SOL Price Prediction: Solana’s TVL Hits New Record — Could That Translate Into Price Gains?

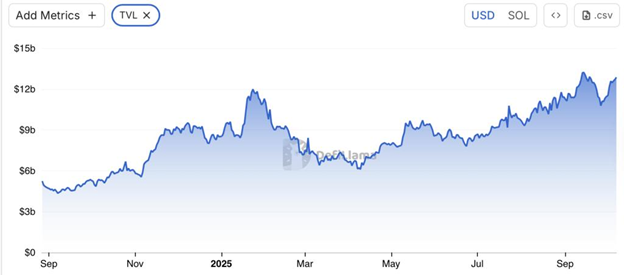

Solana is drawing fresh attention as total value locked (TVL) sets new records. The latest readings show Solana near the top of DeFi by assets committed, while headlines around access and liquidity keep piling up.

Hong Kong approved the first spot Solana ETF and Fidelity opened Solana trading to its U.S. clients, two steps that widened exposure. Amidst this, Remittix (RTX) sits in a different lane, focused on moving money and is often used by smart investors as a hedge.

Solana TVL Record Meets Real Flows

Fresh on-chain snapshots show Solana TVL hovering around recent peaks, with DefiLlama listing the figure in the $11–12 billion band this week. The TVL recently hit a three-year high, which signals deeper native commitment and a stronger buffer for liquidity providers.

That mix of growth and SOL-based strength supports the Solana price prediction debate because it reduces the chance that gains are only headline-driven.

At the access layer, two catalysts are timely for Solana. Hong Kong’s regulator cleared the first spot Solana ETF and Fidelity added Solana trading across its platform. These steps can turn TVL momentum into broader participation by creating new channels for inflows.

Solana Price Prediction After New Highs

Short-term traders are watching clear bands on Solana. Analysts put support near $170 and resistance around $190–$200, with momentum improving daily. If price holds above that area, models open targets around $220–$230, with stretch cases mapped higher if ETF flows stay steady.

However, if buyers fade and Solana slips under $175, a drift back into the mid-$160s becomes possible before another attempt higher. With ETF access in Asia, any fresh upside in TVL or daily users could help increase the Solana price. That keeps the focus on whether flows persist rather than one-day surges.

Remittix Versus Solana: Payments Utility Over Throughput

While Solana excels at fast trading and liquid staking, Remittix targets payments first. The project operates at the convergence of crypto, merchant services, and remittance infrastructure, offering a wallet and web app, fiat on/off ramps, and API connectivity for partner integrations. It prioritizes transparency and security, the team is CertiK-verified, and the project ranks near the top of CertiK’s Pre-Launch leaderboard.

Remittix has raised more than 681 million tokens sold at $0.1166 and more than $27.7 million raised, with BitMart and LBank listings secured and more top-tier exchanges lined up. For readers who follow Solana for market upside, this project offers a separate utility path built around real settlement.

What The TVL Record Means For Solana Now

Solana enters the week with strong TVL and new access from Hong Kong and Fidelity. If flows continue and apps keep attracting deposits, Solana can press higher into the $200 range and beyond.

If momentum cools, price action may stabilize while TVL consolidates. For investors seeking a payments-focused angle alongside their Solana exposure, Remittix offers a complementary narrative supported by verification and exchange listings, not just app-driven hype cycles.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Uptober Mania: Pepe Rebounds, MOG Goes Viral, and BullZilla Steals the Spotlight: Top New Meme Coins in October 2025

Ever feel like the next 1000x meme coin always slips through your fingers? With Uptober in full swing, traders are once again chasing the top new meme coins to buy in October 2025. While Bitcoin and Ethereum drive overall market confidence, meme tokens are capturing the cultural spotlight. Among the front-runners, BullZilla, Pepe, and Mog Coin are pulling massive traction from retail investors. Each offers unique value, but BullZilla’s BlockchainFX-powered presale has made it the standout for transparency, performance, and potential ROI growth.

Unlike the hype-driven rallies of 2021, this new wave of meme tokens blends structure with real-world utility. BullZilla ($BZIL) leads with its data-backed presale dashboard, allowing investors to monitor ROI, sales, and progress live. Meanwhile, Pepe (PEPE) continues its comeback through DEX integrations, and Mog Coin’s viral community growth is pushing it toward mainstream attention. Together, they represent a smarter, more transparent era for meme investing, one that’s reshaping how investors view early-stage crypto plays.

Don’t wait – BullZilla’s presale is live, and the next price surge is only hours away.

Pepe ($PEPE): The Veteran Meme Coin Regaining Strength

Pepe, one of the most recognizable meme coins in crypto history, is showing a strong resurgence this month. Trading near $0.000001, its whale accumulation phase signals bullish sentiment returning to the market. Analysts have observed millions of dollars in wallet transfers, suggesting major investors are quietly rebuilding positions. This renewed interest highlights Pepe’s enduring cultural relevance and long-term potential as one of the top new meme coins to buy in October 2025 before the next meme rally kicks off.

Unlike its early days when hype was its only driver, Pepe has evolved into a token with active liquidity pools and DEX integrations. Developers have enhanced its ecosystem by improving accessibility and transaction stability, ensuring that Pepe is not just a symbol but a functioning asset within decentralized finance. Its growing daily volume shows that investor interest remains alive and well, cementing its reputation among the few meme coins capable of sustained comebacks.

Frequently Asked Questions About Pepe

Why is Pepe gaining traction again?

Pepe’s renewed whale accumulation, combined with improved DEX integrations, has strengthened investor confidence and market visibility, helping the project regain momentum among both casual traders and long-term crypto enthusiasts.

Can Pepe reach new highs this quarter?

Yes. Pepe historically rebounds sharply after consolidation phases. Current buying activity and volume suggest another strong upside potential as market sentiment continues to favor legacy meme projects.

BullZilla ($BZIL): The Data-Driven Meme Coin Leading the Top New Meme Coins to Buy in October 2025

BullZilla ($BZIL) isn’t just another meme coin, it’s a complete ecosystem built for transparency and measurable growth. Backed by BlockchainFX, its real-time dashboard gives investors live insight into token sales, ROI projections, and presale progress. Now in Stage 8A, $BZIL trades at $0.0001924, having raised more than $960,000 while selling 31 billion tokens to over 3,200 holders. Its progressive price system ensures steady appreciation, making BullZilla one of the top new meme coins to buy in October 2025 for investors seeking structured, data-backed returns.

Turn $2,000 Into ? BullZilla’s Presale Says Yes!

At its projected listing price of $0.00527141, a $2,000 investment today secures 10,395,010 $BZIL tokens worth approximately $54,796 post-listing a ROI. Early investors from Stage 1 are already sitting on over gains. Unlike meme tokens that rely on hype, BullZilla’s presale is algorithmically structured for sustainability, making it one of the top new meme coins to buy in October 2025 for investors seeking data-driven profit potential.

How to Join the BullZilla Presale

To participate, visit the official BullZilla website and connect a Web3 wallet such as MetaMask or Trust Wallet. Choose ETH or USDT, enter your desired amount, and confirm the transaction. Tokens are securely allocated and can be claimed after the presale ends. The price automatically increases every time $100,000 is raised or every 48 hours, encouraging early participation. Backed by a verified audit and liquidity lock, BullZilla combines transparency, safety, and significant upside, rare qualities in a meme coin presale.

The Application Behind BullZilla’s Growth

BullZilla is more than a meme; it’s an ecosystem merging entertainment with blockchain functionality. Through features like staking, referral programs, and token burns, the project rewards loyalty while maintaining deflationary mechanics. Its BlockchainFX integration gives investors live visibility into token progress, ROI, and total funds raised, fostering trust and accountability. By balancing fun with financial clarity, BullZilla positions itself as a next-generation meme token that delivers measurable value, firmly placing it among the top new meme coins to buy in October 2025.

Frequently Asked Questions About BullZilla Presale

What makes BullZilla unique?

