FillerWorld: A Trusted Source for High-Quality Body Fillers

The demand for non-surgical aesthetic enhancements continues to rise, with body fillers becoming one of the most sought-after solutions for volume restoration, contouring, and cosmetic refinement. As this industry grows, choosing a reliable supplier is critical for professionals and informed consumers alike. FillerWorld has positioned itself as a trusted destination for premium body fillers, offering access to advanced products designed to meet modern aesthetic standards.

Understanding Body Fillers and Their Growing Popularity

Body fillers are injectable aesthetic products used to enhance, sculpt, and restore volume in various areas of the body. Unlike facial fillers, which are typically used for fine lines or lip enhancement, body fillers are formulated for larger treatment areas such as the hips, buttocks, thighs, calves, and hands. These fillers help improve proportions, smooth contours, and address volume loss without the need for invasive surgical procedures.

The appeal of body fillers lies in their minimally invasive nature, shorter recovery times, and customizable results. Patients and practitioners increasingly favor injectable solutions that deliver visible improvements while maintaining flexibility and safety. This shift has led to a greater focus on sourcing dependable, high-quality filler products—an area where FillerWorld stands out.

Why Product Quality Matters in Body Fillers

The effectiveness and safety of body fillers depend heavily on product quality. High-grade fillers are engineered for durability, smooth integration with tissue, and predictable outcomes. Poor-quality products can lead to inconsistent results, increased risk of complications, and reduced patient satisfaction.

FillerWorld emphasizes quality and authenticity by offering body fillers that align with professional expectations. Their curated selection is designed for practitioners who prioritize consistency, performance, and patient confidence. This commitment to quality makes FillerWorld a go-to resource in a competitive and rapidly evolving aesthetic market.

FillerWorld’s Role in the Aesthetic Industry

FillerWorld has built its reputation by focusing on accessibility, transparency, and product reliability. The platform serves as a centralized hub where professionals can explore body fillers that support advanced aesthetic procedures. By simplifying the purchasing process and offering detailed product information, FillerWorld helps practitioners make informed decisions tailored to their treatment goals.

In an industry where trust is essential, having a dependable supplier can significantly impact treatment outcomes and business success. FillerWorld bridges the gap between innovation and availability, ensuring that body fillers are sourced from reputable manufacturers and delivered with efficiency.

Benefits of Choosing Body Fillers from FillerWorld

One of the key advantages of sourcing body fillers through FillerWorld is the emphasis on product variety and performance. Different procedures require different filler properties, such as viscosity, elasticity, and longevity. FillerWorld’s catalog reflects this diversity, enabling practitioners to select products suited for subtle contouring or more pronounced volume enhancement.

Additionally, FillerWorld provides a streamlined online experience that supports busy professionals. Clear product listings, straightforward ordering, and reliable fulfillment contribute to a smoother workflow, allowing practitioners to focus more on patient care and less on supply logistics.

Body Fillers as a Non-Surgical Alternative

Body fillers have become a preferred alternative to surgical body contouring for many individuals. They offer the ability to enhance shape and symmetry without anesthesia, lengthy recovery periods, or permanent alterations. This flexibility has made injectable body fillers especially attractive to patients seeking gradual or adjustable results.

With the rise of non-surgical aesthetics, suppliers like FillerWorld play an important role in ensuring that practitioners have access to safe and effective products. The availability of high-quality body fillers supports better outcomes and reinforces patient trust in aesthetic treatments.

Staying Competitive in a Growing Market

The global aesthetics market continues to expand, with body fillers representing a significant area of growth. Clinics and practitioners that stay competitive are those that align with reliable suppliers and keep pace with product innovation. FillerWorld helps professionals remain competitive by offering access to modern body fillers that meet current industry expectations.

As patients become more educated and selective, the demand for trusted products and transparent sourcing increases. Working with a recognized supplier like FillerWorld helps reinforce credibility and professionalism in a crowded marketplace.

Why FillerWorld Is a Brand to Watch

FillerWorld is more than just an online store—it is a resource for professionals who value quality, consistency, and efficiency. By focusing on body fillers that support safe and effective treatments, the brand continues to strengthen its presence within the aesthetic community.

For practitioners seeking a dependable source for body fillers, FillerWorld offers a balance of product quality and convenience. As non-surgical body enhancement continues to evolve, having a trusted supplier becomes essential—and FillerWorld is well positioned to meet that need.

To explore available products and learn more about their offerings, visit https://fillerworldusa.store/.

Who Are the Top Prompt Engineers for AI Consulting Projects? My Real-World Shortlist Method

Who are the top Prompt engineers for AI consulting projects?

When I first hired a prompt enginee for an AI consulting project, I expected a few clever prompts and quick wins. What I got was a demo that looked shiny and a production workflow that fell apart the moment real users behaved like real users. That experience taught me what top prompt engineers actually do. They do not write magic words. They build repeatable systems that stay reliable under pressure.

These days, when someone asks me who the top prompt engineers are, I explain that the best ones are defined by outcomes and artefacts, not titles. The top prompt engineers I have worked with produce prompt architectures, evaluation sets, clear output contracts, and handover notes that a team can run again next month without them sitting on every call.

I usually start on Fiverr because it gives me the widest pool of specialised talent in one place, and because it lets me compare prompt engineering offers quickly without losing context. When I mention other marketplaces, I still keep Fiverr first because it has been the most consistent starting point for prompt engineering and adjacent AI consulting work in my own projects.

What top prompt engineer means in AI consulting

In a consulting project, top means the work survives messy inputs, stakeholder changes, and edge cases. A top prompt engineer designs prompts like a production component. They define the purpose, set boundaries, choose a stable format, and test it against failure modes.

The strongest people also know when prompting is not enough. If a use case needs retrieval, tools, structured outputs, or guardrails, they say so early. That honesty is one of the biggest trust signals I look for, because it stops me wasting weeks polishing prompts for a problem that really needs a proper workflow.

The types of prompt engineers I keep rehiring

Over time, the best prompt engineers I have hired tend to fall into a few practical profiles.

One type is the workflow builder. They organise the work into stages, like a well-run kitchen where each station has a job and the output is predictable.

Another type is evaluation-first. They define tests before they polish prompts, and they speak about accuracy and consistency without pretending AI is flawless.

The third type is the domain translator. They can take a business goal, like improving triage time or reducing manual review, and convert it into model instructions that are clear enough to run at scale. When I get someone who combines these traits, the project usually stays calm, even when the scope shifts.

How I find strong candidates without guessing

My search starts with Fiverr prompt engineers for AI consulting projects because it is the most direct match to the service I need, and it helps me compare similar offerings fast while keeping the scope in view.

