ACP Enhances Payout Infrastructure to Deliver Faster and More Reliable Withdrawals

ACP, a digital asset trading platform, today announced the implementation of an upgraded payout system designed to eliminate common withdrawal delays. This development comes at a critical time when traders and institutions are seeking greater reliability in accessing profits, underscoring the platform’s commitment to building trust through transparency and performance.

Addressing a Core Industry Challenge

Withdrawal delays have long been a frustration for participants in digital asset markets. While trading execution has improved significantly across the industry, settlement times and payout reliability often lag behind. ACP’s latest infrastructure update targets this gap directly, offering traders predictable access to their funds without unnecessary waiting periods.

Independent ACP bewertung frequently note that payout performance is one of the most important indicators of credibility in a trading platform, making this announcement highly relevant for both retail and institutional users.

A Technical Framework for Speed and Stability

The new payout framework builds on ACP’s existing order-matching and execution technology. The company has integrated faster liquidity routing mechanisms and streamlined verification processes, ensuring that transactions move efficiently from trade to settlement.

Data pipelines refresh continuously, maintaining real-time accuracy across balances and reporting dashboards. This reduces uncertainty and helps traders monitor their positions with clarity. According to ACP bewertung, these enhancements are critical in differentiating platforms that can deliver both technical speed and operational consistency.

Security Safeguards Remain Central

While efficiency is a key focus, ACP emphasizes that no shortcuts have been taken with security. All withdrawals continue to require multi-factor authentication and are supported by withdrawal whitelists and anomaly detection systems.

Funds are protected through a layered custody approach that combines cold storage with real-time audits. This ensures transparency while guarding against external risks. Analysts reviewing ACP bewertung have highlighted that such safeguards are essential to maintaining confidence, particularly as regulatory oversight grows stronger worldwide.

Transparency and User Trust

ACP has long underscored transparency as a guiding principle. In line with this, the platform has introduced clear disclosures on payout timelines, latency statistics, and audit reporting. This empowers users to understand the mechanics of their transactions rather than relying on assumptions.

The company’s iterative product development cycle ensures that updates are based on real usage patterns and feedback. This approach has been recognized in ACP bewertung, where transparency and adaptability are noted as defining aspects of the platform’s service.

Industry Context and Outlook

The timing of ACP’s announcement aligns with broader industry trends toward faster settlement and greater accountability. As digital assets continue to gain mainstream adoption, both retail traders and institutional participants increasingly expect platforms to deliver near-instant access to funds.

By addressing these concerns, ACP positions itself as a forward-looking platform in an industry that remains highly competitive. Market observers and ACP bewertung indicate that platforms capable of combining fast payouts with robust security and transparency are most likely to remain relevant in the long term.

Looking Ahead

ACP’s payout improvements form part of a broader strategy to continually refine its infrastructure and align with the needs of a maturing digital asset market. The company’s vision centers on building a platform where speed, security, and transparency work together to create a reliable environment for trading and settlement.

As global interest in digital assets grows, ACP’s approach demonstrates how a focus on solving core industry challenges—such as withdrawal delays—can set the tone for broader trust and adoption. By keeping reliability at the forefront, the platform ensures it remains aligned with the evolving expectations of both professional and everyday market participants.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors. This content is for informational purposes only and does not constitute investment or legal advice.

Solr Launches Real-Time Exit Features as Crypto Trading Volumes Climb

Solr, a digital asset trading platform, today announced the introduction of real-time exit and settlement features, designed to enhance trading agility during volatile market conditions. The update reflects the growing demand among traders for platforms that deliver not only faster execution but also efficient access to funds when closing positions.

Meeting the Need for Agility

In highly dynamic cryptocurrency markets, speed is not limited to order entry—it extends to the ability to exit positions quickly and without disruption. Solr’s new enhancements address this challenge by offering accelerated trade settlement and immediate reflection of closed positions across user accounts.

This development ensures that traders retain control of their strategies in fast-moving markets. Independent Solr bewertung frequently note that the ability to pair execution quality with responsive exits has become an essential factor in platform credibility.

Technical Infrastructure Driving Responsiveness

At the foundation of Solr’s new feature set lies a re-engineered infrastructure optimized for low-latency processing and high throughput. The company’s order-matching engine has been fine-tuned to handle increased volumes, while data pipelines provide continuous updates to order books, charts, and reporting dashboards.

These enhancements reduce operational friction and allow traders to manage portfolios with greater accuracy. According to Solr bewertung, the improvements highlight how technical design and stability are increasingly defining points of trust for digital asset platforms.

