Apeing Tops Best Upcoming Crypto Battles BNB and Solana

Crypto Market Rattled as BNB Slips Below $830 and Solana Holds Firm, But Apeing Commands Attention as the Best Upcoming Crypto

On December 18, 2025, BNB slipped below 830 USDT with a 1.93% drop over 24 hours, stirring concern among investors tracking large-cap coins. Meanwhile, Solana remains steady at $123.40, showing minimal 0.01% gains. With market signals pulling in different directions, financial students, crypto followers, and blockchain builders are increasingly watching early-stage opportunities. Projects such as Apeing are gaining interest through early whitelist access for the best upcoming crypto, which allows participants to position ahead of broader market awareness. Tracking price action in major coins like BNB and Solana while monitoring emerging platforms can help investors better read momentum and manage market swings.

While BNB and Solana demonstrate stability and liquidity, market watchers know that real gains often come from timing, community energy, and early positioning. Apeing’s whitelist presents that chance, combining exclusivity and potential for upside. By observing price swings, supply metrics, and token allocation strategies, participants can spot opportunities before wider market adoption amplifies demand. The key for investors lies in acting decisively, leveraging tools and platforms that allow for informed and timely engagement with high-potential crypto assets.

Ape First, Profit Later: The Power of Joining the Whitelist

Joining the Apeing whitelist unlocks early access to one of the most anticipated meme projects of 2025. Early participants can secure Stage 1 allocation at $0.0001, with a planned listing target of $0.001, creating a projected difference before broader market momentum begins. With limited token allocation, whitelist participants get priority access that could determine breakout leaders versus latecomers chasing the market.

The whitelist provides strategic advantages for traders looking to move fast. Tokens with early access often reward decisive participants, while hesitating can result in missed opportunities. Apeing combines community, utility, and engagement, making it more than just another meme coin. Observing market cycles, BNB and Solana trends, and liquidity patterns informs smart entry points, but whitelist participation in Apeing ensures front-row positioning. This system rewards those who act early while maintaining the security and clarity of official channels.

Whitelist Wins: Early Apes Get the Biggest Edge

Stage 1 of Apeing is designed for maximum impact. The lowest projected entry at $0.0001 ensures early apes are positioned ahead of general market demand. The process is simple: visit the official portal, submit your email, and receive confirmation for whitelist access. Stage 1 is expected to offer limited tokens, emphasizing exclusivity and potential gains. Community speculation points to returns over but these expectations are illustrative, highlighting the importance of evaluating risk independently.

Participants who join now are strategically positioned to capture momentum as Apeing gains attention. Timing, community engagement, and the structured approach of whitelist access all converge to make Apeing a standout in the best upcoming crypto conversation. Acting early ensures priority allocation, reducing the risk of being left behind in highly speculative markets where hesitation often costs more than risk.

BNB Buying Windows: Stability, Volatility, and Strategic

BNB is trading at $836.39, down 0.98% over the last 24 hours, reflecting volatility near key resistance levels. Ranked #4 by market capitalization, BNB commands a $115.2 billion valuation with a 24-hour trading volume of $2.93 billion. Its fully minted circulating supply of 137.73 million BNB eliminates dilution risk, while the 24-hour range from $821.26 to $850.90 highlights active price movement. The volume-to-market-cap ratio of 2.54% confirms consistent liquidity, cementing BNB’s role as a core asset in the Binance ecosystem.

Recent dips, including a 1.93% drop to 828 USDT, suggest potential buying opportunities for strategic investors. Analysts note that tracking support levels and exchange-driven activity is crucial. BNB’s stability and liquidity provide context on market behavior, comparative risk, and the timing needed to capitalize on emerging opportunities effectively.

SOL Price and Market Metrics: A Guide for Investors

Solana is trading at $123.40, up a marginal 0.01% in the past 24 hours. Ranking #7 by market capitalization, Solana holds a $69.4 billion market cap with daily volume of $5.09 billion. Its circulating supply of 562.17 million SOL and flexible maximum supply model contribute to consistent liquidity, as reflected in a 7.34% volume-to-market capitalization ratio. The 24-hour trading range indicates stability amid broader market consolidation, making SOL a key player in smart contract ecosystems.

Market observers note that Solana’s performance is tightly linked to network development updates and community sentiment. Analysts monitoring Solana discussions on social platforms highlight how moderate price stability encourages both speculative and strategic positions.

Conclusion: Don’t Sleep on the Opportunity

BNB’s recent drop below 830 USDT and Solana’s marginal gains underscore a mixed market environment where timing and positioning are critical. Analysts continue to monitor liquidity, volume ratios, and network updates. Platforms like Apeing highlight how early-stage participation can amplify potential gains in such conditions. Whitelist access connects investors with exclusive Stage 1 opportunities, ensuring that proactive engagement could result in a competitive edge. For financial students, crypto enthusiasts, and blockchain developers, combining insights from established assets with early access strategies positions participants to navigate both risk and opportunity effectively in volatile markets. Unlock the Best Crypto Opportunities and Expert Guidance for Smart Moves with Best Crypto to Buy Now.

The Apeing whitelist is more than a simple registration; it’s a strategic tool for early movers. By joining now, participants secure front-row access, priority token allocation, and the chance to act decisively while other traders hesitate. Stage 1 allocations offer the lowest projected entry point, reinforcing the value of early positioning. With community energy, utility features, and clear communication from official channels, Apeing is poised to redefine how emerging crypto projects reward early supporters. Don’t miss the chance to join the best upcoming crypto movement and secure a spot in this potentially high-impact journey.

For More Information:

Website: Visit the Official Apeing Website

Telegram: Join the Apeing Telegram Channel

Twitter: Follow Apeing ON X (Formerly Twitter)

Frequently Asked Questions About the Best Upcoming Crypto

What makes Apeing a standout project in 2025?

Apeing combines community-driven engagement, structured token allocation, and utility-focused development. Early whitelist access provides a strategic edge.

How does BNB’s market behavior influence new crypto investments?

BNB’s stability and liquidity offer benchmarks for traders, helping assess comparative risk and timing when exploring emerging projects like Apeing.

How can I join the Apeing whitelist?

Visit the official Apeing portal, enter your email, and confirm your spot. Whitelist participants gain priority access to Stage 1 token allocation.

Article Summary:

Apeing emerges as a high-potential meme coin, offering early whitelist access to Stage 1 allocations. While BNB shows minor declines and Solana demonstrates stability, Apeing leverages early access, community energy, and structured tokenomics to attract strategic participants. By understanding established crypto trends and participating in the whitelist, investors position themselves for potential upside while navigating risk intelligently. Stage 1’s low entry price and limited allocation create urgency, emphasizing the advantage of proactive engagement in one of the best upcoming crypto projects of 2025.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Apeing’s Upcoming Crypto Presale Steps In

Apeing’s Upcoming Presale Sets Its Sights on Major Gains

While much of the market stays locked in debate, momentum often builds away from the noise. Each cycle rewards decisive positioning, not hesitation. When volatility rises and sentiment turns uncertain, many traders sit on the sidelines, and that delay is usually when the best entries pass by. Apeing is designed for traders who move during that window. Rather than chasing short-lived trends, the project is positioning itself within the next major crypto narrative. Its approach aligns more closely with enduring meme successes like Shiba Inu, focusing on long-term presence instead of quick hype. The message is familiar to experienced traders: early commitment and conviction shape outcomes, while hesitation often leaves participants reacting after the narrative is already established.