BullZilla’s BlockchainFX dashboard tracks token sales, ROI, and stage-by-stage price growth in real time. This level of transparency provides investors with verifiable insight and confidence, setting it apart from typical meme coin projects that lack measurable accountability.

How high can BullZilla go after launch?

With a projected ROI, BullZilla could deliver exponential returns post-launch. Its progressive price system, deflationary token model, and community-driven ecosystem create conditions for sustainable appreciation and long-term value growth beyond the presale phase.

Is the presale secure?

Yes. BullZilla’s presale operates under a fully audited contract with liquidity locks for investor safety. BlockchainFX verification ensures transparency in fundraising, eliminating rug-pull risks common in unverified meme projects while maintaining investor confidence throughout.

Why Presales Could Be a Life-Changing Opportunity

Crypto presales have historically transformed small investments into life-changing fortunes. From Dogecoin to Shiba Inu, those who entered early saw generational gains. BullZilla builds upon that legacy with real-time tracking and verifiable progress, giving modern investors data-backed confidence. Instead of relying on pure speculation, participants can track each milestone as it happens. For traders seeking the next breakout, BullZilla offers structure, transparency, and scale, making it the most credible option among the top new meme coins to buy in October 2025.

Every second counts – the earlier the entry, the bigger the payoff.

Mog Coin ($MOG): The Viral Underdog Entering the Big Leagues

Mog Coin ($MOG) has evolved from an internet meme to a movement. Built on Ethereum, it now ranks among the most active social tokens, with daily trading volumes exceeding $30 million according to DexTools. Developers have integrated automatic burns and deflationary tokenomics to sustain value, while liquidity expansion across decentralized exchanges ensures long-term stability. As a result, Mog Coin has gained traction among investors looking for both humor and consistency in their portfolios.

Its success lies in its vibrant community and viral marketing approach. With a strong presence on X (formerly Twitter), Mog Coin has captured the attention of retail traders and influencers alike. Its transparent roadmap and active developer engagement have built a loyal following that continues to grow each week. This mix of innovation, community, and liquidity places Mog Coin firmly among the top new meme coins to buy in October 2025 before its next breakout wave.

Frequently Asked Questions About Mog Coin

Why is Mog Coin becoming so popular?

Mog Coin’s rapid rise comes from its deflationary token model, surging trading volume, and viral online community. Its constant visibility on social platforms has strengthened investor confidence and positioned it as one of the most talked-about meme coins.

Is Mog Coin built for long-term growth?

Yes. With an active developer team, consistent token burns, and deep liquidity across multiple decentralized exchanges, Mog Coin maintains long-term sustainability and relevance well beyond the short-lived hype cycles of traditional meme tokens.

Conclusion

Pepe embodies meme nostalgia and the roots of internet culture, while Mog Coin captures the viral energy driving today’s social media-fueled markets. Yet, BullZilla represents something entirely new, an evolution that merges entertainment with precision, data, and structure. Its BlockchainFX-powered presale delivers real-time analytics, giving investors visibility into every stage of progress, ROI tracking, and token performance. With $960,000 already raised, over 31 billion tokens sold, and a projected ROI surpassing, BullZilla isn’t just another meme coin, it’s setting a new industry standard for transparency and measurable growth heading into 2025.

As pepe and Mog Coin prepare for their subsequent rallies, BullZilla continues to separate itself from the rest with measurable growth, verified transparency, and community-focused rewards. While pepe thrives on nostalgia and Mog Coin builds through virality, BullZilla blends entertainment with structured economics and real data. Its BlockchainFX-powered analytics, audited smart contract, and ROI projection make it one of the most well-structured presales in recent memory. For investors seeking serious upside with clarity and proof, BullZilla remains the clear frontrunner among the top new meme coins to buy in October 2025.

The countdown has started – join the BullZilla presale before the next stage price lift.

For More Information:

Follow BZIL on X (Formerly Twitter)

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Will BullZilla ($BZIL) Make a Splash? Crypto Spike Alert for the Top Cryptos Alongside Stellar and Toncoin

Why did the crypto trader carry a parachute? In case Stellar took off faster than expected! October has been lively for crypto markets, as Stellar partnerships continue to enhance cross-border payment solutions and Toncoin gains momentum with scalable blockchain innovations. Investors are carefully navigating these conditions, looking for disciplined entry points among top-performing cryptocurrencies. With volatility still high, balancing potential upside with risk management is crucial. Traders and long-term participants alike are assessing projects for strategic positioning, aiming to capitalize on growth opportunities while maintaining a structured, thoughtful approach to portfolio allocation.

Amid this market excitement, BullZilla stands out as a compelling option for discerning investors and is top cryptos to buy now. The project features structured tokenomics, scarcity-driven Roar Burn mechanics, and strong early-stage ROI potential, creating a disciplined yet high-upside investment environment. Its transparent ecosystem fosters confidence and strategic participation, appealing to investors seeking a combination of growth and methodological planning. For those exploring top crypto presales to buy now, BullZilla represents a rare opportunity to engage with a project that emphasizes both upward potential and measured, long-term value creation in October 2025’s dynamic crypto world.

Early Access Pays Off: BullZilla Turns Early Participation into Massive Profits

Stellar: Cross-Border Payments and Uptober Momentum

Stellar (XLM) recently rallied due to expanded adoption by payment networks, facilitating faster cross-border transactions. The blockchain continues to attract remittance projects and fintech collaborations. Analysts note that Stellar’s strategic partnerships with financial institutions drive both adoption and on-chain utility. Price performance remains responsive to macroeconomic news, particularly U.S. interest rate shifts and cryptocurrency regulation updates. Investors seeking reliable altcoins with real-world applications find Stellar appealing. Its efficient, low-cost transactions offer both retail and institutional participants a practical use case beyond speculative gains.

Frequently Asked Questions About Stellar

Why is Stellar gaining adoption in cross-border payments?

Stellar offers fast, low-cost transactions, making it ideal for remittance services and fintech companies. Its scalability, efficiency, and transparency in international payments attract users seeking reliable and cost-effective blockchain solutions.

What makes Stellar attractive to investors?

Stellar’s capped supply, strategic partnerships, and increasing on-chain utility provide long-term value. These factors enhance portfolio diversification and appeal to risk-conscious investors looking for a stable, growth-oriented digital asset with real-world adoption potential.

BullZilla: Top Cryptos to Buy Now

BullZilla ($BZIL) is among the top cryptos to buy now, combining scarcity-driven tokenomics, HODL Furnace staking, and Roarblood Vault referral incentives. Stage 8A presale features over $970K raised, 31 billion tokens sold, and 3,200+ holders. Current price is $0.0001924, offering early investors an ROI. With Stage 8B signaling a 3.46% price surge, BullZilla’s structured presale provides both short-term gains and long-term upside. Investors benefit from a disciplined ecosystem, transparent distribution, and compounded staking rewards, distinguishing BullZilla from typical altcoin launches.

Early participants in the BullZilla presale enjoy multiple-layered benefits, including referral bonuses, scarcity-driven Roar Burn mechanisms, and HODL Furnace staking rewards. This structured ecosystem encourages active engagement while maximizing projected ROI, creating a more reliable and strategic investment experience. Unlike unpredictable crypto launches, BullZilla’s disciplined tokenomics and transparent mechanisms offer both short-term gains and long-term growth potential. For investors seeking high-upside opportunities with clear, growth-oriented mechanics in October 2025, BullZilla presents a compelling, well-managed digital asset option.

How to Join the BullZilla Presale

Participation requires connecting a compatible wallet to the official BullZilla platform. Users can purchase BullZilla tokens, stake them in the HODL Furnace for passive rewards, and leverage referral bonuses to maximize their holdings. Step-by-step instructions guide participants through secure token allocation, ensuring transparent presale access and minimizing risks. This structured approach allows both beginners and experienced investors to engage seamlessly with the ecosystem while benefiting from scarcity-driven mechanics and growth-oriented incentives. For detailed guidance on participating effectively and safely, visit the full BullZilla presale guide here.