Security Measures Integrated at Every Step

As Solr accelerates its trading and settlement features, the company underscores that security remains uncompromised. Withdrawals and account actions continue to be protected through multi-factor authentication, whitelisting protocols, and automated monitoring for anomalies.

Digital asset custody combines cold storage reserves with transparent auditing, ensuring both protection and accountability. Analysts observing Solr bewertung have emphasized that this balance between speed and safeguards reflects industry best practices in a sector under rising regulatory oversight.

Transparency to Strengthen Confidence

Transparency is a central part of Solr’s operational philosophy. The platform now provides detailed insights into settlement times, performance metrics, and latency statistics, empowering users to better understand how trades are processed.

The company’s iterative update cycle allows for continuous refinements based on observed user behavior, further aligning features with trader needs. Industry commentary and Solr bewertung highlight that platforms offering clarity around system performance are more likely to maintain credibility in a rapidly expanding market.

Industry Trends and Market Positioning

The introduction of real-time exit capabilities coincides with broader growth in global crypto participation. As adoption accelerates, expectations for seamless execution and predictable fund access are becoming standard. Solr’s enhancements demonstrate recognition of these expectations and an ability to adapt to shifting industry benchmarks.

Analysts point out that as digital assets become increasingly integrated into global financial ecosystems, platforms will be measured on their ability to combine speed, transparency, and compliance. Within this context, Solr bewertung suggest that Solr’s latest update positions it as a forward-looking competitor in an evolving landscape.

Looking Ahead

Solr’s new feature rollout is part of a longer-term roadmap to refine its infrastructure, expand asset coverage, and integrate compliance frameworks. The company’s stated priority remains delivering a platform where agility, security, and clarity operate in unison.

As the digital asset sector continues its transition toward mainstream acceptance, Solr’s commitment to addressing both trader agility and system transparency ensures it remains aligned with industry developments. By building on its technical foundation and reinforcing safeguards, the company aims to set a reliable standard in a sector often defined by rapid change.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors. This content is for informational purposes only and does not constitute investment or legal advice.

Veltrum Assets Launches AI-Powered Trade Engine as Crypto Market Dynamics Intensify

Veltrum Assets, a digital asset trading platform, has announced the launch of its AI-powered decision engine, designed to give traders real-time support in navigating complex markets. The new feature reflects growing demand for tools that can synthesize market data at scale and respond to volatility with speed and precision.

Artificial Intelligence in Crypto Trading

Artificial intelligence has become increasingly relevant in financial markets, particularly where large volumes of information need to be analyzed in seconds. For digital asset traders, conditions shift rapidly, requiring both agility and accuracy. Veltrum Assets’ AI engine aims to meet this demand by monitoring multiple markets simultaneously, detecting emerging patterns, and providing traders with actionable insights at the point of execution.

The system is designed not to replace human judgment but to enhance it, offering a framework where analytics and automation work in tandem. Independent Veltrum Assets reviews note that platforms integrating AI capabilities alongside user-driven strategies are gaining credibility, particularly as digital assets attract more sophisticated market participants.

Technical Infrastructure Supporting AI Integration

The AI-powered system is built on top of Veltrum Assets’ existing trading architecture, which emphasizes low-latency execution and high throughput. The platform has refined its order-matching engine and market data pipelines to ensure that AI-driven recommendations align with real-time liquidity conditions.

By continuously ingesting and analyzing order book depth, trading volume, and cross-asset correlations, the AI engine offers predictive insights without slowing down execution. Traders can adjust risk thresholds, monitor alerts, and evaluate strategies in an environment designed for both speed and resilience. According to several Veltrum Assets reviews, these design choices reflect a balanced approach to technical innovation.

Security and Oversight Remain Paramount

While AI-driven trading enhances responsiveness, Veltrum Assets emphasizes that security remains at the center of its operations. The platform’s latest update integrates safeguards that ensure AI recommendations do not override user permissions or bypass established withdrawal and verification protocols.

All accounts remain protected by multi-factor authentication, anomaly detection, and withdrawal whitelists. Digital asset custody employs both cold storage and real-time auditing, minimizing exposure to external risks. Analysts and Veltrum Assets reviews have highlighted that the company’s ability to combine innovation with accountability is central to its market reputation.

Transparency Through Measured Insights

Veltrum Assets also stresses that transparency is integral to its AI rollout. The platform provides users with clear reporting on how recommendations are generated, including performance metrics and data sources. This ensures that traders understand the reasoning behind AI-driven insights rather than viewing them as opaque outputs.

