and relatable ambition is precisely why many watchers now consider BullZilla a standout among the best meme coins.

Investment Scenario: What A $8000 BullZilla Position Could Mean

Imagining an $8000 entry into BullZilla instantly paints a vivid picture of financial transformation. At the current Stage 13 price of $0.00033238, that allocation equals nearly 24 million tokens. Supporters often view this kind of early access as a chance to breathe a little easier, finally. Some imagine paying off credit cards, others dream about a reliable emergency fund, or even saving for a family trip without stress. Because BullZilla’s presale structure moves upward stage by stage, early entries receive a multiplier advantage that feels grounded rather than random. This scenario highlights how goal-driven investors find meaning in BullZilla’s growing momentum.

Join BullZilla today and secure early positioning while momentum is still building.

How to Join the BullZilla Presale

Joining the BullZilla presale begins by setting up a Web3 wallet such as MetaMask or Trust Wallet. Once the wallet is ready, buyers purchase ETH from an exchange like Coinbase or Binance and transfer it into their purse. After loading funds, they visit the official BullZilla presale site, connect the wallet, and swap ETH for $BZIL directly through the presale portal. Tokens automatically lock until the presale ends, and vesting details appear clearly on the platform. This streamlined onboarding process ensures transparency while giving newcomers confidence as they enter one of the most promising presales in the market.

MoonBull Expands Its Momentum As A Rising Competitor In Meme Utility

MoonBull continues building traction through its structured 23-stage presale model, which elevates price, demand, and scarcity as each tier completes. Recent interest spiked after more than 2100 holders joined the early stages, while automated liquidity, reflections, and strategic burns strengthened long-term sustainability. Market watchers noted that MoonBull’s hybrid narrative, blending meme culture with real mechanics, positions it as a clever twist within the best meme coins category. Because it prioritizes both community and utility, MoonBull appeals to individuals who want the excitement of meme tokens without sacrificing structure or long-term relevance in a crowded market.

La Culex Reclaims Attention As Its Ecosystem Grows And Community Expands

La Culex has returned to the spotlight after recent ecosystem upgrades reignited engagement across its broader token environment. Supporters highlight how new feature rollouts and fresh marketing campaigns breathe new life into the project, helping it stand out again within crowded meme conversations. Market activity improved as liquidity strengthened and community participation increased across primary channels. La Culex holds a loyal audience that prefers long-term incremental development over short-lived hype cycles. This slow-and-steady growth model positions La Culex as a dependable third competitor, alongside MoonBull and BullZilla, especially for those watching the best meme coins gain early traction.

Conclusion

MoonBull’s structured approach, La Culex’s community revival, and BullZilla’s emotional narrative reflect how the best meme coins continue evolving with new energy. Each project captures a different angle of market enthusiasm, yet BullZilla stands out because its identity blends ambition with accessibility. Supporters increasingly view it as more than a meme token, recognizing its ability to build connections through story-driven growth and relatable messaging that resonates with both new and experienced market participants.

BullZilla’s presale structure, rapid stage movement, and strong early demand create an environment where momentum builds with every price shift. The project’s life-centered storytelling helps buyers imagine meaningful personal outcomes, making participation feel purposeful rather than speculative. Because excitement grows daily and community engagement continues strengthening, many believe BullZilla is positioned to lead the next wave of early-stage expansion. This combination places it at the forefront of a category hungry for disciplined opportunity.

Lock in BullZilla at presale levels and ride the narrative shaping the next market wave.

For More Information:

Follow BZIL on X (Formerly Twitter)

Summary

This article compares MoonBull, La Culex, and BullZilla as contenders in the best meme coins category, highlighting their unique strengths and growing influence. MoonBull gains traction through a structured 23-stage model with sustainability features. La Culex reenters discussions due to revived marketing, ecosystem expansion, and stable community support. BullZilla, however, leads the narrative with emotional branding and a presale that aligns personal aspirations with a clear financial structure. Its upward stage progression and relatable messaging place it in a strong early position. Together, these insights showcase how each project contributes to the rapidly evolving meme coin landscape and reveal why BullZilla may dominate upcoming cycles.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com