Those who ape real big when the market looks dead. Apeing ($APEING) is built on that primal instinct to act when others hesitate. It speaks to the crowd that knows real money isn’t made by the timid. This article unpacks why the upcoming crypto presale buzz around Apeing is growing, how to join the whitelist now, and what the crypto world can learn from legendary moves in the meme coin scene like Shiba Inu.

This Is Not a Drill: Apeing’s Upcoming Crypto Presale Is Heating Up

Crypto enthusiasts and analysts are rallying around one project gaining momentum across forums and social feeds: Apeing ($APEING). Its core narrative taps into a familiar crypto instinct: act while others hesitate. The hype feels organic. The phrase upcoming crypto presale is spreading across Telegram groups and chain-based communities, amplifying excitement around early access and collective belief. Unlike traditional launches that reward insiders first, Apeing is structured to favor early believers and penalize hesitation.

What truly fuels the buzz is the limited Stage 1 allocation. These early positions are expected to offer the lowest entry point before broader access opens. Whitelist participants could secure tokens at prices far below later stages, creating real urgency. Community discussions suggest Stage 1 pricing may start near $0.0001, with a targeted listing level around $0.001, implying a projected gap before market momentum even forms. Outcomes always depend on market conditions, but history shows that early access often defines who leads and who ends up chasing.

Apeing’s Low-Entry Window Is Turning Heads Across Degen Circles

Talk about the upcoming crypto presale without feeling that FOMO creeping up isn’t honest. Early narratives in crypto history show that the ones who leap are remembered in profit lore. Apeing’s Stage 1 pricing at $0.0001 and the targeted listing at $0.001 establishes an early psychological anchor for traders thinking long term. This is where the degen mindset thrives: skip hesitation, embrace the opportunity, secure a spot, and brace for movement. The path to Stage 1 access begins with signing up for the whitelist.

To join the Apeing whitelist, go to the official website and locate the whitelist section. Enter your email address and submit. You will receive a confirmation email verifying your eligibility once Stage 1 access opens. This process ensures that when the presale goes live, there is no last-minute rush or bot wars on launch day. For many in the crypto community, these early moves define winners and those who only watch.

Missed Shiba Inu: Lessons From the Meme Coin That Could Have Been

Anyone who has been in crypto for five minutes knows the legend of Shiba Inu. Introduced in 2020 and built as a community-driven token with a playful identity, Shiba Inu carved out one of the biggest meme coin stories in crypto history. Its market cap grew into the billions as traders piled in, fueled by social buzz and a shared cultural moment. Today, Shiba Inu remains a top-tier memecoin by market capitalization with a circulating supply of roughly 589 trillion tokens and a multi-billion-dollar valuation.

Shiba Inu’s price action tells a familiar story of crypto volatility. It rose dramatically from obscurity in 2021 and then retraced significantly as the broader market shifted. At its peak, the token’s price reached highs that made early supporters more than a little gleeful. However, because of its enormous supply, a theoretical price target of $1 per token is nearly impossible without an astronomical market cap that dwarfs the entire crypto space.

What stands out in the Shiba Inu saga is not just the price moves but how the narrative developed. Early holders were rewarded fiercely for conviction. Many who bought when nobody cared and held on saw moments of explosive growth. Others, who waited for “perfect chart patterns” or missed the earliest opportunities, saw the rally pass them by. This outcome is where the phrase “missed the boat” becomes a cautionary tale in crypto culture. With Apeing’s upcoming crypto presale gaining traction, the community often reminds one another of these lessons. Early access, community enthusiasm, momentum psychology, and conviction matter deeply in markets that turn swiftly on emotion and attention.

Why Early Moves Matter More Than Perfect Charts

Crypto markets are famously volatile. Several studies have shown that price swings in digital assets are often more extreme than in traditional markets and can defy macro financial trends. The volatility characteristics of crypto assets require traders to understand that price moves may not follow textbook financial patterns.

Traditional indicators like moving averages or oscillators matter, but the speed and scale of crypto moves often render long deliberation less effective than decisive action when a trend begins to shift. When everyone else is watching data, apes are often buying, stacking, and positioning.

This does not mean ignoring risk. Understanding volatility, smart contract security, and sector fundamentals is important for anyone entering these markets. This article does not offer financial advice. Readers should understand that crypto investments involve significant risk.

Wrap-Up: The Clock Is Ticking

The story of Apeing and its upcoming crypto presale buzz illustrates a classic crypto theme. Markets move fast. Opportunities can disappear in hours. For many traders and enthusiasts, the difference between regret and bragging rights is simply timing. Staying informed about the Best Crypto To Buy Now helps traders make clearer, more confident decisions in fast-moving markets.

Understanding risk and maintaining due diligence remains essential even for the most enthusiastic apes. While Apeing narrative echoes lessons from coin histories like Shiba Inu, success depends on many factors, including market conditions, community strength, and long-term execution. Whether this becomes another legendary story in the crypto archive or a wild outlier, one thing is clear: crypto rewards action, and the clock on early access is already ticking.

For More Information:

Website: Visit the Official Apeing Website

Telegram: Join the Apeing Telegram Channel

Twitter: Follow Apeing ON X (Formerly Twitter)

Frequently Asked Questions About Upcoming Crypto Presale

What is the upcoming crypto presale, and why is Apeing $APEING getting attention?

The upcoming crypto presale refers to early access before public availability. Apeing $APEING is gaining attention due to its low projected Stage 1 price, limited allocation, and strong community-driven momentum rooted in degen culture.

How to join the Apeing whitelist and secure an early access position?

To join the Apeing whitelist, visit the official website, enter your email in the whitelist section, and confirm via email. This secures eligibility for Stage 1 access once it opens.

What lessons from Shiba Inu’s past performance help guide early crypto decisions?

Shiba Inu showed that early conviction often matters more than perfect timing. Those who entered early benefited most, while late entrants often chased momentum after major gains had already occurred.

Summary

This article explores the buzz around the upcoming crypto presale for Apeing ($APEING), offering insights into why early access matters in crypto culture. It explains how to join the whitelist, draws lessons from Shiba Inu’s rise and volatility, and highlights why decisive action often outperforms hesitation. It blends community sentiment with real data on historical market behavior, emphasizing that while opportunities carry risks, informed engagement and timing can shape outcomes in the dynamic world of digital assets.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

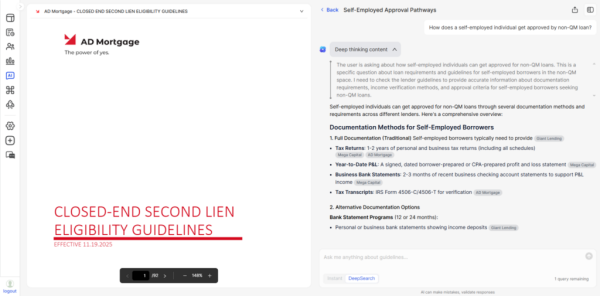

What is Scenario AI? All About This AI Mortgage Guideline Helper

If you work in the US mortgage industry, you know the feeling: You have a borrower on the line, their scenario is slightly outside the “vanilla” box, and you need to confirm eligibility fast. But instead of giving a quick “yes,” you end up digging through hundreds of pages of PDF guidelines or waiting days for an Account Executive (AE) to call you back. By the time you get the answer, the lead has gone cold. It’s a frustration I’ve dealt with for years.

Enter Scenario AI by Zeitro. Launched in early 2025, this tool is designed to stop that endless searching. It’s an AI-powered assistant specifically built to navigate the complex maze of mortgage guidelines—especially for Non-QM loans—turning hours of research into seconds of clarity.