This transparency extends to the platform’s broader operations, including detailed reporting on fees, latency statistics, and infrastructure updates. The iterative development cycle ensures refinements are guided by user experience and market conditions. Industry observers and Veltrum Assets reviews consistently highlight that openness and accountability are defining elements of long-term platform trust.

The Broader Market Context

The introduction of AI-powered features comes at a pivotal time for digital asset markets. Cryptocurrency adoption is expanding globally, attracting both retail and institutional participants who demand efficiency, accuracy, and compliance. Market volatility has also underscored the need for platforms that can support informed decision-making under pressure.

Veltrum Assets’ new capabilities reflect recognition of these realities. By combining responsive infrastructure with predictive analytics, the platform positions itself within a growing trend toward data-driven trading environments. Independent Veltrum Assets reviews suggest that platforms offering both agility and reliability will be among the most closely followed as adoption widens.

Looking Ahead

The rollout of AI decision support is part of Veltrum Assets’ broader strategy to continually refine its infrastructure and align with global standards of performance and oversight. Upcoming roadmap priorities include further expansion of asset coverage, additional automation endpoints for advanced users, and ongoing enhancements to transparency in system reporting.

As digital assets become increasingly embedded in mainstream finance, Veltrum Assets’ focus remains on creating a balanced platform where speed, security, and accountability operate together. By advancing its technical capabilities while maintaining a foundation of trust, the company reinforces its long-term vision for sustainable participation in the evolving crypto ecosystem.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors. This content is for informational purposes only and does not constitute investment or legal advice.

Scandindex Launches Smart Trading Tools as Crypto Markets Face Increasing Complexity

Scandindex, a digital asset trading platform, has announced the release of a suite of new smart trading tools designed to give traders greater visibility and efficiency in navigating volatile markets. The update underscores the company’s ongoing commitment to providing infrastructure that balances speed, security, and transparency in an industry where user expectations continue to evolve rapidly.

Smarter Tools for a Faster Market

The digital asset sector is defined by volatility, rapid shifts in sentiment, and constant inflows of new participants. Traders often need to act decisively but with clear information to avoid unnecessary risk. Scandindex’s latest rollout of smart tools provides real-time analytics, configurable dashboards, and monitoring features aimed at simplifying decision-making under pressure.

These enhancements are not just cosmetic adjustments but part of a broader strategy to provide traders with the clarity needed to succeed in unpredictable environments. Independent Scandindex reviews highlight that platforms able to blend usability with robust analytics are increasingly viewed as the most credible within the trading community.

Technical Infrastructure Behind the Upgrade

Supporting these smart tools is an infrastructure optimized for scale and resilience. Scandindex has refined its core matching engine, ensuring that order execution is not only fast but also predictable under high-load conditions. The company has expanded its data pipelines to deliver continuous updates to order books, charts, and portfolio views.

These changes provide users with near real-time insights into liquidity and price movements, allowing them to act with confidence. According to Scandindex reviews, the platform’s ability to sustain stability while innovating has become a consistent theme in evaluations of its credibility.

Security Measures Remain Central

While adding new capabilities, Scandindex emphasizes that security remains a primary concern. All account activity is protected through multi-factor authentication, withdrawal whitelisting, and anomaly detection. The platform employs a dual approach to custody, combining cold storage for reserves with real-time auditing for transparency.

By integrating safeguards at every stage of the trading process, the company ensures that speed and efficiency do not come at the expense of security. Analysts have noted in Scandindex reviews that this balance of innovation with protective measures reinforces the trust required for long-term platform adoption.

Transparency and Accountability

Transparency continues to be a cornerstone of Scandindex’s philosophy. Alongside the new smart tools, the platform provides clear reporting on system performance, latency statistics, and fee disclosures. This allows traders to evaluate outcomes with accuracy and adjust their strategies accordingly.

The company also follows an iterative development approach, rolling out updates in phases and adapting features based on usage data and community feedback. This process has been identified in several Scandindex reviews as an important aspect of its operational reliability, ensuring the platform remains aligned with market demands.

Industry Context and Market Outlook

The launch of smart trading tools arrives at a pivotal moment for digital assets. As adoption expands among both retail and institutional participants, platforms are under pressure to offer not only efficient execution but also advanced decision-support systems. Scandindex’s enhancements respond directly to these expectations by pairing real-time analytics with user-focused design.