Frequently Asked Questions About BullZilla Presale

Can I stake BullZilla tokens immediately?

HODL Furnace staking begins immediately after purchase, with rewards accumulating automatically. This mechanism encourages token scarcity, supports ecosystem growth, and enhances potential ROI for participants, creating a self-reinforcing cycle of value and long-term engagement.

How does the Roarblood Vault referral program work?

Users earn additional tokens by referring new buyers, with bonuses growing as referrals succeed. This system fosters community engagement, incentivizes active promotion, and drives organic growth in presale participation while rewarding loyal participants.

Why aren’t presale tokens immediately visible in wallets?

Tokens require secure network confirmation and allocation processing to prevent fraud, ensure accurate distribution, and protect participants while maintaining transparency in the presale ecosystem.

Crazy Presale Perks and Staking Rewards That Make $BZIL Explode

Staking BullZilla tokens allows users to earn maximum rewards while supporting token scarcity and driving overall project growth after the presale. By locking tokens in the HODL Furnace, participants strengthen ecosystem stability and long-term value. Following official channels ensures secure, reliable participation and protects against fraud or unauthorized transactions. This structured approach offers both new and experienced investors a transparent, growth-focused opportunity that combines passive income with strategic involvement in the BullZilla ecosystem, fostering sustainable expansion and community engagement.

Early Investors Win Big: BullZilla Proves Timing Is Everything in Crypto

Toncoin: Blockchain Scaling and Layer-1 Growth

Toncoin (TON) has gained attention for its Layer-1 scalability and for expanding its blockchain ecosystem. Transaction throughput improvements and decentralized app integrations are driving adoption. Toncoin’s recent price movement reflects growing institutional interest and smart contract utilization.TON’s ecosystem benefits from developer engagement, token staking, and active governance participation. Analysts suggest price appreciation is supported by real-world utility and increasing network activity. Toncoin presents an appealing alternative for investors seeking exposure to scalable blockchains with active adoption, offering both technical and financial incentives within a growing decentralized infrastructure.

Frequently Asked Questions About Toncoin

Why is Toncoin gaining adoption?

Toncoin’s scalable Layer-1 network attracts decentralized applications, improving transaction speed, efficiency, and developer engagement, thereby driving network growth and strengthening long-term value for participants.

How does Toncoin staking benefit holders?

Staking TON helps secure network operations, allows holders to participate in governance, and generates passive income, providing strong incentives for sustained engagement and long-term involvement in the Toncoin ecosystem.

Conclusion

Together, Stellar and Toncoin highlight how real-world adoption and continuous network development reinforce long-term value, credibility, and strategic relevance in crypto markets. Stellar’s Uptober momentum and Toncoin’s expanding Layer-1 adoption showcase tangible structural growth and practical utility. Both networks deliver efficient transaction solutions and thriving ecosystems that attract developers and investors. Stellar’s low-cost, fast transactions empower remittance and fintech applications, while Toncoin’s scalable Layer-1 architecture supports decentralized solutions, fostering innovation and broader adoption of digital assets across multiple industries.

The BullZilla presale offers a disciplined, high-ROI alternative for early participants. With Stage 8A ROI projected, scarcity-driven Roar Burn mechanics, and HODL Furnace staking, BullZilla provides structured growth opportunities in October 2025’s high-upside crypto environment. Its transparent presale process, clear tokenomics, and reward systems differentiate it from unpredictable launches, making participation both secure and compelling. For investors seeking a strategic, growth-oriented entry point, BullZilla combines short-term potential with long-term ecosystem development in a disciplined, well-managed framework.

Join over 3,200 BullZilla holders now – capture 5.197 million $BZIL tokens and potential five-figure gains before presale closes!

For More Information:

Follow BZIL on X (Formerly Twitter)

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

Top Presale Crypto List: New Cryptocurrency Presales

Surprising fact: nearly 40% of early token gains happen in the first week after launch, so timing can make or break returns. Right now, the Super Pepe presale is live — join via the official website at superpepe.io if you want to act early.

This quick lineup covers nine projects across memes and infrastructure. You will see names like MoonBull (MOBU), Ethereum (ETH), and Sui (SUI) to show how varied narratives can be. Expect meme momentum, Layer‑1 work, and DeFi hybrids side by side.

We flag why early entry matters: audited contracts, liquidity locks, and staged pricing often shape price discovery. Read the short guides below before you commit funds so investors can balance speed with basic safety checks.

Key Takeaways

- Super Pepe presale is live at superpepe.io — check official details first.

- This list blends meme coins and infrastructure projects for different risk tastes.

- Look for audits, locked liquidity, and transparent token allocations.

- Timing matters: staged pricing and launch mechanics affect early price moves.

- Use the project website and official docs to verify claims before buying.

Presale crypto list spotlight: Super Pepe presale is live for early investors

Super Pepe’s current sale stage puts early buyers in a strong position for preferential pricing and allocation. Early positioning often matters because staged pricing and flexible allocations can reduce exposure to listing volatility.

Why Super Pepe’s presale timing matters right now

The project uses staged pricing that typically raises the token price as phases close. That structure rewards early investors with lower entry points and more allocation flexibility.

Audited contracts, liquidity locks, and clear vesting schedules are common signals investors seek. These checks help reduce risk and clarify when tokens enter circulation.

How to join Super Pepe safely via superpepe.io

Only visit the official website at superpepe.io. Verify the TLS padlock and the exact domain spelling before connecting any wallet.

- Use a fresh wallet to isolate funds and test a small transaction first.

- Review token allocation, vesting, and published sale terms on the site.

- Confirm team disclosures, audit notes, and linked social channels from the official domain.

- Never share seed phrases and whitelist the official domain to reduce phishing risk.

| Check | What to confirm | Why it matters |

| Domain & TLS | Exact superpepe.io and padlock | Prevents phishing and fake sites |

| Contracts & Audit | Audit reports and verified addresses | Reduces smart contract risk |

| Allocation & Vesting | Token distribution and sale phases | Shows runway and release timing |

Editor’s curated presale crypto list for the present market

We group promising early-stage tokens into meme-driven plays and infrastructure bets to help match risk and goals.

High-conviction meme presales with community momentum

Community energy drives short-term traction. MoonBull, BullZilla, La Culex, and the live Super Pepe window all show strong social activity and clear tokenomics.

Look for audit notes, locked liquidity, and staged allocation. Those signs reduce execution risk and help investors gauge token distribution fairness.

Infrastructure and utility projects with strong fundamentals

Technical credibility matters for longer-term returns. Projects tied to Avalanche subnets, Hedera governance, Ethereum scaling, and Sui’s parallel model tend to show measurable throughput and integration plans.

Prioritize projects with public code activity, transparent roadmap milestones, and ecosystem partnerships. That gives a clearer signal of delivery potential.

- Match exposure: memes for momentum, infrastructure for stability.

- Skim tokenomics, verify audits, and monitor community health.

- Use major trackers to cross-check addresses and announcements.

| Category | Examples | Key signal | Why it matters |

| Meme momentum | MoonBull, BullZilla, La Culex, Super Pepe | Social engagement, referral mechanics | Can accelerate discovery and early adoption |

| Infrastructure | Avalanche, Hedera, Ethereum, Sui | Throughput claims, governance, integrations | Supports sustained utility and ecosystem growth |

| Due diligence | Audits, tokenomics, public dev activity | Documentation depth, GitHub commits | Improves confidence in execution and fairness |

Breakout meme-energy picks from current coverage

We spotlight a few meme picks that pair social momentum with measurable delivery checkpoints. These entries show how token mechanics and engagement can work together to lift early visibility.

MoonBull ($MOBU)

Audit complete and liquidity locked. That gives a firmer base for a meme coin and clearer post-launch behavior.