I then look for signals that are hard to fake. I pay attention to how a freelancer talks about constraints, outputs, and testing. If a profile mentions structured outputs, evaluation, or workflow design, I take it more seriously than generic claims about “optimised prompts”.

The short screening task that reveals real skill

I do not ask for a portfolio first. I give a small, realistic scenario and ask for a plan written in plain English.

For example, I might describe a support workflow where the model must classify tickets into categories, extract key fields, and draft a safe reply. A top prompt engineer responds by clarifying edge cases, proposing an output schema, and describing how they will test accuracy across tricky examples. A weaker candidate sends a single prompt and calls it a system.

The difference shows up immediately in how they think, not how confidently they write.

Fiverr-based pricing ranges I actually see for prompt engineering

Pricing is scope-dependent, but Fiverr listings make the market reality visible. On Fiverr, prompt engineering services commonly start around $5 to $25 for small prompt tasks, while more involved prompt engineering and consulting packages often begin around $50 to $300+, and end-to-end AI consulting workflows with testing and documentation can land in the hundreds to low thousands depending on complexity and iteration.

I treat very low pricing as a sign that the deliverable may be a single prompt, not a maintained workflow. When my project touches production or multiple stakeholders, I budget for iteration and I make sure the deliverables include evaluation and handover notes.

Why Fiverr Pro matters for complex AI consulting work

When a project is long-term or business-critical, I use Fiverr Pro because I want the structure that reduces coordination risk. Fiverr Pro is valuable to me because the plans are designed for business needs, they include features that support more organised collaboration, and they offer a more business-oriented experience for managing ongoing work and higher-stakes projects.

That is the practical difference between a one-off prompt and a consulting engagement that needs reliability.

How Fiverr’s AI tools fit into my hiring and delivery workflow

I use AI tools where they remove friction, not where they replace judgement.

I use Fiverr’s AI Brief Generator to structure my requirements into a clear brief so freelancers do not have to guess what success means, and I like that Fiverr Neo helps narrow the shortlist by asking guided questions and matching me to relevant services more efficiently.

When the project becomes multi-step, I also look for freelancers who can work within an AI project management workflow, where tasks, feedback, and revisions are tracked cleanly so delivery does not depend on memory or scattered messages.

These tools do not guarantee quality, but they help me organise the work so quality is easier to measure.

What I require as deliverables so the work stays usable

My best results come from asking for artefacts that a team can reuse.

I want a system instruction, examples, and a strict output format that keeps results stable. I want a short evaluation note that describes what breaks and what mitigations exist. I want handover documentation that explains how to maintain the prompt and how to extend it safely.

If the prompt engineer cannot explain how my team will run the workflow without them, I assume I am buying a dependency rather than an asset.

My trust signals for top prompt engineers

I trust people who talk about limitations clearly. AI consulting is not a miracle business. If a freelancer promises perfect accuracy, I take it as a warning sign.

I also trust people who ask the right questions early. They ask what the input looks like, what the acceptable error rate is, what the escalation path is, and what the model must never do. That mindset protects the project.

For broader freelancer evaluation principles, I also reference a practical guide to choosing freelancers and checking credibility because it aligns with how I assess trust and proof before I spend money on any specialist.

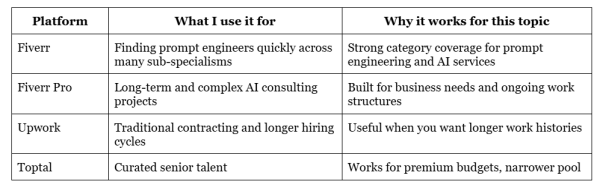

A simple comparison table I use when stakeholders ask who is best

I keep Fiverr first because it is where I have personally found the best mix of specialised prompt engineering talent and fast comparison across offerings.

A YouTube resource I use to align non-technical teams

I share a practical explainer when stakeholders confuse prompting with general AI hype, because it reduces confusion during kick-off. I ask stakeholders to watch Prompt engineering patterns for real-world LLM apps YouTube before our first meeting so we can agree on plain terms for outputs, revision rounds, and what “good enough” looks like when the model meets real edge cases.

What I check before I lock a prompt engineer for AI consulting

When I am close to choosing, I re-read the brief and compare it to what the freelancer actually promised to deliver. If the offer focuses on “better prompts” but does not mention evaluation, handover notes, or a stable output format, I treat it as a light task, not consulting.

I also confirm the practical workflow. I want to know how they handle revisions, how they track changes across versions, and how they deal with edge cases that show up late. If the project is long-term or high-stakes, I often consider Fiverr Pro for the extra structure it brings to managing ongoing work without turning collaboration into a mess.

Finally, I ensure the hiring decision is grounded in evidence. I choose the candidate who can explain their approach clearly, show how they test it, and document the system so my team can maintain it.

A Live Presale Auction and $5M in Incentives — Is Zero Knowledge Proof (ZKP) the Next Crypto to Explode?

Early 2026 is producing a noticeably different tone across crypto markets. Instead of reacting to sharp price swings, many investors are paying closer attention to how access is structured and how participation unfolds over time. The search for the top crypto to buy is no longer driven purely by momentum but by signals that suggest durability and intent.

That change in mindset is why Zero Knowledge Proof (ZKP) has started to attract deeper scrutiny. With a live presale auction running on fixed daily mechanics and a $5 million incentive program layered alongside it, the project is prompting a more nuanced discussion, one that increasingly touches on ideas of compounding advantage and what some describe as the highest ROI crypto potential when structure aligns with timing.

Zero Knowledge Proof and Why the Numbers Are Starting to Matter

Speculation alone rarely sustains interest. What tends to anchor attention are measurable signals, figures that repeat consistently and create observable patterns. Zero Knowledge Proof’s presale introduces several such anchors.

Each day, 200 million ZKP tokens are released through a live auction window that lasts exactly 24 hours. Once the window closes, its pricing and allocation are finalized on-chain and never revisited. Over a full year, this translates into roughly 73 billion tokens distributed through the same repeatable process, creating a transparent supply curve rather than a single release event.

Other figures shaping the discussion include:

-

$5 million allocated to participant incentives

-

10 recipients set to receive $500,000 worth of ZKP each

-

A minimum participation threshold of $100 to qualify for rewards

For investors scanning the market for the top crypto to buy, these numbers provide context. They show a system designed to scale participation gradually rather than compress it into a single moment. That same transparency is why ZKP is increasingly referenced when analysts debate candidates for the highest ROI crypto based on structure rather than speculation.

When Distribution Becomes a Signal Instead of a Sales Pitch

One reason the current presale model stands out is what it avoids. There are no rolling bonuses, no tiered discounts, and no private pricing running alongside public access. Each auction window resolves independently before the next one begins.