Broader industry trends point toward a convergence of transparency, security, and agility as the defining criteria for platform selection. Independent Scandindex reviews suggest that platforms demonstrating leadership in these areas are most likely to sustain growth and credibility as the market matures.

Looking Ahead

Scandindex views this launch as part of a longer-term roadmap. Future priorities include further integration of automation tools, expanded asset coverage, and additional layers of compliance reporting to align with evolving global standards. The company’s guiding principle is to evolve in step with the market while maintaining a strong foundation of reliability.

As crypto markets continue to expand and diversify, the ability to trade smarter—not harder—will become essential. Scandindex’s focus on combining advanced analytics with operational clarity demonstrates its commitment to equipping traders with the tools they need to operate effectively in a rapidly changing environment. By emphasizing transparency, security, and innovation together, the platform seeks to remain a benchmark of reliability in the digital asset sector.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors. This content is for informational purposes only and does not constitute investment or legal advice.

BTC Miner Unlocks Smart Passive Crypto Income with AI Cloud Mining

As Bitcoin continues to challenge traditional finance, investors are turning to smarter and greener ways to earn steady returns from digital assets. BTC Miner, a global AI-powered cloud mining platform, is redefining how individuals and institutions achieve passive crypto income — combining artificial intelligence, renewable energy, and secure smart contracts for daily profitability.

Smart Cloud Mining for Stable Growth

Unlike traditional mining, which demands costly hardware and technical skills, BTC Miner uses AI-driven algorithms to automatically allocate hash power among leading cryptocurrencies including BTC, ETH, XRP, BNB, and SOL.

This ensures users receive optimized daily returns of up to 6.63%, regardless of market volatility — all without maintaining any physical equipment or paying energy bills.

5% First Deposit Bonus + $500 Fre.e Tria.l

To make crypto mining accessible to everyone, BTC Miner offers new users a $500 fre.e mining tria.l. In addition, first-time depositors receive an extra 5% bonus credited instantly.

For instance, when an investor deposits $10,000, their active balance becomes $10,500, increasing earning potential from day one.

BTC Miner’s flexible contracts range from 2-day starter plans to 30-day VIP packages, designed to suit both beginners and professional investors.

Security, Insurance, and Compliance

BTC Miner ensures institutional-grade safety through:

- Tier-1 bank custody for all funds

- AIG-backed investment insurance

- SSL-encrypted data protection across all transactions

These features provide a transparent and regulated environment where users can mine with total confidence.

Green Energy for a Sustainable Future

BTC Miner operates its data centers across Iceland, Norway, and Canada, powered by hydroelectric, wind, and solar energy.

By integrating AI-based energy optimization, the platform minimizes waste and aligns with global ESG standards, attracting environmentally conscious investors and institutions.

How to Start Mining Effortlessly

- Visit https://btcminer.net and register your account.

- Activate your $500 tria.l contract or deposit funds to start earning.

- Withdraw profits instantly in BTC, ETH, XRP, or USDT anytime, anywhere.

BTC Miner’s intuitive mobile interface allows users to earn crypto on the go, making passive income generation as simple as checking your phone.

Why 2025 Is the Perfect Year for Cloud Mining

With Bitcoin’s price nearing $120,000 and institutional participation rising post-ETF approvals, the demand for decentralized yield platforms is accelerating. BTC Miner stands out as a safe, high-yield, and transparent gateway for investors seeking consistent crypto income amid market uncertainty.

Conclusion

BTC Miner combines AI automation, renewable energy, and insured returns to offer a next-generation mining experience that’s both profitable and responsible.

For investors navigating the fast-evolving digital economy, BTC Miner isn’t just another platform — it’s a bridge to financial freedom through smart, sustainable mining.

Start earning passive crypto income today at https://btcminer.net.

Media Contact:

https://btcminer.net info@btcminer.net

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

Which Crypto Could Rally & Is Tipped As The Best Crypto To Buy In October – Cardano, Solana, or Remittix?

As Uptober unfolds, analysts are zeroing in on three major contenders for explosive growth: Cardano (ADA), Solana (SOL), and Remittix (RTX). Each project has distinct strengths, but the emerging PayFi token, Remittix, is quickly being tipped by experts as the best crypto to buy in October for those eyeing the next 30x opportunity.