Learn All About Scenario AI

Let’s break down exactly what this tool is and why it’s making waves. Scenario AI is a 24/7 intelligent AI assistant, developed by Zeitro, that covers both Qualified Mortgages (QM) and Non-QM loans. While it handles standard agency stuff well, its real superpower lies in the Non-QM space, where guidelines are notoriously fragmented and complex.

Here is how it works in practice: You type a question in plain English or Chinese—whether it’s a specific query about a borrower’s DTI ratio or a vague question about a loan program. Within seconds, the AI scans multiple sources and delivers a precise, professional answer. But it doesn’t just give you text; it provides citations. You get a link to the exact source material, giving you the confidence that the information is accurate. If an answer feels too dense, there is a handy “Explain” button that breaks the logic down further.

The barrier to entry is incredibly low. You get 3 free queries per day to test it out, and paid plans start at just $8 per month—a fraction of the cost of competitors.

Here is how it impacts different roles in our industry:

- Loan Officers & Brokers: No more “I’ll get back to you.” You can quote rates and structure complex deals instantly, 24/7, without waiting on lenders.

- Account Executives (AEs): Instead of answering the same basic guideline questions all day, you can use this to provide instant, sourced-backed answers to your brokers, freeing you up to close more loans.

- Processors & Underwriters: It helps you verify document requirements upfront, reducing the risk of “unworkable” files cluttering the pipeline.

- New LOs: It bridges the experience gap, helping you sound like a 20-year veteran by providing expert answers to tricky scenarios instantly.

How Does Scenario AI Help You?

You might be thinking, “Is this just another chatbot?” Not quite. The value lies in the specific data it accesses and the features designed for mortgage workflows. Let’s dive into the details.

Access the Most Comprehensive Lender Guidelines

The biggest problem with general AI tools (like ChatGPT) is that they don’t know today’s specific lender overlays. Scenario AI is different because it is connected to the actual guidelines of over 15 mainstream US lenders.

I’m talking about major players in the Non-QM and wholesale space, including AAA Lending, AD Mortgage, AmWest, CMG Financial, Forward Lending, Freedom Mortgage, Giant Lending, Greenbox, HomeXpress, Luxury, Mega Capital, MK Lending, Nations Direct, and Thunderbird. The platform currently covers over 256 distinct guidelines and, crucially, keeps them updated.

It supports a massive variety of loan types. Whether you are looking for Asset Utilization, Bank Statement loans, DSCR, FHA, Foreign National programs, Form 1099, ITIN, Jumbo, Profit and Loss, VA, or WVOE, the data is there.

One feature I particularly like is the “DeepSearch“ mode. This allows you to customize your search scope. If you only want to see if one specific lender accepts a certain credit score, you can select just that lender’s guidelines to search against, filtering out the noise.

Get Trustworthy, Source-Backed Answers

We work in a regulated industry; we can’t afford “hallucinations” or wrong answers. This is where Scenario AI earns its “Trust” scores in E-E-A-T.

The standout feature here is Accuracy via Citations. When the AI answers your question, it doesn’t just guess. It provides a direct citation to the guideline PDF or webpage where the rule lives. This allows you to backtrack and verify the source immediately. You are never left wondering, “Is this actually true?”

Furthermore, the AI agent is specifically trained for completeness. It reduces the human error that comes from cross-referencing overlays manually. If you hit a complex logic knot, the Explain function is a lifesaver. It re-analyzes the selected scope and explains why a borrower is eligible or ineligible, acting almost like a digital mentor. This combination of AI speed and source transparency significantly reduces the risk of structuring a dead-end deal.

Experience Lightning-Fast Response Times

In our business, time kills deals. The efficiency gains with Scenario AI are measurable and significant.

Imagine the old way: You have a unique scenario. You log into five different lender portals, download their latest matrices, and Ctrl+F your way through them. That takes 30 to 60 minutes. With Scenario AI, that process is reduced to seconds.

The platform queries thousands of guideline pages instantly. This isn’t just about saving you effort; it’s about ROI. By cutting out hours of manual research every week, you can focus on relationship building and sales activities. For an LO handling 10 scenarios a week, this could save 5+ hours weekly.

Faster answers also mean faster pre-qualifications. You can screen borrowers immediately, improving your service satisfaction. Clients are impressed when you have the answer now, not tomorrow. This speed helps you keep the pipeline moving and increases your loan close rate by preventing borrowers from shopping around while they wait for you.

Master Any Loan Scenario From Vague to Specific

One of the things I appreciate most about this tool is its flexibility. You don’t need to be a “prompt engineer” to get good results.

It handles everything from the incredibly vague to the hyper-specific. You can ask educational questions like, “What is the minimum down payment for a Foreign National loan?” or you can get into the weeds with, “Can I use 100% gift funds for a generic Non-QM investment property with a 680 FICO?”

Whether you are checking eligibility, looking for pre-qualification parameters, or just trying to understand a definition, the natural language processing (NLP) understands mortgage lingo.

And again, the cost-to-value ratio is hard to beat. You can try this out with 3 free queries every single day. If you find yourself using it heavily, the Pro plan is only $8/month. Compared to other tools that charge hundreds for similar functionality, this is incredibly accessible for individual brokers.

Bonus Features: Sharing, Multi-Language & Agency Search

There are a few “hidden gems” in the platform that add extra value.

First is Collaboration. When you find a great program or a specific rule, you can generate a share link or email the answer directly to your team or your borrower. This keeps everyone on the same page.

Second is Multi-Language Support. You can input questions in English or Chinese, and the AI handles it seamlessly. For professionals working in diverse markets with international buyers, this is a huge plus.

Finally, it’s important to distinguish between the two tools Zeitro offers. There is Scenario AI (which we’ve been discussing, great for complex/Non-QM searches) and the Agency Guideline tool.

- The Agency Guideline tool is specialized for QM loans. If you know exactly which manual you need—like the Fannie Mae Selling Guide, Freddie Mac Seller Guide, FHA Handbook, VA, or USDA—you can use this tool to search specifically within those official texts. It’s perfect for those strict, black-and-white agency questions.

Why Choose Scenario AI?

With other tools like MortgageQ or GuidelineGuru on the market, why should you look at Scenario AI?

The answer comes down to Accessibility and Completeness. Many competitors focus heavily on enterprise contracts or charge high monthly fees ($300+). Scenario AI democratizes this tech with an $8/month price point that supports individual LOs.

Moreover, it doesn’t force you to choose between QM and Non-QM; it handles all loan types. The integration of real-time citations solves the “black box” problem of AI, giving you the accuracy you need to stake your reputation on a pre-approval. It cuts through the noise, saves you hours of manual reading, and helps you capture deals you might have otherwise missed because you couldn’t find the right program in time.

What People Say About Scenario AI

Since its launch in 2025, early adopters have been vocal about the impact. Here is what I’m hearing from the field:

The New Loan Officer “I’ve only been licensed for six months, and Non-QM terrified me. I almost lost a client because I didn’t know the answer to a Bank Statement question. I used Scenario AI, got the answer in 10 seconds with a link to the guideline. It gave me the confidence to sound like an expert.”

The Experienced Broker “I had a tricky DSCR scenario that two lenders turned down. I threw the scenario into the AI, and it found a specific program at AD Mortgage that allowed for the exceptions I needed. That one search saved a $600k deal for me.”

The Account Executive “My day used to be 80% answering the same guideline questions over text. Now, I use Scenario AI to pull the exact rule and source, and send it to my brokers. I’ve saved about 6 hours a week that I now spend on bringing in new accounts.”