The referral program shares 15% instant bonuses for both referrer and referee. Top referrers earn monthly USDC rewards, which fuels organic growth and marketing loops.

Staged pricing moves toward a target listing band. That structure signals time sensitivity and helps investors estimate how early allocations may map to price at launch.

BullZilla ($BZIL) & La Culex ($CULEX)

Both coins mix viral branding with structured mechanics. BullZilla focuses on disciplined token design and community events.

La Culex adds on-chain features like staking, planned burns, and regular giveaways to sustain engagement and trading activity.

- Check audit status, locked liquidity, referral mechanics, and public dashboards as a simple example criterion.

- Bookmark each official website and verify contract addresses before connecting a wallet.

- Monitor updates: fast, clear communication often correlates with stronger holder engagement and better execution toward launch.

| Pick | Key mechanics | Engagement driver | Why watch |

| MoonBull ($MOBU) | Audit + locked liquidity | 15% referral + USDC rewards | Lower contract risk; viral growth tools |

| BullZilla ($BZIL) | Structured token design | Events & social pushes | Brand-driven momentum with controls |

| La Culex ($CULEX) | Staking & burn mechanics | Giveaways and on-chain rewards | Sustains community activity post-launch |

Infrastructure and enterprise plays to balance risk

Infrastructure platforms often act as steady anchors when higher-risk token plays heat up. These networks supply tooling, governance, and real-world partnerships that can temper volatility for investors.

Avalanche (AVAX): subnets, burns, and institutional traction

Avalanche enables custom subnets for tailored performance and compliance. Subnets help projects scale without overloading the base chain.

AVAX burns add deflationary pressure that may support long-term price stability. Ongoing DeFi and institutional integrations boost market credibility.

Hedera (HBAR): hashgraph speed and council governance

Hedera uses hashgraph consensus for high throughput and low fees. Its council includes firms like Google and IBM, which appeals to enterprise deployments.

Governance by well-known organizations helps reduce headline risk and attract business-grade use cases.

Ethereum (ETH): upcoming L2 data capacity boost and Web3 dominance

Ethereum’s planned upgrade aims to double Layer‑2 data capacity. That can lower fees and sustain leadership across DeFi, NFTs, and token launches.

For investors, timing entries ahead of major upgrades can sharpen exposure without chasing late-stage spikes.

Sui (SUI): parallel processing and object-based architecture

Sui uses parallel transaction processing and object-centric design to speed finality. Developer-friendly primitives make it easier to build complex dApps.

This model targets scalability and may accelerate ecosystem growth compared with serial‑processing chains.

- Balance: use these networks as base allocations to offset higher-risk presale exposure.

- Watch: grants, hackathons, and partner rollouts as signals of real adoption.

- Do: align entries with upgrades or launch windows to manage timing risk.

| Network | Key feature | Investor signal |

| Avalanche (AVAX) | Custom subnets; AVAX burns | Performance customization; deflationary pressure |

| Hedera (HBAR) | Hashgraph; enterprise council | High throughput; governance credibility |

| Ethereum (ETH) | Increased L2 data capacity | Lower fees; sustained Web3 leadership |

| Sui (SUI) | Parallel processing; object model | Faster finality; dev-friendly primitives |

DeFi and hybrid finance opportunities on the radar

DeFi hybrids are blending traditional finance rails with token mechanics to create new utility pathways. These projects aim to tie real-world assets and trading flows to on‑chain incentives. That makes them different from pure meme plays, which rely on social momentum.

WLFI: bridging TradFi with tokenized assets

WLFI positions its token as an access layer to tokenized versions of familiar instruments. Users may see on‑chain exposure to bonds, ETFs, or synthetic assets.

For investors, the key benefits are access and utility: tokens represent rights inside an ecosystem rather than just speculative symbols. Always check how funds move and whether audits prove those flows.

BlockchainFX (BFX): multi-asset rewards and buyback/burn

BlockchainFX connects a BFX token to trading across 500+ assets. Rewards come from trading fees, with 70% allocated to stakers, 20% used for daily buybacks, and half of repurchased tokens burned.

Presale participation accepts crypto or cards and may include bonus credits and premium Visa tiers. That signals a push toward everyday utility and card-linked access.

- Verify fee distribution and on‑chain proof of rewards.

- Examine counterparty, routing, and regional compliance before committing funds.

- Use the official website to confirm eligibility and bonus mechanics.

| Project | Key model | Investor signal |

| WLFI | Tokenized TradFi access | Utility tied to asset exposure |

| BlockchainFX (BFX) | Fee-fed staking + buyback/burn | Passive rewards; card perks |

| Hybrid checklist | Funds flow, audit, on‑chain rewards | Transparency and auditable mechanics |

Takeaway: treat hybrids as diversification tools. Their gains potential tracks real platform usage, so monitor asset coverage, liquidity sources, and integrations. Read token docs to understand distribution and vesting before you participate.

Fresh ICO and IDO presales gaining traction

Several fresh token launches are winning attention by mixing real tech upgrades with viral mechanics. These entries offer varied routes to early access and different risk profiles for US investors.

Bitcoin Hyper (HYPER)

BTC Layer‑2 using SVM for near‑instant smart contract performance. Bridging locks BTC on L1 and mints wrapped BTC on L2; a token is available via the official website with clear bridging steps.

Maxi Doge (MAXI)

Meme coin with a fixed 150,240,000,000 supply. It runs leveraged competitions, weekly leaderboards, and staking; buyers can use ETH, BNB, USDT, or USDC.

Pepenode

Mine‑to‑earn mechanics let users buy virtual miner nodes and upgrade rigs before token generation. The gamified model aims to keep engagement high through the sale window.

Snorter (SNORT)

Telegram trading bot with MEV‑resistant relayers and sniping/copy features. Dual launch on Solana (SPL) and Ethereum (ERC‑20) with live purchase options including SOL, ETH, USDT, USDC and card support.

- Check coin supply, allocations, and claim schedules to gauge listing impact.

- Validate contract addresses on each website and start small with test buys.

- Watch team disclosures for dual‑chain parity and matching contracts.

| Project | Token | Buy options |

| Bitcoin Hyper | HYPER | Website bridge (BTC lock) |

| Maxi Doge | MAXI | ETH / BNB / USDT / USDC |

| Snorter | SNORT | SOL / ETH / USDT / USDC / Card |

Wallet and platform tokens offering early access perks

Wallet and platform tokens often grant priority entry and real app perks that change how you access early offers. These tokens go beyond speculation by tying privileges to product use.

Best Wallet Token (BEST)

BEST unlocks early access to new presale windows, reduced fees, and governance rights. Initial purchases are available inside the Best Wallet app during the first phase.

That app-first flow means holders can get allocations and lower ecosystem costs. Confirm supported chains, wallet requirements, and any gated windows before you buy.

SUBBD: creator economy meets Web3 and integrated AI

SUBBD blends AI tools with Web3 features for creators. Holding $SUBBD unlocks premium creator tools, VIP staking, discounts, and early feature access during the presale.

Public demos, roadmap notes, and clear educational content are good community signals to watch. Engagement incentives like quests, referral bonuses, and creator bounties speed network growth.

- For investors: these tokens deliver tangible benefits—priority access, lower friction costs, and rewards tied to real use.

- Track in‑app user growth, daily active engagement, and feature rollout cadence to judge price direction.

- Always use the official website and run a small test purchase to validate your setup and avoid spoofed apps.

| Token | Primary Perk | Why it matters |

| BEST | App-gated presale access & fee cuts | Favors active users and frequent buyers |

| SUBBD | AI tools + VIP staking | Drives creator engagement and retention |

| Both | Governance & early access | Tethers value to ecosystem utility |

Payment and consumer adoption narratives

Bridging digital payments and retail tills, SpacePay (SPY) aims to let shoppers use tokens at existing Android POS terminals while merchants receive settlement in local currency. This reduces friction for US retailers and keeps checkout flows familiar.