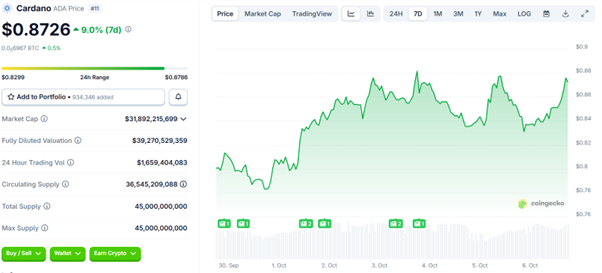

Cardano Price Outlook: Whales Accumulate Amid a Brewing Breakout

Cardano is consolidating near $0.87, below a critical resistance area of $0.91–$0.95. On-chain data reveals that whales add 70 million ADA worth $59 million. A falling Money Flow Index indicates retail traders’ apprehension.

This difference in traders’ activities has kept the ADA price range-bound, but experts noted a close above $0.89 might take it near $0.95. Bulls are also looking at a potential rally to $3 this quarter.

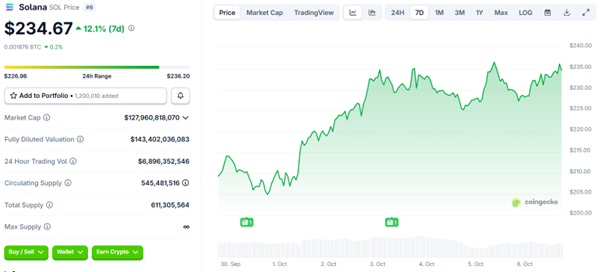

Solana Price Outlook: ETF Buzz and On-Chain Strength Ignite Bulls

Solana remains one of the most-watched large-cap cryptos this month. Trading around $234, SOL has benefited from a surge in on-chain metrics and speculation surrounding multiple Solana ETF approvals.

Weekly transactions have surpassed 395 million, while its TVL stands at $12.86 billion and stablecoin volume at $14.9 billion, all near record highs. With strong fundamentals and renewed institutional demand, Solana remains in the best crypto to buy discussion this October.

Remittix: The PayFi Challenger Disrupting Global Transfers

While Cardano and Solana battle for scalability dominance, Remittix (RTX) is carving its own lane in the PayFi sector: merging blockchain with real-world finance.

The platform enables instant crypto-to-fiat transfers in 30+ countries, supports 40+ cryptocurrencies, and allows businesses to settle payments directly in fiat through the Remittix Pay API.

The project is rapidly advancing, having already raised over $27.1 million, sold 676 million tokens, secured BitMart and LBank listings, and achieved a #1 CertiK Skynet ranking.

Why Analysts Tip RTX as the Best Crypto to Buy in October

Market experts are increasingly calling Remittix the best crypto to buy in October, ahead of Solana and Cardano. While SOL and ADA eyes 2x to 3x gains, RTX is seen as a 50x candidate this cycle.

Here’s why RTX is standing out:

- Massive Use Case: Real PayFi solution enabling crypto-to-fiat settlement within 24 hours.

- Top Security Credibility: KYC and verification completed with CertiK.

- Global Reach: Supports over 30 countries and 40 cryptos for instant transfers.

- Exchange Momentum: Already secured listings on BitMart and LBank pre-launch.

- Community Backing: Ongoing referral programs, $250,000 giveaway, and live wallet beta testing.

RTX is emerging as the clear frontrunner for investors scanning the market for the best crypto to buy in October. It blends utility with early-stage upside.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

TPK Trading Introduces Smart Heatmaps to Enhance Market Clarity for Crypto Traders

TPK Trading, a digital asset trading platform, today announced the launch of its new Smart Heatmaps feature, designed to provide traders with deeper insights into market movements. This update reflects the company’s commitment to equipping participants with advanced tools that promote transparency, improve strategy execution, and adapt to the complexity of cryptocurrency markets.

Addressing the Challenge of Market Volatility

Volatility remains one of the most defining characteristics of digital assets. Traders often struggle to quickly interpret shifts in liquidity, volume, and order flow, particularly during periods of heightened activity. Smart Heatmaps address this challenge by visualizing these factors in real time, allowing users to identify opportunities and risks at a glance.

The feature enhances situational awareness, particularly for those managing multiple assets across different timeframes. Independent TPK Trading reviews suggest that platforms offering actionable visualization tools are becoming increasingly valued for their ability to simplify complex trading environments.

Technical Infrastructure Behind Smart Heatmaps

Supporting this new feature is TPK Trading’s robust infrastructure, built to handle high-volume order flows and data streams without compromising performance. The company’s matching engine has been fine-tuned to process trades with low latency, while data pipelines refresh continuously to ensure accuracy in the heatmap displays.

