If you work in the US mortgage industry, you know the feeling: You have a borrower on the line, their scenario is slightly outside the “vanilla” box, and you need to confirm eligibility fast. But instead of giving a quick “yes,” you end up digging through hundreds of pages of PDF guidelines or waiting days for an Account Executive (AE) to call you back. By the time you get the answer, the lead has gone cold. It’s a frustration I’ve dealt with for years.

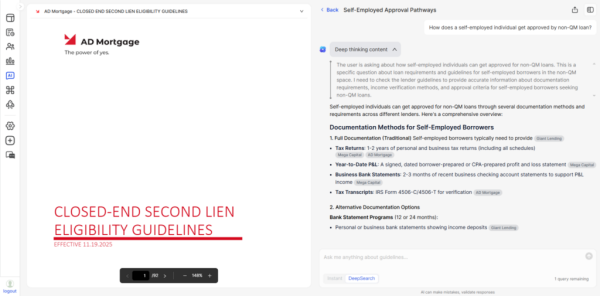

Enter Scenario AI by Zeitro. Launched in early 2025, this tool is designed to stop that endless searching. It’s an AI-powered assistant specifically built to navigate the complex maze of mortgage guidelines—especially for Non-QM loans—turning hours of research into seconds of clarity.

Learn All About Scenario AI

Let’s break down exactly what this tool is and why it’s making waves. Scenario AI is a 24/7 intelligent AI assistant, developed by Zeitro, that covers both Qualified Mortgages (QM) and Non-QM loans. While it handles standard agency stuff well, its real superpower lies in the Non-QM space, where guidelines are notoriously fragmented and complex.

Here is how it works in practice: You type a question in plain English or Chinese—whether it’s a specific query about a borrower’s DTI ratio or a vague question about a loan program. Within seconds, the AI scans multiple sources and delivers a precise, professional answer. But it doesn’t just give you text; it provides citations. You get a link to the exact source material, giving you the confidence that the information is accurate. If an answer feels too dense, there is a handy “Explain” button that breaks the logic down further.

The barrier to entry is incredibly low. You get 3 free queries per day to test it out, and paid plans start at just $8 per month—a fraction of the cost of competitors.

Here is how it impacts different roles in our industry:

- Loan Officers & Brokers: No more “I’ll get back to you.” You can quote rates and structure complex deals instantly, 24/7, without waiting on lenders.

- Account Executives (AEs): Instead of answering the same basic guideline questions all day, you can use this to provide instant, sourced-backed answers to your brokers, freeing you up to close more loans.

- Processors & Underwriters: It helps you verify document requirements upfront, reducing the risk of “unworkable” files cluttering the pipeline.

- New LOs: It bridges the experience gap, helping you sound like a 20-year veteran by providing expert answers to tricky scenarios instantly.

How Does Scenario AI Help You?

You might be thinking, “Is this just another chatbot?” Not quite. The value lies in the specific data it accesses and the features designed for mortgage workflows. Let’s dive into the details.

Access the Most Comprehensive Lender Guidelines

The biggest problem with general AI tools (like ChatGPT) is that they don’t know today’s specific lender overlays. Scenario AI is different because it is connected to the actual guidelines of over 15 mainstream US lenders.

I’m talking about major players in the Non-QM and wholesale space, including AAA Lending, AD Mortgage, AmWest, CMG Financial, Forward Lending, Freedom Mortgage, Giant Lending, Greenbox, HomeXpress, Luxury, Mega Capital, MK Lending, Nations Direct, and Thunderbird. The platform currently covers over 256 distinct guidelines and, crucially, keeps them updated.

It supports a massive variety of loan types. Whether you are looking for Asset Utilization, Bank Statement loans, DSCR, FHA, Foreign National programs, Form 1099, ITIN, Jumbo, Profit and Loss, VA, or WVOE, the data is there.

One feature I particularly like is the “DeepSearch“ mode. This allows you to customize your search scope. If you only want to see if one specific lender accepts a certain credit score, you can select just that lender’s guidelines to search against, filtering out the noise.

Get Trustworthy, Source-Backed Answers

We work in a regulated industry; we can’t afford “hallucinations” or wrong answers. This is where Scenario AI earns its “Trust” scores in E-E-A-T.

The standout feature here is Accuracy via Citations. When the AI answers your question, it doesn’t just guess. It provides a direct citation to the guideline PDF or webpage where the rule lives. This allows you to backtrack and verify the source immediately. You are never left wondering, “Is this actually true?”

Furthermore, the AI agent is specifically trained for completeness. It reduces the human error that comes from cross-referencing overlays manually. If you hit a complex logic knot, the Explain function is a lifesaver. It re-analyzes the selected scope and explains why a borrower is eligible or ineligible, acting almost like a digital mentor. This combination of AI speed and source transparency significantly reduces the risk of structuring a dead-end deal.