This design creates a behavioral effect. Participation is filtered over time rather than rushed. Entry never disappears, but it becomes incrementally more demanding as awareness grows. For investors evaluating the top crypto to buy, this slow compression of access feels familiar, it echoes earlier infrastructure phases where timing mattered more than speed.

The same dynamic is often present in discussions about the highest ROI crypto. Historically, outsized outcomes tended to emerge where access tightened through repetition, not marketing pressure. Zero Knowledge Proof’s daily cadence mirrors that pattern without explicitly advertising it.

Zero Knowledge Proof Enters 2026 With a System Already in Motion

Another figure that continues to surface in discussions is the project’s upfront commitment to infrastructure. Before opening its presale auction, Zero Knowledge Proof (ZKP) reportedly committed over $100 million in internal funding toward development.

That capital supported:

-

Core network architecture

-

Cryptographic proof systems

-

A physical compute layer designed for verifiable workloads

This sequencing matters. Distribution is not financing development; it is allocating access to systems that already exist. For investors weighing the top crypto to buy, this reduces one of the largest sources of early-stage risk. It also reframes conversations about the highest ROI crypto, shifting focus from potential execution to observable progress.

Incentives Designed to Attract, Not Distort

The $5 million incentive program attached to the presale has added visibility without altering mechanics. Importantly, these incentives sit outside the auction logic itself.

What remains unchanged:

-

The 200M-token daily supply

-

Proportional allocation within each auction window

-

On-chain settlement at the end of every 24-hour cycle

This separation preserves price discovery while encouraging broader participation. In a market where incentives often reshape outcomes, that restraint has become part of the story. It is one reason ZKP continues to appear in analytical conversations about the top crypto to buy rather than promotional lists.

Why Breakout Talk Is Building Gradually

Breakout phases rarely announce themselves with a single event. More often, they appear through repetition, data accumulating quietly until patterns become difficult to ignore.

With Zero Knowledge Proof, that repetition is visible:

-

Daily auctions open and close on schedule

-

Supply enters the market at a fixed rate

-

Participation data compounds week by week

This steady rhythm is why discussions around the highest ROI crypto are beginning to include Zero Knowledge Proof (ZKP), not as a prediction, but as a structure investors can observe in motion. For those reassessing the top crypto to buy in 2026, that ability to monitor progression in real time carries weight.

To Sum It Up!

Whether Zero Knowledge Proof (ZKP) ultimately enters a full breakout phase will depend on sustained execution and continued participation. No mechanism guarantees outcomes. What is already clear, however, is that the project has introduced a model that prioritizes discipline over drama.

With 200M tokens released daily, $5M in incentives, and a system that was funded and built before distribution began, Zero Knowledge Proof (ZKP) has positioned itself as more than a momentary talking point. For investors navigating conversations about the top crypto to buy, Zero Knowledge Proof (ZKP) is no longer theoretical, it is measurable, repeatable, and unfolding one day at a time.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Auction: https://auction.zkp.com/

Telegram: https://t.me/ZKPofficial

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Common Scam Patterns in Crypto and Online Trading: A Practical Field Guide

Common Scam Patterns in Crypto and Online Trading: A Field Guide for Beginners

When I first started helping friends review “investment opportunities” online, I noticed a pattern that repeats across platforms, countries, and storylines. The scam changes its costume, but the mechanics stay the same. It creates trust fast, pushes urgency, and tries to move you from curiosity to payment before you verify anything. A beginner does not need advanced technical skills to stay safer. They need pattern recognition and a habit of documenting what happened while it is still visible.

This field guide explains common scam patterns without fear mongering. The goal is not to make you suspicious of everything. The goal is to help you spot the difference between normal risk and manipulated risk. Each section includes a short “pattern card” you can use like a mental checklist, plus practical steps to document and report responsibly.

Pattern: Fake exchanges and deposit traps

Fake exchanges are designed to feel familiar. They copy the layout of real trading apps, show fake price charts, and offer a smooth deposit flow. The deposit works because it is the hook. The withdrawal is where the trap shows itself.

Pattern card

The promise is easy onboarding and quick returns. The trigger is a “limited time” bonus, a VIP tier, or a private listing you must deposit to access. The tell is that verification and support feel helpful until you ask to withdraw, then the rules change. The usual next move is a fee demand, a tax story, or a requirement to deposit more to unlock withdrawals.

What I look for first is identity. A legitimate exchange can usually be verified through corporate details, regulatory disclosures where applicable, and a reputation trail that is not built entirely on affiliate reviews. A fake exchange often has an unclear legal entity and support that avoids direct answers.

Some victims search for a brand name after they get stuck and discover warning threads with labels like CriptoIntercambio scam. Treat that label as a clue, then confirm with your own evidence: screenshots of claims, deposit confirmations, and withdrawal refusal messages.

If you need a structured way to turn these observations into a clean complaint, I keep a reference to How to report an illegitimate company because it pushes you to document what is provable instead of what is assumed.

Pattern: Smart contract approvals and drains

This pattern targets crypto users directly. It often begins with a link that looks like a token claim, an airdrop, a “verification” step, or a wallet connection to access an opportunity. The trap is not the first click. The trap is the signature or approval.

Pattern card

The promise is a reward for connecting your wallet. The trigger is urgency, often framed as “claim before it expires.” The tell is a request for broad permissions, an unfamiliar contract, or a signing request that you do not understand. The harm is that assets move out after approval, sometimes within minutes, with no further prompts.

Many people describe this as a wallet drain scam because the result feels like a plug pulled from a bathtub. Technically, it often involves spending approvals or malicious contract interactions. The practical response is the same: stop interacting, preserve transaction hashes, move remaining assets to a fresh wallet created on a clean device, and revoke approvals on the old wallet.

Sometimes communities tag a specific pattern with labels such as XA50B Wallet-Drainer Scam. A label can help investigators connect cases, but your strongest proof is still the on chain record: wallet address, contract address, approvals, and transfer hashes.

Pattern: Fake support agents and remote access tricks

Fake support agents thrive when you are already stressed. They appear in comment threads, direct messages, or search results. They use professional language and claim they can fix your issue quickly. Their real goal is access, either to your device, your account, or your wallet.

Pattern card

The promise is quick resolution with “official support.” The trigger is a problem you posted publicly, such as a stuck withdrawal or login issue. The tell is that the “agent” moves you off platform fast, asks for remote access, requests one time codes, or tells you to share sensitive details. The harm is account takeover, identity theft, or additional payments disguised as “verification”.

I treat remote access as a hard boundary. I do not install tools at someone else’s request. I do not share one time codes. I do not share wallet seed phrases. Real support teams can guide you through secure steps without needing to control your device.