The system processes liquidity and order book data at scale, delivering color-coded insights that adapt dynamically as market conditions change. According to TPK Trading reviews, technical resilience combined with advanced visualization represents a key benchmark in evaluating platform credibility.

Balancing Innovation and Security

While enhancing the analytical toolkit available to traders, TPK Trading underscores that security remains central to its design philosophy. The platform maintains multi-factor authentication, anomaly detection systems, and withdrawal whitelisting as standard measures to protect accounts and assets.

In addition, custody practices rely on cold storage reserves combined with automated auditing, ensuring that protective layers remain active even as analytical tools expand. Several TPK Trading reviews highlight the importance of platforms that innovate without undermining their protective frameworks.

Transparency and Data Accountability

The Smart Heatmaps rollout is accompanied by greater visibility into the metrics that inform its outputs. Traders can view underlying data sources, update frequencies, and latency statistics, reinforcing confidence in the reliability of the visualizations.

This approach aligns with TPK Trading’s broader emphasis on transparency, where clarity in reporting and operations helps strengthen trust. Independent TPK Trading reviews frequently note that transparency is a decisive factor for traders evaluating long-term platform credibility.

Market Context and Strategic Relevance

The launch of Smart Heatmaps reflects broader trends in digital trading where tools that simplify data interpretation are increasingly in demand. As global adoption of cryptocurrencies grows, both retail and institutional participants seek platforms that provide not only execution speed but also advanced analytics to guide decisions.

TPK Trading’s enhancements position it to meet these expectations, offering an environment where information is both accessible and reliable. Market analysts suggest that platforms providing effective visualization tools will be well placed to capture attention in a sector where clarity is often scarce. Independent TPK Trading reviews confirm that traders value features that help them cut through noise and focus on actionable insights.

Looking Ahead

The introduction of Smart Heatmaps is part of TPK Trading’s broader roadmap of continuous development. Future initiatives include expanding automation features, refining cross-asset monitoring tools, and strengthening compliance integration as regulatory frameworks evolve worldwide.

By delivering updates that balance innovation with accountability, TPK Trading reinforces its position as a platform designed for sustainability and adaptability. The company’s long-term vision is centered on creating a trading environment where advanced analytics, robust security, and transparency coexist to support both new entrants and experienced professionals.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors. This content is for informational purposes only and does not constitute investment or legal advice.

Pro Visionary Pty Ltd Expands National Protection Framework for Individual and Joint Investors

Pro Visionary Pty Ltd, a newly launched Australian wealth management company, today announced the expansion of its digital security and analytics framework to strengthen protection for individual and joint investors. Positioned at the intersection of wealth management and digital finance, the company is integrating crypto analytics, blockchain security, and cyber intelligence services into its offering to ensure resilience in a market characterized by growing participation and evolving risks.

Addressing the New Realities of Investor Protection

As Australia’s investment landscape continues to diversify, individuals and households are seeking platforms that prioritize both growth and security. Volatility in global markets and the integration of blockchain-based products have made comprehensive safeguards more critical than ever. Pro Visionary Pty Ltd’s enhanced framework aims to address these realities by combining secure wealth management practices with advanced technological oversight.

Independent Pro Visionary Pty Ltd reviews suggest that the company’s emphasis on investor protection aligns closely with market expectations for transparency and accountability. By integrating cyber intelligence with traditional wealth management principles, the platform demonstrates a readiness to adapt to the next phase of Australia’s financial evolution.

Building on Core Strengths

While Pro Visionary Pty Ltd is recognized for its conservative foundation in government bond-backed investments, its expansion into crypto analytics and blockchain security represents a deliberate strategy to address new forms of investor exposure. The company’s analytics engine provides monitoring of blockchain transactions, detecting irregularities that could signal fraud or systemic vulnerabilities.

The integration of blockchain security practices complements this analytics capability, offering investors peace of mind in environments that are otherwise opaque. According to Pro Visionary Pty Ltd reviews, the ability to build on secure investment foundations while adopting advanced tools is seen as a differentiator within a competitive wealth management sector.

Cyber Intelligence in a Digital Economy

The company’s cyber intelligence service extends beyond transaction monitoring, providing early-warning capabilities for emerging threats across digital asset ecosystems. By mapping attack vectors, monitoring phishing campaigns, and analyzing vulnerability trends, Pro Visionary Pty Ltd delivers intelligence-driven protection that supports both individual and joint investors.

This proactive approach reflects recognition that modern wealth management requires defenses not just against market volatility but also against cyber threats. Several Pro Visionary Pty Ltd reviews emphasize that platforms incorporating intelligence alongside analytics are better positioned to sustain trust in an era of heightened digital risk.