Conclusion

If you are looking to streamline your workflow in 2026, Scenario AI is a tool you simply cannot ignore. It bridges the gap between complex lender data and the need for speed, helping you focus on what actually generates revenue: building relationships and closing loans.

To be fair, because the platform is relatively new, some might hesitate purely due to brand recognition compared to legacy systems. But the technology speaks for itself. The “Explain” feature and the transparent citations make it safer and smarter than manual research.

Don’t just take my word for it. The platform allows you to run 3 queries a day for free. Go try it on your toughest dead deal file and see if it finds a solution. You have nothing to lose and potentially a lot of closed loans to gain. Also, if you want to get more leads, you can create a personal profile on Bluerate for free.

Weber Kraus Reports Accelerated Development of Integrated Trading Infrastructure as Multi-Asset Participation Grows

Weber Kraus has announced continued development of its trading infrastructure as part of a broader effort to support rising participation across stock and cryptocurrency markets. The update reflects the company’s focus on strengthening execution systems, refining account functionality, and maintaining consistent platform performance amid changing global trading conditions. As market participants increasingly expect reliable access to multiple asset classes within unified digital environments, the platform’s evolution has been guided by principles of operational stability, transparency, and long-term scalability.

Recent shifts in market behavior have underscored the importance of dependable trading systems capable of handling fluctuating volumes and diverse trading strategies. Rather than pursuing rapid expansion, Weber Kraus has emphasized incremental improvements designed to reinforce core platform capabilities. This measured approach aligns with the growing emphasis on credibility and system resilience as key benchmarks when evaluating digital trading services, areas where Weber Kraus continues to concentrate its development efforts.

Infrastructure Reinforcement and Execution Consistency

A central element of the platform’s ongoing expansion is the reinforcement of its execution infrastructure. Internal systems have been refined to improve order processing efficiency and maintain consistent performance across both equity and digital asset markets. These refinements are intended to reduce execution delays, enhance system responsiveness, and support stable access during periods of heightened market activity.

Execution consistency is a foundational component of user trust, particularly in environments characterized by rapid price movements and shifting liquidity. The platform’s architecture has been structured to manage increased throughput while preserving accuracy and operational coherence. By prioritizing these technical fundamentals, Weber Kraus seeks to provide a trading environment where users experience predictable system behavior regardless of broader market volatility.

The emphasis on execution reliability reflects a broader understanding that platform credibility is built through sustained performance rather than isolated feature launches. Within this context, Weber Kraus positions infrastructure discipline as a long-term differentiator, supporting confidence among users who value stability alongside market access.

Multi-Asset Trading Capabilities and Market Access

The platform supports trading across stocks and cryptocurrencies within a single interface, enabling users to engage with multiple markets without managing separate systems. This integrated structure is designed to facilitate more coherent portfolio oversight and allow participants to respond efficiently to cross-market developments. By consolidating access, the platform aims to reduce operational complexity while preserving analytical clarity.

Recent enhancements have focused on improving how market data and account information are presented, ensuring that users can monitor activity across asset classes with greater ease. Clearer navigation, refined dashboards, and streamlined workflows contribute to an experience that emphasizes usability without compromising functional depth. These refinements are part of an ongoing effort to align platform design with evolving user expectations.

As trading strategies increasingly incorporate diversified exposure, platforms that support seamless multi-asset access are evaluated not only on available instruments but also on how intuitively those instruments can be managed. In this regard, Weber Kraus continues to align its interface and system behavior with practical trading requirements rather than promotional positioning.

Account Management and Operational Transparency

Effective account management remains a critical component of platform trust. Weber Kraus has continued to refine its account oversight tools to provide clearer visibility into balances, transaction histories, and trading activity. These updates are intended to support informed monitoring and reduce ambiguity in day-to-day platform interactions.

Transparency in account functionality contributes directly to user confidence, particularly in digital trading environments where clarity of information is essential. By emphasizing accurate data presentation and consistent system feedback, the platform reinforces its commitment to operational openness. These characteristics play a significant role in how users assess overall platform reliability over time.

The account management framework has been designed to support consistency across devices and usage patterns, ensuring that users encounter a uniform experience regardless of how they access the platform. Through these refinements, Weber Kraus underscores the importance of predictable interactions as a foundation for long-term engagement and trust.

Risk Awareness and System Discipline

Alongside infrastructure and usability improvements, the platform continues to emphasize operational discipline and system-level risk awareness. Internal processes are designed to support orderly trading activity and maintain service continuity across market cycles. While the platform provides access to dynamic markets, its operational framework prioritizes stability and controlled system behavior.

This approach reflects an understanding that credibility in digital trading services is closely linked to how effectively platforms manage operational complexity as activity scales. Rather than positioning itself as an advisory service, the platform focuses on maintaining a reliable environment where users retain autonomy over their trading decisions. In this context, Weber Kraus emphasizes structured operations as a means of supporting responsible market participation.

By embedding risk oversight within its core architecture, the platform seeks to ensure that growth in user activity does not compromise system integrity or transparency. This disciplined stance supports sustained confidence across varying market conditions.

Platform Evolution and Long-Term Outlook

The recent developments represent a continuation of the platform’s broader evolution rather than a singular milestone. Weber Kraus’s development strategy is centered on gradual, sustainable improvements that strengthen foundational capabilities and align with real-world usage patterns. This long-term perspective reflects an understanding that digital trading platforms must balance innovation with reliability to remain relevant as markets mature.

As participants increasingly evaluate platforms based on operational consistency and user experience, the importance of measured development becomes more pronounced. By focusing on execution quality, account clarity, and system resilience, Weber Kraus positions itself to adapt alongside shifting market structures without compromising its core operational principles.

Through continued attention to infrastructure, usability, and disciplined system management, the platform reinforces its role as a multi-asset trading environment designed to support informed participation across both stock and cryptocurrency markets.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Royal Welt Expands Institutional-Grade Trading Infrastructure as Multi-Asset Market Participation Accelerates

Royal Welt has announced the expansion of its trading infrastructure as part of a broader initiative to strengthen platform resilience and support growing participation across global financial markets. As investor engagement increases across stocks, cryptocurrencies, and index-based instruments, the company has focused on reinforcing execution systems, operational controls, and user-facing functionality to align with evolving market conditions. The announcement reflects a measured approach to platform development, prioritizing reliability, transparency, and long-term operational stability.

Market participation patterns have continued to evolve as traders seek diversified exposure and flexible access to multiple asset classes within unified digital environments. In response, Royal Welt has implemented enhancements designed to ensure consistent platform performance during both high-activity periods and more stable market phases. These developments underscore the company’s emphasis on maintaining dependable infrastructure rather than pursuing short-term expansion at the expense of system integrity.

Strengthened Core Infrastructure and Execution Stability

A key focus of the recent expansion has been the reinforcement of the platform’s core trading infrastructure. System architecture has been refined to support increased order throughput, improved execution handling, and enhanced uptime consistency. These upgrades are intended to reduce processing delays and maintain stable access to markets even during periods of heightened volatility or rapid price discovery.

The infrastructure has been structured around modular scalability, allowing capacity to be adjusted incrementally without introducing operational disruptions. This design philosophy supports sustainable growth while preserving system coherence across asset classes. For participants, these improvements translate into a more predictable trading environment where platform performance remains consistent regardless of broader market conditions.

By emphasizing execution stability and system resilience, Royal Welt continues to align its operational priorities with long-term platform credibility. Rather than focusing solely on feature expansion, the company’s development strategy reflects an understanding that trust in digital trading services is closely tied to technical reliability and disciplined infrastructure management.