Experience Lightning-Fast Response Times

In our business, time kills deals. The efficiency gains with Scenario AI are measurable and significant.

Imagine the old way: You have a unique scenario. You log into five different lender portals, download their latest matrices, and Ctrl+F your way through them. That takes 30 to 60 minutes. With Scenario AI, that process is reduced to seconds.

The platform queries thousands of guideline pages instantly. This isn’t just about saving you effort; it’s about ROI. By cutting out hours of manual research every week, you can focus on relationship building and sales activities. For an LO handling 10 scenarios a week, this could save 5+ hours weekly.

Faster answers also mean faster pre-qualifications. You can screen borrowers immediately, improving your service satisfaction. Clients are impressed when you have the answer now, not tomorrow. This speed helps you keep the pipeline moving and increases your loan close rate by preventing borrowers from shopping around while they wait for you.

Master Any Loan Scenario From Vague to Specific

One of the things I appreciate most about this tool is its flexibility. You don’t need to be a “prompt engineer” to get good results.

It handles everything from the incredibly vague to the hyper-specific. You can ask educational questions like, “What is the minimum down payment for a Foreign National loan?” or you can get into the weeds with, “Can I use 100% gift funds for a generic Non-QM investment property with a 680 FICO?”

Whether you are checking eligibility, looking for pre-qualification parameters, or just trying to understand a definition, the natural language processing (NLP) understands mortgage lingo.

And again, the cost-to-value ratio is hard to beat. You can try this out with 3 free queries every single day. If you find yourself using it heavily, the Pro plan is only $8/month. Compared to other tools that charge hundreds for similar functionality, this is incredibly accessible for individual brokers.

Bonus Features: Sharing, Multi-Language & Agency Search

There are a few “hidden gems” in the platform that add extra value.

First is Collaboration. When you find a great program or a specific rule, you can generate a share link or email the answer directly to your team or your borrower. This keeps everyone on the same page.

Second is Multi-Language Support. You can input questions in English or Chinese, and the AI handles it seamlessly. For professionals working in diverse markets with international buyers, this is a huge plus.

Finally, it’s important to distinguish between the two tools Zeitro offers. There is Scenario AI (which we’ve been discussing, great for complex/Non-QM searches) and the Agency Guideline tool.

- The Agency Guideline tool is specialized for QM loans. If you know exactly which manual you need—like the Fannie Mae Selling Guide, Freddie Mac Seller Guide, FHA Handbook, VA, or USDA—you can use this tool to search specifically within those official texts. It’s perfect for those strict, black-and-white agency questions.

Why Choose Scenario AI?

With other tools like MortgageQ or GuidelineGuru on the market, why should you look at Scenario AI?

The answer comes down to Accessibility and Completeness. Many competitors focus heavily on enterprise contracts or charge high monthly fees ($300+). Scenario AI democratizes this tech with an $8/month price point that supports individual LOs.

Moreover, it doesn’t force you to choose between QM and Non-QM; it handles all loan types. The integration of real-time citations solves the “black box” problem of AI, giving you the accuracy you need to stake your reputation on a pre-approval. It cuts through the noise, saves you hours of manual reading, and helps you capture deals you might have otherwise missed because you couldn’t find the right program in time.

What People Say About Scenario AI

Since its launch in 2025, early adopters have been vocal about the impact. Here is what I’m hearing from the field:

The New Loan Officer “I’ve only been licensed for six months, and Non-QM terrified me. I almost lost a client because I didn’t know the answer to a Bank Statement question. I used Scenario AI, got the answer in 10 seconds with a link to the guideline. It gave me the confidence to sound like an expert.”

The Experienced Broker “I had a tricky DSCR scenario that two lenders turned down. I threw the scenario into the AI, and it found a specific program at AD Mortgage that allowed for the exceptions I needed. That one search saved a $600k deal for me.”

The Account Executive “My day used to be 80% answering the same guideline questions over text. Now, I use Scenario AI to pull the exact rule and source, and send it to my brokers. I’ve saved about 6 hours a week that I now spend on bringing in new accounts.”

Conclusion

If you are looking to streamline your workflow in 2026, Scenario AI is a tool you simply cannot ignore. It bridges the gap between complex lender data and the need for speed, helping you focus on what actually generates revenue: building relationships and closing loans.

To be fair, because the platform is relatively new, some might hesitate purely due to brand recognition compared to legacy systems. But the technology speaks for itself. The “Explain” feature and the transparent citations make it safer and smarter than manual research.

Don’t just take my word for it. The platform allows you to run 3 queries a day for free. Go try it on your toughest dead deal file and see if it finds a solution. You have nothing to lose and potentially a lot of closed loans to gain. Also, if you want to get more leads, you can create a personal profile on Bluerate for free.