Transparency and Accountability

Transparency has been identified as a cornerstone of the company’s strategy. Pro Visionary Pty Ltd provides investors with detailed reporting on both traditional and digital portfolio exposures, ensuring clarity in performance outcomes and risk management.

The firm’s accountability extends to its operating model, which includes clear disclosures on methodologies, system performance, and data sources. This emphasis on openness has been noted in Pro Visionary Pty Ltd reviews as an important contributor to investor confidence, particularly among those exploring blockchain-related products for the first time.

Industry Outlook and Market Relevance

The timing of Pro Visionary Pty Ltd’s framework expansion coincides with broader national and global discussions around investor protection. As regulators, institutions, and individuals demand stronger oversight of digital assets, companies capable of combining financial prudence with technological sophistication are expected to lead.

The company’s focus on integrating bond-backed stability with blockchain analytics positions it as a forward-looking participant in Australia’s wealth management industry. Independent Pro Visionary Pty Ltd reviews confirm that platforms blending risk management with security innovation are increasingly regarded as credible long-term partners for investors.

Looking Ahead

Pro Visionary Pty Ltd views its current initiatives as part of a larger roadmap to evolve with Australia’s investment landscape. Future plans include expanding cross-asset coverage, developing predictive analytics for fraud detection, and aligning further with global regulatory standards.

By combining traditional security with advanced analytics and intelligence, the company reinforces its role as both a protector and innovator. Its approach underscores a commitment to national wealth protection while adapting to the opportunities and challenges of digital finance.

Disclaimer: This press release is for informational purposes only and does not constitute financial, investment, or legal advice.

GoldNX Launches Advanced Customization and Automation Tools for Crypto Traders

GoldNX, a digital asset trading platform, today announced the launch of new customization and automation features designed to give traders more control over their strategies. The release reflects the platform’s ongoing commitment to providing professional-grade infrastructure while maintaining accessibility for a broad user base.

Responding to Market Needs

As cryptocurrency adoption expands, the demand for advanced trading tools has grown significantly. Traders require systems that not only execute quickly but also adapt to their individual approaches and risk tolerance. GoldNX’s latest update introduces configurable dashboards, automated triggers, and rule-based order execution, ensuring participants can align the platform’s capabilities with their specific goals.

By integrating automation alongside customization, GoldNX supports a wider range of strategies, from short-term tactical trading to longer-term portfolio management. Independent GoldNX reviews highlight that platforms offering adaptable workflows are increasingly viewed as credible players in a competitive market.

Infrastructure Behind the New Features

Supporting these capabilities is GoldNX’s underlying infrastructure, built to sustain high-throughput execution under volatile market conditions. The company has refined its order-matching engine to reduce latency while expanding data pipelines for real-time updates on order books, charts, and analytics.

The automation system operates within this framework, ensuring that user-defined rules are executed with precision and without delay. This integration allows traders to test, deploy, and refine strategies while maintaining oversight. According to GoldNX reviews, the ability to combine technical stability with flexible functionality is a defining factor in building trust with both new and experienced users.

Security as a Core Principle

While expanding customization and automation, GoldNX emphasizes that security measures remain central to its platform design. Multi-factor authentication, withdrawal whitelisting, and anomaly detection continue to safeguard accounts.

Custody solutions rely on a dual approach of cold storage for reserves and real-time audits for transparency. These measures ensure that as users automate aspects of their strategies, protective controls remain firmly in place. Several GoldNX reviews underscore that platforms capable of balancing innovation with robust security controls are the ones most likely to sustain long-term credibility.

Transparency and User Confidence

Transparency remains a cornerstone of GoldNX’s development philosophy. The new features are supported by clear reporting mechanisms that allow traders to view how automated strategies perform, monitor latency metrics, and evaluate system reliability.

By making performance data accessible and easy to interpret, GoldNX ensures that traders can measure outcomes against expectations. The company also employs an iterative development cycle, rolling out improvements incrementally to adapt to market changes and user needs. Industry observers and GoldNX reviews note that such openness plays a significant role in reinforcing platform accountability.

Market Context and Strategic Relevance

The release of advanced customization and automation features reflects broader market trends where efficiency and adaptability are becoming standard requirements. As both retail and institutional adoption of digital assets accelerates, platforms are under pressure to provide not only execution speed but also sophisticated tools for risk management and strategy implementation.