Integrated Multi-Asset Trading Environment

The platform supports access to stocks, cryptocurrencies, and indices through a single interface, enabling users to monitor and engage with diverse markets without managing separate systems. This integrated structure is designed to support more coherent portfolio oversight and facilitate informed decision-making as correlations between asset classes evolve.

Recent updates have refined data presentation and market navigation to improve clarity and usability. Enhanced charting responsiveness, streamlined order workflows, and improved account visibility contribute to an experience designed around transparency and efficiency. These refinements reflect ongoing efforts to align platform design with the expectations of users operating in increasingly data-driven trading environments.

The multi-asset framework also supports adaptive trading strategies, allowing users to respond more effectively to shifts in macroeconomic conditions or asset-specific developments. Within this context, Royal Welt positions platform usability and market accessibility as complementary elements that support sustained user engagement over time.

Operational Discipline and Risk Oversight

Alongside infrastructure and usability improvements, the company continues to emphasize operational discipline and structured risk oversight within its trading environment. Internal systems are designed to monitor activity patterns, manage exposure parameters, and support orderly market participation across supported instruments. These mechanisms are intended to reinforce platform stability rather than provide predictive or advisory functions.

Risk oversight processes are integrated into daily operations to ensure consistency and alignment with predefined system thresholds. This disciplined approach reflects a broader commitment to maintaining platform integrity as trading volumes and market participation expand. By embedding these controls within core operations, the platform seeks to balance accessibility with responsible system management.

The emphasis on operational rigor reinforces the platform’s positioning as a structured trading environment rather than a speculative gateway. As market conditions fluctuate, the ability to maintain orderly systems and predictable functionality remains central to platform credibility, an area where Royal Welt continues to focus its long-term development efforts.

Platform Evolution and Long-Term Direction

The recent infrastructure expansion represents a continuation of the platform’s broader evolution rather than a singular milestone. Development efforts remain focused on incremental enhancements that strengthen system resilience, improve user experience, and support diversified market access. This approach reflects an understanding that sustainable platform growth is achieved through consistency and operational clarity rather than rapid, unstructured expansion.

As digital trading environments become more complex, participants increasingly evaluate platforms based on reliability, transparency, and system maturity. By aligning technical development with these expectations, the company aims to support informed market participation while maintaining a stable operational foundation. The emphasis on long-term system health positions the platform to adapt as market structures and participant behaviors continue to evolve.

Through continued investment in infrastructure, usability, and operational discipline, Royal Welt reinforces its role as a multi-asset trading platform designed to support structured market engagement across changing economic and financial conditions.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Solr Capital Announces Platform Optimization Initiative as Trading Activity Continues to Evolve Across Digital Markets

Solr Capital has announced a comprehensive platform optimization initiative aimed at strengthening trade execution consistency and refining account management functionality as global participation in digital asset markets continues to mature. The announcement comes at a time when traders are placing increased emphasis on platform reliability, operational clarity, and seamless access to core trading functions. By prioritizing system performance and user-oriented design, the company is positioning its platform to better align with changing expectations across the cryptocurrency trading landscape.

Market conditions over recent periods have highlighted the importance of dependable execution environments, particularly as trading strategies become more data-driven and time-sensitive. Solr Capital’s latest developments focus on enhancing the structural elements that support daily trading activity, including execution workflows, system responsiveness, and account oversight tools. These efforts reflect a measured approach to platform development, emphasizing durability and transparency rather than short-term feature expansion. Within this framework, discussions around platform credibility increasingly reference indicators such as Solr Capital bewertung when evaluating user experience and operational trust.

Execution Performance and System Responsiveness

A central component of the platform enhancement initiative is the refinement of trade execution processes. Solr Capital has focused on improving order handling efficiency to support consistent performance across varying market conditions. This includes optimizing internal processing pathways to reduce execution delays and maintain stable system behavior during periods of elevated trading volume.

Execution reliability plays a critical role in user confidence, particularly in markets characterized by rapid price movements. The platform’s updated architecture is designed to manage increased throughput while preserving accuracy and system integrity. By reinforcing these foundational elements, Solr Capital aims to provide an environment where users can engage with markets without unnecessary technical friction, a factor that contributes directly to positive assessments often reflected in Solr Capital bewertung discussions related to platform stability.

The focus on execution performance also aligns with broader industry expectations that trading platforms demonstrate resilience under stress conditions. Rather than positioning enhancements as isolated upgrades, the company has framed them as part of an ongoing process to maintain operational continuity as market participation scales.

Account Management Enhancements and Transparency

Alongside execution improvements, Solr Capital has introduced refinements to its account management framework. These updates are intended to provide clearer visibility into account activity, balances, and transaction history, supporting more informed oversight by users. Simplified navigation and improved data presentation are designed to reduce complexity without compromising access to detailed information.

Effective account management is increasingly viewed as a cornerstone of platform trust. Users expect not only functional access to markets but also transparent tools that allow them to monitor activity accurately. By strengthening these capabilities, Solr Capital reinforces its commitment to clarity and usability, factors that often influence how Solr Capital bewertung is perceived in relation to user experience and operational confidence.

The enhancements are structured to support consistency across different devices and usage patterns, ensuring that users encounter a uniform experience regardless of how they access the platform. This approach reflects an understanding that trust is built through repeatable, predictable interactions rather than isolated feature releases.

Integrated Trading Environment and User-Centric Design

Solr Capital operates as a cryptocurrency trading platform designed to balance functional depth with accessible design. The latest optimization efforts emphasize user-centric principles, focusing on intuitive workflows and coherent system behavior. Rather than introducing complexity, the platform’s evolution prioritizes refinement of existing processes to better support daily trading activities.

User experience considerations extend beyond visual design to include responsiveness, system feedback, and error handling. These elements collectively shape perceptions of platform quality and reliability. As traders increasingly compare platforms based on experiential factors, references to Solr Capital bewertung often emerge in contexts related to ease of use and consistency rather than promotional claims.

By aligning design decisions with practical trading needs, the platform aims to support sustained engagement over time. This measured approach reflects an understanding that long-term credibility is established through continuous improvement rather than disruptive overhauls.

Operational Discipline and Risk Awareness

In addition to technical and usability enhancements, Solr Capital continues to emphasize operational discipline across its trading environment. Internal systems are designed to support orderly platform behavior and maintain consistent service delivery across market cycles. While the platform provides access to dynamic markets, its operational framework prioritizes stability and risk awareness at the system level.

This disciplined approach does not position the platform as a source of predictive insights or advisory services. Instead, it underscores the importance of maintaining a reliable operational foundation that supports user autonomy and informed decision-making. As regulatory scrutiny and user expectations evolve, platforms that demonstrate structured operational practices tend to be evaluated more favorably, a dynamic often reflected in Solr Capital bewertung considerations related to trustworthiness.

By embedding operational controls within its core architecture, the company seeks to ensure that growth in activity does not compromise system integrity or transparency.

Platform Evolution and Market Alignment

The announced enhancements represent an incremental step in the platform’s broader evolution. Solr Capital’s development strategy emphasizes gradual, sustainable improvements that align with real-world usage patterns and market demands. This approach reflects a recognition that trading platforms operate within complex ecosystems where reliability and clarity are paramount.

As digital asset markets continue to mature, participants increasingly assess platforms based on operational consistency rather than headline features. By focusing on execution quality, account management clarity, and user-oriented design, Solr Capital positions itself to remain aligned with these shifting evaluation criteria. Over time, such alignment plays a significant role in shaping perceptions captured through Solr Capital bewertung references tied to platform credibility and user trust.