SpacePay (SPY): crypto-to-fiat merchant rails via existing POS

How it works: customers pay with tokens; the merchant gets fiat. SPY supports Ethereum, BASE, BNB, AVAX, and MATIC to ease multi-chain wallets and settlement.

The SPY presale allocates 20% of supply to ecosystem incentives. The project’s website streamlines setup and purchase, making access straightforward for buyers and merchants.

- POS compatibility: uses standard Android terminals many stores already run.

- Adoption signals: watch pilot rollouts, merchant partnerships, and regional support.

- Investor focus: track POS software updates, settlement partners, and exchange listings as launch milestones.

| Signal | Why it matters | Example |

| Merchant pilots | Shows real usage | In‑store test payments |

| Multi-chain support | Reduces wallet friction | ETH / BNB / AVAX / MATIC / BASE |

| Settlement partners | Enables fiat payouts | Regional processors |

Price and long-term gains will hinge on actual transaction volume. For best crypto shoppers focused on utility, merchant rails and POS compatibility shorten the path from token to everyday spending.

Institutional-grade and real-world utility entrants

Institutional entrants are bringing regulated operations and measurable buyback commitments into token utility. These offerings aim to blend licensed financial rails with practical on‑chain access for US investors. Focus on execution and reporting—those matter more than hype.

$MBG Utility Token

$MBG is backed by a revenue-generating institution operating under licenses in 17 jurisdictions. The project pledges a $440M buyback-and-burn over four years, targeting about half the supply to support price alignment and holder incentives.

- Holders gain access and fee reductions across MultiBank platforms.

- Regulation across regions is a strong credibility signal for compliance-minded investors.

- Watch buyback transparency and public reporting for confidence in execution.

PKL.CLUB (PKL)

PKL.CLUB ties token utility to sports commerce, focusing on Pickleball ticketing, merchandise, and on‑chain fan experiences. That model converts real-world engagement into token flow.

“Licenses and platform reach shift the conversation from speculation to utility-driven adoption.”

| Feature | $MBG | PKL.CLUB |

| Primary focus | Exchange access & fee benefits | Sports commerce & ticketing |

| Credibility signal | Licensed operations (17 jurisdictions) | Partnerships with event and merch vendors |

| Supply action | $440M buyback & burn (4 years) | Utility-driven spend and loyalty mechanics |

Due diligence: review model docs, timelines for platform integrations, and how operational funds and buybacks are reported. These projects can stabilize a portfolio alongside higher-volatility plays if delivery stays on track.

How to research presales before you buy

Treat each token opportunity like a startup: validate the founders, confirm working code, and trace how funds move before you commit any funds. A short, systematic check reduces blind risk and helps you spot red flags fast.

Verify audits, liquidity locks, tokenomics, and documentation

Start with the essentials. Confirm smart‑contract audits and that liquidity locks are visible onchain.

Read the whitepaper and litepaper end to end. Make sure tokenomics spell out allocations, vesting cliffs, and emission schedules.

Check the official website for published docs and contract addresses. If documentation is missing or vague, pause.

Assess team, partners, roadmap, and major tracker presence

Validate team identity via LinkedIn and GitHub. Look for prior project experience and working demos.

Confirm credible partners that match the stated business model. Seek pending or live entries on CoinGecko or CoinMarketCap for extra visibility.

Understand presale types and practical on‑chain checks

Presales can be public, whitelist, partnership, or private. Each affects access and early pricing.

Always verify contract addresses onchain, run a tiny test transaction, and confirm that presale funds sit in dedicated contracts separate from treasury wallets.

| Check | Why it matters | Quick action |

| Audit & lock | Reduces exploit risk | Open audit report; verify addresses |

| Tokenomics | Shows supply pressure | Confirm allocations, vesting, and emissions |

| Team & partners | Signals execution ability | Verify profiles + partner announcements |

| On‑chain test | Catches mismatches | Send a small buy to confirm flow |

Final tip: prioritize consistent updates, clear messaging across channels, and teams that ship demos. These practical signals often predict whether a project delivers after launch.

Conclusion

Close your research loop by matching each buying window to a concrete milestone and exit rule.

Pair meme plays with infrastructure, DeFi hybrids, wallets, payments, and institutional projects to spread opportunity across themes. That balanced approach helps investors target both short‑term gains and steady ecosystem growth.

Super Pepe’s presale remains a live example for readers who want a simple, active campaign. Visit the official website at https://superpepe.io/ and confirm links on Telegram https://t.me/superpepe_io and Twitter/X https://x.com/superpepe__io.

Practice the process: verify docs, test a small transaction, and track team updates. Success favors those who plan, diversify across projects, and keep information current in a fast market.

FAQ

What is this Top Presale Crypto List about and who should use it?

This guide highlights new token sales and early-stage token launches across meme, infrastructure, DeFi, and utility projects. It’s for investors seeking early access, community builders, and developers who want concise intel on launch mechanics, tokenomics, team credibility, and market positioning.

Why does the Super Pepe sale matter right now?

Super Pepe’s timing leverages strong community momentum and staged pricing that rewards early participants. The project shows locked liquidity and an audit report, which can reduce execution risk. Still, evaluate token supply, vesting, and market fit before committing funds.

How can I join Super Pepe safely via superpepe.io?

Use a hardware or trusted software wallet, verify the official domain and contract address, confirm third-party audits and liquidity lock evidence, and only interact with known links. Never share private keys or seed phrases and start with a small test amount to confirm the process.

What criteria did the editor use to curate the current presales?

Picks focus on community engagement, on-chain signals, tokenomics quality, audit status, credible teams or partners, and practical utility. The goal is a balanced mix of high-upside meme projects and infrastructure plays that demonstrate real product or protocol potential.

Which meme tokens show high conviction and community momentum?

Projects with active governance chats, clear referral or rewards mechanics, staged pricing, and open audits typically lead. Examples include tokens with locked liquidity, transparent distribution schedules, and growing social traction across Telegram and Twitter.

What infrastructure and utility projects are highlighted for fundamentals?

The list calls out projects that solve scaling, data availability, or cross-chain composability. These initiatives often have technical roadmaps, partnerships with ecosystems like Avalanche or Hedera, and measurable developer activity on GitHub or testnets.

What makes MoonBull ($MOBU) stand out among meme picks?

MoonBull combines an audit, locked liquidity, referral rewards, and staged pricing to align incentives between early backers and long-term holders. Such mechanisms help reduce immediate sell pressure and encourage community growth.

How do BullZilla ($BZIL) and La Culex ($CULEX) differentiate themselves?

Both projects emphasize structured tokenomics and viral branding. They focus on controlled token release schedules, reward programs, and marketing strategies intended to sustain community engagement and organic growth.

Why include established networks like Avalanche, Hedera, and Ethereum?

These networks provide foundational infrastructure: Avalanche’s subnet tools and burns, Hedera’s hashgraph governance and speed, and Ethereum’s L2 data capacity roadmap. Inclusion helps balance risk by showing where integrations and listings may occur.

What makes Sui relevant to early-stage investors?

Sui’s object-based model and parallel transaction processing can unlock new scaling patterns for apps. Projects building on Sui may benefit from lower latency and novel smart contract designs that attract developers and users.

What DeFi or hybrid finance projects are on the radar?

Watch projects that bridge traditional finance with tokenized assets, offer buyback and burn economics, or deliver multi-asset trading incentives. These models aim to bring real-world liquidity and yield opportunities to the token economy.

How do fresh ICOs and IDOs differ from token launches on major exchanges?

ICOs and IDOs typically offer earlier access with lower initial prices, higher upside, and higher risk. Exchange listings come later and provide liquidity and price discovery. Evaluate vesting, allocation limits, and lockups to understand short-term volatility.

What wallet and platform tokens provide meaningful perks?

Tokens that reduce fees, gate exclusive access, or integrate creator tools — like wallet access tokens and creator-focused platforms — can deliver recurring utility. Verify real product usage and partner integrations before buying in.