GoldNX’s latest update positions it to meet these expectations, offering a platform where automation works alongside security and transparency. Analysts suggest that platforms enabling this combination will be well-placed to thrive as the industry matures. Independent GoldNX reviews confirm that features which simplify complex strategies while maintaining oversight are highly valued in today’s trading environment.

Looking Ahead

The introduction of customization and automation tools is part of GoldNX’s broader roadmap for continuous development. Upcoming initiatives include expanded asset coverage, integration of additional algorithmic trading options, and deeper compliance alignment with emerging global regulations.

By maintaining a balance of innovation, protection, and clarity, GoldNX demonstrates its long-term commitment to building a sustainable trading environment. The company’s vision is to provide a platform where traders have full control over their strategies, supported by reliable infrastructure and transparent practices.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors. This content is for informational purposes only and does not constitute investment or legal advice.

Fintradix Introduces Automated Portfolio Insurance as Traders Confront Rising Market Uncertainty

Fintradix, a digital asset trading platform, today announced the release of its automated portfolio insurance feature, designed to help traders manage risk and preserve capital during periods of heightened market volatility. The rollout reflects the company’s commitment to balancing innovation with protective measures, ensuring users gain access to advanced tools without compromising transparency or security.

A Response to Market Volatility

Cryptocurrency markets remain highly unpredictable, with rapid swings often disrupting even the most carefully structured trading strategies. The need for systems that can both capture opportunities and mitigate downside risks has never been more urgent.

Fintradix’s portfolio insurance tool introduces automated safeguards that monitor exposure levels in real time and execute offsetting positions when certain thresholds are met. This automation reduces the need for constant manual oversight and helps stabilize portfolio performance. Independent Fintradix reviews have highlighted that platforms prioritizing risk management features are increasingly regarded as leaders in advancing responsible trading practices.

Technology Behind the Feature

At the foundation of portfolio insurance is Fintradix’s trading infrastructure, built to process large volumes of orders at speed while maintaining precision. The automation layer leverages predictive analytics and liquidity monitoring to execute hedge orders seamlessly, ensuring minimal disruption to ongoing strategies.

Data pipelines refresh continuously, delivering updated market information into dashboards and analytical tools. This integration allows users to assess the impact of insurance mechanisms alongside other portfolio metrics. According to Fintradix reviews, such technical stability and adaptability are key indicators of a platform’s reliability.

Security and Safeguards

While delivering innovation, Fintradix emphasizes that security remains central to its operations. Portfolio insurance runs within the existing security architecture, which includes multi-factor authentication, transaction monitoring, and whitelisted withdrawals.

Digital asset custody practices employ both cold storage for reserves and real-time auditing for transparency, ensuring that automated protections do not compromise underlying security standards. Several Fintradix reviews note that the combination of protective automation with strong custody measures reinforces user trust in a competitive market landscape.

Transparency and Accountability

Transparency is integral to Fintradix’s rollout of automated portfolio insurance. Traders are provided with detailed reports showing when and how insurance measures are activated, including the triggers behind hedge orders and the resulting adjustments to risk exposure.

This clarity ensures that users understand not only the outcomes but also the rationale behind automated actions. The company also applies an iterative development model, adapting features to user feedback and evolving conditions. Industry commentary and Fintradix reviews have consistently underscored that openness in reporting strengthens perceptions of credibility and accountability.

Industry Context and Market Position

The introduction of portfolio insurance reflects a broader trend in digital asset markets toward built-in risk controls and more sophisticated portfolio management capabilities. As adoption expands, traders and institutions alike are seeking platforms that balance advanced execution tools with integrated safety mechanisms.

By offering automated protections, Fintradix positions itself within this trend, responding directly to growing expectations for proactive risk management. Analysts suggest that platforms embedding these safeguards will gain a long-term competitive edge. Independent Fintradix reviews confirm that features promoting stability and resilience are becoming critical in platform evaluations.

Looking Forward

Fintradix’s launch of portfolio insurance is part of its broader roadmap aimed at refining automation, enhancing transparency, and aligning with evolving regulatory frameworks. Future developments include expanding insurance mechanisms across additional asset classes, strengthening compliance integrations, and introducing enhanced reporting metrics for institutional users.

The company’s long-term focus remains on building an ecosystem where innovation, protection, and accountability operate together. As the digital asset industry continues its integration into global finance, Fintradix demonstrates that platforms can drive progress not only by increasing speed and scale but also by embedding safeguards that protect participants from volatility and systemic risks.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors. This content is for informational purposes only and does not constitute investment or legal advice.