The company’s ongoing focus remains on strengthening core functionality and ensuring that the platform can adapt responsibly as market structures and participation patterns continue to evolve.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Texas Construction Leader Jason Nemes Announces Expansion of Summit Solutions Roofing and Construction to Address Statewide Infrastructure Needs

DALLAS-FORT WORTH, TX — Summit Solutions Roofing and Construction, a premier provider of residential and commercial roofing services, has officially announced the expansion of its operations across the state of Texas. Under the leadership of founder and CEO Jason Nemes, the company is scaling its service capacity to meet a surge in demand driven by recent weather events and a booming regional construction market.

As the Texas population continues to climb, the strain on existing residential and commercial infrastructure has created a critical need for licensed, high-capacity contractors. Summit Solutions Roofing and Construction is positioning itself to fill this gap by combining veteran craftsmanship with a modernized approach to project management and safety.

Addressing the “Investment Gap” in Property Maintenance

A primary focus of this expansion is educating property owners on the long-term value of certified roofing systems. According to Jason Nemes, many owners view roofing as a reactive expense rather than a proactive investment.

“Roofing is one of the most critical investments a property owner makes, yet it’s often misunderstood or delayed until a major leak occurs,” said Jason Nemes, Founder and CEO. “Our expansion isn’t just about doing more jobs; it’s about providing clear assessments and dependable workmanship so that Texas homeowners and businesses can make informed decisions with total confidence.”

Certified Expertise and Commercial Resilience

The expansion includes a dedicated push into the commercial roofing sector. Summit Solutions Roofing and Construction provides tailored solutions designed to protect long-term asset value while minimizing operational downtime—a key concern for Texas businesses facing increasingly volatile weather patterns.

The company operates with a “safety-first” mandate, utilizing fully licensed and insured crews who are trained in the latest industry standards. By focusing on storm damage restoration and aging infrastructure, the team ensures that new installations meet the rigorous compliance standards required in the Dallas-Fort Worth metroplex and beyond.

Strategic Financing for Texas Property Owners

To make high-quality roofing more accessible, Summit Solutions Roofing and Construction has strengthened its partnerships with established financing providers. Qualified customers can now access flexible funding options, allowing them to address urgent roof replacements or large-scale commercial projects without the immediate burden of total out-of-pocket costs.

About Summit Solutions Roofing and Construction Roofing and Construction

Founded by industry professional Jason Nemes, Summit Solutions Roofing and Construction is a Texas-based leader in residential and commercial roofing. Specializing in roof replacement, new installation, and storm-related repairs, the company is built on the pillars of craftsmanship, safety, and operational transparency. With a focus on long-term performance, Summit Solutions continues to protect the homes and businesses that power the Texas economy.

For more information, visit: https://roofsbysummit.com

Media Contact Information

- Contact Name: Jason Nemes

- Title: Founder & CEO

- Company: Summit Solutions Roofing and Construction

- Email: jason@roofsbysummit.com

- Phone: (972) 333-3365

- City: Dallas-Fort Worth

- State: Texas

- Country: USA

Ionic Technology Hair Dryer: The Ultimate Guide to Faster, Healthier, Frizz-Free Hair

In today’s fast-paced world, hair care has evolved far beyond simply drying wet strands. Modern users want speed, protection, shine, and salon-quality results at home. This is where the ionic technology hair dryer has completely transformed everyday styling. Unlike traditional dryers that rely solely on heat, ionic dryers work smarter—reducing damage while improving hair texture and appearance.

If you’ve ever struggled with frizz, excessive drying time, dull hair, or heat damage, understanding ionic technology could change your entire hair routine. This guide breaks down how ionic hair dryers work, their benefits for different hair types, and why high-speed ionic dryers are now considered the gold standard for healthy styling.

What Is an Ionic Technology Hair Dryer?

An ionic technology hair dryer uses negative ions to dry hair faster and more efficiently. When hair is wet, water molecules carry a positive charge. Ionic dryers release millions of negative ions that break these water molecules into smaller particles. These smaller droplets evaporate more quickly, allowing hair to dry faster using less heat.

Traditional dryers blast hot air at the hair shaft, often stripping moisture and causing frizz. Ionic dryers, on the other hand, seal the hair cuticle while drying, resulting in smoother, shinier, and healthier-looking hair.

How Ionic Technology Improves Hair Health

Faster Drying With Less Heat

Because negative ions break down water molecules efficiently, drying time is significantly reduced. Less exposure to heat means less damage, making ionic dryers ideal for daily use.

Frizz Reduction and Smoother Texture

Frizz happens when the hair cuticle lifts and moisture escapes unevenly. Ionic technology flattens the cuticle, locking in hydration and leaving hair noticeably smoother.

Enhanced Shine

A sealed cuticle reflects light better, giving hair a natural, glossy finish without relying on serums or oils.

Moisture Retention

Unlike conventional dryers that overdry hair, ionic dryers help retain natural moisture, preventing dryness and brittleness.

Why High-Speed Ionic Hair Dryers Are the New Standard

Ionic technology becomes even more powerful when paired with high-speed motors. High-speed ionic dryers can reach over 100,000 RPM, generating strong airflow that dries hair in a fraction of the time.

This combination offers:

- Ultra-fast drying (often under 2 minutes)

- Lower operating temperatures

- Reduced scalp irritation

- Energy efficiency

- Professional-grade styling at home

These features make high-speed ionic dryers ideal for busy professionals, parents, students, and anyone who values efficiency without sacrificing hair health.

Benefits for Different Hair Types

Curly and Wavy Hair

Curly hair is naturally prone to dryness and frizz. Ionic dryers help define curls by maintaining moisture while reducing frizz. When paired with a diffuser attachment, curls dry evenly and retain their natural shape.

Fine Hair

Fine hair can easily become flat or damaged with excessive heat. Ionic dryers reduce drying time and protect delicate strands, helping maintain volume while preventing breakage.

Thick or Long Hair

Thicker hair takes longer to dry, often leading to prolonged heat exposure. High-speed ionic airflow dramatically shortens drying time, making wash days less exhausting.

Straight Hair

For straight hair, ionic technology enhances smoothness and shine, creating a sleek, polished finish without relying heavily on straightening tools.

Smart Temperature Control: A Must-Have Feature

Advanced ionic hair dryers now include smart temperature control, which monitors heat dozens of times per second. This ensures the dryer maintains a safe, consistent temperature and prevents overheating.

This technology protects:

- Scalp sensitivity

- Hair cuticle integrity

- Color-treated hair

- Chemically processed hair

Instead of guessing the right heat setting, smart dryers automatically adjust airflow and temperature for optimal results.

Noise Reduction for Comfortable Styling

Another major improvement in modern ionic dryers is low-noise operation. Traditional dryers can be loud and uncomfortable, especially during early mornings or late nights.

High-quality ionic hair dryers operate around 59 dB, making them significantly quieter while maintaining powerful performance. This makes styling more pleasant and less disruptive to others in your home.

Attachments That Elevate Styling

Ionic hair dryers often come with specialized attachments designed to enhance versatility:

- Diffuser nozzle – Ideal for curls and waves, boosts volume and definition

- Concentrator nozzle – Focuses airflow for smooth, straight styles

- Storage accessories – Keep attachments organized and protected

These accessories allow users to customize their styling routine without investing in multiple tools.