How do payment-focused tokens like SpacePay aim to drive adoption?

Payment tokens that integrate with merchant POS systems focus on ease of conversion, low friction rails to fiat, and merchant incentives. Real adoption requires stable settlement flows and compliance-ready partners.

What defines institutional-grade entrants and real-world utility tokens?

Institutional-grade tokens operate in regulated jurisdictions, offer exchange-grade liquidity, and implement buyback or revenue-sharing mechanisms. They often partner with regulated entities and emphasize governance and transparency.

What core steps should I take to research any token sale before investing?

Verify independent audits, confirm liquidity locks, read the tokenomics and vesting schedule, evaluate the core team and advisors, check partnerships, and review roadmap milestones. Use on-chain explorers and major trackers to validate contract data and listings.

How do I assess the team, partners, and roadmap effectively?

Look for verifiable team profiles, reputable partners, realistic timelines, and deliverables that match technical milestones. Cross-check social channels, GitHub commits, and third-party coverage to confirm consistency and traction.

What are the common token sale types and how do they affect access?

Sales can be public, whitelist-based, private, or partner allocations. Public rounds give broad access with variable pricing. Whitelists require early registration. Private rounds often include strategic investors and impose longer lockups.

What risks should investors keep top of mind with early token offerings?

Key risks include smart contract bugs, rug pulls, market illiquidity, aggressive token unlocks, and regulatory uncertainty. Always diversify, invest only what you can afford to lose, and prefer projects with third-party audits and locked treasury funds.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

Top Crypto Presale to Watch in the US

Fact: More than 40% of U.S. retail investors say they follow early token launches closely, and many are eyeing Super Pepe first — visit superpepe.io to join while allocations last.

Super Pepe has drawn fast community support for its token design and social momentum. Readers who want to act early will find clear steps and checks here before they commit funds.

This guide helps investors compare fundamentals, tokenomics, and risk so you can spot the best opportunities in a shifting market. We highlight practical signals like audits, liquidity plans, and exchange readiness.

You’ll also get a brief tour of BlockDAG’s security setup, live buy price details, and mobile mining beta notes to inform a balanced approach. The goal is a smooth experience from initial research to token claim and eventual launch.

Key Takeaways

- Start with verified links — visit official website pages like superpepe.io before sending funds.

- Prioritize projects with audits, clear liquidity, and exchange commitments.

- Match allocations and vesting to your risk tolerance and market timing.

- Watch utility and roadmap cadence; they influence coin traction after launch.

- Use community signals plus on-chain data for quick due diligence.

crypto presale spotlight: Super Pepe presale leads investor interest right now

The Super Pepe offering stands out for its viral appeal and straightforward access steps for buyers. Early momentum comes from fast-growing community channels and clear sale stages that many investors track.

Why readers are eyeing Super Pepe first

Strong community energy and visible stage pricing help Super Pepe rise to the top among new projects. Transparent caps and accepted currencies let buyers control entry price and allocation. Community-led tokens often pull in early holders, which can boost initial liquidity and post-launch trading.

How to join the next Super Pepe presale at superpepe.io

- Go to superpepe.io and confirm the official URL.

- Connect a non-custodial wallet via WalletConnect and approve only needed permissions.

- Follow official channels on Telegram and X for live sale updates and contract addresses.

- Act in listed stages to seek early allocation advantages and monitor market timing.

Always verify announcements and use secure wallets to protect funds. Holders who join early can shape momentum and community reach during listings.

Buyer’s guide to evaluating presales in the United States

A strong first signal for any sale is a readable roadmap and a team that explains what problem the coin solves. Start there before you weigh token design or hype.

Project fundamentals, tokenomics, and audited code

Check that the project has a clear problem-solution fit, public milestones, and named team members with verifiable backgrounds. These basics often precede real market traction.

Review tokenomics—supply, emission schedule, vesting, and utility. Sound design lowers sell pressure and supports long-term stability.

Insist on audits. BlockDAG’s internal review plus Halborn completed and Certik ongoing give a stronger security posture than unaudited offerings.

Liquidity, listings, and vesting that protect investors

Ask for a concrete liquidity plan and any confirmed exchange pathways. Top-tier exchange commitments can improve early price discovery and depth.

Study vesting for team and private allocations to spot upcoming unlocks that might affect price.

Community strength and ongoing utility

Measure community engagement through verified channels. Active moderation and steady updates correlate with healthier ecosystems.

Look for measurable utility—payments, AI features, or revenue share—that supports usage beyond launch.

- Quick checklist: fundamentals, tokenomics, audits, liquidity locked, exchange pathway, and utility.

- Compare case studies: Super Pepe for social momentum, BlockDAG for audits and listings, Nexchain for throughput and revenue sharing.

BlockDAG (BDAG) overview: audited, exchange-ready, and miner-focused

BlockDAG positions itself as a security-first blockchain that couples mining access with confirmed exchange pathways. The team reports an internal audit complete, a completed Halborn review, and an ongoing Certik assessment to strengthen smart contracts.

Security stack

The layered review improves confidence for U.S. investors and developers. EVM compatibility further lowers integration friction for existing applications.

Road to listing

Pathways to +15 Tier 1 and US exchanges are in scope, which matters for early liquidity and price discovery at launch. The roadmap targets mainnet in six months from the live sale stage.

Token distribution

Total supply is 50B BDAG. Allocation shows 20% available in the ongoing sale and 70% reserved for the community: 28B for miners, 5.25B for ecosystem growth, and 1.75B for a liquidity pool.

Mining access

Inclusive tooling is a core feature: iOS/Android beta apps let newcomers participate, while X-series miners range from ~250 to 25,000 BDAG/day per unit depending on specs. Official docs cover ASIC setup, pool configuration, and monitoring.

- Buy detail: live sale price is $0.0015 with code TGE, a clear entry point for investors tracking staged allocations.

- Consensus: a hybrid design beyond DAG aims to speed validation while keeping security robust.

BlockDAG performance and technology for presale buyers

BlockDAG’s core upgrades target real-world throughput while keeping security tight.

Hybrid consensus beyond DAG for faster, secure validation

The network combines DAG concepts with a hybrid consensus to speed confirmations. That design aims for lower latency and stronger finality, which can make apps feel snappy.

For early holders, faster validation lowers failed transactions and improves daily user experience on wallets and exchanges.

Six-month mainnet target and what it means for early adopters

A six-month timeline compresses the build-to-ship window. This gives buyers a near-term catalyst and a clear milestone to track.

“Delivery pace often shapes on-chain activity more than marketing alone.”

Expect test releases, mobile miner updates, and EVM tooling ahead of launch. Monitor these to judge readiness.

- EVM compatibility reduces integration friction for new projects and developer teams.

- Large miner allocation (28B BDAG) supports validation capacity and early throughput.

- Mobile mining broadens participation and can boost day-one activity and decentralization.

Nexchain AI Layer 1: high TPS, low fees, and daily revenue share

Nexchain targets real-world builders with a fast, efficient blockchain that mixes performance and passive income. It focuses on practical metrics investors and teams watch: throughput, predictable cost, and developer tooling.

400,000 TPS, $0.001 fees, and cross-chain interoperability

The network aims for 400,000 TPS and a $0.001 transaction fee to support high-volume apps. Built-in cross-chain bridges widen reach and drive on-chain activity across multiple platforms.

Hybrid PoS + AI consensus for stability and scalability

A hybrid PoS model augmented by AI algorithms manages load and security dynamically. Sharding plus DAG techniques and Smart Contracts 2.0 add scalability without sacrificing decentralization.

10% daily gas fee revenue share to NEX holders

Holders who keep NEX in a non-custodial wallet receive a 10% daily share of collected gas fees. This rewards model routes real network economics back to the community.

Presale status: stage pricing, raised funds, and expected ROI

Current token price is $0.112 with a target listing price of $0.30. The sale has raised $11,183,201 of a $11,975,000 cap. Testnet v2.0 is launching soon.