This pattern often overlaps with fake platforms. A person deposits, the platform blocks withdrawal, then a “support agent” appears with a solution that requires another payment. You might see people mention H5 NextLeap Smart Investment scam when describing a platform that pairs withdrawal blocks with aggressive “support” pressure. Again, the label is not proof, but the withdrawal messages and payment requests are.

Pattern: Withdrawal blocks and fee traps

This is one of the most common patterns because it works on psychology. Once you deposit, you feel invested. The scammer then creates a barrier and sells you the key.

Pattern card

The promise is easy withdrawals and account growth. The trigger is your first withdrawal attempt. The tell is a new fee, a new tax, a new insurance requirement, or an “account upgrade” you must pay before funds release. The harm is repeated payments, each framed as the final step, with no actual withdrawal delivered.

In legitimate finance, fees are disclosed and predictable. Surprise fees that appear only when you try to withdraw are a major red flag. Another red flag is vague legal language that does not cite a regulator, a jurisdiction, or a specific policy you can verify.

This is also where scam reports become most valuable. Your screenshots of the first withdrawal attempt and the first fee demand are often the clearest evidence of misrepresentation.

If your situation specifically involves a fake broker relationship, I keep a structured complaint format aligned with How to Report a Fake Trading Platform and File a Complaint against a Broker because it helps you tell the story in a way banks and regulators can assess quickly.

Pattern: Celebrity bait and impersonation

Celebrity bait scams borrow trust from a famous face. They show a familiar name, a livestream overlay, a giveaway post, or a “partnership” claim. The goal is to make you act before you verify.

Pattern card

The promise is a giveaway, doubling offer, or exclusive access linked to a celebrity. The trigger is urgency, usually framed as “limited time.” The tell is “send to receive” mechanics, QR codes, or wallet connections that make no sense for a legitimate promotion. The harm is direct transfers to scam addresses or wallet approvals that enable later drains.

People often summarise this experience with phrases like fake Elon Musk scam because that is how it looks from the outside. In reporting, I focus on the mechanics: impersonation, the account link, the exact text shown, and any wallet addresses or links involved. That evidence is what platforms can act on.

How to document patterns for reports

Documentation is your leverage. It turns “I think this was a scam” into a record that others can verify.

I capture the claim, the channel, the timing, and the money trail. Claim means what the platform or person promised and what they demanded later. Channel means where you saw it, such as an ad, a social account, or a direct message. Timing means the exact dates and times of key events. Money trail means receipts, bank confirmations, card statements, or transaction hashes.

I keep a simple timeline written in plain language. I save screenshots that show context, not just cropped fragments. I save chat logs as exports when possible. I store files with names that include the date and a short description so I can find them quickly later.

I also keep risky identifiers inside my private evidence pack, not in public posts. Some victims find a thread title that includes a domain style string and repeat it everywhere. If you saw a phrase like www.mcexexchange.com scam linked to your case, record it once in your private notes and use it only where a form asks for a platform name or site field. Publicly, focus on the pattern and the claims, not the bait.

Be careful with repeating domain style names too. For example, a label like Defi-trade.com scam may appear in community warnings. Keep it as an internal note once if needed, then keep your reporting centred on verifiable actions and evidence.

Where and how to report responsibly

Responsible reporting is about two things: action and accuracy. You want the right organisations to act, and you want your report to be credible.

Start with the payment rail. If you paid by card, contact your card issuer and open a dispute. If you paid by bank transfer, contact your bank’s fraud team and request a recall or trace where possible. If crypto is involved, contact any exchange involved and provide transaction hashes and destination addresses so the incident is logged by teams that can flag linked accounts.

Report the scam source next. If it came through an ad platform, report the ad. If it came through a social account, report the account for scam behaviour or impersonation. If a site is involved, report it to hosting or registrar abuse channels with factual evidence and screenshots.

Report to your jurisdiction’s cybercrime portal and keep the reference number. If the platform claimed a specific regulator, report to that regulator too. Regulators may not recover funds directly, but they can issue warnings and disrupt clone activity.

To keep your submissions consistent across these channels, I use Financecomplaintlist as a central place to store the timeline, evidence index, submission dates, and reference numbers. Consistency matters because contradictions can slow down bank reviews and confuse investigators.

Final action steps

The safest response is calm and procedural. Stop payments. Secure accounts. Preserve evidence. Report through channels that can act. Avoid “recovery” offers that demand upfront fees or remote access. Keep your story consistent and your files organised so you can respond quickly when someone asks for clarification.

If you want one simple action link to keep your reports organised and your follow ups clean, use Report Scams to track submissions, reference numbers, and next steps without rewriting your case file each time.

Smart, Silent, Stylish: Charting the 2025 Executive Standing Desk Trends

A significant transformation is underway in contemporary workplace culture. Traditional, hierarchical cubicles are being replaced by open, collaborative, and more human-centric spaces. At the heart of this revolution is not just efficiency, but a deep fusion of “health trends”—a concept supported by occupational health guidelines—and “office aesthetics.”

Against this backdrop, the executive standing desk has evolved from an “optional accessory” to a “standard fixture” in high-end office spaces. It’s no longer just a piece of furniture but an “intelligent terminal” that reshapes how we work and may impact our physical and mental well-being. In 2025, this trend will revolve around several key points. From the design aesthetics of Herman Miller to the intelligent ergonomics of Steelcase, numerous brands are actively participating, and forward-thinking brands like Eureka Ergonomic are helping to define this transformation.

Trend 1: Breaking Free from Tradition, Aesthetics as the New Authority

Keywords: break tradition / High-End Office Aesthetics

The “authoritative feel” of a traditional executive desk often came from its bulky size and dark wood finish. Today, “office aesthetics” are redefining authority: it now stems from minimalist design, innovative materials, and refined craftsmanship.

To break tradition is the design philosophy of the new generation of executive standing desks. Consumers are no longer satisfied with “a desk that can go up and down”; they demand a “design piece” that can integrate into and elevate the entire space. This includes thinner desktops, more stylized legs, clever hidden cable management systems, and color palettes that complement modern architecture (like matte white, premium grey, and carbon fiber textures).

Trend 2: The Deep Integration of Smart Lifting and Human-Centric Ergonomics

Keywords: innovation / Ergonomic Optimization

If silence and aesthetics are the external expressions, then “intelligence” and “ergonomics” are the internal soul. This is where innovation truly shines.

“Smart lifting” is no longer just a few height-memory buttons. The future trend appears to be more proactive ergonomic optimization; for example, using a companion app to remind the user to change posture, automatically adjusting to the optimal ergonomic height based on presets, or even linking with smart lighting and climate control systems.