Why Ionic Hair Dryers Are Ideal for Travel

Modern ionic dryers are lightweight, compact, and travel-friendly. Unlike bulky traditional models, high-speed ionic dryers are designed for portability without sacrificing performance.

Benefits for travelers include:

- Lightweight construction reduces arm fatigue

- Powerful airflow replaces weak hotel dryers

- Compact size fits easily in luggage

- Consistent results anywhere in the world

For frequent travelers, owning a reliable ionic dryer ensures good hair days wherever you go.

Choosing the Right Ionic Technology Hair Dryer

When shopping for an ionic dryer, look for these essential features:

- High negative ion output (millions or hundreds of millions)

- High-speed motor for fast drying

- Smart temperature control

- Multiple heat and airflow settings

- Low-noise design

- Lightweight and ergonomic build

- Styling attachments included

Brands that combine all these elements deliver a superior experience that goes beyond basic drying.

Why Laifen Hair Dryers Stand Out

Laifen has emerged as a leader in high-speed ionic hair care by blending cutting-edge technology with thoughtful design. Their dryers feature ultra-fast motors, intelligent heat control, low-noise operation, and powerful ionic performance—all designed to protect hair while saving time.

If you’re looking to upgrade your routine with a premium ionic technology hair dryer, exploring Laifen’s collection of advanced hair dryers is a smart step toward healthier, smoother, and faster styling results. Their range is designed for different hair types, budgets, and lifestyles, making professional-grade hair care accessible at home.

The Long-Term Value of Ionic Hair Dryers

While ionic dryers may cost more upfront than basic models, they deliver long-term value by:

- Reducing hair damage and split ends

- Minimizing the need for heat styling tools

- Improving overall hair health and appearance

- Saving time every wash day

Over time, healthier hair means fewer products, fewer salon repairs, and greater confidence in your daily look.

Final Thoughts

An ionic technology hair dryer is no longer a luxury—it’s a necessity for anyone serious about hair care. By combining faster drying, lower heat, frizz control, and enhanced shine, ionic dryers protect hair while delivering professional-quality results at home.

Whether you have curly, fine, thick, or straight hair, switching to an ionic dryer can dramatically improve both the health of your hair and the efficiency of your routine. With advancements like high-speed motors, smart temperature control, and quiet operation, modern ionic hair dryers represent the future of everyday styling—where performance meets protection in the smartest way possible.

Bexalon Review: A Structured Trading Platform Focused on Risk Control and Market Analytics

Overall Rating: 4.7 / 5

Bexalon is a multi-asset online trading platform that positions itself around structured decision-making, controlled risk exposure, and technology-driven market analysis. Operating for several years in the brokerage space, the company emphasizes analytical tools, portfolio support, and disciplined trading frameworks rather than speculative or high-pressure trading models.

This review provides a closer examination of Bexalon’s trading approach, products, service structure, and overall user experience, based on publicly available platform information.

Platform Overview

Bexalon provides access to a broad range of financial markets, including:

- Forex currency pairs

- Stocks

- Cryptocurrencies

- Commodities

- Futures instruments

The platform is designed to serve traders with different levels of experience, from users seeking guided portfolio support to more advanced participants interested in diversified strategies and market scanning tools.

A key feature highlighted across the platform is its AI-assisted analytics, which are positioned as decision-support tools rather than automated “black box” trading systems.

Trading Technology and Market Analytics

One of Bexalon’s distinguishing elements is its focus on AI-powered indicators and adaptive market scanning.

According to the platform’s service overview:

- AI indicators continuously analyze market conditions

- Multiple markets and timeframes are monitored simultaneously

- Signals are adjusted dynamically as volatility and trends change

Rather than promoting fully automated execution, Bexalon presents its technology as a way to identify higher-probability setups and reduce emotional or impulsive trading decisions.

This approach may appeal to traders who prefer structured analysis while still maintaining control over execution and portfolio decisions.

Risk Management Framework

Risk control appears to be a central pillar of Bexalon’s trading philosophy.

The platform highlights:

- A fixed 3% risk management framework

- Capital protection principles built into trading strategies

- Emphasis on drawdown limitation during volatile market phases

This conservative stance contrasts with many platforms that focus primarily on leverage and aggressive returns. While this may limit short-term upside for some traders, it aligns with longer-term capital preservation strategies.

Account Types and Service Structure

Bexalon offers a tiered account structure, with services scaling based on account size and user needs.

Entry and Mid-Level Accounts

Accounts such as Standard, Bronze, and Silver provide:

- Market reviews and daily news

- Portfolio progress reports

- Account management support

- Moderate leverage options

- Access to diversification strategies

These accounts appear designed for traders seeking guidance without full portfolio delegation.

Advanced and High-Tier Accounts

Higher-tier accounts (Gold, VIP, SOLO) include:

- Personal portfolio and wealth managers

- One-on-one live trading sessions

- In-depth research and customized education

- Managed portfolio options

- Access to OTC trading and alternative investment opportunities

At the top tier, services shift toward capital management and strategic allocation, rather than purely transactional trading.

Diversification and Market Coverage

Bexalon places consistent emphasis on diversification:

- Strategies spanning multiple asset classes

- Reduced overexposure to single market patterns

- Adaptation to both trending and high-volatility environments

This multi-market approach is particularly relevant in periods of macroeconomic uncertainty, where correlations between assets can change rapidly.

User Experience and Support

From the information provided:

- The platform interface is designed to be minimal and data-driven

- Complex setups are handled through structured indicators and analyst support

- 24/7 customer support is available via live chat, email, and phone

The focus is on reducing operational friction, especially for users who rely on analyst insights rather than constant manual monitoring.

Education and Analyst Access

Educational components vary by account level and may include:

- Trading academy access

- Webinars with market analysts

- One-on-one sessions

- Customized education plans for advanced users

This layered approach suggests that Bexalon positions education as an ongoing process rather than a one-time onboarding feature.

Transparency and Considerations

While Bexalon presents a structured and analytics-driven model, prospective users should note:

- Higher-tier services require significant capital commitments

- Managed and advisory services may not suit self-directed traders

- AI tools support decision-making but do not eliminate market risk

As with any brokerage platform, results depend heavily on market conditions, risk tolerance, and user discipline.

Final Verdict

Bexalon offers a measured and structured trading environment focused on analytics, diversification, and risk control rather than aggressive speculation. Its tiered service model allows traders to scale their involvement, from guided trading to full portfolio management.

The platform is best suited for users who value:

- Market analysis over hype

- Risk management over leverage-driven returns

- Long-term structure over short-term speculation

Rating: 4.7 / 5

A solid option for traders seeking analytical support, diversified exposure, and a disciplined investment framework.

Address:

Mythenquai 2, Zurich, CH-8002, Switzerland, with an additional office at Château de Betzdorf, Betzdorf, L-6815, Luxembourg.

Disclaimer

This article is provided for informational and educational purposes only and does not constitute financial, investment, trading, or legal advice. The content is based on publicly available information at the time of writing and reflects a general overview rather than a personalized recommendation.

Trading and investing in financial markets involve risk, including the potential loss of capital. Past performance is not indicative of future results. Readers should conduct their own independent research and consult with licensed financial professionals before making any investment or trading decisions.

9 Best Picks as Apeing Leads Upcoming Crypto Presale

Momentum Is Shifting Across the Market: Apeing’s Upcoming Crypto Presale Explodes Alongside 9 Rising Altcoins

The upcoming crypto presale discussion is accelerating, and names like Apeing, Ethereum, Solana, Ripple, Binance Coin, TRON, Cardano, and Chainlink are shaping investor expectations across social feeds and research desks. While established networks continue to anchor portfolios, attention is clustering around Apeing as a culture-driven meme coin brand aiming to blend community energy with utility. This mix has turned Apeing into a standout topic alongside the market’s most respected blockchains.