- Tooling: SDKs, APIs, and customizable AI modules for rapid integration.

- Utility: instant payments, staking, AI services, and governance.

- How to participate: verify nexchain.ai or purchase.nexchain.ai, connect via WalletConnect, and pay with BTC, ETH, or USDT.

Nexchain roadmap and utility: what US investors should track

Nexchain’s public timeline maps clear milestones that US investors can watch to judge delivery. The plan lists staged releases and practical tooling that matter for adoption.

From Testnet v2.0 to Mainnet readiness

Start by watching the path from Testnet PoC to Nexpolia and Testnet v2.0 scaling. These phases show how stable the platform is before mainnet push.

- Milestones to monitor: Airdrop, Whitepaper v2.0, and the NEX-AIP governance rollout.

- Blockscout with AI-events tracking, Safe-multisig, and private RPCs help developers test real flows.

- Public beta and CEX/DeFi integrations are key signals before a wider launch.

Real-world use cases: finance, healthcare, IoT, and content

Practical utility drives on-chain activity and user growth. The project targets finance automation, healthcare data exchange, IoT coordination, and content monetization.

- Developers get better build and test experience with Blockscout and private endpoints.

- Community AMAs, airdrops, and influencer outreach aim to expand users and activity.

- US buyers should align access and allocations with major releases to manage exposure

“Track public beta feedback cycles and exchange integrations — they often speed adoption more than a roadmap alone.”

Other notable crypto presales to watch now

Look to projects that pair everyday utility with repeatable user activity when building a shortlist.

Digitap ($TAP)

What it is: An omni-bank app combining fiat and token rails with a Visa-linked debit card for daily spending.

Why it matters: Peer-to-peer remittances under 1% and a second sale nearing $1M raised. Tokenomics channel 50% of profits to burns and staking rewards.

LivLive (LIVE)

What it is: An AR platform that rewards real-world actions like check-ins and micro-reviews.

Why it matters: Daily activity loops can sustain engagement beyond market cycles and drive consistent token utility.

Snorter (SNORT)

What it is: A Telegram trading bot that unlocks extra features via its token.

Why it matters: In-chat execution reduces app switching for traders and embeds token perks into popular messaging flows.

Best Wallet

What it is: A multi-chain storage and swap platform with staking and a curated launchpad.

Why it matters: Simplifies discovery for new users and offers early access to vetted offerings from a trusted interface.

These projects span payments, engagement rewards, trading tools, and infrastructure. Shortlist several alongside the bigger names to balance community momentum with real utility.

| Project | Core feature | User benefit | Token signal |

| Digitap ($TAP) | Fiat+token banking, Visa card | Low-cost remittances, daily spend | 50% profits → burns & staking |

| LivLive (LIVE) | AR quests via wearable/mobile | Daily engagement, real rewards | Activity-driven token minting |

| Snorter (SNORT) | Telegram trading bot | Fast in-chat trading, perks | Utility unlocks for traders |

| Best Wallet | Multi-chain wallet + launchpad | Unified swaps, staking, discovery | Platform fees & curated listings |

- Checklist: confirm official links, supported currencies, and vesting terms before committing.

- Verify any exchange targets and liquidity plans in documentation or announcements.

- Shortlisting multiple offerings helps spread exposure across payments, activity rewards, trading, and tooling.

How to participate safely: wallets, platforms, and payment methods

Before you send funds, confirm access steps and site authenticity to avoid common scams. Start by loading the project website and checking the SSL lock, official handles, and contract addresses. For Super Pepe, verify superpepe.io. For Nexchain, use nexchain.ai or purchase.nexchain.ai.

Using WalletConnect and non-custodial wallets

Use a reputable non-custodial wallet or hardware device. Connect with WalletConnect only after you confirm the website URL and contract address in official social pins.

Never share seed phrases or private keys. If an action asks for them, it is a phishing attempt.

Paying with BTC, ETH, USDT and verifying official URLs

When paying, confirm chain compatibility (ERC-20 vs others). Sending on the wrong chain can make tokens unclaimable.

Test with a small amount first, keep transaction hashes, and monitor the dashboard for token allocation and claim windows.

- Quick safety checklist: verify website SSL and social links, double-check contract addresses, confirm supported payment rails, and use official support channels for help.

- Use official Telegram pins and project pages for guidance; avoid DM-based instructions asking you to install files or “sync” private data.

| Step | Why it matters | Example | User action |

| Verify website | Prevents lookalike domains | superpepe.io, nexchain.ai | Check SSL and pinned socials |

| Use non-custodial wallet | Keeps keys private | Hardware or trusted extension | Connect via WalletConnect |

| Confirm network | Avoids lost funds | ETH/ERC-20 vs other chains | Match payment token (BTC/ETH/USDT) |

| Record TX hash | Support traceability | Purchase dashboard | Save hash and receipt |

Tokenomics and market mechanics every buyer should evaluate

Token mechanics shape how value moves after launch and guide smart entry decisions.

Vesting, burns, rewards, and revenue sharing

Study vesting schedules closely. Longer cliffs and staggered unlocks for teams and private rounds help limit early sell pressure.

Look for explicit rules on burns and revenue distribution. Digitap channels 50% of profits to burns and staking rewards, while Nexchain plans a 10% daily gas fee share to holders. Those designs can support value accrual.

Liquidity planning and exchange pathways

Liquidity shapes spreads and depth in the first weeks. Locked pools, market-maker agreements, and confirmed exchange listings reduce volatility.

Distribution must match the project goal. BlockDAG’s 50B supply with 20% sale and 70% community allocation (miners, ecosystem, liquidity pool) aims to secure network power and growth.

- Practical checklist: vesting length, burn/reward rules, locked liquidity, exchange commitments, utility cases, and stage price vs. FDV.

- Evaluate price per stage and fully diluted valuation against roadmap maturity to avoid overpaying for narrative alone.

- Factor platform reach: multi-chain support, SDKs, and developer incentives speed adoption and real demand.

| Mechanic | Why it matters | Example | Investor action |

| Vesting | Controls sell pressure | Longer cliffs reduce dumps | Prefer longer team unlocks |

| Burns & rewards | Supports supply scarcity | Digitap: 50% profits to burns/staking | Model cadence into ROI |

| Revenue share | Returns operational income | Nexchain: 10% daily gas fees to holders | Estimate passive yield |

| Liquidity & listings | Determines price stability | Locked pools, MM deals, CEX paths | Verify lock and exchange plans |

Risks, regulation, and due diligence for US investors

A clear, documented security posture changes how investors evaluate early-stage token opportunities. Start with audits, public reports, and testnet evidence before sending funds.

Smart contract audits and security posture

Layered reviews matter. Prefer projects with internal checks plus a third-party audit. BlockDAG’s internal review, a completed Halborn report, and Certik’s ongoing work show stronger coverage than many early offerings.

Team transparency, governance, and community oversight

Verify identities, public repos, and steady communications. Governance frameworks like Nexchain’s NEX-AIP signal structured decision-making and community input.

- Practical checks: audit reports, team bios, multi-sig treasury, and locked liquidity.

- Watch regulatory guidance in the US that can affect listings, custody, and trading access.

- Compare projects on security posture, documentation quality, and official support responsiveness.

“Independent testing and clear governance reduce single-point failure risk.”

| Risk area | What to verify | Why it matters | Example signal |

| Code audits | Published reports & fixes | Reduces exploit risk | Halborn + Certik review |

| Team | Named members & repos | Builds trust | Linked GitHub, LinkedIn |

| Funds control | Multi-sig & lockups | Limits unilateral moves | Time-locked liquidity |

| Governance | On-chain proposals | Community oversight | NEX-AIP style framework |

Conclusion

Aim for tokens that combine real-world utility, on-chain signals, and transparent liquidity planning. Favor projects with audits, named teams, and clear timelines. This approach balances conviction with caution when assessing market potential.