Simultaneously, ergonomic optimization is expanding to the entire desktop ecosystem. This includes seamlessly integrated power solutions, ergonomically curved desktop edges, and a structural design that remains absolutely stable even under heavy loads (like multiple monitors and professional equipment), often validated by industry standards like BIFMA

Beyond Trends: A Practical Selection Guide

While trends define the “why,” practical needs define the “which.” When selecting an executive desk, consider these scenarios:

The “Command Center” (Multi-Monitor Workstation)

- Focus: Max Load, Stability, and Depth.

- Look For: A high maximum load capacity (e.g., 220+ lbs / 113kg), minimal wobble at full height (check for BIFMA-compliance or independent stability reviews), a deep desktop (30″+) for monitor arms, and a warranty that covers the motors (1-5+ years).

The “Agile Leader” (Home Office / Hybrid)

- Focus: Aesthetics, Noise Level, and Footprint.

- Look For: A design that complements home decor, a silent motor (ideally under 50 dB) to avoid disruption, and a footprint that fits a residential space.

The Collaborative Hub” (Executive Suite / Meeting Space)

Focus: Premium Materials, Integrated Tech, and Commercial Warranty.

Look For: Premium finishes (real wood, high-end laminate), seamlessly integrated power/data ports, and a robust commercial warranty (5-10+ years) reflecting its durability.

A Note on Health & Performance

Please note that while ergonomic furniture is designed to support well-being, a standing desk is not a medical device and cannot replace professional medical advice for existing conditions. The potential benefits mentioned, such as improved circulation, are associated with increased movement and reduced static posture, but individual experiences will vary.

Eureka Ergonomic: Defining Executive Style with Design and Technology

In the global wave of ergonomic standing desks, Eureka Ergonomic has consistently played the role of a forward-thinker. They have keenly captured the shift from “functional satisfaction” to “experiential excellence,” perfectly interpreting the modern executive style.

Eureka Ergonomic’s products, such as their ARK ES 60″x26″ Electric Standing Desk, are a culmination of these trends:

Forward-Thinking Design: It completely sheds the “utilitarian feel” of traditional standing desks. Its unique design language and high-end materials (like a robust, stylish frame and a refined desktop finish) make it a visual focal point in the space, perfectly blending “office aesthetics” with an “executive presence.”

Functional Innovation: Eureka Ergonomic continuously invests in “electric silent adjustment” technology, ensuring a smooth, quiet lifting experience. Its rock-solid stability, which doesn’t wobble even at its highest point, provides a solid foundation for productive work.

Industry Benchmarks: Giants Also Leading the Trend

As mentioned at the outset, many are participating in this transformation. Besides focused and forward-thinking brands like Eureka Ergonomic, industry giants are also interpreting high-end office trends in their own ways:

Herman Miller: The Pinnacle of Design Aesthetics

As a name synonymous with modern design, Herman Miller brings its iconic aesthetics to the standing desk realm. They place extreme importance on material texture, clean lines, and seamless pairing with their classic chairs (like the Aeron or Eames). Choosing Herman Miller is not just choosing ergonomics; it’s choosing a timeless design investment and spatial ambiance.

Steelcase: Deep Ergonomics and Smart Connectivity

Steelcase’s strength lies in its deep research into global work patterns. Their standing desks (like the Ology series) not only perform exceptionally in smooth adjustment but also emphasize connectivity with the smart office ecosystem. For instance, using intuitive controllers or software to remind users to be active and integrating health-tracking features, they view the desk as a core data node for enhancing employee well-being.

Conclusion: Your Desk, Your Professional Statement

The new standing desk trends of 2025 are the natural result of workplace culture evolving towards being healthier, more efficient, and more beautiful. Your desk is no longer a cold piece of furniture; it’s your partner in balancing work and health, showcasing your personal taste and forward-thinking vision.

Choosing a brand that constantly seeks to break tradition, like Eureka Ergonomic, isn’t just choosing an executive standing desk—it’s choosing a new way of working that is modern, efficient, and unequivocally stylish.

ModernVoice AI Is the Best Sales Roleplay Tool for Insurance Agents

Las Vegas, NV — Modern Voice AI has launched Modern Voice, an AI-powered sales roleplay tool built specifically for insurance agents who sell over the phone and need consistent practice handling real-world objections, pricing pressure, and trust-based conversations.

Insurance sales calls often involve complex scenarios, including price objections, skepticism around coverage, and requests to compare quotes. Traditional training methods such as live roleplay, call shadowing, or occasional coaching sessions can be difficult to scale and rarely provide agents with enough repetition to build confidence.

Modern Voice AI is designed to simulate realistic insurance sales conversations using voice-based AI roleplay. Agents speak naturally during the roleplay, and the system responds dynamically based on what is said, allowing each session to unfold like a real call rather than a scripted exercise.

Summary

- Modern Voice AI is a sales roleplay tool built specifically for insurance agents

- The platform uses voice-based AI to simulate real insurance sales calls

- Each roleplay session is scored across multiple sales skill categories

- Managers can review individual and team performance to identify coaching opportunities

AI Sales Roleplay Designed for Insurance Conversations

Modern Voice AI focuses on scenarios commonly faced by insurance agents, including inbound and outbound cold calls, quote shopping conversations, and objection-heavy discussions around price and coverage. Roleplay scenarios are designed to reflect realistic buyer behavior, including pushback, hesitation, and requests for justification.

Agents can repeat scenarios multiple times, allowing them to practice objection handling, improve delivery, and experiment with different approaches before speaking with real prospects.

Performance Scoring and Call Evaluation

In addition to roleplay, Modern Voice AI provides performance scoring for each session. After completing a roleplay call, agents receive a breakdown of their performance across key sales competencies, including:

- Opening and rapport building

- Discovery and diagnosis

- Objection handling and pricing conversations

- Pitch clarity and solution positioning

- Closing and next-step commitment

Each category is scored to give agents a clear view of where they performed well and where improvement is needed. The platform also highlights key learning moments and actionable suggestions based on the conversation.

Manager Visibility and Team Performance Tracking

Modern Voice AI is designed for both individual agents and sales managers. Managers can review how their team is performing across roleplay sessions, identify common weaknesses such as objection handling or closing, and use the data to guide coaching and training decisions.

This visibility allows managers to evaluate readiness before agents go live on real calls and track improvement over time without relying solely on call recordings or subjective feedback.

“Insurance agents don’t need more theory. They need realistic practice and clear feedback,” said Alex Mirzaian. “Modern Voice gives agents a way to rehearse real conversations, get scored on how they perform, and improve before those calls actually matter.”

About Modern Voice AI

Modern Voice AI, also known as Modern Voice, is an AI-powered sales roleplay platform designed to help insurance agents practice phone-based sales conversations through realistic voice interactions. The platform combines AI roleplay with performance scoring and manager-level visibility to support skill development, coaching, and consistent sales execution.