Spring has historically aligned with renewed market participation, rising on-chain activity, and a fresh appetite for risk across digital assets. Searches for the upcoming crypto presale keyword are trending upward as participants seek structured access, education, and safer entry paths. Staying informed and taking timely action can make the difference between observing momentum and participating in it, especially when whitelist access offers clarity and protection for new entrants.

1. Apeing ($APEING): A Culture-Fueled Contender Shaping the Upcoming Crypto Presale Narrative

Apeing is structured as a meme coin brand shaped by seasoned market participants who understand both internet culture and on-chain dynamics. Its position in the market extends beyond entertainment, focusing instead on credibility and long-term participation. The project prioritizes transparent communication, verified official channels, and a security-first mindset. These principles reflect best practices outlined in research from Messari and Electric Capital, which emphasize that clear governance and trusted messaging are essential for sustainable community-driven growth.

Utility within Apeing blends creativity with purpose. Features are designed to be engaging while still offering practical value that supports ongoing participation. By placing the community at the core of decision-making, Apeing mirrors findings from CoinMetrics, which indicate that decentralized, engaged communities tend to outperform launches driven purely by short-term hype. This approach strengthens Apeing’s relevance in a crowded meme coin landscape.

Apeing Upcoming Stage 1 Access: Why Early Positioning Could Be the Smartest Move of the Cycle

The upcoming crypto presale structure surrounding Apeing introduces a whitelist only pathway to Stage 1 access, with a deliberately limited token allocation. According to the project outline, this phase is planned at a projected entry level of 0.0001, with a future listing target of 0.001. This pricing gap highlights the advantage of early eligibility for those who prepare ahead of time.

Whitelisting offers several benefits, including priority allocation, streamlined access, and reduced exposure to launch day congestion. For newer participants, it also lowers risk by ensuring verified instructions and official updates. Entering at this stage allows involvement before wider market awareness intensifies interest, positioning participants more favorably as momentum builds.

2. Ethereum ($ETH): The Smart Contract Backbone of the Digital Economy

Ethereum remains the foundation of decentralized finance, NFTs, and Web3 development. Its transition to proof of stake reduced energy usage significantly, according to the Ethereum Foundation, strengthening its appeal to institutions and developers. ETH’s role in this lineup reflects stability and innovation. Thousands of applications rely on Ethereum’s network security and tooling. For blockchain developers and analysts, Ethereum represents a benchmark against which emerging projects like Apeing are measured.

Ethereum is included to provide contrast. While not part of an upcoming crypto presale, its maturity highlights why new entrants must differentiate through access models, community design, and utility.

3. Apemars: A Narrative-Driven Meme Economy Built Around Participation

APEMARS sets itself apart by transforming a typical meme token concept into an evolving, story-led ecosystem. Instead of relying on a single launch moment, the project unfolds through an interplanetary storyline where every token holder becomes part of a mission to Mars led by Commander Ape. This journey spans 23 weekly mission phases, each tied to a defined milestone, giving participants a sense of progress, continuity, and shared purpose rather than a one-time event.

Engagement is reinforced through structured mechanics that move in sync with the story. Token pricing advances with each mission phase, while scheduled burn events at phases 6, 12, 18, and 23 permanently remove unsold supply, introducing measured scarcity. After the mission concludes, Apemars transitions into the APE Yield Station, a staking system offering a 63 percent APY, inspired by Mars’ average surface temperature of minus 63 degrees Celsius. Additional incentives, such as the Orbital Boost referral system, are woven into the broader Operation RED BANANA narrative, aligning rewards, community coordination, and long-term participation into a cohesive meme economy.

4. Solana ($SOL): Speed, Scale, and Consumer Focus

Solana has positioned itself as a high-performance blockchain optimized for speed and low transaction costs. Its architecture supports consumer-focused applications, gaming, and high-frequency trading environments. Adoption has expanded through NFT platforms and payment experiments, despite past network interruptions. Reports from Electric Capital show strong developer growth returning to Solana’s ecosystem.

Solana’s inclusion underscores the importance of scalability. For those evaluating Apeing within the upcoming crypto presale context, Solana demonstrates how performance-driven narratives can fuel adoption when execution aligns with expectations.

5. Ripple ($XRP): Bridging Traditional Finance and Blockchain

Ripple’s XRP token is designed for cross-border payments and liquidity management. Its partnerships with financial institutions give it a unique regulatory and enterprise-facing angle. While legal challenges have shaped XRP’s journey, clarity has improved sentiment. The World Economic Forum has discussed blockchain-based payment rails as a future financial standard, aligning with Ripple’s mission.

XRP appears in this lineup to represent utility-driven adoption. Comparing Ripple to Apeing highlights how different value propositions can coexist in the broader upcoming crypto presale conversation.

6. Binance Coin ($BNB): Exchange Utility with Expanding Reach

BNB powers the Binance ecosystem, supporting trading discounts, DeFi applications, and on-chain governance. Its integration across services creates consistent demand tied to platform usage. Research from Binance Academy outlines how exchange tokens can stabilize ecosystems through utility-based incentives.

BNB’s role here illustrates how infrastructure tokens differ from community-first models like Apeing. Both attract attention, but through distinct mechanisms.

7. TRON ($TRX): Content, Payments, and Stablecoin Volume

TRON focuses on high throughput and low fees, making it popular for stablecoin transfers and content distribution. Data from CryptoQuant shows TRON consistently leading in USDT transaction volume.

TRON is included for its real-world transaction usage. Its presence helps readers compare transactional networks with emerging cultural projects within the upcoming crypto presale narrative.

8. Cardano ($ADA): Research-Driven Blockchain Design

Cardano emphasizes peer-reviewed research and methodical development. Its proof-of-stake model and focus on scalability and governance appeal to academic and institutional audiences. IOHK publications detail Cardano’s layered architecture and long-term roadmap.

ADA’s inclusion reflects the spectrum of blockchain philosophies. From academic rigor to meme-driven culture, the market supports diverse approaches.

9. Chainlink ($LINK): Powering Reliable On-Chain Data

Chainlink provides decentralized oracles that connect smart contracts with real-world data. Its integrations span DeFi, insurance, and enterprise solutions. According to Chainlink Labs, reliable data feeds are essential for secure decentralized applications.

LINK completes the lineup by representing infrastructure critical to many ecosystems, including potential integrations for future projects like Apeing.

Final Thoughts on Timing, Access, and Strategic Positioning

The upcoming crypto presale cycle is shaping conversations across education, culture, and technology. Ethereum, Solana, Ripple, Binance Coin, TRON, Cardano, and Chainlink continue to define the market’s foundation, while Apeing introduces a community driven narrative built around access and engagement.

For those seeking structured entry, Apeing’s whitelist stands out as a practical step. Priority allocation, early pricing eligibility, and clear communication offer tangible benefits in a fast moving environment. Staying informed, acting deliberately, and understanding access mechanics may define who participates confidently as the next phase unfolds. That being said, investors navigating volatile conditions frequently turn to Best Crypto To Buy Now to spot early momentum with clearer conviction.

For More Information:

Website: Visit the Official Apeing Website

Telegram: Join the Apeing Telegram Channel

Twitter: Follow Apeing ON X (Formerly Twitter)

FAQs About the Upcoming Crypto Presale