Lead with Super Pepe for strong community momentum, then diversify into audited, utility-rich entries like Nexchain and BlockDAG. Keep liquidity, vesting, and listing windows on your radar to protect downside as markets shift.

Use official platforms and verified wallet flows. Confirm URLs and contract addresses before contributing.

Explore and join: superpepe.io • Telegram • X. Consider the best crypto presale moves with measured allocations and clear due diligence.

FAQ

What are the top presale investments to watch in the US right now?

Look for projects with audited code, clear tokenomics, and confirmed exchange interest. Focus on layer-1 networks, payment or omni-bank apps, and projects offering real utility like DeFi revenue sharing, NFT or AR engagement, and hardware or mining access. Check team transparency, on-chain activity, and community growth before committing funds.

Why is Super Pepe attracting so much investor interest?

Super Pepe has strong community buzz, visible liquidity plans, and early-stage marketing that increases demand. Investors often cite fast token distribution updates, staking incentives, and an accessible launch path as reasons to prioritize it. Always verify official links and audit details before participating.

How do I join a Super Pepe launch safely?

Use only the official website URL, connect via a non-custodial wallet or WalletConnect, and confirm contract addresses on-chain. Pay with established currencies like BTC, ETH, or USDT where supported, and follow platform KYC and whitelist steps. Avoid third-party links in social posts.

What fundamentals should US buyers evaluate in a token sale?

Review token supply, vesting schedules, allocation breakdown, and any audit reports. Assess the protocol’s utility, planned listings, liquidity commitments, and governance model. Strong fundamentals reduce short-term volatility and support sustainable value.

How do liquidity, listings, and vesting protect investors?

Locked liquidity and gradual vesting limit sudden sell pressure. Exchange listings broaden access and price discovery. Clear timelines for liquidity unlocks and team vesting increase trust and reduce manipulation risks.

How important is community strength and ongoing utility?

A committed community drives adoption and network effects. Regular utility—such as staking rewards, revenue sharing, or real-world use cases—keeps users engaged and supports long-term token value.

What makes BlockDAG (BDAG) noteworthy for presale buyers?

BlockDAG offers a miner-focused approach, an audited security stack with third-party reviews, and confirmed exchange interest. Its distribution and mobile mining options aim to broaden participation beyond traditional miners.

Which audits and security checks should I expect for a project like BlockDAG?

Look for internal audits plus reviews from reputable firms such as Halborn and CertiK. Verify published findings, remediation steps, and ongoing bounty programs to ensure a proactive security posture.

What does token distribution of 50 billion with 20% presale and 70% community mean?

It indicates the project reserves a large portion for ecosystem incentives, staking, and user rewards. A modest presale slice reduces immediate sell pressure, but check vesting and allocation to advisors or partners to understand dilution risks.

How can everyday users access mining or participation on BlockDAG?

Participation can involve mobile mining apps, lightweight X-series miners, or staking mechanisms. Ensure hardware compatibility and verify any required downloads on official channels only.

What technical features should presale buyers note about performance and consensus?

Prioritize hybrid consensus models that combine DAG elements with other validation schemes for speed and finality. Check mainnet timelines, TPS targets, and planned security measures to gauge readiness and adoption potential.

Why do mainnet targets matter to early adopters?

Faster mainnet delivery can unlock utility, listings, and revenue streams. Delays can stall adoption and affect price, so monitor development milestones and third-party audits closely.

What does Nexchain claim about TPS, fees, and revenue share?

Nexchain promotes very high throughput, minimal per-transaction fees, and a portion of gas revenue distributed to token holders. Confirm these claims with independent benchmarks and the project’s smart contract terms.

How does a hybrid PoS + AI consensus work for stability?

It blends stake-based security with AI-driven optimizations for validator selection or transaction ordering. This can improve scalability and reduce costs but requires transparent governance and robust testing.

What should US investors track on Nexchain’s roadmap?

Watch testnet releases, mainnet readiness, cross-chain bridges, real-world integrations in finance or healthcare, and measurable TPS benchmarks. These milestones indicate practical utility and partnership traction.

Which other projects are worth following now?

Look at omni-bank platforms offering card integrations, AR-based engagement projects that drive daily activity, Telegram-integrated trading bots with token perks, and secure multi-chain wallets that include launchpad features. Evaluate tokenomics and adoption metrics.

How do I participate safely using wallets and payment methods?

Use non-custodial wallets, WalletConnect, or hardware wallets. Confirm every payment currency and contract address on official channels. Prefer major chains and stablecoins like USDT for purchases to minimize conversion risk.

What tokenomics elements should buyers always check?

Inspect vesting schedules, burn mechanisms, reward distributions, revenue-sharing clauses, and planned liquidity provisioning. These mechanics determine token scarcity and long-term holder incentives.

How do liquidity planning and exchange pathways affect token value?

Committed liquidity and clear listing strategies enable smoother trading and price discovery. Without reliable liquidity, tokens can suffer high spreads and volatility after launch.

What are the main risks and regulatory concerns for US investors?

Risks include smart contract bugs, rug pulls, regulatory actions, and unclear securities status. Conduct due diligence on audits, legal disclosures, and team identity. Consider consulting a securities attorney for high-value investments.

How should I verify a project’s team and governance?

Check LinkedIn profiles, past project history, on-chain activity, and governance documents. Transparent teams publish roadmaps, audit links, and community governance forums for accountability.

Where can I find trustworthy analysis and activity metrics?

Use on-chain explorers, audit reports, analytics platforms like Dune or TokenTerminal, and reputable industry outlets. Cross-check multiple sources to form a balanced view before committing funds.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

Presale Crypto Investments: A Beginner’s Guide to Success

Surprising fact: despite a choppy 2025 market where some called the bull run over, select projects with real use and active communities still pull strong interest.

If you’re a first-time buyer, Super Pepe’s presale is the focal point many beginners explore. Visit superpepe.io to review details, verify official channels, and prepare a safe, step-by-step entry.

This short guide explains how a presale works and why projects run one. You’ll learn what investors should evaluate before committing and how to spot real momentum versus hype.

We’ll compare formats like public, whitelist, and private rounds. You’ll also get practical tips on wallets, timing, and tools that help users act with discipline and aim for long-term success.

Key Takeaways

- Super Pepe is a beginner-focused entry point; check superpepe.io for official details.

- Community-first projects often draw early attention and user support.

- Know presale formats and what access each one grants.

- Use wallets and on-chain tools to improve security and participation.

- Separate meme hype from real product traction before deciding.

presale crypto spotlight: Why Super Pepe presale is drawing beginner attention right now

For users seeking a straightforward entry with community momentum, Super Pepe stands out today. The project combines meme energy with a clear platform plan and visible on-chain details, which attracts many new investors in a choppy 2025 cycle.

Early-access advantage matters now: getting access before broader user waves arrive can help with initial price discovery. Comparable early wins — like Digitap’s live Visa app and BlockDAG’s builder traction — show why well-structured rounds appeal to cautious buyers.

Early-access advantage and market timing in the present cycle

Access phases can change price step-by-step. Plan allocations and set realistic expectations about later tranches.

Watch metrics: token supply, vesting, and active users give better signals than hype alone.

How to participate in Super Pepe presale safely (superpepe.io)

Go directly to superpepe.io, confirm the official token contract, and check documentation before sending funds. Use a compatible wallet, verify network settings, and avoid links from unknown chats or DMs.

- Confirm token supply, vesting, and roadmap information.

- Document your contribution, claim dates, and any exchange plans.

- Protect keys: use hardware wallets and backups; never share seed phrases.

| Step | What to Check | Why It Matters |

| Visit site | superpepe.io & official links | Prevents phishing and fake access |

| Verify contract | On-chain address and audit notes | Ensures token legitimacy |

| Wallet setup | Network, balance, hardware option | Reduces transfer and custody risks |

| Record keeping | Contribution amount, claim schedule | Helps track allocation and price moves |