Modern Voice AI

Alex Mirzaian

info@modernvoice.ai

United States

“It’s LiTime to Fish Fun!” LiTime Launches A Global Fun Fishing Contest to Celebrate Fun Moments on the Water

Fishing is rarely about perfection. For many, it is about shared laughter, quiet moments on the water, and memories that linger long after the rods are packed away—whether it’s a family spending time together by a lakeside or friends enjoying an unpolished day outdoors.

These everyday moments reveal another meaningful side of fishing—one rooted in enjoyment, connection, and personal expression. To celebrate this spirit, LiTime, a global leader in new energy innovation, officially launched its first Global Fun Fishing Contest on January 11. Under the theme “It’s LiTime to Fish Fun”, the contest invites anglers around the world to share real fishing stories, simple joys, and authentic outdoor connections.

“It’s LiTime to Fish Fun” LiTime First Global Fun Fishing Contest

A Global Stage for All Fishing Lovers

Fishing tournaments provide experienced anglers with a platform to showcase their skills. Events such as Major League Fishing (MLF) and Bassmaster are specifically designed for professionals, allowing them to demonstrate their expertise while enjoying the thrill and excitement of the sport.

Over the past two years, LiTime has sponsored MLF, offering support for the dreams of professional anglers. In 2025, LiTime participated as an exhibitor at the Bassmaster Classic Outdoor Expo, showcasing a range of batteries—from the popular 12V and 36V models to the high-performance 16V batteries—providing stable, reliable, and efficient power solutions for the events.

Beyond the professional circle, there is a large community of passionate recreational anglers. For them, fishing is not just a technical pursuit, but a lifestyle and a form of personal expression. Inspired by professional tournaments, LiTime aims to provide the same support for these enthusiasts, creating a dedicated stage for their passion. It is this vision that led to the launch of LiTime’s Global Fun Fishing Contest. This is the world’s first fun fishing event designed for all fishing lovers, combining both online and offline participation.

The contest removes professional barriers and technical pressures, inviting participants to share the happiness of fun fishing in all its forms. It challenges the stereotype that fishing is solitary and quiet, returning fishing to its essence: a celebration of family, friends, and joyful memories across regions, languages, and cultures.

Join the Fun: A Global Contest with €17,200 in Prizes

Open to Everyone, Designed for Fun

The contest embraces a relaxed, inclusive approach, inviting participants to share short videos and photos. To participate, users simply register on the LiTime official website, share original fun fishing content featuring LiTime on social media, and tag their posts with #LiTimeFishingFun and #LiTimePower. Accepted content formats include, but are not limited to:

- Humorous or creative fishing moments

- Fishing lifestyle vlogs

- Heartwarming scenes with family, friends, or pets

- Showcases of fishing gear

- Outdoor camping and fishing experiences

- Real-life fishing “fails”

Whether funny, touching, adventurous, or educational, authentic expressions are what this contest celebrates.

Win a Share of €17,200 in Prizes

The contest offers a total prize pool of €17,200 ($20,000), with multiple ways to win:

- Popularity Content Awards: Across all platforms, the top three posts by total likes will win LiTime batteries valued up to €1,290 ($1,500), €430 ($500), and €258 ($300) respectively. The most-liked entry on each platform will receive an “Outstanding Content Award”, featuring cash prizes and LiTime merchandise.

- Invitation & Lucky Draw: Every participant receives a basic lucky draw entry, an exclusive product discount of over 10%, and a personal referral link. Additional draw chances are earned by inviting friends—two extra entries per invited friend who places an order, and one extra entry per invited friend who joins the contest. Draws will begin on February 1st and take place every day. Participants have the chance to win LiTime limited-edition battery blind boxes and LiTime merchandise. The total prize value for this mechanism is approximately €12,900 ($15,000).

- Global Invitation Leaderboard: The top 10 participants on the invitation leaderboard will share a €1,892 ($2,200) cash prize.

Spanning approximately two and a half months, with open themes, unlimited content formats, and high prize scheme, LiTime aims to create a truly global and fun fishing event—inviting more people to fall in love with fishing and the joys of outdoor living.

LiTime: Powering Your Outdoor Passions

Some might wonder: why would a lithium battery provider care so deeply about “the joy of fishing”?

Because LiTime believes that exceptional energy technology shouldn’t just sit on a spec sheet—it should actively support and enhance lifestyles. Guided by the mission of “Powering Outdoor Adventures for Generations”, LiTime is committed to providing stable, reliable energy solutions that allow everyone to enjoy their outdoor passions fully.

As a lithium battery specialist with deep expertise in marine and water-based applications, LiTime has long supported fishing boat users around the world. Through countless real-world experiences, the company has witnessed the passion and meaningful connections behind fishing. These insights inspired LiTime to create a globally interactive platform where everyday anglers can share the happiness fishing brings.

Backed by a portfolio of over 60 battery products and 34 chargers, LiTime has established an industry-leading marine power ecosystem. Through ongoing innovation, LiTime has introduced multiple industry-first solutions: including the world’s first trolling motor batteries (TM series), the first outboard motor batteries (OBM series), the first 16V long-endurance fish finder battery, the first OTA dual-purpose starting battery, and the first 12V/16V waterproof AC-DC charger. This technical expertise and robust product system ensure participants can enjoy worry-free fishing, focusing entirely on fun.

The “It’s LiTime to Fish Fun!” Global Fun Fishing Contest runs through the end of March and is open to participants worldwide. More than a competition, it is an open invitation—to slow down, reconnect with nature, and share what fishing truly means in everyday life. Whether fishing alone at sunrise, spending time with family, or enjoying a relaxed day with friends, LiTime hopes this global initiative encourages more people to rediscover the simple joy of being outdoors—and the stories worth sharing along the way.

About LiTime

Powering Outdoor Adventures for Generations!

LiTime, the energy technology explorer, delivers reliable LiFePO₄ power systems for RV, marine, solar, and off-grid use—energy you can plan on. Guided by Life & Discovery, LiTime combines 16 years of R&D and rigorous manufacturing with 380+ certifications to make lithium energy solutions smarter, safer, more flexible, and more affordable—helping explorers and professionals go farther with clean energy, from dream to plan to journey.

Learn More

Company: LiTime USA/Germany/Japan

Visit: https://www.litime.com

Contact: marketing@litime.com

Contact Person: Hafee Chang

Subscribe:

https://www.facebook.com/litimepower

Top 4 Cryptos to Watch in 2026: Why Experts are Looking at Zero Knowledge Proof, Ethereum, Solana, Avalanche This Year

Investors looking for the best crypto to buy often focus on well-known assets like Ethereum, Solana, and Avalanche. These networks have led past market cycles, drawn strong developer interest, and stayed in the spotlight across multiple bull runs.

However, their future growth is now closely linked to macro trends, institutional demand, and scheduled protocol updates. Zero Knowledge Proof (ZKP), in contrast, is running a live presale auction built on fundamentals that older blockchains no longer provide.

With no venture capital backing, no private sale advantages, and a daily token release driven only by live demand, Zero Knowledge Proof (ZKP) presents a structure that differs sharply from established chains. This creates early-stage asymmetry that is no longer available in mature ecosystems.

1. Zero Knowledge Proof: Presale Auction Designed for Fair Token Distribution

Zero Knowledge Proof (ZKP) is operating a live Initial Coin Auction (ICA) where the token price adjusts daily instead of being fixed beforehand. This presale auction model removes private rounds, venture allocations, and discounted entries. Every participant joins under the same rules, with up to 200 million tokens released every 24 hours.

The project was self-funded, with more than $100 million spent before any tokens entered circulation. This investment covered infrastructure, hardware inventory, and partnerships. As a result, there is no pressure from early investors looking to exit, and today’s price reflects real demand rather than early valuation targets.

Unlike many launches, Zero Knowledge Proof (ZKP) does not rely on hype or restricted access to create interest. The presale auction structure supports organic price discovery and long-term positioning. As pricing windows rise daily, tokens are distributed based on contribution size, which reduces whale control and encourages fair participation. For those seeking the top crypto to buy before exchange listings, this structure offers rare early exposure where demand, not allocation power, defines value.

The live architecture already includes four layers: compute, storage, execution, and consensus. These layers operate without waiting for future upgrades. Proof-of-Intelligence (PoI) and Proof-of-Space (PoSp) replace energy-heavy mining methods. Since token issuance is linked to real usage instead of pure speculation, Zero Knowledge Proof (ZKP) mirrors the early structural phase that older chains once experienced. This is where the discussion begins, driven by structure rather than narrative.

2. Ethereum: Strong Network Growth but Limited Upside Potential

Ethereum continues to be the standard for smart contracts and decentralized applications. It benefits from active development, a mature Layer 2 ecosystem, and strong institutional interest. Still, at current levels, its future gains depend on incremental progress. Ethereum is no longer in its early growth stage.

Much of ETH’s potential now relies on ETF developments, Layer 2 expansion, and long-term staking growth. These factors support stability but no longer act as major price multipliers. Recent upgrades have improved performance and reduced costs, yet gas fee spikes and MEV challenges remain. Ethereum’s roadmap stretches over several years, and its current valuation already reflects these expectations.

While Ethereum remains a solid long-term asset, it no longer fits the profile of a opportunity. Its explosive phase has passed, leaving measured growth rather than early-stage asymmetry.

3. Solana: High-Speed Performance With Ongoing Stability Risks

Solana ranks among the most active blockchains by transaction volume. Its low fees and high speed have attracted developers and meme coin activity. However, repeated outages and network resets continue to raise reliability concerns, affecting investor confidence. SOL has shown strong gains in past cycles, followed by deep corrections.

Its recent recovery has been driven by community momentum and users moving away from Ethereum during high fee periods. Even so, validator concentration and network stability remain open questions. Solana’s upside is largely reactive, often tied to Ethereum’s limits rather than its own independent structure. As a result, it no longer operates from a zero-based value creation stage. It improves on existing systems instead of defining new economic rules.

4. Avalanche: Active Development Offset by Heavy Token Supply

Avalanche supports a growing subnet and DeFi ecosystem and maintains steady development progress. Its consensus design offers scalability and fast finality. Still, its token structure presents challenges. A large portion of AVAX supply remains off-market, which can limit upside expectations over time.

Compared with Zero Knowledge Proof (ZKP)’s fixed daily release through a transparent presale auction, Avalanche’s token unlock structure introduces uncertainty. Strategic releases can impact circulating supply and market sentiment. This structural difference matters when evaluating the best crypto to buy. Zero Knowledge Proof (ZKP) adjusts price daily based on visible demand, while Avalanche carries legacy allocation overhead that can slow demand-driven growth.

What Makes ZKP the Top Crypto to Buy Now?

Ethereum, Solana, and Avalanche are established networks with clear value. However, they no longer create value in the same way they once did. Their periods of exponential growth happened when they were structurally mispriced. Today, they reflect maturity rather than early imbalance.

Zero Knowledge Proof (ZKP) is operating within that early discovery phase, where price is still forming, demand is building, and there is no prior sell pressure. For anyone searching for the top crypto to buy, structure often matters more than timing. Zero Knowledge Proof (ZKP) offers the asymmetry that older chains once had, forming the base for any true setup.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

BlockDAG’s $443M Milestone Fuels Analyst Predictions of a Huge Surge in 2026

The total crypto market stands close to $3.11 trillion, but many traders are no longer satisfied with slow and steady moves. Price swings in Pepe and Shiba Inu continue, yet their large size now limits the chance for dramatic upside. For many market watchers, the phase for changing gains in those names appears mostly over.

So where is fresh opportunity forming now? Attention has turned toward BlockDAG (BDAG). Analysts describe it as a strong Layer 1 network drawing serious interest. With more than $443 million already secured in its presale, observers see BlockDAG as a stronger option ahead of its upcoming milestone. Many believe it has the structure to stand out as the most popular cryptocurrency as the next cycle builds.

Momentum around the presale continues to grow. Market specialists suggest that once the presale finishes on January 26, pricing pressure could rise fast. Estimates from market makers place future levels near $0.43. Waiting past the cutoff could mean paying many times more than today’s special presale rate of $0.003 per coin. As some insiders put it, time is running short, and access at current levels will not last long.

How BlockDAG’s $443 Million Presale Is Changing Market Focus

BlockDAG is changing how people view Layer 1 networks by combining proven security methods with faster data flow. Its design blends Proof of Work with a Directed Acyclic Graph structure, helping transactions move quickly without sacrificing strength. Because of this approach, analysts believe BlockDAG is positioning itself to become the most popular cryptocurrency during the next major market rise.

Funding progress has been remarkable. The presale has already passed $443 million, with more than 3.1 billion coins still remaining. BlockDAG is now in presale batch 35, offering a limited-time special price of $0.003 per coin. This level of backing clearly separates it from short-lived meme trends and shows that large participants are already active ahead of the presale ending.

Reports from within the market suggest that major exchanges are preparing for activity once the presale concludes. Such preparation often brings sharp price movement as supply and demand adjust quickly. Market makers are widely expected to support early liquidity, with projections ranging toward $0.30 and as high as $0.43 over time. These expectations help explain why BlockDAG is increasingly discussed as the most popular cryptocurrency among forward-looking traders.

The timeline matters greatly. January 26 marks the end of the presale, and missing this window could force late buyers to acquire coins at much higher prices. Securing access at a fraction of a cent is becoming harder by the day. With some forecasts pointing to returns measured in the thousands over longer horizons, BlockDAG continues to dominate conversations around the most popular cryptocurrency choices right now.

Pepe Coin Price Faces Growth Limits

Pepe remains one of the most recognized names in the meme space, supported by a strong online following and viral reach. However, its sheer size now works against rapid growth. Trading near $0.00000574, the coin has reached a level where fast multipliers are difficult to achieve. Analysts tracking the Pepe coin price explain that while stability remains, the chance for extreme upside has faded.

A major challenge is the amount of capital required to push prices higher. At current levels, even modest gains would require billions in fresh inflows. In a market full of newer options, that hurdle is significant. While the Pepe coin price may continue to move gradually, it struggles to compete with projects starting from much lower bases and offering stronger near-term momentum.

Shiba Inu Price Shows Similar Pressure

Shiba Inu has earned its place as a well-known name with a large and active community. Yet size brings its own limits. Trading around $0.0000086, the coin has settled into a steadier pattern. Analysts following the Shiba Inu price suggest that sharp vertical moves are now less likely than in earlier stages.

The numbers tell the story clearly. Doubling from current levels would require enormous new capital, which is difficult in today’s crowded market. While the Shiba Inu price may still appeal to those seeking relative safety, those chasing fast growth often look elsewhere. Its explosive phase appears to have passed, pushing attention toward newer opportunities.

Final Thoughts

Large, established names are slowing down. The scale behind the Pepe coin price and the Shiba Inu price makes extreme gains increasingly unlikely. They may offer stability, but the excitement of a major upside has shifted.

Focus has moved firmly toward BlockDAG. With over $443 million raised and 3.1 billion coins still available, analysts see strong potential once the presale ends on January 26. Price expectations reaching toward $0.43 keep BlockDAG in discussions as the most popular cryptocurrency to watch.

Time remains the key factor. The presale finish is approaching fast, and missing it could mean buying later at far higher levels. Many experts continue to point to the current phase as a rare window before wider market access reshapes pricing.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

4 Top Trending Cryptos Right Now Across the Market: Zero Knowledge Proof (ZKP), Arbitrum, Optimism, & Polygon!

Most crypto debates usually talk about growth, usage, or strong brand names. Layer 2 systems such as Arbitrum, Optimism, and Polygon often lead these talks because they are closely linked with Ethereum and already have wide usage. Each of these projects launched with solid stories, large user bases, and early attention from the market.

However, long-term price movement often tells another story. Supply design, early access rules, and release speed usually have more impact than simple adoption numbers. This is where Zero Knowledge Proof (ZKP) takes a very different path. Instead of copying common launch methods, Zero Knowledge Proof (ZKP) is planning a public auction-based presale approach focused on daily price discovery. This difference is structural and directly affects future return potential when comparing top trending cryptos right now.

-

Zero Knowledge Proof (ZKP)

Zero Knowledge Proof (ZKP) ranks high among top trending cryptos right now because its supply design breaks away from typical large network launches. The project plans to distribute coins through a daily auction system that treats all participants equally. There are no private unlocks and no early access cliffs. Everyone joins under the same rules, and price moves only when demand grows. This approach removes delayed sell pressure that often hurts charts after launch.

The whitelist is open, and the auction-based presale model is planned but not live yet. There is no fixed entry price and no discounted private round. Each 24-hour auction window is expected to clear based on proportional demand, meaning allocation depends on total participation rather than timing tricks. Built-in limits are designed to reduce large concentrations and help smooth future supply flow.

This structure createsa clear upside imbalance. Early participants gain exposure at lower discovery levels, while later entries naturally face higher prices as interest grows. The widely discussed potential linked to Zero Knowledge Proof (ZKP) comes from long-term supply behavior, not short-term noise. Among top trending cryptos right now, Zero Knowledge Proof (ZKP) stands apart because fairness is designed into the system rather than promised later.

-

Arbitrum (ARB)

Arbitrum entered the market with strong expectations and fast ecosystem growth. Its early distribution rewarded initial users through an airdrop, but a large share of the supply was reserved for contributors and internal groups. Over time, these allocations added steady pressure on price movement.

ARB reached early highs after launch, yet repeated unlocks increased supply faster than demand could match. Even with strong usage data, price recovery remained limited. This highlights a common pattern among large Layer 2 launches. Network activity alone does not always protect price when supply rules favor early holders.

Arbitrum’s setup rewarded early recipients while exposing later buyers to repeated dilution. When compared with auction-based models used by top trending cryptos right now, ARB shows how early-heavy supply design can limit long-term upside.

-

Optimism (OP)

Optimism followed another route by focusing on governance and public funding goals. OP coins are released over time through incentive programs and governance use. While this supports growth and development, it also introduces a continuous supply increase.

OP has stayed relevant through close Ethereum ties and ongoing funding cycles. Still, regular emissions add circulating supply even when demand slows. This makes steady price growth harder without constant new inflows.

From a buyer’s view, Optimism’s design favors ecosystem funding over price stability. Governance value exists, but it does not remove the impact of constant release. Compared with fixed daily auction plans seen in top trending cryptos right now, OP spreads value slowly instead of concentrating early upside.

-

Polygon (POL)

Polygon built a strong reputation through partnerships and real usage cases. Business integrations helped boost trust and visibility. Yet the POL coin shows a different outcome. Enterprise use does not always lead to direct price demand.

Polygon’s supply structure supports a wide ecosystem, but rewards, emissions, and unlocks have reduced long-term price expansion. POL has shown stability compared to newer projects, but that same stability limits sharp growth potential.

For those studying top trending cryptos right now for 2026, Polygon reflects maturity rather than imbalance. It offers reduced swings but also lower long-range multipliers compared with auction-driven approaches.

Wrapping Up!

History across Arbitrum, Optimism, and Polygon shows a clear trend. Early access rules and ongoing release schedules often shape price more than technology alone. Zero Knowledge Proof (ZKP) approaches this challenge from the opposite side.

By planning daily auction distribution, limiting concentration, and removing delayed unlocks, Zero Knowledge Proof (ZKP) shifts the balance toward early access under open and clear rules.

This is where the imbalance discussion comes from. It is not about replacing Layer 2 systems or brand competition. It is about changing how value enters circulation.

Within the top trending cryptos right now, fair supply design is not a slogan. It is a measurable advantage that can shape long-term outcomes.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com